- Understanding Balance Transfer Credit Cards

- No-Fee Balance Transfer Credit Cards

- How to Use Balance Transfer Credit Cards Effectively

- Alternatives to Balance Transfer Credit Cards: Balance Transfer Credit Card No Fee

- Considerations Before Applying for a Balance Transfer Credit Card

- Closure

- Frequently Asked Questions

Balance transfer credit card no fee offers a tempting solution to high-interest debt, promising a way to consolidate your balances and potentially save on interest charges. These cards, as the name suggests, allow you to transfer existing balances from other credit cards without incurring a transfer fee, making them an attractive option for those looking to manage their debt more effectively.

However, it’s crucial to understand the nuances of these cards before jumping in. While they can be beneficial, they also come with certain drawbacks. Factors like introductory APRs, ongoing APRs, and credit score requirements all play a significant role in determining if a balance transfer credit card is the right choice for you.

Understanding Balance Transfer Credit Cards

Balance transfer credit cards are a financial tool that allows you to move outstanding balances from one credit card to another. They offer a temporary reprieve from high-interest rates, providing an opportunity to pay down debt more efficiently.

Typical Features of Balance Transfer Credit Cards

Balance transfer credit cards typically offer attractive features that can help you manage your debt. These features include:

- Introductory APR: This is a temporary, lower interest rate that is applied to the transferred balance for a specified period, usually 6 to 18 months. This can significantly reduce the amount of interest you accrue during the introductory period.

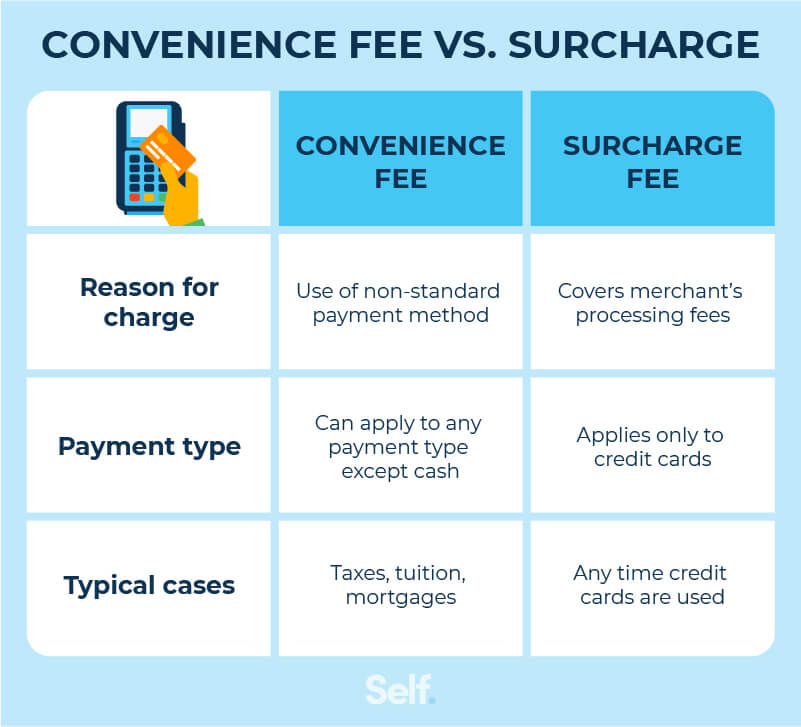

- Transfer Fees: While some balance transfer cards offer a zero-fee transfer, others may charge a fee, usually a percentage of the transferred balance. This fee is typically deducted from the transferred balance before it is credited to your new card.

- Ongoing APR: Once the introductory period ends, the balance transfer credit card will revert to its standard APR. This rate is typically higher than the introductory APR, so it’s crucial to pay down the balance before the introductory period expires.

Advantages of Using Balance Transfer Credit Cards

Balance transfer credit cards can offer several advantages, particularly for individuals seeking to consolidate high-interest debt:

- Lower Interest Rates: By transferring your balance to a card with a lower introductory APR, you can save on interest charges and potentially pay off your debt faster.

- Debt Consolidation: Balance transfer cards allow you to combine multiple credit card balances into one, simplifying your debt management and potentially reducing your monthly payments.

- Improved Credit Utilization: Moving debt to a new card can lower your overall credit utilization ratio, which is the amount of credit you’re using compared to your available credit limit. This can positively impact your credit score.

