Transfer credit card balance to 0 apr – Transfer credit card balance to 0% APR – a phrase that sounds like a dream come true for anyone burdened by high-interest debt. It’s the allure of a temporary reprieve from crippling interest charges, a chance to breathe easier and strategize a path towards financial freedom. But is it truly as magical as it sounds?

This guide delves into the world of 0% APR balance transfer offers, exploring their benefits, drawbacks, and how to navigate this financial landscape effectively. We’ll discuss the eligibility requirements, the process of transferring balances, and the crucial steps to take to make the most of this opportunity. Prepare to discover the secrets to unlocking a path towards a debt-free future.

Potential Drawbacks and Risks

While balance transfer offers can be appealing, it’s essential to be aware of the potential drawbacks and risks involved. Failing to understand these aspects can lead to unforeseen financial burdens.

Higher Interest Rates After Introductory Period

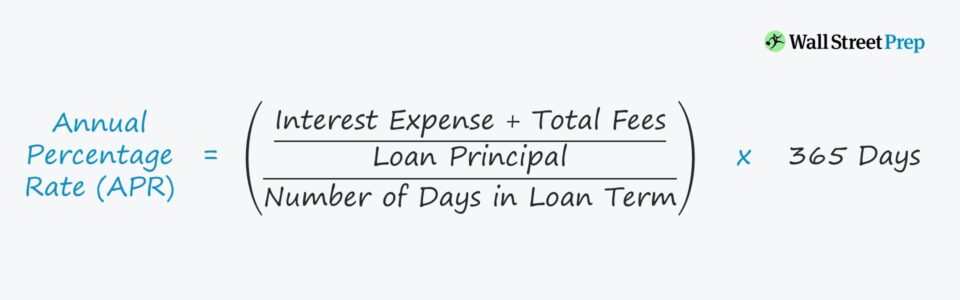

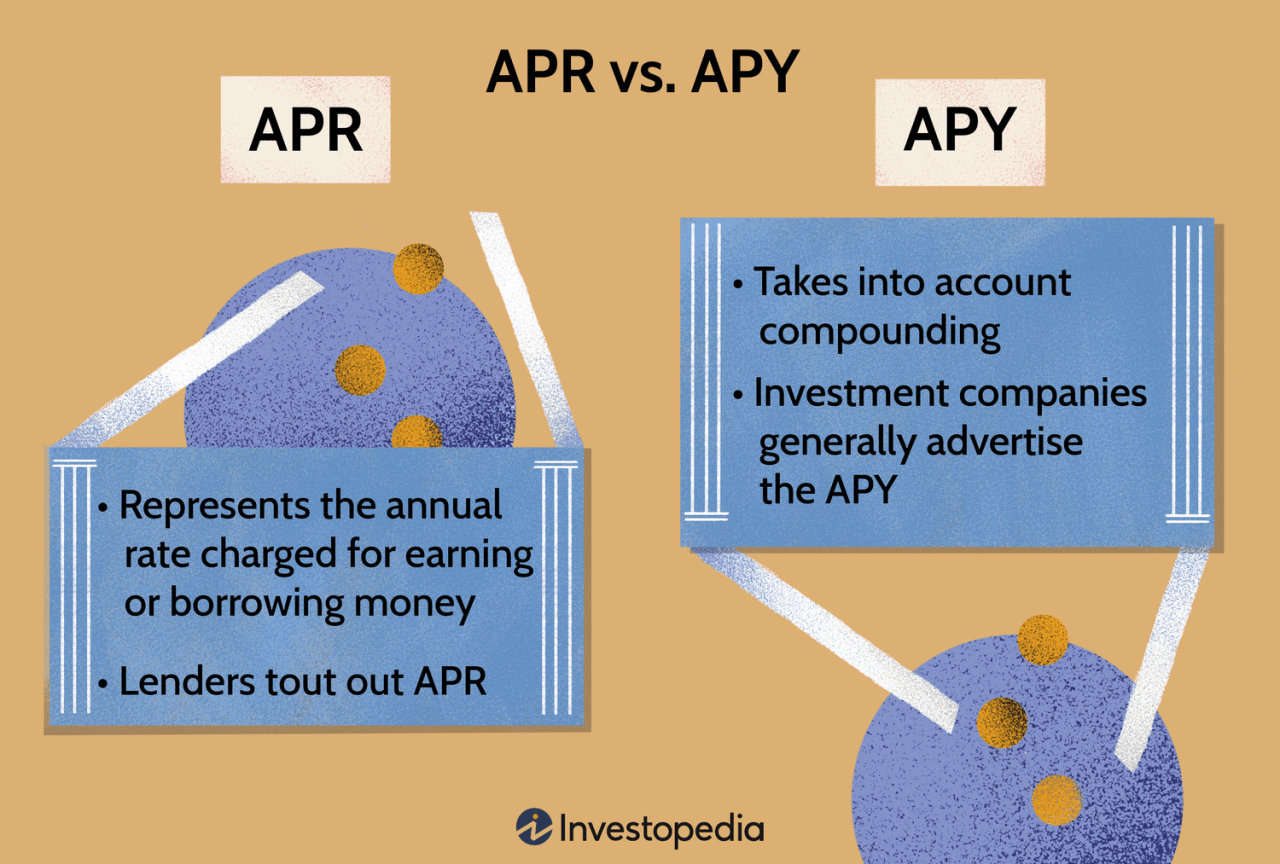

A key drawback of balance transfer offers is the temporary nature of the 0% APR. This introductory period typically lasts for a limited time, usually 12 to 18 months. After this period, the interest rate on the transferred balance often reverts to a much higher standard APR. This can result in a significant increase in your monthly payments and overall interest charges if you haven’t paid off the balance before the introductory period ends.

Importance of Planning for the Transition to a Higher APR

To avoid a financial shock, it’s crucial to plan for the transition to a higher APR. This includes:

- Calculating the remaining balance: Track your balance transfer payments and estimate the remaining balance before the introductory period ends.

- Considering repayment options: Determine how you’ll pay off the remaining balance. This might involve increasing your monthly payments, making lump-sum payments, or exploring options like a balance transfer to another card with a lower APR.

- Exploring alternative debt consolidation options: If you can’t afford the higher APR, consider other debt consolidation options like a personal loan or a debt consolidation program.

Case Studies and Examples: Transfer Credit Card Balance To 0 Apr

Real-life examples can illustrate how balance transfer offers have been used effectively, highlighting both successful and unsuccessful outcomes. These case studies demonstrate the factors that contributed to these results.

Successful Balance Transfer

Successful balance transfer scenarios typically involve strategic planning and responsible usage. For instance, consider a person with a high-interest credit card balance of $5,000. They successfully transferred this balance to a 0% APR card with a 12-month promotional period. During this period, they diligently paid down the balance, prioritizing the transferred amount over other expenses. By the end of the promotional period, they had paid off the entire balance, avoiding further interest charges and saving significantly on interest costs.

