Balance transfer credit card no transfer fee is a powerful tool that can help you save money on debt. These cards allow you to transfer balances from high-interest credit cards to a new card with a lower interest rate, often with no transfer fee. This can significantly reduce your interest charges and help you pay off your debt faster.

But finding the right balance transfer credit card with no transfer fee isn’t always easy. You need to consider factors like APR (Annual Percentage Rate), introductory periods, credit score requirements, and rewards programs. This guide will walk you through everything you need to know about balance transfer credit cards with no transfer fee, helping you make an informed decision and save money on your debt.

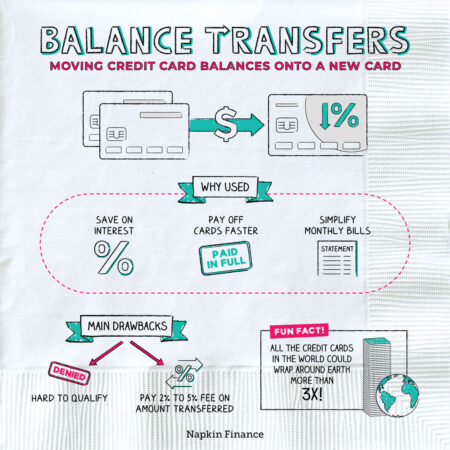

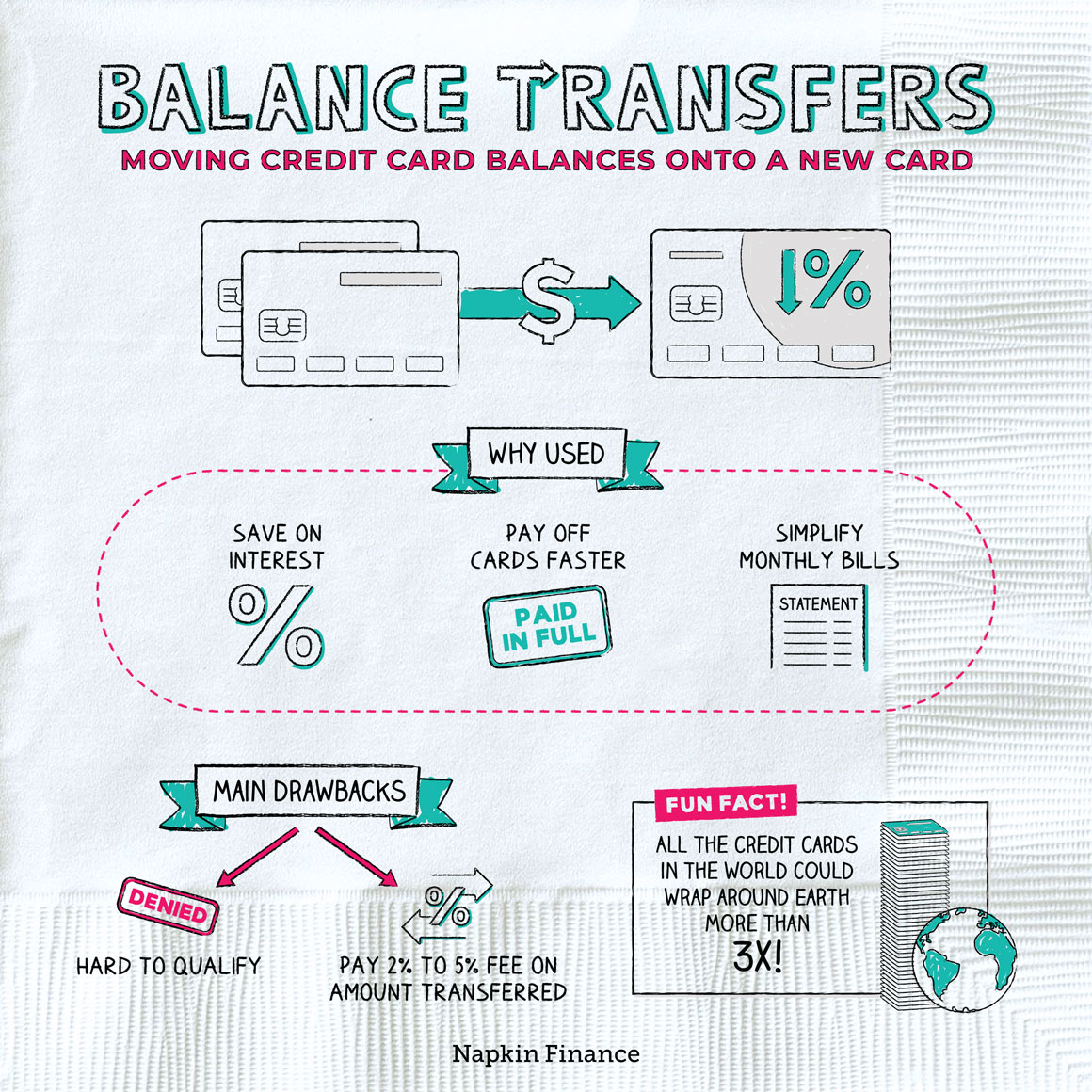

Introduction to Balance Transfer Credit Cards

A balance transfer credit card allows you to move existing debt from one credit card to another. This can be a useful tool for managing your debt and potentially saving money on interest charges.

Balance transfer credit cards offer a way to consolidate your debt and potentially lower your interest payments. They work by transferring your outstanding balance from another credit card to a new card, often with a promotional period offering a lower interest rate.

Key Features of Balance Transfer Credit Cards

These cards typically have several key features that can impact their effectiveness for managing debt:

- Interest Rates: Balance transfer cards usually offer a lower introductory interest rate for a set period, often 0% APR for a certain number of months. This period allows you to focus on paying down your balance without accruing significant interest charges.

