The best balance transfer credit card can be a lifesaver when you’re carrying high-interest debt. These cards allow you to transfer balances from other credit cards to a new card with a lower introductory APR, potentially saving you hundreds or even thousands of dollars in interest charges. By taking advantage of a balance transfer offer, you can consolidate your debt, lower your monthly payments, and get back on track to becoming debt-free.

However, it’s crucial to understand the nuances of balance transfer cards and choose one that aligns with your financial goals. This guide delves into the essential features to consider, provides tips for finding the best balance transfer card for your needs, and explores strategies for using these cards effectively.

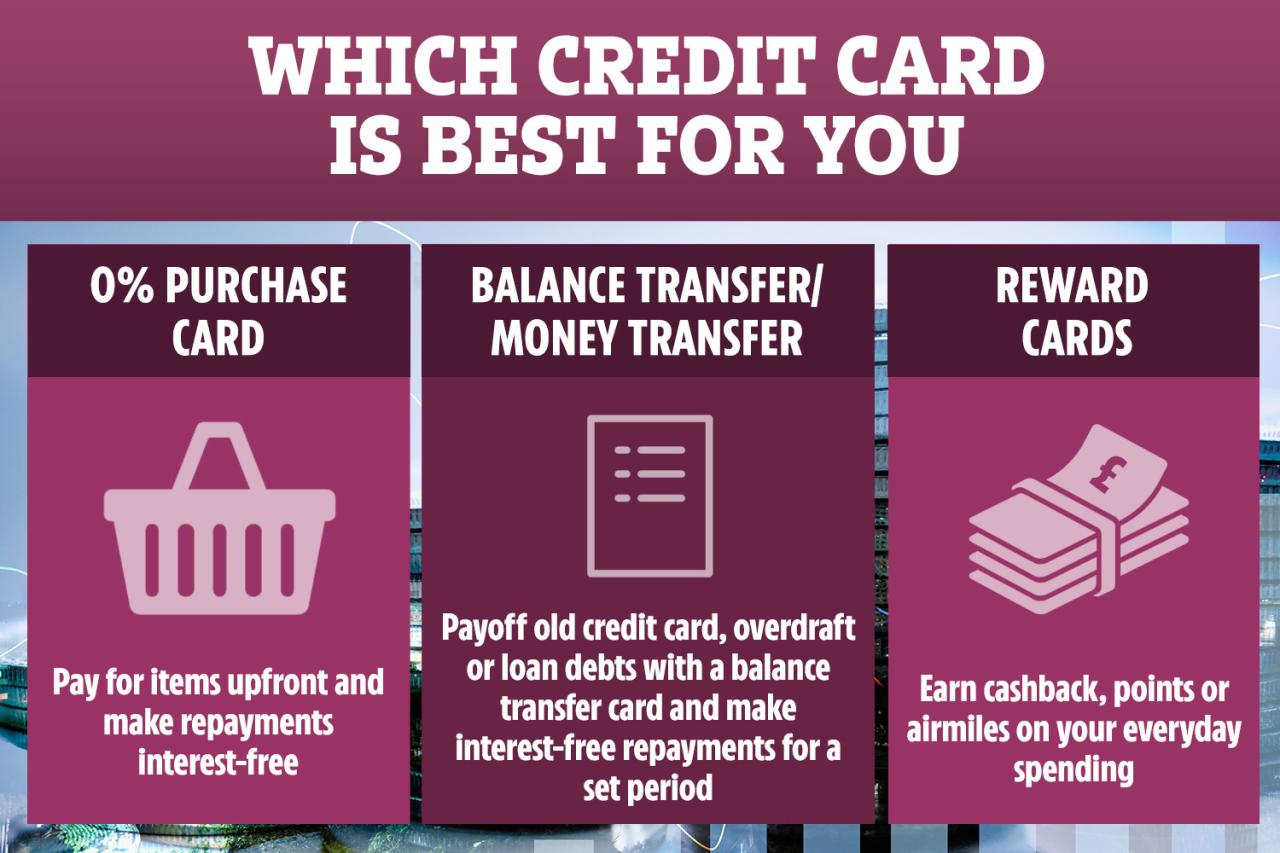

Understanding Balance Transfer Credit Cards

A balance transfer credit card allows you to move existing debt from one credit card to another, often with a lower interest rate. This can help you save money on interest charges and pay off your debt faster.

