Best credit balance transfer cards can be a lifesaver if you’re drowning in high-interest debt. By transferring your existing balances to a card with a lower interest rate, you can potentially save hundreds or even thousands of dollars in interest charges. But before you jump into a balance transfer, it’s important to understand how these cards work, the benefits and drawbacks, and how to choose the right one for your situation.

Balance transfer cards work by allowing you to transfer your existing credit card debt to a new card with a lower interest rate. This can be a great way to save money on interest, but it’s important to be aware of the potential drawbacks. For example, balance transfer cards often have a limited introductory period, after which the interest rate may increase significantly. They may also have balance transfer fees, which can add to the overall cost of the transfer.

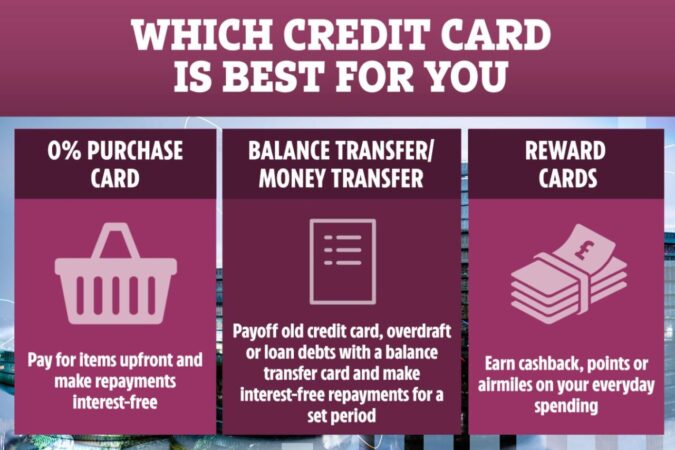

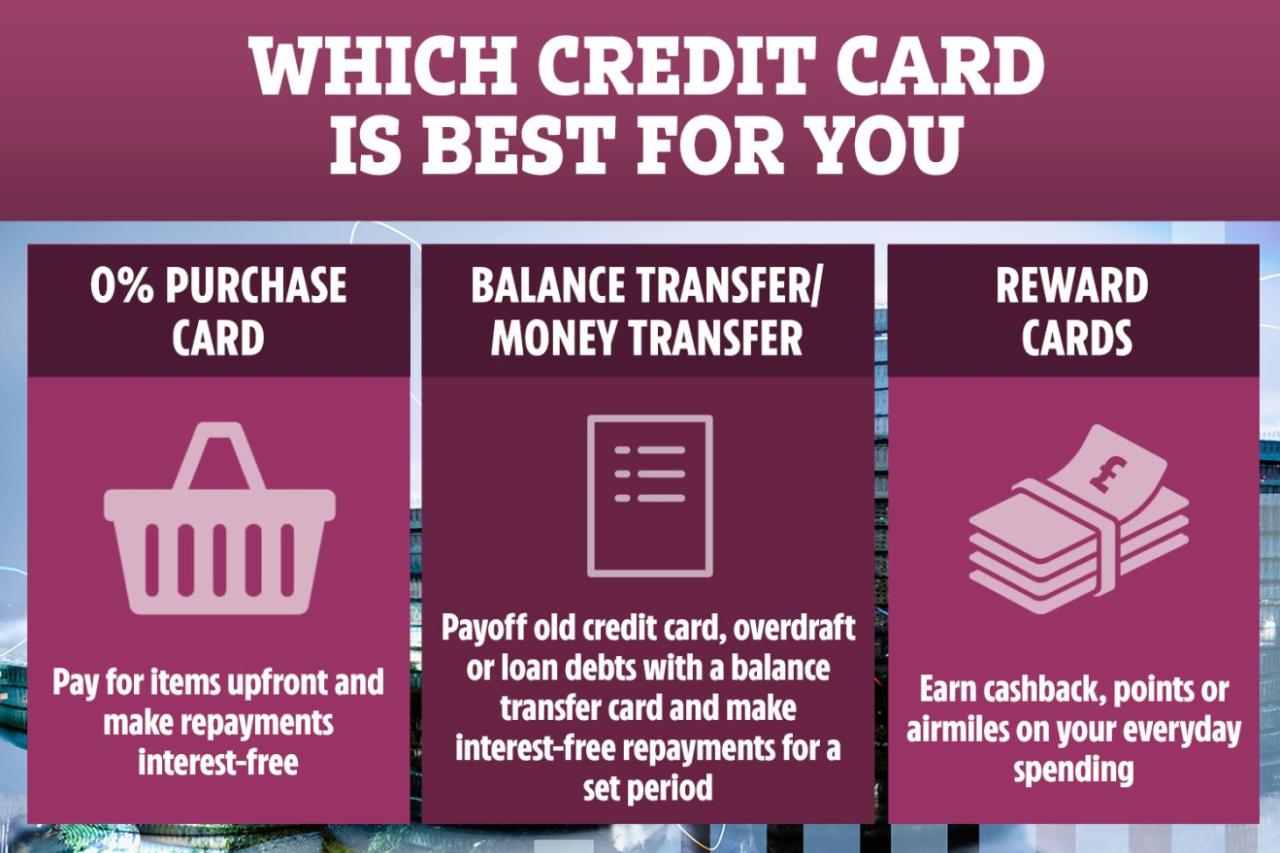

What are Balance Transfer Credit Cards?

