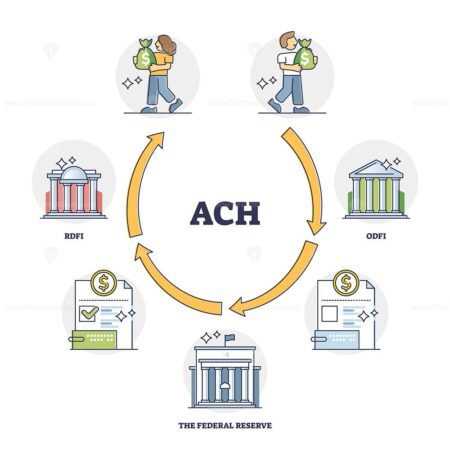

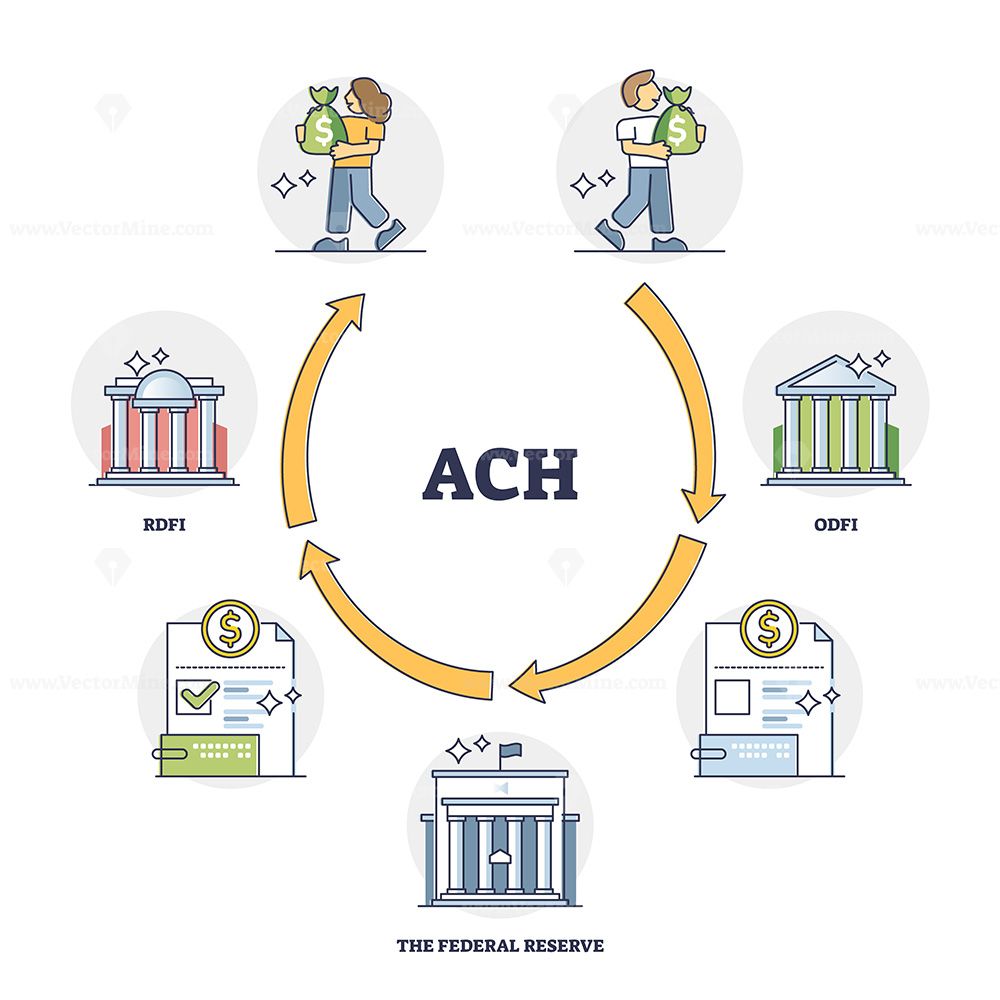

Stripe ACH Credit Transfer empowers businesses to receive funds directly from customer bank accounts, offering a secure and efficient alternative to traditional payment methods. This streamlined approach leverages the Automated Clearing House (ACH) network, facilitating electronic fund transfers between financial institutions.

