- Balance Transfer Credit Cards

- Key Features of Balance Transfer Credit Cards

- Finding the Best Balance Transfer Credit Card

- Utilizing a Balance Transfer Credit Card Effectively

- Potential Drawbacks of Balance Transfer Credit Cards

- Alternatives to Balance Transfer Credit Cards: Balance Transfer Credit Card Best

- Ultimate Conclusion

- FAQ Explained

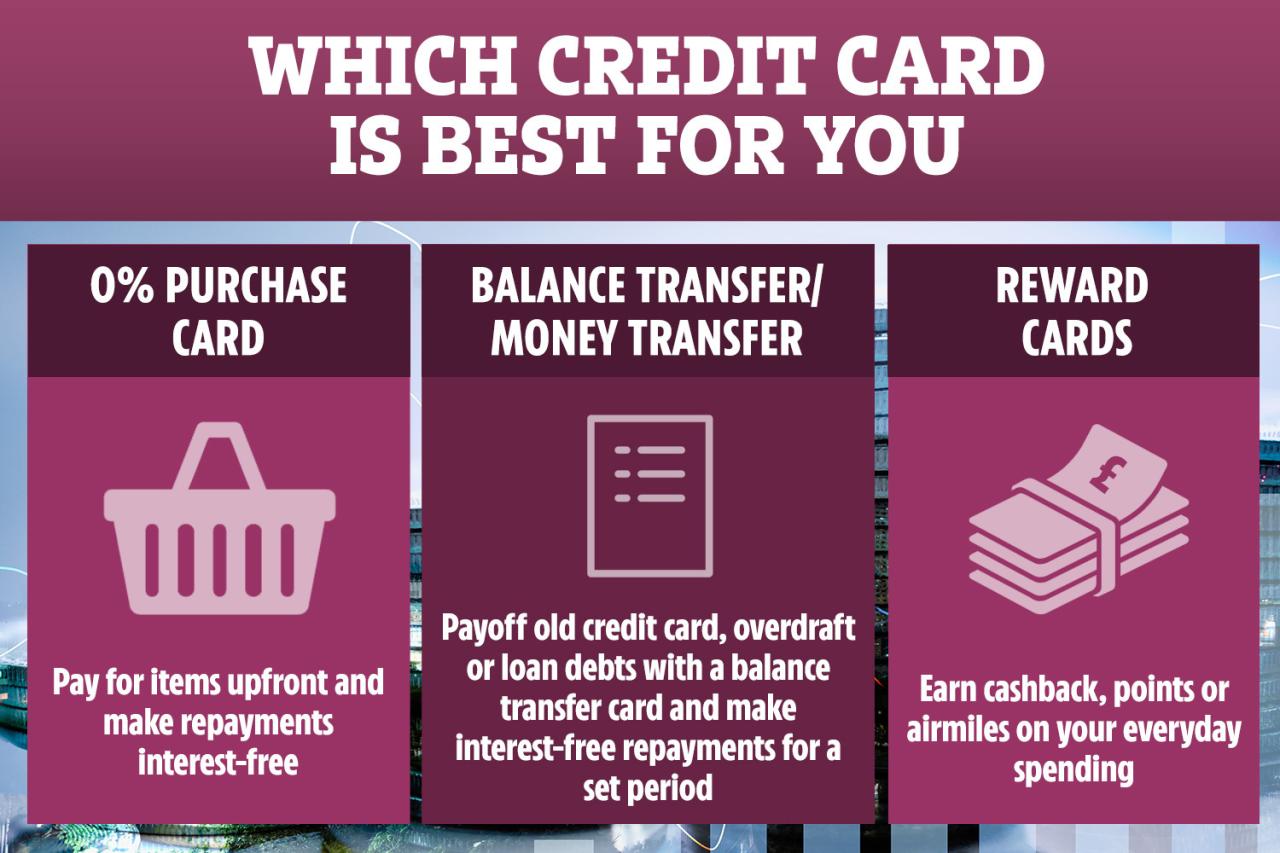

Balance transfer credit card best – Balance transfer credit cards can be a powerful tool for tackling debt, offering the potential to save significantly on interest charges. These cards allow you to transfer existing balances from high-interest credit cards to a new card with a 0% introductory APR period, giving you breathing room to pay down your debt without accruing additional interest.