Benefits of Balance Transfer Credit Cards

Balance transfer credit cards offer several benefits, making them a valuable tool for managing debt.

- Lower Interest Rates: The primary benefit is the opportunity to transfer your debt to a card with a lower interest rate, reducing your monthly interest payments and allowing you to pay off your balance faster.

- Introductory 0% APR Periods: Many balance transfer cards offer introductory periods with 0% APR (annual percentage rate). This means you won’t accrue any interest during this period, giving you more time and flexibility to pay off your balance without incurring interest charges.

- Balance Transfer Fees: While balance transfer cards often charge a fee for transferring your balance, this fee can be significantly less than the interest you would pay on your original card, especially if you have a large balance.

- Consolidation of Debt: Combining multiple credit card balances onto one card with a lower interest rate simplifies debt management and reduces the number of monthly payments you need to track.

Situations Where Balance Transfer Credit Cards Are Advantageous

Balance transfer cards are particularly beneficial in various situations:

- High-Interest Debt: If you have credit card debt with a high interest rate, transferring your balance to a card with a lower interest rate can significantly reduce your interest charges.

- Debt Consolidation: If you have multiple credit card balances, consolidating them onto one card with a lower interest rate can simplify your debt management and potentially reduce your overall interest payments.

- Unexpected Expenses: If you’ve incurred unexpected expenses and need to consolidate debt to free up cash flow, a balance transfer card can provide temporary relief and a lower interest rate.

Key Features to Consider

When choosing a balance transfer credit card, understanding the key features is crucial for making an informed decision that aligns with your financial goals. The following features play a significant role in determining the overall value and effectiveness of a balance transfer card.

Introductory APR

The introductory APR (Annual Percentage Rate) is the interest rate applied to your balance transfer during a specific promotional period. This period is usually a set amount of time, such as 12 to 18 months. A lower introductory APR allows you to save significantly on interest charges during the promotional period, accelerating your debt repayment.

Balance Transfer Fees

Balance transfer fees are typically charged as a percentage of the amount you transfer, and they can vary considerably between credit cards. Understanding these fees is crucial because they directly impact the cost of transferring your debt. For example, a 3% transfer fee on a $10,000 balance would cost you $300.

Minimum Payments

The minimum payment required each month on a balance transfer card can influence your debt repayment strategy. Higher minimum payments may accelerate debt repayment, but they can also make it challenging to manage your budget. Conversely, lower minimum payments may allow for more flexibility in your budget, but they could extend the repayment period and result in higher overall interest charges.

Comparison of Balance Transfer Credit Card Features

| Feature | Card A | Card B | Card C |

|---|---|---|---|

| Introductory APR | 0% for 12 months | 0% for 18 months | 0% for 21 months |

| Balance Transfer Fee | 3% | 2% | 1% |

| Minimum Payment | 2% of balance or $25 | 1% of balance or $10 | 3% of balance or $30 |

It’s essential to compare the features of different balance transfer cards to find the best fit for your specific needs and financial situation. Consider factors such as the introductory APR, balance transfer fees, minimum payments, and other perks offered by the card.

Finding the Best Balance Transfer Credit Card

Finding the right balance transfer credit card can save you a significant amount of money in interest charges. But with so many options available, it can be challenging to determine which card is best for your needs. This section will provide you with a comprehensive guide to help you find the best balance transfer credit card for your situation.