Stripe ACH Credit Transfer streamlines the payment process by eliminating the need for credit card processing fees and the associated security risks. This method is particularly beneficial for recurring payments, payroll, and vendor payments, providing businesses with a cost-effective and reliable solution.

How Stripe ACH Credit Transfer Works

Stripe ACH Credit Transfer is a payment method that allows businesses to transfer funds directly from a customer’s bank account to their Stripe account. This method is often used for recurring payments, such as subscriptions, or for large one-time payments.

Stripe ACH Credit Transfer is a secure and efficient way to receive payments. It is also a cost-effective option, as there are no transaction fees associated with ACH transfers.

Bank Accounts, Routing Numbers, and Account Verification

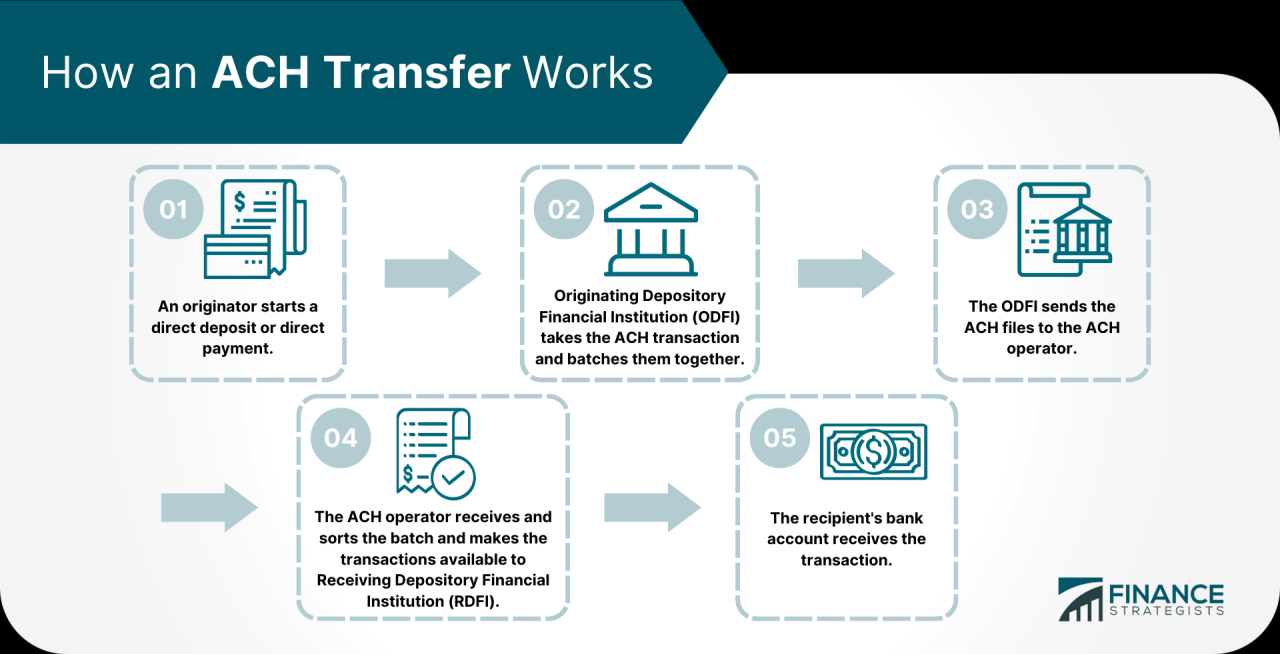