But with numerous options available, finding the best balance transfer credit card for your needs requires careful consideration. Factors like the length of the 0% APR period, balance transfer fees, and credit limit all play a crucial role in determining the card’s effectiveness for debt consolidation.

Balance Transfer Credit Cards

A balance transfer credit card is a type of credit card that allows you to transfer existing balances from other credit cards to it. This can be beneficial if you have high-interest debt on other cards, as balance transfer cards often offer introductory 0% APR periods, which can save you money on interest charges.

Balance transfer credit cards are a valuable tool for managing debt and can help you save money on interest charges. They are particularly useful in situations where you have high-interest debt on other cards, and you want to consolidate your debt or pay it off faster.

Benefits of Balance Transfer Credit Cards

Balance transfer credit cards offer several advantages, including:

- Lower Interest Rates: Balance transfer cards typically offer introductory 0% APR periods, which can save you a significant amount of money on interest charges. These periods can range from 6 to 21 months, depending on the card.

- Debt Consolidation: Balance transfer cards allow you to consolidate multiple high-interest debts into one lower-interest account, making it easier to manage your finances.

- Faster Debt Repayment: By transferring your balance to a card with a lower interest rate, you can pay off your debt faster, as more of your monthly payment goes towards principal.

- Improved Credit Score: By reducing your overall debt and credit utilization ratio, balance transfer cards can help improve your credit score.

Common Situations Where Balance Transfer Cards Are Useful

Balance transfer credit cards can be a valuable tool in various situations, including:

- High-Interest Debt: If you have high-interest debt on other credit cards, a balance transfer card can help you save money on interest charges.

- Consolidating Debt: If you have multiple credit cards with high balances, a balance transfer card can help you consolidate your debt into one account, making it easier to manage.

- Paying Off Debt Faster: If you want to pay off your debt faster, a balance transfer card with a 0% APR period can help you achieve your goal.

- Improving Credit Score: By reducing your overall debt and credit utilization ratio, a balance transfer card can help improve your credit score.

Key Features of Balance Transfer Credit Cards

Balance transfer credit cards offer a unique opportunity to save money on existing debt by transferring high-interest balances to a card with a lower interest rate. Understanding the key features of these cards is essential for maximizing their benefits.

0% Introductory APR Period

The 0% introductory APR period is a crucial feature of balance transfer credit cards. This period allows you to transfer your existing debt to the new card and avoid paying interest for a specified time, typically ranging from 6 to 18 months. During this period, you can focus on paying down your debt without the burden of accruing interest charges.

Balance Transfer Fees

Balance transfer fees are charged when you transfer your existing debt to a new credit card. These fees are typically a percentage of the balance transferred, ranging from 3% to 5%. It is important to consider the balance transfer fee when evaluating the overall savings potential of a balance transfer credit card.

For example, if you transfer a $10,000 balance with a 3% transfer fee, you will be charged $300.

Credit Limit

The credit limit of a balance transfer credit card is the maximum amount of debt you can carry on the card. A higher credit limit allows you to consolidate more debt, potentially leading to greater savings. However, it’s crucial to use the credit limit responsibly and avoid overspending.

Finding the Best Balance Transfer Credit Card

Finding the best balance transfer credit card involves comparing offers from different issuers to find the one that best suits your financial needs. You should consider several factors to determine which card offers the most value, including the introductory APR, balance transfer fee, and annual fee.

Comparing Balance Transfer Credit Cards

A balance transfer credit card can be a helpful tool to save money on interest charges. When comparing offers, consider these key factors:

| Card Name | 0% APR Period | Balance Transfer Fee | Annual Fee |

|---|---|---|---|

| Chase Slate | 15 months | 3% | $0 |

| Citi Simplicity | 21 months | 5% | $0 |

| Discover it Balance Transfer | 18 months | 3% | $0 |

| US Bank Visa Platinum | 18 months | 3% | $0 |

Tips for Researching and Comparing Offers, Balance transfer credit card best

You should research and compare balance transfer credit card offers to find the best deal. Here are some tips:

- Compare introductory APRs: The introductory APR is the interest rate you’ll pay for a certain period. Look for cards with the longest 0% APR period.