Unsuccessful Balance Transfer

Unsuccessful balance transfer cases often arise from a lack of planning or poor financial discipline. Imagine a person who transfers a $10,000 balance to a 0% APR card with a 18-month promotional period. However, they continue to make minimum payments and rack up new charges on the transferred card. By the time the promotional period ends, they have accumulated even more debt, negating the benefits of the balance transfer.

Factors Contributing to Success

Several factors contribute to successful balance transfer outcomes:

- Careful planning: Before transferring a balance, it’s crucial to assess the promotional period, transfer fees, and the minimum payment required.

- Budgeting and prioritization: Allocate a significant portion of your budget to pay down the transferred balance during the promotional period.

- Avoiding new charges: Limit or eliminate new purchases on the transferred card to avoid accumulating further debt.

Factors Contributing to Unsuccess, Transfer credit card balance to 0 apr

Factors that contribute to unsuccessful balance transfer outcomes include:

- Ignoring transfer fees: Failing to account for transfer fees can negate the savings from the 0% APR.

- Overspending: Using the transferred card for new purchases can lead to a larger balance than initially transferred.

- Failing to pay down the balance: Neglecting to make substantial payments during the promotional period can result in hefty interest charges once the promotional period ends.

Last Recap

The power of 0% APR balance transfer offers lies in its ability to empower you to take control of your debt. By understanding the intricacies of these offers, you can leverage them to your advantage, gaining valuable time and resources to pay down your balance and ultimately achieve financial peace. Remember, it’s not just about finding the right offer, it’s about using it strategically to build a brighter financial future.

FAQ Resource

What is the typical duration of a 0% APR period?

Introductory 0% APR periods usually last for 12 to 18 months, but some offers may extend to 24 months or longer. It’s crucial to pay close attention to the specific terms of each offer.

What happens after the introductory period ends?

Once the introductory period ends, the interest rate on your balance will revert to the card’s standard APR, which is typically much higher. This is why it’s crucial to pay down the balance as quickly as possible during the 0% period.

Are there any fees associated with balance transfers?

Most balance transfer offers involve a fee, usually a percentage of the transferred balance. This fee can vary from 3% to 5% or more. It’s essential to factor in these fees when comparing offers.

How do I know if I qualify for a balance transfer offer?

To qualify for a balance transfer offer, you generally need a good credit score and a history of responsible credit use. Lenders will also assess your income and debt-to-income ratio.