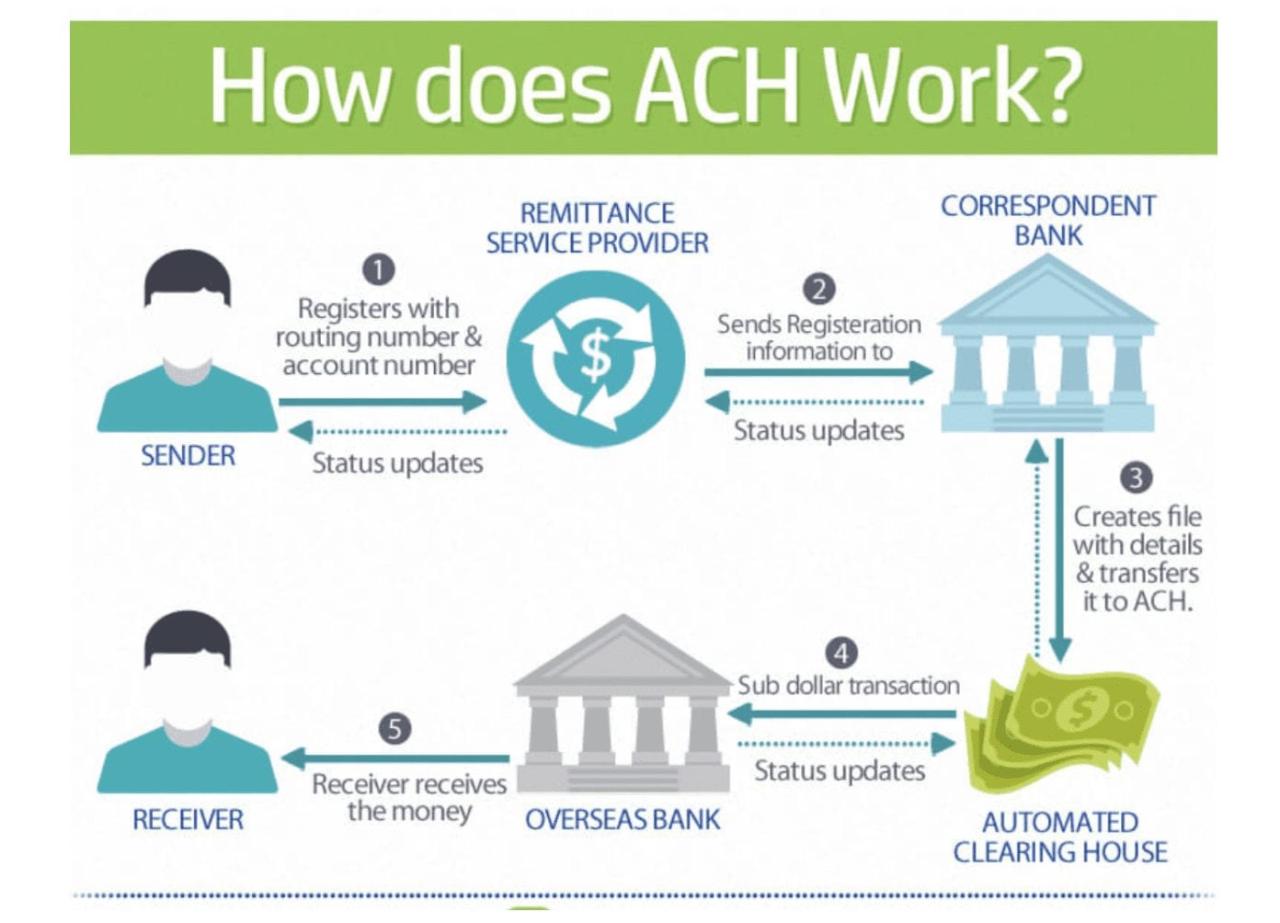

To initiate an ACH Credit Transfer, the customer needs to provide their bank account information, including their bank account number and routing number. This information is used to verify the customer’s bank account and ensure that the funds are transferred to the correct account.

Stripe uses a variety of methods to verify bank accounts, including:

- Micro-deposits: Stripe will deposit small amounts of money into the customer’s bank account and then ask the customer to verify the amounts. This method is used to confirm that the customer has access to the bank account.

- Automated Clearing House (ACH) Network: Stripe uses the ACH Network to process ACH Credit Transfers. The ACH Network is a secure and reliable system that is used by banks and financial institutions to process electronic payments.

