Best credit card balance transfer no fee offers a lifeline for consumers burdened by high-interest debt. By transferring balances to cards with 0% introductory APR periods, you can potentially save thousands of dollars in interest charges, allowing you to pay off your debt faster and reclaim your financial freedom. However, navigating the complexities of balance transfer offers can be daunting. This guide delves into the key features, benefits, and risks associated with these cards, empowering you to make informed decisions and maximize your savings.

Understanding the nuances of balance transfer cards is crucial. Factors such as the introductory APR period, balance transfer fees, and eligibility criteria can significantly impact your overall savings. We’ll explore these aspects in detail, providing you with the knowledge and strategies to choose the best balance transfer card for your needs.

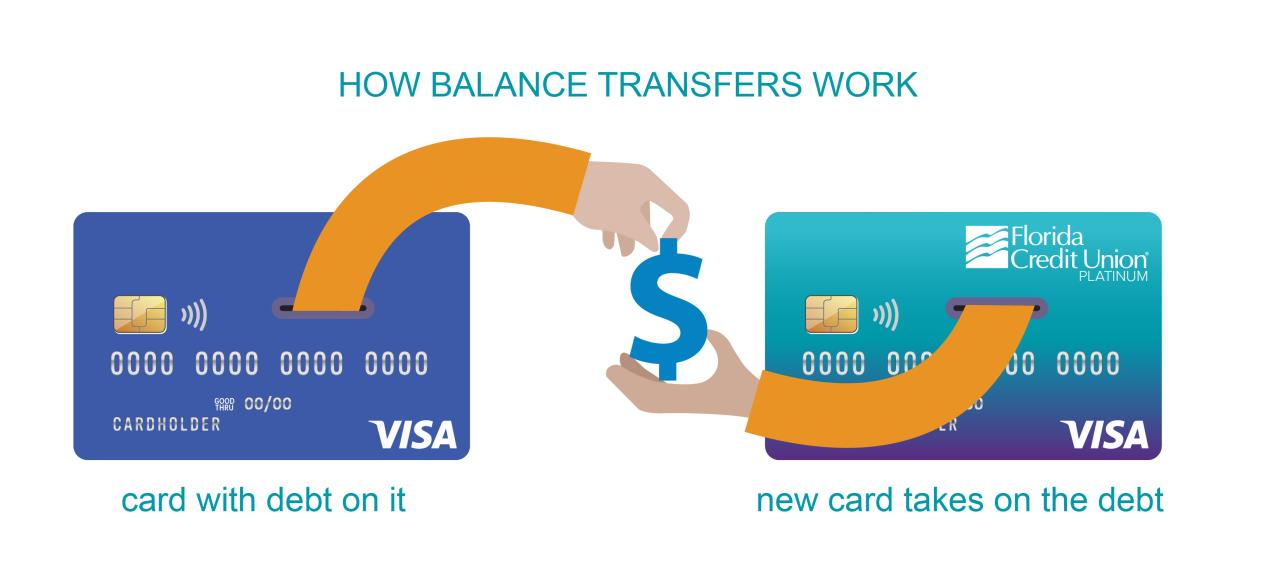

Introduction to Balance Transfers

A balance transfer is a way to move debt from one credit card to another. This can be a useful strategy if you have high-interest debt, as it can help you save money on interest charges.

Balance transfers can be a smart move for those with high-interest debt, especially if you find a credit card offering a 0% introductory APR period. This allows you to pay down your debt without accruing interest for a set period, potentially saving you a significant amount of money.

Benefits of Balance Transfers, Best credit card balance transfer no fee

Balance transfers offer several benefits, particularly when you transfer to a card with no fees:

- Lower Interest Rates: By transferring your balance to a card with a lower APR, you can significantly reduce the amount of interest you pay over time. This can free up more of your budget to pay down your debt faster.

- 0% Introductory APR Periods: Many balance transfer cards offer introductory periods with 0% APR. During this period, you only need to pay the minimum payment, allowing you to focus on paying down the principal balance without accruing interest. This can be a valuable opportunity to make substantial progress on your debt.

- Debt Consolidation: If you have multiple credit cards with high balances, a balance transfer can help you consolidate your debt into a single account. This can simplify your debt management and make it easier to track your progress.

Factors to Consider When Choosing a Balance Transfer Card

When choosing a balance transfer card, several factors are crucial:

- Introductory APR: Look for cards with a long introductory period and a 0% APR to maximize your savings. Be aware that the APR will revert to a standard rate after the introductory period, so ensure you have a plan to pay off the balance before then.

- Balance Transfer Fee: Some cards charge a fee for transferring your balance. While it’s generally advantageous to choose a card with no balance transfer fee, it’s worth considering if the potential savings on interest outweigh the fee.

- Credit Limit: Ensure the card offers a credit limit that is sufficient to cover your entire balance. You may need to apply for a higher credit limit or consider multiple balance transfers if your existing limit is insufficient.

- Other Terms and Conditions: Carefully review the card’s terms and conditions, including the minimum payment, late payment fees, and any restrictions on balance transfers. Understanding these details can help you avoid unexpected charges or penalties.

Key Features of Balance Transfer Cards with No Fees

Balance transfer cards with no fees offer a valuable opportunity to save money on interest charges and pay off your debt faster. These cards typically have a 0% introductory APR period, which allows you to transfer your balance from another credit card without incurring interest for a specified time. They also waive balance transfer fees, further maximizing your savings.

