- What is a Credit Balance Transfer?: Credit Balance Transfer No Fee

- Understanding “No Fee” Credit Balance Transfers

- Eligibility Criteria for Credit Balance Transfers

- Finding the Best “No Fee” Credit Balance Transfer Offer

- The Process of Transferring a Credit Balance

- Considerations and Risks Associated with Credit Balance Transfers

- Alternatives to Credit Balance Transfers

- Epilogue

- Popular Questions

Credit balance transfer no fee offers a tempting way to consolidate debt and potentially save on interest. This enticing proposition, however, comes with its own set of considerations and potential pitfalls. Understanding the nuances of these transfers is crucial before jumping into a seemingly free solution.

This guide will demystify the world of credit balance transfers, explaining what they are, how they work, and the key factors to consider when evaluating “no fee” offers. We’ll also explore the potential risks and provide insights into alternative debt management strategies.

What is a Credit Balance Transfer?: Credit Balance Transfer No Fee

A credit balance transfer is a way to move the outstanding balance from one credit card to another. This can be a useful strategy if you’re looking to save money on interest charges or consolidate your debt.

A credit balance transfer works by transferring the outstanding balance from your existing credit card to a new credit card with a lower interest rate. You’ll then make payments on the new credit card, and the interest rate will be based on the new card’s terms.

Benefits of a Credit Balance Transfer

Credit balance transfers can offer several benefits, including:

- Lower interest rates: One of the main benefits of a credit balance transfer is the potential to save money on interest charges. If you transfer your balance to a card with a lower interest rate, you’ll pay less in interest over time.

- Consolidation of debt: Credit balance transfers can help you consolidate your debt into a single payment, making it easier to manage your finances.

- 0% introductory APR: Many credit cards offer 0% introductory APRs on balance transfers for a limited time. This can be a great way to save money on interest if you can pay off the balance before the introductory period ends.

Understanding “No Fee” Credit Balance Transfers

Credit balance transfers, also known as balance transfers, allow you to move your outstanding debt from one credit card to another. While they can be a helpful tool for managing debt, it’s essential to understand the various fees associated with them. “No fee” balance transfers can seem appealing, but it’s crucial to examine the details to determine if they truly offer a cost-effective solution.

Different Types of Fees Associated with Credit Balance Transfers

Balance transfers are not always free. There are several types of fees you might encounter:

- Balance Transfer Fee: This is a percentage of the balance you transfer, typically ranging from 1% to 5%.

- Annual Fee: Some credit cards have annual fees, which can add up over time.

- Foreign Transaction Fee: If you make purchases outside of your home country, you may incur a foreign transaction fee.

- Late Payment Fee: You may be charged a late payment fee if you fail to make your minimum payment by the due date.

- Over-Limit Fee: If you exceed your credit limit, you may be charged an over-limit fee.

Implications of “No Fee” Credit Balance Transfers

While a “no fee” balance transfer might sound enticing, it’s crucial to remember that these offers typically come with certain caveats.

- Introductory APR: Many “no fee” balance transfer offers come with an introductory APR (Annual Percentage Rate) for a limited period, usually 6 to 18 months. After this introductory period, the APR can significantly increase, potentially offsetting any savings from the initial “no fee” transfer.

- Balance Transfer Limits: There are usually limits on the amount you can transfer. If your debt exceeds the limit, you may not be able to transfer the entire balance.

- Eligibility Requirements: Credit card issuers may have eligibility requirements for “no fee” balance transfers. You may need a good credit score to qualify for the offer.

Comparing “No Fee” Offers from Various Financial Institutions

Before accepting a “no fee” balance transfer offer, it’s crucial to compare offers from different financial institutions. Here’s a breakdown of factors to consider:

- Introductory APR: Compare the introductory APRs offered by different institutions and consider how long the introductory period lasts.

- Regular APR: Understand the regular APR that applies after the introductory period. This will help you determine the long-term cost of the balance transfer.

- Balance Transfer Fees: While the offer may advertise “no fee,” ensure there are no hidden fees or charges associated with the transfer.

- Other Fees: Look out for other fees, such as annual fees, foreign transaction fees, and late payment fees. These can add up over time and negate the benefits of a “no fee” balance transfer.

- Credit Limit: Consider the credit limit offered by the new card and ensure it’s sufficient to cover your entire debt.

- Eligibility Requirements: Check if you meet the eligibility requirements for the offer, such as having a good credit score or a specific credit history.

Eligibility Criteria for Credit Balance Transfers

To qualify for a “no fee” credit balance transfer, you must meet specific eligibility criteria set by the lender. These criteria are designed to ensure that the lender can assess your creditworthiness and determine if you’re a suitable candidate for a balance transfer.