- Check balance transfer fees: Most cards charge a fee to transfer a balance, usually a percentage of the amount transferred. Compare fees to find the lowest rate.

- Consider annual fees: Some cards charge an annual fee, while others do not. Compare fees to find the most affordable option.

- Read the fine print: Before applying for a balance transfer card, carefully read the terms and conditions. This includes the APR, fees, and other important details.

- Compare offers from different lenders: Don’t just rely on the first offer you see. Compare offers from different lenders to find the best deal.

Factors to Consider When Choosing a Card

When choosing a balance transfer credit card, consider these factors:

- Your credit score: Your credit score will affect your eligibility for a balance transfer card and the interest rate you’ll be offered.

- The amount of debt you want to transfer: Make sure the card has a credit limit that’s high enough to cover your debt.

- Your ability to pay off the balance before the introductory period ends: If you can’t pay off the balance before the introductory period ends, you’ll be charged a higher interest rate.

Utilizing a Balance Transfer Credit Card Effectively

Balance transfer credit cards can be a valuable tool for saving money on interest charges, but it’s essential to use them strategically to maximize their benefits. By understanding how to transfer balances and manage your payments, you can effectively leverage these cards to pay off debt faster and reduce your overall interest costs.

Transferring Balances

Transferring balances to a new card is a straightforward process that usually involves a few steps:

- Apply for a balance transfer card: Look for a card with a 0% APR introductory offer and a low balance transfer fee. Compare different options based on their terms and conditions.

- Receive your new card: Once approved, you’ll receive your new card in the mail.

- Initiate the balance transfer: Contact the issuer of your new card and provide them with the account number and balance you wish to transfer. You can often do this online, over the phone, or through the mobile app.

- Confirm the transfer: The issuer will verify the transfer request and process it within a few business days. You should receive confirmation of the transfer and the updated balance on your new card.

Paying Down the Balance Within the 0% APR Period

The 0% APR period is a crucial aspect of balance transfer cards. This introductory period allows you to pay down your balance without incurring interest charges. However, it’s essential to make consistent payments and focus on paying down the balance before the promotional period ends.

- Calculate your minimum payment: Determine the minimum amount you need to pay each month to avoid late fees and maintain a good credit history.

- Create a budget: Plan your finances to ensure you can make more than the minimum payment each month and pay down the balance more quickly.

- Set up automatic payments: Automate your payments to avoid missing deadlines and ensure you make consistent progress on your debt.

- Monitor your progress: Regularly track your balance and payments to ensure you’re on track to pay off the balance within the 0% APR period.

Avoiding Interest Charges and Penalties

While balance transfer cards offer a 0% APR period, failing to meet the terms can result in interest charges and penalties. To avoid these costs, it’s essential to:

- Avoid late payments: Late payments can trigger interest charges and negatively impact your credit score. Set reminders or automate payments to avoid missing deadlines.

- Stay within your credit limit: Using more than your available credit can lead to penalties and higher interest rates. Make sure to monitor your spending and keep your balance well below your credit limit.

- Pay off the balance before the promotional period ends: Failing to pay off the balance before the 0% APR period expires will result in a higher interest rate. Make a plan to pay down the balance quickly and avoid this scenario.

Potential Drawbacks of Balance Transfer Credit Cards

While balance transfer credit cards offer a tempting solution to high-interest debt, it’s crucial to understand the potential drawbacks before diving in. These cards can be beneficial, but they come with risks that need careful consideration.

Impact of Late Payments and Missed Deadlines

Late payments and missed deadlines can significantly impact your credit score and increase the cost of your debt. Here’s why:

- Increased Interest Rates: If you miss a payment, your balance transfer card issuer may revert to a much higher standard interest rate, negating the initial benefit of a low introductory rate.

- Late Fees: You’ll be charged late fees, adding to your existing debt.

- Damaged Credit Score: Late payments and missed deadlines negatively impact your credit score, making it harder to obtain loans or credit in the future.

It’s essential to prioritize timely payments to avoid these negative consequences. Set reminders, automate payments, and ensure you have sufficient funds available to make your monthly payments on time.

