0 interest credit cards 0 balance transfer fee – 0 Interest Credit Cards, 0 Balance Transfer Fee – a seemingly magical combination that promises to banish high-interest debt and provide much-needed financial breathing room. But is it truly as simple as it sounds? This article delves into the alluring world of 0% interest credit cards, dissecting the benefits, drawbacks, and everything you need to know to make informed decisions about your finances.

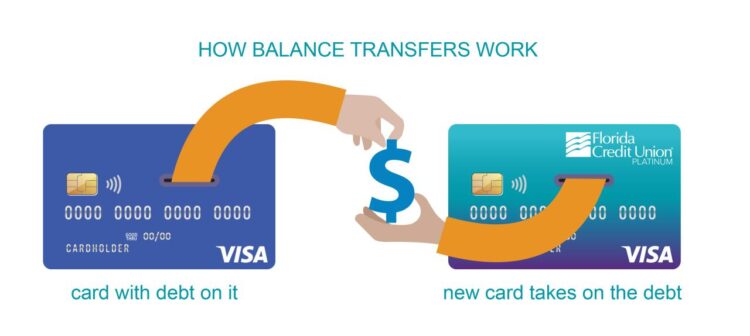

Imagine transferring your existing high-interest credit card debt to a new card with a 0% introductory APR, all without paying a balance transfer fee. Sounds enticing, right? But before you jump on board, understanding the nuances of these cards is crucial. This guide provides insights into the mechanics of 0% interest credit cards, helping you navigate the complex world of credit card offers and make informed decisions about your financial future.

Finding the Best 0% Interest Credit Cards with 0 Balance Transfer Fees

Transferring a balance from a high-interest credit card to a 0% APR card can be a great way to save money on interest charges. However, many cards charge a balance transfer fee, which can eat into your savings. Fortunately, some cards offer both 0% APR and 0 balance transfer fees, making them ideal for debt consolidation.

Comparing 0% APR Credit Cards with 0 Balance Transfer Fees

The best 0% APR credit card for you will depend on your individual needs and credit score. Here’s a table comparing some popular options:

| Card | Introductory APR | Balance Transfer Fee | Credit Limit | Annual Fee |

|---|---|---|---|---|

| Chase Slate | 0% for 15 months | $0 | Variable | $0 |

| Citi Simplicity® Card | 0% for 18 months | $0 | Variable | $0 |

| Discover it® Balance Transfer | 0% for 18 months | $0 | Variable | $0 |

| U.S. Bank Visa® Platinum Card | 0% for 15 months | $0 | Variable | $0 |

Remember that these are just a few examples, and there are many other cards available. It’s important to compare offers from different issuers to find the best card for your situation.

Utilizing 0% Interest Credit Cards Effectively: 0 Interest Credit Cards 0 Balance Transfer Fee

Zero-interest credit cards offer a valuable opportunity to save money on interest charges, but maximizing their benefits requires a strategic approach. By understanding the nuances of these cards and implementing a well-defined plan, you can effectively leverage their potential and achieve your financial goals.

Maximizing the Benefits of 0% Interest Credit Cards

To fully utilize the advantages of 0% interest credit cards, it’s crucial to adopt a proactive strategy. Here are some key tips:

- Transfer Existing High-Interest Debt: One of the primary benefits of 0% interest cards is the ability to consolidate high-interest debt from other sources, such as personal loans or credit cards with high APRs. This can significantly reduce your monthly interest payments and accelerate debt repayment.

- Time-Sensitive Purchases: For large purchases, such as home renovations or medical expenses, 0% interest cards can provide a temporary interest-free period to spread out payments over time. This can help you avoid accruing substantial interest charges.

- Avoid Overspending: While 0% interest cards can be tempting, it’s essential to maintain responsible spending habits. Avoid using the card for frivolous purchases or exceeding your budget, as this can lead to accumulating debt that you may not be able to repay before the promotional period ends.

- Set a Payment Schedule: Develop a realistic payment schedule that ensures you can repay the balance before the 0% interest period expires. This will prevent interest charges from accruing once the promotional period ends.

- Track Your Balance: Regularly monitor your credit card balance and ensure you’re making payments on time. This helps you stay on top of your debt and avoid late fees or negative impacts on your credit score.

Developing a Debt Repayment Strategy

A well-defined strategy is crucial for effectively paying off debt using 0% interest periods. Consider the following steps:

- Determine Your Total Debt: Calculate the total amount of debt you need to repay, including any transfer fees associated with the 0% interest card.

- Set a Repayment Timeline: Establish a clear timeframe for paying off the debt. Aim to repay the balance before the 0% interest period ends.

- Create a Budget: Develop a budget that allocates sufficient funds towards your debt repayment. This may involve reducing discretionary spending or finding additional income sources.

- Make Consistent Payments: Make consistent and regular payments towards your debt. This helps you steadily reduce the balance and avoid accruing interest.

- Consider Debt Consolidation: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your repayment process and potentially save you money on interest charges.

