Credit transfer balance is a powerful financial tool that allows you to move outstanding credit card balances to a new account, often with more favorable terms. This strategy can be particularly beneficial when seeking lower interest rates, reduced monthly payments, or a combination of both. Imagine consolidating multiple debts into a single, manageable account, potentially saving you money in the long run.

This process involves transferring your existing credit card balance to a new card with a lower interest rate or other attractive features. The goal is to streamline your debt management, reduce interest charges, and potentially free up cash flow for other financial goals.

What is Credit Transfer Balance?

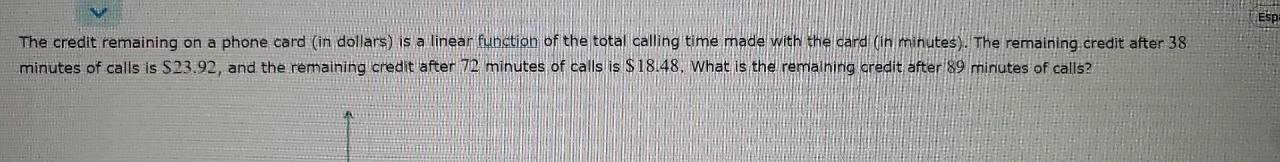

Credit transfer balance is a crucial concept in finance, particularly when dealing with credit cards and loans. It essentially represents the amount of credit you have available to spend or borrow. Understanding credit transfer balance is vital for managing your finances effectively and avoiding unnecessary debt.

Credit transfer balance is the amount of credit you have available to spend or borrow. It is a valuable tool for managing your finances, as it allows you to track your spending and borrowing activity.

Examples of Credit Transfer Balance

Credit transfer balance is a common practice in the financial world. Here are some examples of how it works in real-world scenarios:

* Credit Card Balance Transfers: When you transfer a balance from one credit card to another, you are essentially utilizing the credit transfer balance of the new card. This is often done to take advantage of a lower interest rate offered by the new card.

* Loan Consolidation: When you consolidate multiple loans into a single loan, you are using the credit transfer balance of the new loan to pay off the existing debts. This can help simplify your debt management and potentially lower your monthly payments.

* Home Equity Line of Credit (HELOC): A HELOC is a type of loan that allows you to borrow against the equity you have built up in your home. You can use the credit transfer balance of your HELOC for various purposes, such as home improvements or debt consolidation.

* Personal Loans: Personal loans can be used for a variety of purposes, such as medical expenses, home repairs, or debt consolidation. The credit transfer balance of a personal loan allows you to borrow a specific amount of money, which you then repay over a set period.

Benefits of Credit Transfer Balance

Transferring your credit card balance can be a smart financial move, especially if you’re looking to save money on interest charges or consolidate your debt.

Lower Interest Rates

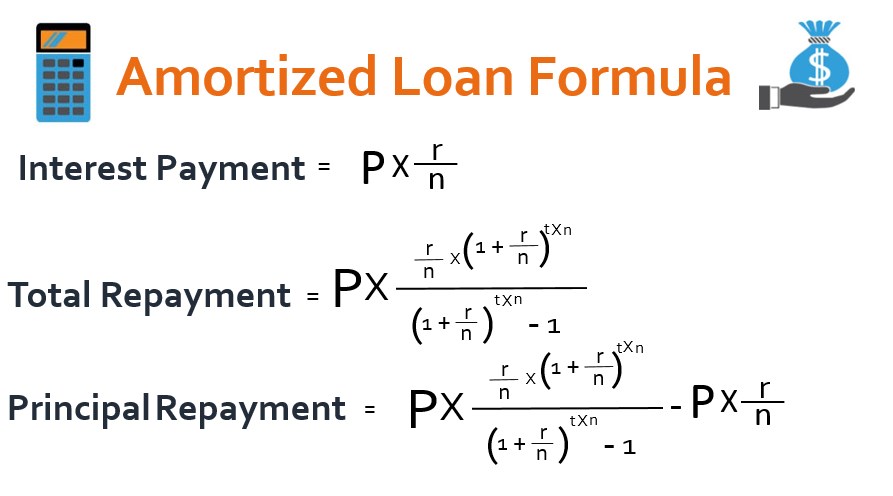

A credit transfer balance allows you to move your existing debt to a new credit card with a lower interest rate. This can significantly reduce the amount of interest you pay over time, freeing up more money for other financial goals. For example, imagine you have a $5,000 balance on a credit card with a 20% interest rate. If you transfer that balance to a card with a 10% interest rate, you could save hundreds of dollars in interest charges over the life of the debt.