Credit Score and Debt-to-Income Ratio

Your credit score and debt-to-income ratio are key factors that lenders consider when evaluating your eligibility for a credit balance transfer.

- Credit Score: Lenders typically prefer applicants with good credit scores, usually above 670, as this indicates a lower risk of default. A higher credit score can increase your chances of approval and potentially secure a lower interest rate.

- Debt-to-Income Ratio (DTI): This ratio measures the percentage of your monthly income that goes towards debt payments. Lenders prefer applicants with a lower DTI, ideally below 43%, as it demonstrates your ability to manage your finances effectively. A higher DTI might make it more challenging to qualify for a balance transfer.

Common Requirements for Applicants

Here’s a checklist of common requirements for applicants seeking “no fee” credit balance transfers:

- Good Credit History: A consistent record of on-time payments and responsible credit use is essential.

- Sufficient Income: You need to demonstrate a stable income stream that allows you to comfortably make your monthly payments.

- Low Existing Debt: Lenders prefer applicants with minimal existing debt, indicating a healthy financial position.

- No Recent Credit Applications: Multiple recent credit applications can negatively impact your credit score, potentially making you ineligible for a balance transfer.

- No Open Bankruptcies or Foreclosures: These events can significantly impact your creditworthiness and make it harder to qualify.

- Meeting Minimum Credit Limit Requirements: Lenders often have minimum credit limit requirements for balance transfers.

Finding the Best “No Fee” Credit Balance Transfer Offer

Securing a “no fee” credit balance transfer offer can be a smart move to save money on interest charges. However, it’s crucial to compare offers meticulously to find the most advantageous deal. This involves understanding the various aspects of each offer and selecting the one that best suits your financial needs.

Comparing Credit Balance Transfer Offers

Finding the best “no fee” credit balance transfer offer requires comparing various offers from different lenders. This involves examining interest rates, transfer fees, and other important terms.

- Interest Rates: Look for offers with the lowest possible interest rate, as this directly affects the total cost of transferring your balance. A lower interest rate means you’ll pay less in interest charges over time.

- Transfer Fees: Although you’re seeking “no fee” offers, some lenders may have small processing fees. Be sure to check for any hidden fees or charges associated with the transfer.

- Introductory Periods: Many credit card issuers offer introductory periods with low or even zero interest rates. These periods can be beneficial, but remember they are typically temporary. Once the introductory period ends, the interest rate usually reverts to the standard rate.

- Balance Transfer Limits: Each offer has a maximum balance transfer limit. Make sure the limit is sufficient to cover your existing balance.

- Credit Card Rewards: Consider any rewards programs or perks associated with the credit card. Some cards offer cash back, travel points, or other benefits that can enhance your overall value proposition.

Factors to Consider When Evaluating Offers

Evaluating credit balance transfer offers requires considering several factors beyond just interest rates and fees.

- Your Credit Score: Your credit score plays a significant role in determining the offers you’ll qualify for. A higher credit score typically translates to more favorable terms and lower interest rates.

- Existing Debt: Assess your overall debt situation and consider the impact of a balance transfer on your overall financial health. Ensure you can manage the new debt responsibly.

- Payment History: Your payment history on existing credit cards is crucial. Maintaining a consistent and on-time payment record can improve your chances of securing a favorable balance transfer offer.

- Terms and Conditions: Carefully review the terms and conditions of each offer. Pay close attention to the duration of introductory periods, late payment penalties, and other relevant details.

- Customer Service: Choose a lender with a good reputation for customer service. This is especially important if you anticipate needing assistance or have any questions during the transfer process.

Table of Credit Balance Transfer Offers

To illustrate the comparison process, consider the following table, which provides a hypothetical example of different credit balance transfer offers:

| Provider | Interest Rate | Transfer Fee | Introductory Period | Balance Transfer Limit |

|---|---|---|---|---|

| CardIssuer A | 12.99% | $0 | 12 months | $5,000 |

| CardIssuer B | 14.99% | $25 | 18 months | $10,000 |

| CardIssuer C | 16.99% | $0 | 6 months | $2,500 |

In this example, CardIssuer A appears to be the most attractive option due to its lower interest rate, no transfer fee, and a decent introductory period. However, you must consider your individual needs and financial situation before making a decision.