Disadvantages of Using Balance Transfer Credit Cards

While balance transfer credit cards can be beneficial, it’s essential to be aware of their potential drawbacks:

- Transfer Fees: Some balance transfer cards charge fees, which can add to your overall debt burden. These fees can range from a few dollars to a percentage of the transferred balance.

- Temporary Relief: The introductory APR is only temporary, and the interest rate will revert to the standard APR after the introductory period ends. If you don’t pay down your balance significantly before this happens, you could end up paying more interest than you would have with your original card.

- Potential for Overspending: The convenience of a balance transfer card can lead to overspending if you’re not careful. It’s crucial to use the card responsibly and stick to a budget.

No-Fee Balance Transfer Credit Cards

No-fee balance transfer credit cards are a valuable tool for consumers looking to consolidate debt and save money on interest charges. These cards allow you to transfer balances from high-interest credit cards to a new card with a lower interest rate, often with no balance transfer fee. This can significantly reduce your monthly payments and help you pay off your debt faster.

Factors to Consider When Choosing a No-Fee Balance Transfer Credit Card

It is important to carefully consider several factors when searching for a no-fee balance transfer credit card to find the best option for your needs.

Credit Score Requirements

No-fee balance transfer credit cards typically have credit score requirements that vary depending on the issuer. Generally, you’ll need good to excellent credit (a FICO score of 670 or higher) to qualify for the most competitive offers.

Introductory APRs

Introductory APRs are the interest rates offered for a limited time, usually for the first 6 to 18 months, on balance transfers. These rates can be significantly lower than the ongoing APR, making them attractive for debt consolidation.

Ongoing APRs

The ongoing APR is the interest rate charged after the introductory period expires. It’s crucial to compare ongoing APRs across different cards, as they can vary significantly. A lower ongoing APR can help you save money on interest charges in the long run.

Other Fees

While these cards typically don’t charge balance transfer fees, they may have other fees, such as annual fees, foreign transaction fees, or late payment fees. Carefully review the terms and conditions to understand all potential fees.

Comparing No-Fee Balance Transfer Credit Cards

Here are some examples of no-fee balance transfer credit cards available in the market:

Card 1

* Introductory APR: 0% for 18 months

* Ongoing APR: 18.99%

* Credit Score Requirement: Good to excellent

* Other Fees: $0 annual fee, foreign transaction fee of 3%

Card 2

* Introductory APR: 0% for 12 months

* Ongoing APR: 16.99%

* Credit Score Requirement: Fair to good

* Other Fees: $0 annual fee, no foreign transaction fees

Card 3

* Introductory APR: 0% for 15 months

* Ongoing APR: 19.99%

* Credit Score Requirement: Excellent

* Other Fees: $99 annual fee, no foreign transaction fees

It’s essential to compare these factors across different cards to find the one that best aligns with your financial goals and creditworthiness.

How to Use Balance Transfer Credit Cards Effectively

Balance transfer credit cards can be a valuable tool for saving money on interest charges, but it’s essential to use them strategically to maximize their benefits. Understanding how to effectively utilize these cards can help you pay off debt faster and avoid potential pitfalls.

