- Understanding 24-Month Credit Card Transfers

- Eligibility Criteria for 24-Month Credit Card Transfers

- Finding the Right 24-Month Credit Card Transfer Offer

- The Process of Transferring Your Balance

- Using a 24-Month Credit Card Transfer Strategically

- Alternatives to 24-Month Credit Card Transfers

- Ending Remarks

- FAQ Guide: 24 Month Credit Card Transfer

24 month credit card transfer sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

A 24-month credit card transfer is a financial tool that can help you consolidate high-interest debt and potentially save money on interest charges. By transferring your balance to a new credit card with a lower interest rate and a 24-month promotional period, you can gain valuable time to pay down your debt and potentially reduce the overall amount of interest you pay. However, it’s crucial to understand the potential drawbacks, including transfer fees and the possibility of interest rate increases after the promotional period expires.

Understanding 24-Month Credit Card Transfers

A 24-month credit card transfer allows you to move the outstanding balance from one credit card to another, often with a lower interest rate for a specified period, typically 24 months. This can be a helpful strategy to manage debt and potentially save on interest charges.

Benefits of a 24-Month Credit Card Transfer

A 24-month credit card transfer can offer several benefits, primarily related to potential interest savings.

- Lower Interest Rates: A 24-month credit card transfer often comes with a promotional interest rate that is significantly lower than your existing card’s rate. This can lead to substantial savings on interest charges, especially if you have a high balance. For example, if you have a $5,000 balance on a card with a 20% APR and transfer it to a card with a 0% APR for 24 months, you could save hundreds of dollars in interest charges.

- Consolidated Debt: A credit card transfer can help you consolidate multiple debts into one, making it easier to manage and track your payments. This can be particularly helpful if you have several credit cards with high balances and different interest rates.

- Improved Credit Utilization: By transferring your balance to a new card, you can potentially reduce your credit utilization ratio, which is the percentage of your available credit that you are using. A lower credit utilization ratio can improve your credit score, making it easier to qualify for loans and other forms of credit in the future.

Drawbacks of a 24-Month Credit Card Transfer

While a 24-month credit card transfer can offer benefits, it also comes with potential drawbacks.

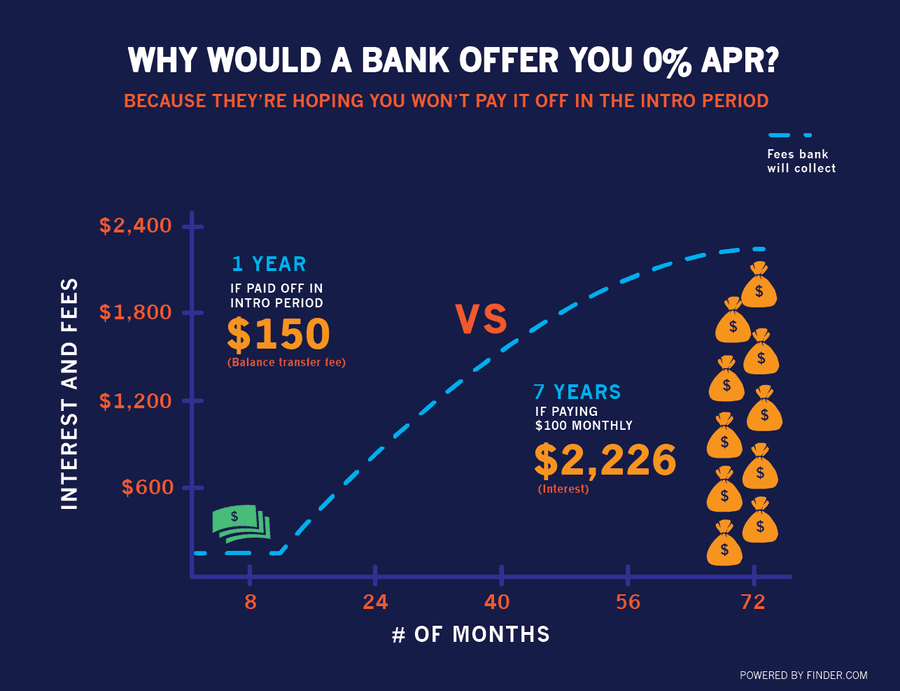

- Transfer Fees: Many credit card issuers charge a transfer fee, typically a percentage of the transferred balance, for transferring your balance to a new card. These fees can range from 3% to 5% of the transferred amount, so it’s essential to factor this cost into your calculations.