Alternatives to Balance Transfer Credit Cards: Balance Transfer Credit Card Best

While balance transfer credit cards offer a compelling solution for debt consolidation, they’re not the only option. Exploring alternative strategies can help you find the best fit for your financial situation and goals.

Personal Loans

Personal loans provide a direct method for debt consolidation. They allow you to borrow a lump sum at a fixed interest rate, which you then use to pay off your existing high-interest debts.

The advantages of personal loans include:

- Lower Interest Rates: Personal loans often have lower interest rates than credit cards, which can save you money on interest charges over time.

- Fixed Interest Rates: Fixed interest rates provide predictable monthly payments, eliminating the risk of fluctuating interest rates.

- Flexible Loan Terms: Personal loans offer various loan terms, allowing you to choose a repayment schedule that aligns with your budget.

However, personal loans also have potential drawbacks:

- Credit Score Requirements: To qualify for a personal loan with favorable terms, you typically need a good credit score.

- Origination Fees: Some lenders charge origination fees, which can add to the overall cost of the loan.

- Potential for Overspending: It’s essential to use a personal loan responsibly and avoid overspending, as this could lead to further debt.

Debt Consolidation Loans

Debt consolidation loans are specifically designed to combine multiple debts into a single loan with a lower interest rate. These loans can simplify your debt management and potentially save you money on interest charges.

The advantages of debt consolidation loans include:

- Simplified Repayments: You make a single monthly payment instead of multiple payments to different creditors.

- Lower Interest Rates: Debt consolidation loans typically offer lower interest rates than credit cards, which can significantly reduce your overall debt cost.

- Improved Credit Score: By consolidating your debt and making timely payments, you can improve your credit score.

However, debt consolidation loans also have potential drawbacks:

- Credit Score Requirements: You typically need a good credit score to qualify for a debt consolidation loan with favorable terms.

- Potential for Higher Overall Debt: If you don’t manage your spending carefully, you could end up with a larger overall debt than before.

- Limited Availability: Not all lenders offer debt consolidation loans.

Debt Management Programs

Debt management programs (DMPs) are offered by non-profit credit counseling agencies. These programs help you negotiate lower interest rates and monthly payments with your creditors.

The advantages of DMPs include:

- Reduced Interest Rates: DMPs can help you negotiate lower interest rates with your creditors, saving you money on interest charges.

- Lower Monthly Payments: DMPs can help you reduce your monthly payments, making it easier to manage your debt.

- Financial Counseling: Credit counseling agencies provide financial education and support to help you manage your debt and avoid future financial problems.

However, DMPs also have potential drawbacks:

- Fees: Credit counseling agencies typically charge fees for their services.

- Impact on Credit Score: DMPs can negatively impact your credit score, as they often involve closing existing accounts.

- Limited Eligibility: Not all creditors participate in DMPs.

Financial Advice and Debt Management Support

For comprehensive financial guidance and debt management support, consider reaching out to these resources:

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that provides free and low-cost credit counseling services.

- Consumer Credit Counseling Service (CCCS): The CCCS is another non-profit organization that offers credit counseling and debt management services.

- Financial Counseling Association of America (FCAA): The FCAA is a professional organization that certifies financial counselors.

These organizations can provide personalized advice and support to help you create a debt management plan that meets your specific needs and goals.

Ultimate Conclusion

Choosing the right balance transfer credit card can be a smart financial move, but it’s essential to use it strategically. By understanding the benefits and drawbacks, researching different options, and following a disciplined repayment plan, you can leverage this tool to achieve your debt reduction goals. Remember, responsible credit card management is key to avoiding further financial strain and building a solid credit history.

FAQ Explained

How long does it typically take for a balance transfer to be processed?

The processing time for a balance transfer can vary depending on the credit card issuer. It usually takes a few business days to complete, but it can sometimes take longer.

Can I transfer my balance to a credit card with a lower credit limit?

You can only transfer a balance to a credit card with a credit limit that is equal to or higher than the amount you want to transfer.

What happens if I miss a payment on my balance transfer credit card?

If you miss a payment, you could be charged a late fee and the 0% APR period may be revoked, resulting in the standard interest rate applying to your remaining balance.