Transferring Balances

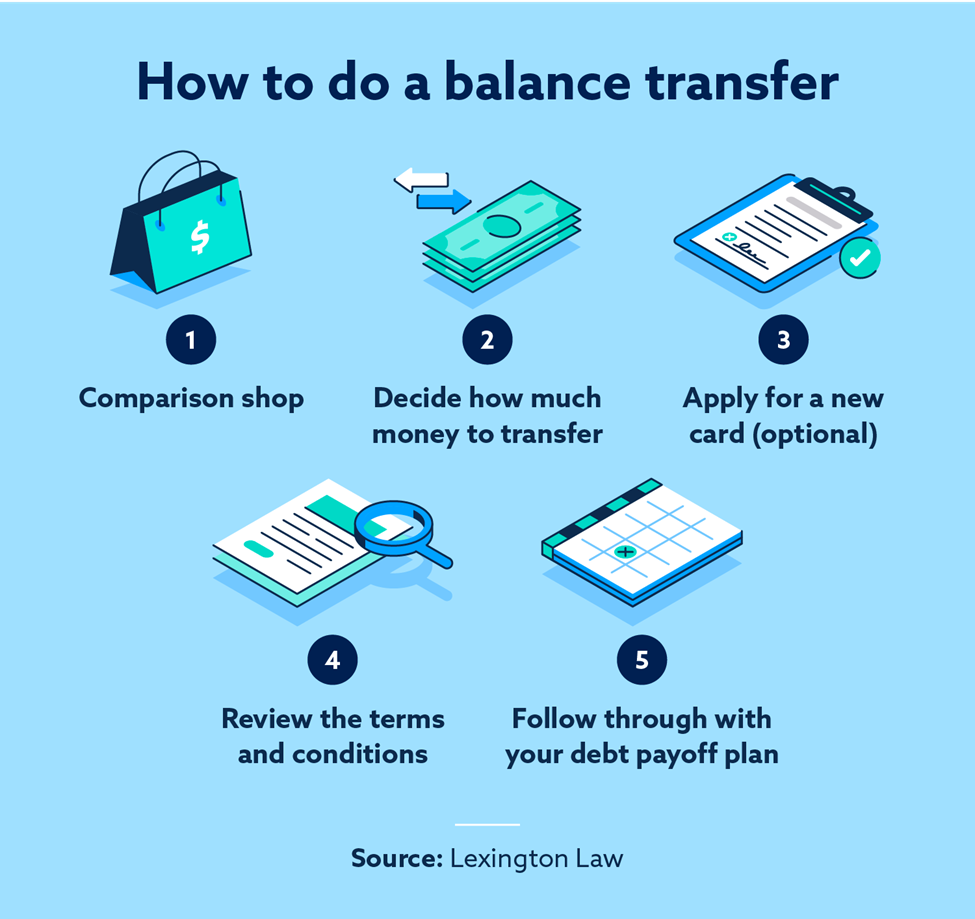

To transfer balances to a no-fee balance transfer credit card, follow these steps:

- Choose a balance transfer card: Compare different cards based on the introductory 0% APR period, balance transfer fee, and other terms.

- Apply for the card: Once you’ve chosen a card, submit an application and wait for approval.

- Request a balance transfer: After your card is approved, contact the new card issuer and provide them with the details of the account you want to transfer. This typically includes the account number, the amount you want to transfer, and any necessary documentation.

- Monitor the transfer process: Keep an eye on your account statements to ensure the balance transfer is processed correctly and on time.

Maximizing the Benefits of a Balance Transfer Credit Card

Using a balance transfer credit card effectively requires a strategic approach to ensure you take full advantage of the introductory 0% APR period and avoid incurring additional interest charges.

- Pay down the balance as quickly as possible: The goal of a balance transfer card is to pay off the debt before the introductory period ends. Aim to make more than the minimum payment each month to accelerate your progress.

- Avoid new purchases: Use the card solely for transferring existing balances. Avoid making new purchases to prevent accruing interest at the regular APR.

- Set up automatic payments: Automate your payments to ensure you don’t miss a deadline and incur late fees.

- Consider a debt consolidation loan: If you have multiple high-interest debts, a debt consolidation loan may be a better option.

Monitoring Your Credit Card Statement

Regularly reviewing your credit card statement is crucial to avoid surprises and ensure you’re on track to pay off your debt.

- Check for errors: Verify that all transactions are accurate and that there are no unauthorized charges.

- Track your progress: Monitor your balance and payment history to ensure you’re making sufficient payments and staying within your budget.

- Be aware of the expiration date: Note the date when the introductory 0% APR period ends.

Avoiding Late Payments

Late payments can significantly impact your credit score and lead to additional fees.

- Set reminders: Set up reminders for your due date to ensure you make timely payments.

- Consider automatic payments: Automate your payments to avoid missing deadlines.

- Pay early if possible: Paying your balance before the due date gives you a buffer in case of unforeseen circumstances.

Alternatives to Balance Transfer Credit Cards: Balance Transfer Credit Card No Fee

While balance transfer credit cards offer a temporary reprieve from high interest rates, they’re not the only solution for managing debt. Exploring other options can lead to a more strategic and long-term approach to financial stability.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts into a single loan with a lower interest rate. This simplifies repayment and potentially reduces monthly payments.

- Pros: Lower interest rates can lead to significant savings on interest payments over time. A single monthly payment streamlines debt management.

- Cons: Requires a good credit score for approval. May not be suitable for those with high debt-to-income ratios.

Balance Transfer Checks

Balance transfer checks allow you to transfer debt from one credit card to another, similar to a balance transfer credit card. However, they are often offered as a promotional tool by banks and credit unions.

- Pros: Can provide a lower interest rate compared to the original credit card. Often come with introductory promotional periods.

- Cons: May have fees associated with the transfer. Can be less flexible than balance transfer credit cards.

Debt Management Plans

Debt management plans, offered by credit counseling agencies, help you negotiate lower interest rates and monthly payments with your creditors.