- Interest Rate Increases: After the promotional period ends, the interest rate on your transferred balance will typically revert to the card’s standard APR, which can be significantly higher than the promotional rate. This could result in higher interest charges if you haven’t paid off the balance by the end of the promotional period.

- Impact on Credit Score: Applying for a new credit card to transfer your balance can lead to a temporary decrease in your credit score, as it will create a hard inquiry on your credit report. However, the potential benefits of a lower interest rate and consolidated debt can outweigh this temporary impact.

Eligibility Criteria for 24-Month Credit Card Transfers

Securing a 24-month credit card balance transfer can be a great way to consolidate debt and save money on interest charges. However, not everyone qualifies for these offers. Lenders carefully evaluate applicants to ensure they meet specific eligibility criteria before approving a transfer.

Credit Score and Credit History

Your credit score and credit history are paramount to getting approved for a 24-month balance transfer. Lenders use your credit score to gauge your creditworthiness and assess the risk of lending you money. A higher credit score generally translates to a better chance of approval and potentially more favorable terms.

A good credit history demonstrates responsible borrowing habits, which are essential for lenders. Factors like timely payments, credit utilization, and overall credit history length are considered.

A credit score of at least 670 is often considered a good starting point for most balance transfer offers.

Income and Debt-to-Income Ratio

Your income and debt-to-income ratio (DTI) are crucial indicators of your ability to repay the transferred balance. Lenders want to ensure you can manage the new debt without jeopardizing your financial stability.

DTI is calculated by dividing your monthly debt payments by your gross monthly income.

A lower DTI generally signifies a better financial position and increases your chances of approval. Lenders may have specific DTI requirements, so it’s essential to check the terms of the balance transfer offer.

Finding the Right 24-Month Credit Card Transfer Offer

Finding the right 24-month credit card transfer offer involves careful consideration of several factors to ensure you secure the best deal for your financial situation.

Comparing 24-Month Credit Card Transfer Offers

When comparing 24-month credit card transfer offers, it is crucial to analyze various factors to determine the most suitable option for your needs.

- Transfer Fee: This fee is charged when you transfer your balance from another credit card. It’s typically a percentage of the transferred balance, ranging from 1% to 5% or a fixed fee. Lower transfer fees are generally more beneficial.

- Interest Rate: The interest rate on the balance transferred is crucial. While a 0% introductory period is appealing, it’s essential to consider the interest rate that applies after the introductory period expires. A lower interest rate minimizes interest charges and helps you pay off the balance faster.

- Introductory Period: The duration of the 0% introductory period for balance transfers is another important factor. A longer introductory period provides more time to pay off the balance without accruing interest. However, ensure you can repay the balance before the introductory period ends, as interest charges will apply after this period.

- Minimum Payment: The minimum monthly payment required is essential to consider. A lower minimum payment might seem appealing, but it can prolong the repayment period and lead to higher interest charges. Conversely, a higher minimum payment can accelerate debt repayment but may strain your budget. Choose a minimum payment that aligns with your financial capabilities and repayment goals.

- Credit Limit: The credit limit offered on the new credit card is important, especially if you plan to make additional purchases. A higher credit limit provides greater flexibility but also increases the risk of overspending. Choose a credit limit that suits your spending habits and helps you manage your debt responsibly.

- Other Fees: Be aware of any additional fees associated with the credit card, such as annual fees, late payment fees, or over-limit fees. These fees can add up over time and impact your overall costs.