The Significance of a 0% Introductory APR Period

The 0% introductory APR period is the cornerstone of balance transfer cards with no fees. This period allows you to transfer your existing credit card balance to the new card without paying any interest for a predetermined duration, typically ranging from 12 to 21 months. This grace period provides valuable time to make significant progress towards paying off your debt.

Balance Transfer Fees and Their Impact on Savings

Balance transfer fees are charges associated with transferring your existing credit card balance to a new card. These fees can range from a percentage of the transferred balance to a flat fee. While balance transfer cards with no fees eliminate this expense, it’s crucial to understand the potential impact of these fees on your overall savings.

For instance, a balance transfer fee of 3% on a $5,000 balance would cost you $150, reducing your potential savings.

Comparing the Benefits of Different Balance Transfer Cards

Several balance transfer cards with no fees are available, each offering unique features and benefits. Comparing these cards based on factors such as the introductory APR period, the balance transfer fee, and other perks can help you choose the most suitable option for your needs.

- Introductory APR Period: Compare the duration of the 0% introductory APR period offered by different cards. A longer period provides more time to pay down your balance without accruing interest.

- Balance Transfer Fee: Ensure that the card you choose does not charge a balance transfer fee. Some cards may offer a promotional period with no fee, followed by a fee after the promotional period ends.

- Other Perks: Consider other benefits offered by the card, such as rewards programs, travel insurance, or purchase protection.

How to Choose the Best Balance Transfer Card: Best Credit Card Balance Transfer No Fee

Finding the best balance transfer card involves comparing various factors and carefully considering your specific financial needs. A well-chosen balance transfer card can save you money on interest charges and help you pay off debt faster.

Evaluating Key Features

To make an informed decision, it’s crucial to assess the following key features of balance transfer cards:

- Introductory APR: This is the interest rate you’ll pay on transferred balances for a specific period. Aim for the lowest introductory APR available, ideally 0% for a significant duration, to maximize savings on interest.

- Transfer Fee: Most balance transfer cards charge a fee, typically a percentage of the transferred amount. Look for cards with low or no transfer fees, as these fees can significantly impact your overall savings.

- Regular APR: This is the interest rate you’ll pay after the introductory period expires. It’s essential to consider the regular APR to ensure it’s manageable once the introductory period ends.

- Balance Transfer Deadline: This is the timeframe within which you need to transfer your balance to qualify for the introductory APR. Make sure the deadline aligns with your debt payoff plan.

- Rewards Program: Some balance transfer cards offer rewards programs, such as cash back or travel points. While these rewards can be beneficial, prioritize cards with favorable introductory APRs and low fees first.

Determining the Optimal Transfer Amount and Timeframe

The ideal balance transfer amount depends on your debt situation and the card’s transfer limit.

- Consider Your Debt-to-Income Ratio: Calculate your debt-to-income ratio (DTI) by dividing your total monthly debt payments by your gross monthly income. Aim for a DTI below 36% for financial stability.

- Transfer Amount and Timeframe: Transfer as much debt as possible within the transfer deadline to maximize savings. Create a realistic debt payoff plan, factoring in the regular APR that applies after the introductory period.

- Avoid Overspending: Resist the temptation to use the balance transfer card for new purchases. Focus on paying down the transferred debt to avoid accumulating more interest.

Checklist of Factors to Consider

When evaluating balance transfer cards, use the following checklist to ensure you choose the best option for your needs:

- APR: Compare introductory APRs and regular APRs across different cards.

- Fees: Consider transfer fees, annual fees, and any other potential charges.

- Rewards: Evaluate the rewards program and determine if it aligns with your spending habits.

- Eligibility Criteria: Check the card’s credit score requirements and other eligibility criteria.

- Customer Service: Research the issuer’s customer service reputation and responsiveness.

Strategies for Maximizing Balance Transfer Savings

Balance transfers can be a powerful tool for saving money on debt, but you need to use them strategically to get the most out of them. Here are some tips for maximizing your savings.

Timely Minimum Payments During Introductory Period

Making timely minimum payments during the introductory period is crucial for maximizing balance transfer savings. This ensures that you avoid accruing interest charges and keep your credit score healthy. Failure to make timely payments can lead to penalties and interest charges, negating the benefits of the balance transfer.

Avoiding Interest Charges

To avoid interest charges, it’s important to pay off the transferred balance before the introductory period ends. This requires careful planning and budgeting to ensure you can make significant payments towards the balance. Consider creating a budget that allocates extra funds towards the balance transfer debt.

Maintaining a Good Credit Score

Maintaining a good credit score is essential for accessing favorable credit terms, including balance transfer offers. A good credit score demonstrates your responsible financial behavior to lenders, making you more attractive for future loans and credit cards.

Ultimate Conclusion

Harnessing the power of best credit card balance transfer no fee can be a game-changer for your financial well-being. By carefully selecting a card that aligns with your debt payoff goals, you can strategically reduce your interest burden and accelerate your path to debt-free living. Remember, thorough research and comparison are essential to unlocking the maximum benefits of balance transfers. Don’t let high-interest debt hold you back; seize the opportunity to reclaim control of your finances and embark on a journey toward financial stability.

FAQ

How long does a 0% APR period typically last?

0% APR periods on balance transfer cards usually range from 12 to 18 months, but some cards offer longer terms.

What happens after the introductory period ends?

Once the introductory period ends, the standard APR for the card kicks in. Make sure to pay off the balance before this happens to avoid high interest charges.

Are there any income requirements for balance transfer cards?

While not all cards have specific income requirements, some may have minimum credit score or income thresholds for eligibility.