Processing Time and Potential Delays

Once the customer’s bank account has been verified, Stripe will initiate the ACH Credit Transfer. The processing time for ACH Credit Transfers can vary depending on the bank, but it typically takes 1-3 business days for the funds to be transferred to the Stripe account.

Potential delays can occur for a variety of reasons, including:

- Bank holidays: If the transfer is initiated on a bank holiday, the funds may not be transferred until the next business day.

- Weekend transfers: Transfers initiated on a weekend may not be processed until the following Monday.

- Technical issues: Technical issues with the ACH Network or with the customer’s bank can also cause delays.

Use Cases for Stripe ACH Credit Transfer

Stripe ACH Credit Transfer is a versatile payment method that offers several advantages for businesses, making it suitable for a wide range of use cases. This method enables businesses to receive payments directly from customers’ bank accounts, facilitating efficient and cost-effective transactions.

Recurring Payments

Recurring payments are a common scenario where Stripe ACH Credit Transfer proves beneficial. Businesses that offer subscription services, such as software-as-a-service (SaaS) companies, gym memberships, or online streaming services, can utilize this method to automate recurring payments from their customers.

- Convenience: Customers can set up automatic payments, eliminating the need to manually enter payment details each month.

- Reduced Churn: Automated payments minimize the risk of missed payments, reducing customer churn and ensuring consistent revenue streams.

- Increased Efficiency: Businesses can streamline their payment processes, saving time and resources on manual payment management.

Payroll

Stripe ACH Credit Transfer can be a valuable tool for businesses looking to simplify payroll processing.

- Direct Deposit: Businesses can directly deposit employee salaries into their bank accounts, eliminating the need for paper checks or physical transfers.

- Faster Payment: Employees receive their salaries faster, improving their financial well-being and satisfaction.

- Reduced Costs: Businesses can save on printing, mailing, and handling costs associated with traditional payroll methods.

Vendor Payments

Businesses can leverage Stripe ACH Credit Transfer to make efficient and secure payments to their vendors.

- Automated Payments: Businesses can schedule automated payments to vendors, ensuring timely payments and maintaining strong vendor relationships.

- Reduced Errors: Automated payments minimize the risk of manual errors, ensuring accurate payments and avoiding disputes.

- Improved Cash Flow: Businesses can optimize their cash flow by automating payments, reducing the need for manual reconciliation and ensuring timely payments to vendors.

Other Use Cases

- B2B Payments: Stripe ACH Credit Transfer can be used for businesses to make payments to other businesses, facilitating seamless transactions within supply chains.

- Bill Payments: Consumers can use Stripe ACH Credit Transfer to make payments for utilities, insurance, and other bills directly from their bank accounts.

- Donation Payments: Non-profit organizations can utilize this method to receive donations from individuals and businesses.

Fees and Pricing Structure

Stripe ACH Credit Transfer is a cost-effective payment method, but it’s important to understand the associated fees to make informed decisions about your payment processing strategy.

Stripe’s pricing for ACH Credit Transfer is transparent and straightforward, but it can vary based on factors such as your business volume and the specific plan you choose.

Fees Associated with Stripe ACH Credit Transfer

The primary fee associated with Stripe ACH Credit Transfer is a per-transaction fee. This fee is typically a fixed amount, regardless of the transaction value.

Stripe charges a flat fee per successful ACH Credit Transfer transaction.

In addition to the per-transaction fee, there may be other fees associated with ACH Credit Transfer, such as:

- Monthly platform fees: Some Stripe plans may have a monthly fee, regardless of transaction volume.

- International transaction fees: If you process transactions in currencies other than your primary currency, you may incur additional fees.

- Chargeback fees: If a customer disputes a transaction, you may be charged a fee for processing the chargeback.

Comparison with Other Stripe Payment Methods

To understand the pricing structure of Stripe ACH Credit Transfer in context, it’s helpful to compare it to other payment methods offered by Stripe:

- Credit and debit cards: Stripe’s fees for credit and debit card transactions are typically higher than ACH Credit Transfer fees, as these transactions involve higher processing costs.