- Pros: Can reduce your monthly payments and potentially shorten the repayment period. Can help you avoid defaulting on your debts.

- Cons: May require a monthly fee for the service. Can negatively impact your credit score in the short term.

Debt Settlement

Debt settlement involves negotiating with creditors to pay off your debt for a lower amount than what you originally owed.

- Pros: Can significantly reduce the amount of debt you owe. Can improve your credit score by lowering your debt-to-credit ratio.

- Cons: May damage your credit score in the short term. Can be difficult to negotiate a favorable settlement.

Key Features of Debt Management Options

| Option | Interest Rate | Fees | Eligibility Requirements |

|---|---|---|---|

| Balance Transfer Credit Cards | Variable, often with introductory 0% APR periods | Balance transfer fees, annual fees | Good credit score, sufficient available credit |

| Debt Consolidation Loans | Fixed or variable, typically lower than credit card rates | Origination fees, closing costs | Good credit score, low debt-to-income ratio |

| Balance Transfer Checks | Variable, often with introductory 0% APR periods | Transfer fees, processing fees | Good credit score, sufficient available credit |

| Debt Management Plans | Negotiated with creditors, typically lower than original rates | Monthly service fees | Financial hardship, willingness to work with a credit counseling agency |

| Debt Settlement | Negotiated with creditors, typically a significant reduction from the original amount | Negotiation fees, potential legal fees | High debt burden, willingness to accept a negative impact on credit score |

Considerations Before Applying for a Balance Transfer Credit Card

Before you apply for a balance transfer credit card, it’s crucial to assess your financial situation to ensure it’s the right choice for you. This involves examining your credit score, current debt levels, and spending habits.

Understanding Your Credit Score

Your credit score is a numerical representation of your creditworthiness. It plays a significant role in determining the interest rates and terms you qualify for when applying for a credit card. A higher credit score generally leads to better interest rates and terms, which can be advantageous when transferring balances.

A good credit score can help you secure a balance transfer credit card with a low introductory APR, allowing you to save on interest charges.

Assessing Your Debt Levels

Evaluate your current debt levels and identify the sources of your debt. This includes credit card balances, personal loans, and any other outstanding debts. Determine the total amount of debt you’re carrying and the interest rates you’re paying.

A comprehensive understanding of your debt levels is essential for deciding if a balance transfer credit card is a viable solution for managing your debt.

Analyzing Your Spending Habits, Balance transfer credit card no fee

Reflect on your spending habits and identify areas where you can cut back or reduce your spending. This helps you determine if you can manage your debt payments effectively after transferring your balances.

By analyzing your spending patterns, you can create a realistic budget that allows you to make consistent payments on your balance transfer credit card and avoid accruing new debt.

Improving Your Credit Score

If your credit score is not optimal, consider taking steps to improve it before applying for a balance transfer credit card. This can increase your chances of getting approved and securing a better interest rate.

- Pay your bills on time: Timely payments are a crucial factor in building a good credit score. Make sure to pay all your bills, including credit card payments, on or before the due date.

- Reduce your credit utilization ratio: This ratio represents the amount of credit you’re using compared to your total available credit. Aim to keep this ratio below 30% to improve your credit score.

- Avoid opening too many new credit accounts: Each time you apply for a new credit account, a hard inquiry is placed on your credit report, which can temporarily lower your score. Limit your applications to avoid unnecessary inquiries.

- Check your credit report for errors: Review your credit report for any inaccuracies or mistakes. If you find any errors, dispute them with the credit reporting agencies to correct them.

Closure

Ultimately, the decision to use a balance transfer credit card no fee depends on your individual financial circumstances. If you’re struggling with high-interest debt and have a good credit score, this option could be a viable solution. However, it’s essential to research different cards, compare terms, and understand the potential risks before making a decision. By carefully considering your options and utilizing these cards responsibly, you can potentially save money and get your finances back on track.

Frequently Asked Questions

What is the typical introductory APR for a balance transfer credit card no fee?

Introductory APRs for balance transfer credit cards no fee can vary widely, but they often range from 0% to 18% for a specific period, typically 12 to 18 months.

What happens after the introductory APR period ends?

Once the introductory period expires, the ongoing APR kicks in, which can be significantly higher than the introductory rate. It’s essential to understand the ongoing APR before applying for a balance transfer credit card.

Do all balance transfer credit cards have a minimum balance transfer amount?

Yes, most balance transfer credit cards have a minimum balance transfer amount, which can range from $50 to $500 or more. Be sure to check the terms and conditions of the card you’re considering.