Balance transfer credit cards are a type of credit card that allows you to transfer a balance from another credit card to the new card. This can be a useful tool for consolidating debt and potentially saving money on interest charges.

How Balance Transfer Credit Cards Work

When you transfer a balance to a balance transfer credit card, you are essentially borrowing money from the new card issuer to pay off the debt on your old card. The new card issuer will then send a payment to your old card issuer to cover the balance.

Benefits of Using a Balance Transfer Credit Card

- Lower Interest Rates: Balance transfer credit cards often offer lower interest rates than other types of credit cards. This can help you save money on interest charges over time.

- Consolidation of Debt: Balance transfer credit cards can help you consolidate multiple credit card balances into one, making it easier to manage your debt.

- 0% Introductory APR: Many balance transfer credit cards offer a 0% introductory annual percentage rate (APR) for a certain period of time. This can give you a chance to pay off your balance without accruing interest.

Potential Drawbacks of Balance Transfer Credit Cards

- Balance Transfer Fees: Most balance transfer credit cards charge a fee for transferring a balance. This fee is typically a percentage of the balance transferred.

- Limited Time Offer: The 0% introductory APR on a balance transfer credit card is usually only valid for a limited time. After the introductory period, the interest rate will revert to the standard APR, which can be much higher.

- Credit Score Impact: Applying for a new credit card can have a small negative impact on your credit score, even if you are approved.

Key Features of Balance Transfer Credit Cards

Balance transfer credit cards are a popular option for consumers looking to consolidate high-interest debt and save money on interest charges. These cards typically offer a 0% introductory APR for a specific period, allowing you to transfer your existing balances without accruing interest during that time. However, it’s crucial to understand the key features of these cards to make an informed decision.

Interest Rates Offered by Balance Transfer Cards

Balance transfer cards offer varying interest rates, which can significantly impact your overall savings. Generally, these cards have two types of interest rates: introductory APR and standard APR.

The introductory APR is a promotional rate offered for a limited period, typically 12 to 18 months. It’s often 0%, allowing you to transfer your balances without paying interest during this period. After the introductory period ends, the standard APR kicks in, which is usually higher than the introductory rate.

Here’s a comparison of interest rates offered by some popular balance transfer cards:

| Card | Introductory APR | Standard APR |

|—————————————–|——————-|—————-|

| Chase Slate | 0% for 15 months | 17.24% – 25.24% |

| Citi Simplicity® Card | 0% for 18 months | 16.99% – 25.99% |

| Discover it® Balance Transfer | 0% for 14 months | 14.99% – 25.99% |

It’s important to compare interest rates from different cards and choose the one with the lowest introductory APR and standard APR that suits your needs.

Introductory APR Periods Offered

Introductory APR periods vary significantly across balance transfer cards, ranging from 6 to 21 months. The longer the introductory period, the more time you have to pay off your balance without accruing interest.

Here are some examples of introductory APR periods offered by popular balance transfer cards:

| Card | Introductory APR Period |

|—————————————–|————————–|

| Chase Slate | 15 months |

| Citi Simplicity® Card | 18 months |

| Discover it® Balance Transfer | 14 months |

Choosing a card with a longer introductory period gives you more flexibility in managing your debt and allows you to focus on paying down your balance without the pressure of accruing interest.

Balance Transfer Fees

Balance transfer cards typically charge a fee for transferring your balances. This fee is usually a percentage of the balance transferred, ranging from 3% to 5%. Some cards offer a promotional period with no balance transfer fees, but this is often limited to a few months.

Here are some examples of balance transfer fees charged by popular balance transfer cards:

| Card | Balance Transfer Fee |

|—————————————–|———————–|

| Chase Slate | 3% of the balance transferred |

| Citi Simplicity® Card | 5% of the balance transferred |

| Discover it® Balance Transfer | 0% for 6 months, then 3% |

It’s crucial to factor in the balance transfer fee when comparing different cards. While a card might offer a lower introductory APR, it could have a higher balance transfer fee, making it less cost-effective than a card with a slightly higher APR but a lower fee.

Strategies for Effective Balance Transfer

Balance transfers can be a valuable tool for managing debt, but it’s crucial to use them strategically to maximize their benefits. This section will guide you through the process of transferring balances effectively, highlighting best practices and common pitfalls to avoid.

Steps for Transferring a Balance, Best credit balance transfer cards

The process of transferring a balance is straightforward, but it requires careful planning and execution. Here’s a step-by-step guide:

- Choose a balance transfer card: Compare offers from different credit card issuers based on the transfer fee, introductory APR, and other terms. Consider your credit score and spending habits when selecting a card.