Examples of 24-Month Credit Card Transfer Offers

Here are some examples of 24-month credit card transfer offers from different lenders:

| Issuer | Transfer Fee | Introductory APR | Introductory Period | Minimum Payment | Credit Limit |

|---|---|---|---|---|---|

| Bank A | 3% | 0% | 24 months | 2% of balance | $10,000 |

| Bank B | 1% | 0% | 18 months | 3% of balance | $5,000 |

| Bank C | $50 | 0% | 21 months | 1% of balance | $7,500 |

Reading the Fine Print

It is crucial to read the terms and conditions of each credit card transfer offer carefully. Pay attention to the following details:

- Eligibility Requirements: Ensure you meet the eligibility criteria for the offer, such as minimum credit score, income, and debt-to-income ratio.

- Transfer Restrictions: Some offers may have restrictions on the types of balances you can transfer, such as excluding certain types of debt or limiting the amount you can transfer.

- Interest Rate After Introductory Period: Understand the interest rate that applies after the introductory period ends, as it can significantly impact your repayment costs.

- Fees: Carefully review all applicable fees, including transfer fees, annual fees, late payment fees, and over-limit fees.

- Payment Due Date: Note the payment due date to avoid late fees and maintain a good payment history.

By understanding the terms and conditions of each offer, you can make an informed decision that aligns with your financial goals and helps you manage your debt effectively.

The Process of Transferring Your Balance

Transferring your credit card balance to a 24-month card is a straightforward process that involves several steps. By understanding these steps, you can ensure a smooth transition and make the most of your balance transfer offer.

Steps Involved in Balance Transfers

The process of transferring your balance to a 24-month credit card typically involves the following steps:

- Apply for a 24-month balance transfer credit card: The first step is to apply for a credit card that offers a 24-month balance transfer promotion. Carefully compare offers from different lenders to find the best interest rate, transfer fee, and other terms.

- Provide your existing credit card information: Once your application is approved, you will need to provide the details of your existing credit card, including the account number and balance you want to transfer.

- Initiate the balance transfer: The lender will then initiate the balance transfer process, which typically involves transferring the balance from your existing card to the new 24-month card.

- Pay off the transferred balance within the promotional period: The key to maximizing the benefits of a 24-month balance transfer is to pay off the transferred balance within the promotional period. Failure to do so will result in the application of a higher interest rate, negating the benefits of the transfer.

The Importance of Timely Payment and Maintaining a Good Credit Score

Making timely payments on your 24-month balance transfer card is crucial. It not only helps you avoid late fees and penalties but also plays a significant role in maintaining a good credit score.

- Impact on credit score: Late payments can negatively impact your credit score, making it harder to secure loans or credit cards in the future.

- Avoid penalties and fees: Missing payments can result in late fees and penalties, which can quickly add up and erode the savings you hoped to achieve with the balance transfer.

- Maintain good credit standing: By making timely payments, you demonstrate responsible financial behavior, which helps maintain a good credit score and opens doors to better financial opportunities.

Potential Consequences of Missing Payments

Failing to meet the terms of your 24-month balance transfer agreement can have several negative consequences:

- Higher interest rates: After the promotional period ends, the interest rate on your transferred balance will revert to the standard interest rate of the card, which can be significantly higher. This can quickly negate the benefits of the balance transfer.

- Late fees and penalties: Late payments can result in late fees and penalties, which can add up quickly and make it even more difficult to pay off your debt.

- Negative impact on credit score: Late payments can negatively impact your credit score, making it harder to secure loans or credit cards in the future.

- Account closure: In extreme cases, failing to make payments on time can lead to the closure of your account, which can further damage your credit score.

Using a 24-Month Credit Card Transfer Strategically

A 24-month credit card balance transfer can be a powerful tool for saving money on interest, but it’s essential to use it strategically to maximize its benefits. A well-designed strategy ensures you get the most out of the promotional period and avoid falling back into debt.

Prioritizing High-Interest Debt for Transfer

Transferring high-interest debt to a 24-month balance transfer credit card is crucial for maximizing savings. By transferring balances with the highest interest rates first, you reduce the amount of interest accruing on your debt and free up cash flow for other financial goals.

- Identify the credit cards with the highest interest rates and prioritize transferring those balances first. A lower interest rate means you’ll pay less in interest charges over the 24-month promotional period.