Debt Consolidation

Credit transfer balances can be a convenient way to consolidate multiple credit card debts into one. This simplifies your debt management by reducing the number of monthly payments you need to track. It can also improve your credit utilization ratio, which is a key factor in your credit score.

Potential for Rewards

Some credit card issuers offer rewards programs for balance transfers. These programs can provide you with cash back, travel miles, or other perks, which can further offset the cost of your debt.

Improved Financial Management

Transferring your credit balance can improve your financial management by helping you take control of your debt. By simplifying your payments and potentially reducing your interest charges, you can free up more money for savings, investments, or other financial goals.

Considerations Before Transferring Credit Balance

Before you transfer your credit balance, it’s crucial to carefully consider various factors to ensure it’s a financially beneficial decision. This involves assessing potential risks, understanding associated fees and charges, and comparing the terms and conditions of different credit transfer options.

Potential Risks Associated with Credit Transfer Balance

Transferring your credit balance can be a smart move, but it’s essential to understand the potential risks involved.

- Higher Interest Rates: While a lower introductory rate might be tempting, it’s crucial to check the standard interest rate that applies after the introductory period. If this rate is higher than your current credit card, you might end up paying more interest in the long run.

- Transfer Fees: Most credit card providers charge a fee for transferring your balance, which can be a percentage of the amount transferred or a flat fee. These fees can significantly impact the overall cost of the transfer.

- Limited Time Offer: Many introductory rates are valid for a specific period, after which the standard interest rate applies. Failing to pay off the balance before the introductory period ends can result in higher interest payments.

- Credit Score Impact: Applying for a new credit card can impact your credit score, even if you don’t use it. This can affect your ability to secure loans or other credit products in the future.

- Penalty Fees: Some credit cards have penalty fees for late payments or exceeding your credit limit. If you’re unable to make timely payments on your transferred balance, you could face these additional fees.

Fees and Charges Involved in Credit Transfer

Credit transfer involves various fees and charges that can significantly impact the overall cost.

- Transfer Fee: This is a percentage of the transferred amount or a flat fee charged by the new credit card provider for processing the transfer. It’s crucial to compare transfer fees across different credit card providers.

- Annual Fee: Some credit cards have an annual fee that needs to be considered, especially if the introductory rate is valid for a longer period.

- Interest Rate: The interest rate charged on the transferred balance is a significant factor, especially after the introductory period.

- Late Payment Fee: This fee is charged if you miss a payment on your transferred balance.

- Overlimit Fee: This fee is charged if you exceed your credit limit on the new credit card.

Comparison of Terms and Conditions

Comparing the terms and conditions of different credit transfer options is crucial to make an informed decision.

- Introductory Interest Rate: Compare the introductory interest rates offered by different credit card providers and the duration for which they are valid.

- Standard Interest Rate: Check the standard interest rate that applies after the introductory period expires.

- Transfer Fees: Compare the transfer fees charged by different providers, which can vary significantly.

- Minimum Payment Requirements: Compare the minimum payment requirements on different credit cards to ensure you can make timely payments.

- Other Features: Consider other features like reward programs, travel insurance, or purchase protection offered by different credit cards.

End of Discussion

By understanding the mechanics of credit transfer balance, its potential benefits, and the considerations involved, you can make informed decisions about your financial well-being. Whether you’re looking to simplify your debt, lower your monthly payments, or gain control over your finances, credit transfer balance offers a viable path toward achieving your financial objectives. Remember to carefully evaluate the terms and conditions of any transfer offer and weigh the potential advantages against any associated fees or risks.

Detailed FAQs

Is credit transfer balance always a good idea?

Not necessarily. It depends on your individual circumstances. Consider the fees, interest rates, and terms of the new card. A thorough analysis of your current situation is crucial.

What are the common fees associated with credit transfer balance?

Fees can vary depending on the lender. Common fees include balance transfer fees, annual fees, and potential penalties for early repayment.

How can I find the best credit transfer balance offers?

Compare offers from different lenders, paying close attention to interest rates, fees, and any introductory periods. Use online comparison tools or consult with a financial advisor.

Can I transfer my entire credit card balance?

Typically, there’s a limit on the amount you can transfer. Check the terms and conditions of the new card for the specific transfer limit.