- Apply for the card: Once you’ve chosen a card, apply online or by phone. Ensure you meet the eligibility criteria and have the necessary documentation readily available.

- Receive approval: After your application is approved, you’ll receive a welcome packet with instructions on how to initiate the balance transfer.

- Transfer your balance: Follow the instructions provided by the credit card issuer to transfer your balance from your existing card to the new card. This typically involves providing the account number and balance you wish to transfer.

- Pay down your balance: Make regular payments on your new card to pay down the transferred balance as quickly as possible. The sooner you pay off the balance, the less interest you’ll accrue.

Best Practices for Managing a Balance Transfer Card

Effective management of a balance transfer card is key to realizing its full potential. Here are some best practices to follow:

- Pay more than the minimum: Always pay more than the minimum payment to reduce your balance faster and minimize interest charges.

- Avoid new purchases: Resist the temptation to make new purchases on your balance transfer card during the introductory period. Focus on paying down the transferred balance.

- Set a budget: Create a realistic budget that allows you to make consistent payments on your balance transfer card. This will help you stay on track and avoid falling behind.

- Monitor your credit score: Regularly check your credit score to ensure your balance transfer doesn’t negatively impact it. Make sure you’re using your credit responsibly.

Common Pitfalls to Avoid

While balance transfers offer a valuable opportunity to save on interest, it’s essential to be aware of common pitfalls that can undermine their effectiveness:

- Ignoring the introductory period: The introductory APR on a balance transfer card is usually temporary. Once the introductory period ends, the interest rate will revert to the standard APR, which could be significantly higher. Make sure to pay off the transferred balance before the introductory period expires.

- Transferring too much: Avoid transferring more than you can comfortably repay within the introductory period. Overstretching yourself could lead to missed payments and damage your credit score.

- Making new purchases: Resist the urge to make new purchases on your balance transfer card during the introductory period. This will only increase your balance and defeat the purpose of the transfer.

- Not comparing offers: Don’t settle for the first balance transfer card you find. Shop around and compare offers from different issuers to find the best terms for your situation.

Alternative Solutions for Debt Consolidation

While balance transfer credit cards can be an effective way to consolidate debt, they are not the only option available. Other debt consolidation strategies, such as personal loans and debt consolidation loans, can also be suitable depending on your individual circumstances.

Comparison of Debt Consolidation Options

Understanding the pros and cons of each option can help you make an informed decision. Here’s a comparison of balance transfer credit cards, personal loans, and debt consolidation loans:

-

Balance Transfer Credit Cards:

- Pros: Offer 0% introductory APRs, which can save you money on interest charges. They are relatively easy to qualify for compared to other options.

- Cons: Introductory periods are often limited (typically 12-18 months), after which the interest rate can become high. They may have balance transfer fees. They can potentially lead to further debt if you continue to use the card for new purchases after the introductory period.

-

Personal Loans:

- Pros: Fixed interest rates, which provide predictable monthly payments. Loan terms can be longer than balance transfer credit card introductory periods, giving you more time to repay the debt. May have lower interest rates than credit cards, especially if you have good credit.

- Cons: May require a credit check and can impact your credit score. Origination fees may apply. You may need to provide collateral, such as a car or home, for a secured personal loan.

-

Debt Consolidation Loans:

- Pros: Similar to personal loans, they offer fixed interest rates and longer repayment terms. They can simplify your debt management by combining multiple debts into a single monthly payment. They can improve your credit score by reducing your credit utilization ratio.

- Cons: May have higher interest rates than personal loans. May require a credit check and can impact your credit score. May have origination fees.

Best Debt Consolidation Strategy Based on Individual Circumstances

The best debt consolidation strategy depends on your specific financial situation, including your credit score, debt amount, and financial goals.

For individuals with good credit and a significant amount of debt, a personal loan or debt consolidation loan may be the most advantageous option.

If you have a lower credit score or a smaller debt amount, a balance transfer credit card with a 0% introductory APR could be a better choice.

It is essential to compare interest rates, fees, and loan terms from different lenders before making a decision.

End of Discussion

Ultimately, whether or not a balance transfer card is right for you depends on your individual circumstances. If you have high-interest debt and you’re looking for a way to save money, a balance transfer card could be a good option. However, it’s important to carefully compare the terms and conditions of different cards before making a decision. Be sure to consider the introductory APR period, the balance transfer fee, and the ongoing interest rate. With careful planning and research, you can find a balance transfer card that can help you get out of debt and back on track financially.

FAQ Corner: Best Credit Balance Transfer Cards

What is the minimum credit score required for a balance transfer card?

The minimum credit score required for a balance transfer card varies depending on the issuer. However, you generally need a good credit score (at least 670) to qualify for the best offers.

How long does it take to transfer a balance?

The time it takes to transfer a balance can vary depending on the issuer. However, it typically takes a few business days to complete the transfer.

What happens if I miss a payment on a balance transfer card?

If you miss a payment on a balance transfer card, you may be charged a late fee and your interest rate could increase. It’s important to make your payments on time to avoid these penalties.