Monitoring Credit Card Balances and Due Dates

Staying organized and vigilant in tracking your credit card balances and due dates is essential for avoiding late fees and maintaining a healthy credit score. Here’s how to do it:

- Set Reminders: Utilize online banking tools, calendar reminders, or mobile apps to set reminders for upcoming due dates. This helps you avoid missing payments.

- Review Your Statements: Regularly review your credit card statements to ensure the accuracy of charges and payments. This helps identify any errors or discrepancies.

- Monitor Your Credit Score: Check your credit score regularly to assess your financial health. Late payments can negatively impact your score, making it more difficult to obtain loans or credit cards in the future.

Alternative Options to 0% Interest Credit Cards

While 0% interest credit cards can be a great way to consolidate debt and save money on interest charges, they’re not the only option available. If you’re looking for ways to pay down debt quickly, consider exploring alternative debt consolidation options like personal loans or balance transfer loans.

These options can offer lower interest rates and more flexible repayment terms than credit cards, making them a more suitable choice for some individuals.

Comparing Interest Rates, Fees, and Terms, 0 interest credit cards 0 balance transfer fee

It’s crucial to compare the interest rates, fees, and terms of these alternative options with those of 0% interest credit cards. This will help you determine which option is most beneficial for your specific financial situation.

Here’s a breakdown of key factors to consider:

Interest Rates

- Personal Loans: Personal loans typically offer fixed interest rates, which means your monthly payment will remain the same throughout the loan term. Interest rates for personal loans can vary depending on your credit score, loan amount, and lender.

- Balance Transfer Loans: Balance transfer loans allow you to transfer your existing credit card balances to a new loan with a lower interest rate. These loans often come with a promotional introductory period during which you’ll pay a lower interest rate. After the introductory period, the interest rate will revert to the standard rate, which can be higher than the introductory rate.

- 0% Interest Credit Cards: 0% interest credit cards offer a promotional period during which you can pay down your balance without accruing interest. However, once the promotional period ends, you’ll be charged the standard interest rate, which can be significantly higher than the introductory rate.

Fees

- Personal Loans: Personal loans may have origination fees, which are charged as a percentage of the loan amount. Some lenders also charge late payment fees or prepayment penalties.

- Balance Transfer Loans: Balance transfer loans often have balance transfer fees, which are charged as a percentage of the balance transferred. These fees can range from 1% to 5% of the balance transferred.

- 0% Interest Credit Cards: 0% interest credit cards may have balance transfer fees, annual fees, or other fees. It’s essential to review the terms and conditions carefully to understand all applicable fees.

Terms

- Personal Loans: Personal loans typically have fixed repayment terms, ranging from 1 to 7 years. The longer the loan term, the lower your monthly payments will be, but you’ll end up paying more in interest over the life of the loan.

- Balance Transfer Loans: Balance transfer loans also have fixed repayment terms, typically ranging from 1 to 5 years. The terms of a balance transfer loan can vary depending on the lender.

- 0% Interest Credit Cards: The promotional period for 0% interest credit cards can range from 6 months to 21 months. After the promotional period ends, the standard interest rate will apply, and you’ll need to make minimum payments on the remaining balance.

Choosing the Best Option for Your Financial Situation

The best option for you will depend on your individual financial circumstances. Here are some factors to consider:

Credit Score

- If you have a good credit score, you’re likely to qualify for lower interest rates on personal loans and balance transfer loans. If you have a lower credit score, you may be limited to higher interest rates or less favorable terms.

Debt Amount

- If you have a large amount of debt, a personal loan or balance transfer loan might be a better option than a 0% interest credit card. These options can help you consolidate your debt into a single, lower interest rate loan, making it easier to manage your finances.

Repayment Term

- Consider your ability to repay the loan within the specified repayment term. If you choose a longer repayment term, you’ll have lower monthly payments, but you’ll end up paying more in interest over the life of the loan.

Fees

- Compare the fees associated with each option. Some lenders charge origination fees, balance transfer fees, or annual fees. It’s important to factor these fees into your decision-making process.

Epilogue

The allure of 0% interest credit cards, coupled with the promise of no balance transfer fees, is undeniable. However, it’s essential to remember that these offers are not a magical solution for all your financial woes. By understanding the intricacies of these cards, carefully evaluating your options, and utilizing them strategically, you can harness the power of 0% interest credit cards to achieve your financial goals and pave the way for a brighter financial future.

FAQ Guide

What happens after the 0% introductory period ends?

Once the introductory period expires, the standard APR for the card kicks in, which can be significantly higher than the 0% rate. It’s crucial to have a plan in place to either pay off the balance in full before the introductory period ends or to transfer the balance to another 0% interest card if eligible.

Can I use a 0% interest credit card for everyday purchases?

While you can use these cards for everyday purchases, it’s generally advisable to focus on paying off the transferred balance first. Using the card for new purchases can lead to accumulating new debt and defeating the purpose of the 0% introductory period.

How can I improve my chances of getting approved for a 0% interest credit card?

Building a good credit score is key. Pay bills on time, keep credit utilization low, and avoid applying for too many credit cards within a short period.

Are there any hidden fees associated with 0% interest credit cards?

Besides balance transfer fees, some cards may have annual fees, foreign transaction fees, or late payment fees. Carefully read the terms and conditions before applying.