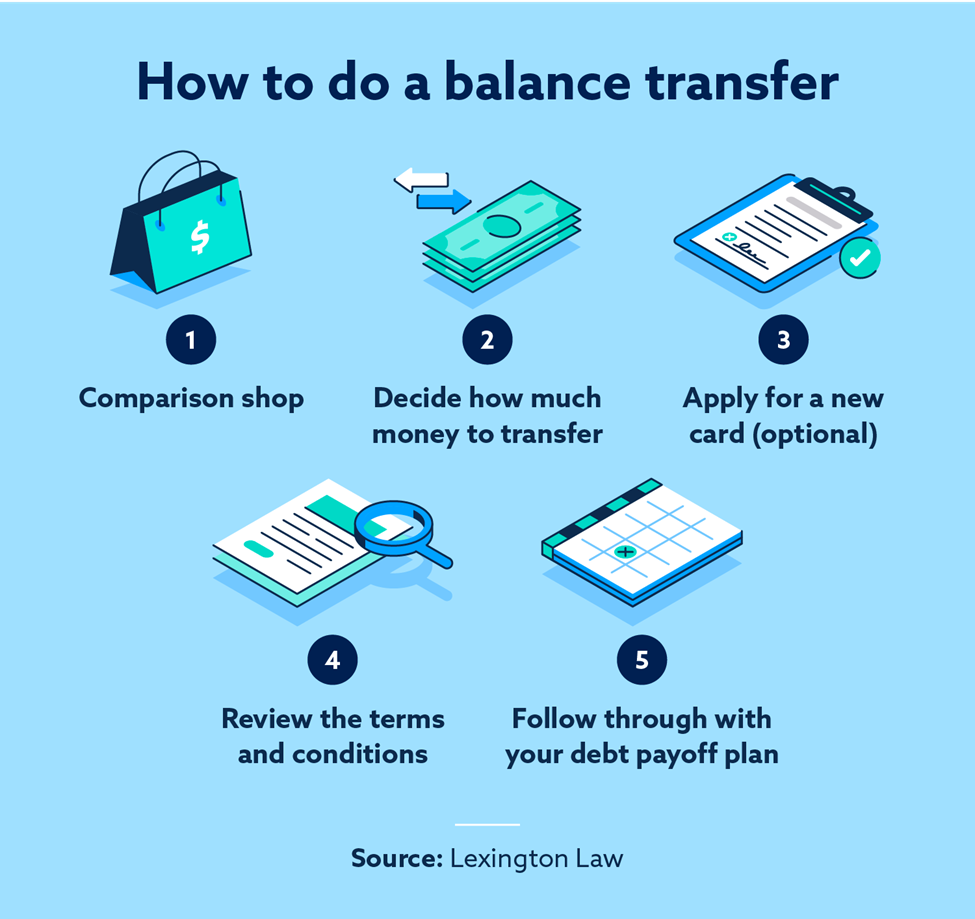

The Process of Transferring a Credit Balance

Transferring a credit balance from one credit card to another involves a straightforward process, typically initiated by the cardholder. This transfer allows you to consolidate debt, potentially benefitting from a lower interest rate on the new card.

Documentation Required for Transfer, Credit balance transfer no fee

The transfer process usually requires providing certain documentation to the new credit card issuer. This documentation helps verify your identity and the credit balance you intend to transfer.

- Your existing credit card details: This includes your credit card number, expiry date, and security code.

- Your personal details: This typically includes your full name, address, and Social Security Number (SSN) or other identification details.

- Proof of income: This may be required to assess your ability to manage the transferred balance.

- Authorization for the transfer: You may need to sign a form authorizing the transfer of your credit balance.

Timeline for Completing the Transfer

The time it takes to complete a credit balance transfer can vary depending on the issuer and the complexity of the process. However, it typically takes a few business days to a couple of weeks.

- Initial processing: Once you submit your request, the new issuer will typically review your application and verify your information. This process can take a few days.

- Transfer confirmation: You will receive confirmation once the transfer is approved, and the new credit card issuer will contact your previous issuer to initiate the transfer.

- Funds transfer: The funds will be transferred from your old credit card to your new credit card. This can take a few business days to a week.

Considerations and Risks Associated with Credit Balance Transfers

While credit balance transfers can be a valuable tool for saving money on interest, it’s crucial to be aware of the potential risks and drawbacks before making a decision. Understanding the terms and conditions of the offer and the potential consequences of not making timely payments is essential for maximizing the benefits of a balance transfer and minimizing potential negative outcomes.

Understanding the Terms and Conditions

The terms and conditions of a credit balance transfer offer are crucial to understanding the true cost of the transfer. These terms can vary significantly between lenders, so it’s essential to carefully review them before accepting an offer. Key aspects to consider include:

- Balance Transfer Fee: While a balance transfer may be advertised as “no fee,” there may be a balance transfer fee, which is a percentage of the transferred balance. This fee can be a significant cost, so it’s essential to factor it into your calculations.