- Wire transfers: While wire transfers are often faster than ACH Credit Transfers, they typically involve higher fees, particularly for international transactions.

- Apple Pay and Google Pay: These mobile payment methods are generally more expensive than ACH Credit Transfer, as they involve additional processing and security measures.

Factors Influencing the Cost of ACH Credit Transfer

The cost of using Stripe ACH Credit Transfer can be influenced by several factors:

- Transaction volume: Businesses with high transaction volumes may benefit from discounted pricing.

- Transaction size: While the per-transaction fee is typically fixed, some plans may have a tiered pricing structure where the fee varies based on the transaction amount.

- Plan chosen: Stripe offers different pricing plans, each with its own set of fees and features.

- Industry: Stripe may offer industry-specific pricing for certain sectors.

Integration and Setup

Integrating Stripe ACH Credit Transfer into your business system is a straightforward process that requires a few key steps. This involves setting up a Stripe account, configuring payment settings, and ensuring seamless integration with your existing systems. By following these steps, you can leverage the benefits of Stripe ACH Credit Transfer for efficient and secure transactions.

Setting Up Your Stripe Account

Setting up a Stripe account is the first step towards integrating Stripe ACH Credit Transfer into your business system. This involves providing basic business information and verifying your identity. Stripe’s user-friendly interface makes this process simple and efficient.

- Create a Stripe account by providing basic business information, including your business name, website, and contact details.

- Verify your identity by providing documentation such as your government-issued ID or business registration details.

- Enable ACH Credit Transfer as a payment method within your Stripe account settings.

Configuring Payment Settings

After setting up your Stripe account, you need to configure your payment settings to enable ACH Credit Transfer for your customers. This involves specifying the details for receiving payments and setting up security measures.

- Define the bank account details where you want to receive ACH Credit Transfer payments. This includes your bank account number, routing number, and account type.

- Set up security measures to protect sensitive customer data, such as enabling two-factor authentication and adhering to PCI DSS compliance standards.

- Configure payment settings to specify the maximum amount you are willing to accept per transaction and the currency you will accept.

Integrating with Your Business Systems

Integrating Stripe ACH Credit Transfer with your existing business systems is crucial for seamless transactions. This involves connecting your Stripe account to your accounting software, CRM, or other relevant systems.

- Use Stripe’s API to connect your Stripe account to your existing business systems, such as your accounting software, CRM, or e-commerce platform.

- Utilize Stripe’s pre-built integrations for popular platforms to streamline the integration process. Stripe offers integrations with platforms like Shopify, WooCommerce, and QuickBooks.

- Consider using a third-party integration tool if you need more customization or if your system doesn’t have a pre-built Stripe integration.

Optimizing Integration for Seamless Transactions, Stripe ach credit transfer

Optimizing your integration process is essential for smooth and efficient ACH Credit Transfer transactions. This involves testing your integration thoroughly and ensuring your customers have a seamless experience.

- Test your integration thoroughly to ensure that ACH Credit Transfer payments are processed correctly and that funds are deposited into your bank account without errors.

- Provide clear and concise instructions to your customers on how to make ACH Credit Transfer payments. This includes information about the required bank account details and any potential processing times.

- Monitor your transactions regularly to identify and resolve any issues promptly. This includes checking for declined payments, processing delays, or other errors.

Conclusive Thoughts

By leveraging the power of Stripe ACH Credit Transfer, businesses can unlock a world of streamlined financial transactions, enhancing efficiency and minimizing costs. This versatile payment method empowers businesses to embrace a future where payments are seamless, secure, and readily accessible.

Questions Often Asked

What is the difference between Stripe ACH Credit Transfer and Stripe ACH Debit Transfer?

Stripe ACH Credit Transfer pulls funds from a customer’s bank account, while Stripe ACH Debit Transfer pushes funds to a customer’s bank account.

How long does it take for a Stripe ACH Credit Transfer to be processed?

ACH transfers typically take 1-3 business days to process.

Is Stripe ACH Credit Transfer safe?

Stripe implements robust security measures to protect ACH transfers, ensuring the safety and integrity of financial transactions.