- Introductory Periods: The introductory period is the time during which the lower interest rate applies. It’s crucial to understand the duration of this period, as the regular interest rate will kick in once it ends.

- Transfer Fees: Many balance transfer cards charge a fee for transferring your balance. This fee can be a percentage of the transferred amount or a flat fee. Carefully consider the transfer fee when comparing cards, as it can impact the overall savings you achieve.

Understanding “No Transfer Fee”

A balance transfer credit card with “no transfer fee” is a type of credit card that allows you to transfer your existing debt from other credit cards to this new card without charging a fee for the transfer. This is a significant benefit, as transfer fees can be a substantial cost when consolidating debt.

The Implications of Having No Transfer Fee

The absence of a transfer fee directly translates into savings for you. This means you can transfer your existing debt without having to pay an additional cost on top of the balance you’re transferring. This can be a significant financial advantage, especially if you have a large balance to transfer.

Comparing the Benefits of Transfer Fees, Balance transfer credit card no transfer fee

- No Transfer Fee: The primary advantage of a no-transfer-fee card is the immediate savings. You get to transfer your balance without any extra costs, allowing you to focus on paying down the debt itself.

- Transfer Fee: While transfer fees might seem like an extra cost, some cards may offer lower interest rates or promotional periods that could ultimately offset the cost of the fee. For example, a card with a 0% introductory APR for 18 months might be worth the transfer fee if it helps you pay off your debt faster and save on interest.

Factors to Consider When Choosing a Balance Transfer Card with No Fee

Finding a balance transfer credit card with no fee can be a great way to save money on interest charges and pay down debt faster. However, it’s crucial to consider several factors beyond the absence of a transfer fee to ensure you’re getting the best deal.

Annual Percentage Rate (APR) and Introductory Periods

The Annual Percentage Rate (APR) is the interest rate charged on your balance. A lower APR means you’ll pay less interest over time. Balance transfer cards often offer introductory APRs, which are lower than the standard APR for a certain period, typically 12-18 months. It’s essential to compare the introductory APR and the standard APR to determine the overall cost of the card.

A balance transfer card with a 0% introductory APR for 18 months might seem appealing, but if the standard APR is very high, it could become expensive after the introductory period ends.

Credit Score and Credit History

Your credit score and credit history play a significant role in your eligibility for a balance transfer card and the terms you’ll receive. A higher credit score typically translates to better APRs and more favorable terms. Lenders assess your creditworthiness to determine the risk of lending to you.

If you have a lower credit score, you may be offered a higher APR or may not be approved for a balance transfer card at all.

Other Relevant Factors

Beyond APR and credit score, other factors can influence your decision.

- Rewards Programs: Some balance transfer cards offer rewards programs, such as cash back, travel miles, or points. These can be beneficial if you use the card frequently.

- Customer Service: Look for a card issuer with a reputation for excellent customer service. This can be helpful if you encounter any issues with your account.

- Ease of Use: Consider the card’s online and mobile banking features, as well as the availability of customer support channels.

Potential Risks and Considerations

While balance transfer credit cards with no transfer fees can be a valuable tool for managing debt, it’s essential to be aware of potential risks and considerations to make informed decisions. Understanding the terms and conditions, avoiding common mistakes, and recognizing potential consequences can help you maximize the benefits of balance transfers while mitigating potential drawbacks.

Understanding the Terms and Conditions

The terms and conditions of a balance transfer credit card are crucial for determining its suitability for your needs and avoiding unexpected costs.

- Introductory APR: Understand the introductory APR period, which is the time frame during which the low interest rate applies. After the introductory period, the interest rate usually reverts to a standard APR, which can be significantly higher. Failing to pay off the transferred balance before the introductory period ends could lead to substantial interest charges.

- Balance Transfer Fee: While the card may advertise “no transfer fee,” it’s essential to verify if there are any hidden fees or conditions associated with the transfer. For instance, some cards may charge a fee if you exceed a specific transfer limit or if you fail to meet certain spending requirements.

- Minimum Payment: Always review the minimum payment amount required each month. Making only the minimum payment can extend the repayment period and increase the overall interest paid.

- Late Payment Fees: Be aware of late payment fees, which can be substantial and add to your overall debt burden.

- Annual Fee: Some balance transfer credit cards may charge an annual fee, which can negate the benefits of a low introductory APR.

Final Wrap-Up: Balance Transfer Credit Card No Transfer Fee

Choosing a balance transfer credit card with no transfer fee can be a smart move to save money on interest charges and pay off your debt faster. However, it’s crucial to understand the terms and conditions of the card, including the APR, introductory period, and eligibility requirements. By carefully evaluating your options and using the card responsibly, you can leverage the benefits of a balance transfer credit card with no transfer fee to your advantage.

Query Resolution

What is the best balance transfer credit card with no transfer fee?

The best balance transfer credit card for you will depend on your individual needs and circumstances. Consider factors like APR, introductory period, credit score requirements, and rewards programs when making your decision. It’s recommended to compare offers from multiple issuers to find the best fit.

How long does it take to transfer a balance?

The time it takes to transfer a balance varies depending on the issuer. It can take anywhere from a few days to a few weeks for the transfer to be processed. Check with the issuer for specific timelines.

What happens if I don’t pay off the balance by the end of the introductory period?

After the introductory period ends, the interest rate on the balance will revert to the standard APR. It’s essential to make a plan to pay off the balance before the introductory period ends to avoid paying higher interest charges.

Are there any other fees associated with balance transfer credit cards?

While some cards offer no transfer fees, there may be other fees associated with the card, such as annual fees, cash advance fees, or late payment fees. Carefully review the terms and conditions of the card to understand all potential fees.