- Calculate the total interest you would pay on each debt over the 24-month period if you didn’t transfer the balance. This will help you understand the potential savings you can achieve by transferring the debt.

- Compare the interest rate offered by the balance transfer card with the current interest rates on your existing cards. Ensure the balance transfer card offers a significantly lower interest rate for the promotional period to justify the transfer.

Avoiding New Debt During the Transfer Period, 24 month credit card transfer

It’s essential to avoid accruing new debt during the 24-month promotional period of the balance transfer. Using the balance transfer card for new purchases can negate the benefits of the promotional period, as you’ll start accruing interest on the new purchases.

- Resist the temptation to use the balance transfer card for new purchases. Focus on paying down the transferred debt during the promotional period.

- Set a strict budget and stick to it. Track your spending carefully to ensure you’re not overspending.

- Consider using a different credit card for everyday purchases or a debit card to avoid accumulating new debt.

Alternatives to 24-Month Credit Card Transfers

While 24-month credit card balance transfers offer a valuable solution for debt consolidation, they are not the only option available. Several alternatives can help you manage your debt effectively.

Exploring these alternatives can be crucial to find the best solution for your unique financial circumstances.

Personal Loans

Personal loans can be a suitable alternative to credit card balance transfers, especially if you need a longer repayment term.

- Longer Repayment Terms: Personal loans typically offer repayment terms ranging from 2 to 7 years, providing more flexibility to manage your debt comfortably.

- Fixed Interest Rates: Unlike credit cards, personal loans usually have fixed interest rates, protecting you from fluctuating interest costs and making budgeting easier.

- Lower Interest Rates: Personal loans can offer lower interest rates than credit cards, particularly if you have good credit. This can lead to significant savings on interest charges over time.

However, personal loans also come with drawbacks:

- Origination Fees: Some lenders charge origination fees, which are a percentage of the loan amount. These fees can add to the overall cost of borrowing.

- Credit Score Impact: Applying for a personal loan can temporarily lower your credit score, as it involves a hard inquiry. This can be a concern if you are planning to apply for other loans in the near future.

- Eligibility Requirements: Personal loans often have stricter eligibility requirements than credit card balance transfers. Lenders may require a minimum credit score and income level to qualify.

Balance Transfers with Longer Terms

Some credit cards offer balance transfer options with longer terms, extending beyond the typical 24 months.

- Extended Repayment Period: These options allow you to spread out your debt payments over a longer period, potentially lowering your monthly payments.

- Flexibility in Payment Management: With a longer term, you can manage your debt more comfortably, especially if you have a limited budget.

However, consider the following:

- Higher Interest Rates: Longer-term balance transfers often come with higher interest rates than shorter-term offers, increasing the overall cost of borrowing.

- Potential for Increased Interest Charges: While a longer term lowers your monthly payments, it can lead to higher interest charges over the life of the transfer.

Ending Remarks

In conclusion, a 24-month credit card transfer can be a powerful tool for debt consolidation, offering the potential for significant interest savings. However, it’s vital to carefully consider the eligibility criteria, compare offers, and understand the terms and conditions before making a decision. By strategically using this financial instrument, you can effectively manage your debt and work towards a brighter financial future.

FAQ Guide: 24 Month Credit Card Transfer

How do I find the best 24-month credit card transfer offer?

Compare offers from different lenders based on factors like interest rates, transfer fees, and eligibility requirements. Consider your credit score and debt-to-income ratio when choosing an offer.

What happens after the 24-month promotional period ends?

The interest rate on your transferred balance will revert to the standard rate for the credit card, which can be significantly higher than the promotional rate. Make sure you have a plan to pay off your debt before the promotional period ends to avoid accruing more interest.

Can I transfer my entire debt balance?

Credit card issuers often have limits on the amount of debt you can transfer. Check the terms and conditions of the offer to determine the maximum transfer amount.

Is it better to get a personal loan instead of a 24-month credit card transfer?

Personal loans often have fixed interest rates and fixed terms, making them a more predictable option. However, credit card transfers can offer lower interest rates during the promotional period. Consider your financial situation and compare both options to determine the best fit.