Comparing Top Balance Transfer Credit Cards

To make an informed decision, it’s essential to compare different balance transfer credit cards based on key factors. The table below showcases five top balance transfer credit cards, highlighting their introductory APR, balance transfer fees, and other important features.

| Credit Card | Introductory APR | Balance Transfer Fee | Other Features |

|---|---|---|---|

| Card 1 | 0% for 18 months | 3% of the balance transferred | Rewards program, travel insurance |

| Card 2 | 0% for 15 months | 2% of the balance transferred | Cash back rewards, fraud protection |

| Card 3 | 0% for 21 months | 5% of the balance transferred | Credit limit increase options, purchase protection |

| Card 4 | 0% for 12 months | 1% of the balance transferred | Travel perks, airport lounge access |

| Card 5 | 0% for 18 months | 4% of the balance transferred | Balance transfer bonus, extended warranty |

Tips for Finding the Right Balance Transfer Credit Card

- Consider your debt amount and timeline: Determine the total amount of debt you need to transfer and the timeframe you need to pay it off. Choose a card with an introductory APR that aligns with your repayment goals.

- Compare transfer fees: Balance transfer fees can range from 1% to 5% of the transferred balance. Opt for a card with a lower transfer fee to minimize upfront costs.

- Evaluate other benefits: Consider other features like rewards programs, travel perks, purchase protection, and fraud protection. These benefits can add value to your card.

- Check eligibility requirements: Ensure you meet the eligibility requirements for the card, including credit score and income. You can use a pre-qualification tool to check your eligibility without affecting your credit score.

- Read the fine print: Pay attention to the terms and conditions, including the introductory APR period, the standard APR after the introductory period, and any late payment penalties.

Using a Balance Transfer Credit Card Effectively

Transferring your existing credit card debt to a balance transfer credit card can be a smart financial move, especially if you can secure a 0% introductory APR. This strategy allows you to save on interest charges and pay off your debt faster. However, using a balance transfer credit card effectively requires careful planning and execution.

Transferring a Balance

Before transferring your balance, you need to understand the process and ensure you meet the eligibility requirements.

- Choose the right balance transfer credit card. Compare offers from different lenders and select a card with a 0% introductory APR for a period that suits your repayment plan. Consider the balance transfer fee, which is typically a percentage of the transferred balance.

- Apply for the card and get approved. Once you’ve chosen a card, submit your application and wait for approval. Ensure you meet the eligibility criteria, which may include credit score, income, and debt-to-income ratio.

- Initiate the balance transfer. After approval, you can transfer your balance from your existing card to the new card. You can do this online, over the phone, or by mail. Provide the new card issuer with the account number and the amount you want to transfer.

- Pay off the balance within the introductory period. The key to maximizing savings with a balance transfer credit card is to pay off the transferred balance before the introductory APR expires. This will prevent you from incurring high interest charges.

Minimizing Interest Charges

To minimize interest charges and maximize savings, you need to develop a strategic repayment plan.

- Make more than the minimum payment. Making only the minimum payment will prolong the repayment period and result in higher interest charges.

- Set a budget and stick to it. Create a budget that allocates enough funds to cover your minimum payment and additional payments towards the balance transfer card.

- Consider a debt consolidation loan. If you have multiple high-interest debts, a debt consolidation loan may be a better option. It combines your debts into a single loan with a lower interest rate.

Responsible Credit Card Management

Using a balance transfer credit card effectively requires responsible credit card management.

“Avoid using the card for new purchases during the introductory period. Focus on paying down the transferred balance to maximize your savings.”

- Monitor your spending. Track your credit card spending to ensure you don’t overspend and maintain a healthy credit utilization ratio.

- Pay your bills on time. Late payments can damage your credit score and incur late fees.

- Review your credit card statements regularly. Check your statements for any errors or unauthorized charges.

Considerations and Potential Drawbacks: The Best Balance Transfer Credit Card

While balance transfer credit cards offer a tempting solution to high-interest debt, it’s crucial to understand the potential drawbacks and risks involved. These cards can be a valuable tool for debt management, but only when used strategically and responsibly.

Failing to do so could result in increased debt and financial hardship. It’s essential to carefully weigh the benefits against the potential downsides before applying for a balance transfer card.