- Introductory Interest Rate: Many balance transfer offers come with an introductory interest rate that is significantly lower than the standard APR. This introductory rate typically lasts for a specific period, after which the standard APR applies. Failing to pay off the transferred balance before the introductory period ends could result in significantly higher interest charges.

- Minimum Payment Requirements: The minimum payment required on a balance transfer can vary between lenders. A lower minimum payment may seem attractive, but it can lead to a longer repayment period and higher overall interest costs. Always aim to make more than the minimum payment to pay off the balance faster and reduce interest charges.

- Late Payment Fees: Late payments on a balance transfer can result in late payment fees. These fees can add up quickly, so it’s essential to make payments on time to avoid incurring these costs.

Consequences of Not Making Timely Payments

Failing to make timely payments on a balance transfer can have serious consequences, including:

- Higher Interest Charges: When you miss a payment, your credit card issuer may charge you a late payment fee and increase your interest rate. This can significantly increase your overall debt burden.

- Negative Impact on Credit Score: Late payments can negatively impact your credit score, making it more difficult to obtain credit in the future, such as a mortgage or auto loan, or potentially leading to higher interest rates on future loans.

- Account Closure: If you consistently miss payments, your credit card issuer may close your account, leaving you without access to credit and potentially affecting your credit score.

Alternatives to Credit Balance Transfers

While credit balance transfers can be a valuable tool for managing debt, they are not the only solution. Exploring alternative strategies can help you find the best approach for your specific financial situation.

Debt Consolidation Loans

Debt consolidation loans involve taking out a new loan to pay off multiple existing debts, such as credit cards, personal loans, or medical bills. By consolidating your debts into a single loan, you can simplify your repayment process and potentially lower your monthly payments.

- Pros:

- Lower monthly payments

- Simplified repayment process

- Potentially lower interest rates

- Cons:

- May not be available to everyone with poor credit

- Can extend the repayment period

- May come with origination fees

Balance Transfer Credit Cards

Balance transfer credit cards offer a temporary 0% APR period, allowing you to transfer your existing credit card balances and avoid interest charges for a specific time. This can be a useful strategy to pay down your debt faster and save on interest.

- Pros:

- 0% APR period for a specific time

- Can save on interest charges

- Potential for a lower interest rate after the introductory period

- Cons:

- Balance transfer fees may apply

- Higher interest rates after the introductory period

- May not be available to everyone with poor credit

Debt Management Plans

Debt management plans (DMPs) are programs offered by credit counseling agencies that help you negotiate lower interest rates and monthly payments with your creditors. These plans can help you get out of debt faster and avoid defaulting on your loans.

- Pros:

- Lower interest rates and monthly payments

- Protection from creditors’ collection efforts

- Professional guidance and support

- Cons:

- May require a monthly fee

- Can negatively impact your credit score

- Not all creditors participate in DMPs

Debt Settlement

Debt settlement involves negotiating with creditors to pay off your debt for a lower amount than what you originally owed. This can be a viable option for individuals struggling to make their payments but may come with significant risks.

- Pros:

- Potential to reduce your debt significantly

- May be a solution when other options are not available

- Cons:

- Can negatively impact your credit score

- May result in tax implications

- May be illegal in some states

Budgeting and Financial Management

Effective budgeting and financial management are crucial for managing debt and achieving financial stability. By tracking your income and expenses, you can identify areas where you can cut back and allocate funds towards debt repayment.

- Tips for Budgeting and Financial Management:

- Track your income and expenses

- Create a realistic budget

- Set financial goals

- Automate your savings

- Avoid impulse purchases

- Seek professional financial advice if needed

Epilogue

Navigating the world of credit balance transfers requires careful consideration. While the allure of “no fee” offers can be tempting, it’s essential to weigh the potential benefits against the associated risks. By understanding the mechanics of these transfers, evaluating eligibility criteria, and exploring alternative solutions, you can make informed decisions that align with your financial goals and minimize potential pitfalls.

Popular Questions

How long does a credit balance transfer typically take?

The time it takes to complete a credit balance transfer can vary depending on the financial institution. It can range from a few business days to several weeks. It’s advisable to contact your chosen provider for an estimated timeline.

Are there any hidden fees associated with “no fee” credit balance transfers?

While “no fee” credit balance transfers may not have an upfront transfer fee, it’s crucial to review the terms and conditions carefully. Some offers may include annual fees, balance transfer fees after a certain period, or other charges. Be sure to read the fine print to avoid surprises.