High APR After Introductory Period

One of the most significant drawbacks of balance transfer cards is the high APR that kicks in after the introductory period ends. This period typically lasts for 12 to 18 months, during which you enjoy a low or even 0% APR. However, once this period expires, the APR can jump significantly, often to a rate that’s higher than your original credit card. If you haven’t paid off your balance by the time the introductory period ends, you’ll start accruing interest at this higher rate, potentially negating any savings you achieved during the initial period.

For example, if you transferred a $5,000 balance to a card with a 0% APR for 18 months and only paid the minimum payment during that time, you’ll still owe the full $5,000 at the end of the introductory period. If the APR then jumps to 20%, you’ll start accruing interest at a rate of $83.33 per month. This means that you’ll need to make significantly larger payments to avoid accumulating more debt.

Balance Transfer Fees

Many balance transfer credit cards charge a fee for transferring your balance. This fee is typically a percentage of the balance transferred, ranging from 3% to 5%. This fee can add up quickly, especially if you’re transferring a large balance. It’s essential to factor in the balance transfer fee when calculating the total cost of using a balance transfer card. For example, a 3% fee on a $5,000 balance would cost you $150.

Potential Penalties

Balance transfer credit cards may also have penalties for late payments, exceeding your credit limit, or making a balance transfer after the introductory period has ended. These penalties can add up quickly and significantly increase the cost of using a balance transfer card. It’s important to read the terms and conditions carefully to understand the potential penalties before applying for a card.

Risks of Relying Solely on Balance Transfer Cards, The best balance transfer credit card

While balance transfer cards can be helpful for managing debt, relying solely on them for debt management can be risky. If you keep transferring your balance from one card to another, you’ll never truly get rid of the debt. You’ll also continue to pay fees and interest, which can make it difficult to get ahead. It’s important to have a comprehensive debt management plan that includes reducing your spending, increasing your income, and paying down your debt as quickly as possible.

Avoiding Common Pitfalls

To maximize the benefits of balance transfer cards and avoid common pitfalls, consider the following:

- Choose a card with a long introductory period. This gives you more time to pay down your balance before the higher APR kicks in.

- Transfer your entire balance. If you only transfer a portion of your balance, you’ll still be paying interest on the remaining balance, which could negate the benefits of the balance transfer.

- Pay more than the minimum payment. Aim to pay as much as you can afford each month to pay down your balance quickly.

- Don’t make any new purchases on the balance transfer card. Using the card for new purchases will increase your balance and make it more difficult to pay off.

- Set a reminder for the end of the introductory period. This will give you time to find a new card with a lower APR or develop a plan to pay off the balance before the higher rate kicks in.

Last Point

In conclusion, balance transfer credit cards can be a valuable tool for managing high-interest debt. By carefully evaluating your options, understanding the terms and conditions, and using these cards responsibly, you can potentially save significant amounts of money on interest charges and accelerate your journey towards financial freedom. Remember to always compare different offers, prioritize low introductory APRs and minimal transfer fees, and stay mindful of the potential drawbacks to make informed decisions that align with your financial goals.

Q&A

What is the minimum credit score required for a balance transfer credit card?

The minimum credit score required for a balance transfer credit card varies depending on the issuer and specific card. Generally, you’ll need a good credit score of at least 670 to qualify for the best offers.

Can I transfer my entire balance to a new card?

While you can typically transfer a significant portion of your balance, there are often limits on the amount you can transfer. Be sure to check the terms and conditions of the card to determine the maximum transfer amount.

What happens after the introductory APR period ends?

Once the introductory APR period expires, the interest rate will revert to the standard APR, which can be significantly higher. To avoid paying high interest, it’s crucial to pay down the balance as quickly as possible before the introductory period ends.

Are there any fees associated with balance transfers?

Yes, most balance transfer credit cards charge a transfer fee, typically a percentage of the amount transferred. It’s essential to factor this fee into your calculations when comparing offers.