Transfer credit card balance to citibank – Transferring a credit card balance to Citibank can be a smart move, especially if you’re looking to lower your interest rate or take advantage of a 0% introductory APR. Citibank offers a variety of balance transfer options, each with its own terms and conditions. This guide will explore the ins and outs of transferring your balance to Citibank, covering everything from eligibility requirements to the benefits and potential drawbacks.

By understanding the process and carefully evaluating your options, you can make an informed decision about whether a Citibank balance transfer is right for you. We’ll also provide a step-by-step guide on how to transfer your balance, along with tips for managing your debt and avoiding late payments.

Citibank Balance Transfer Offers

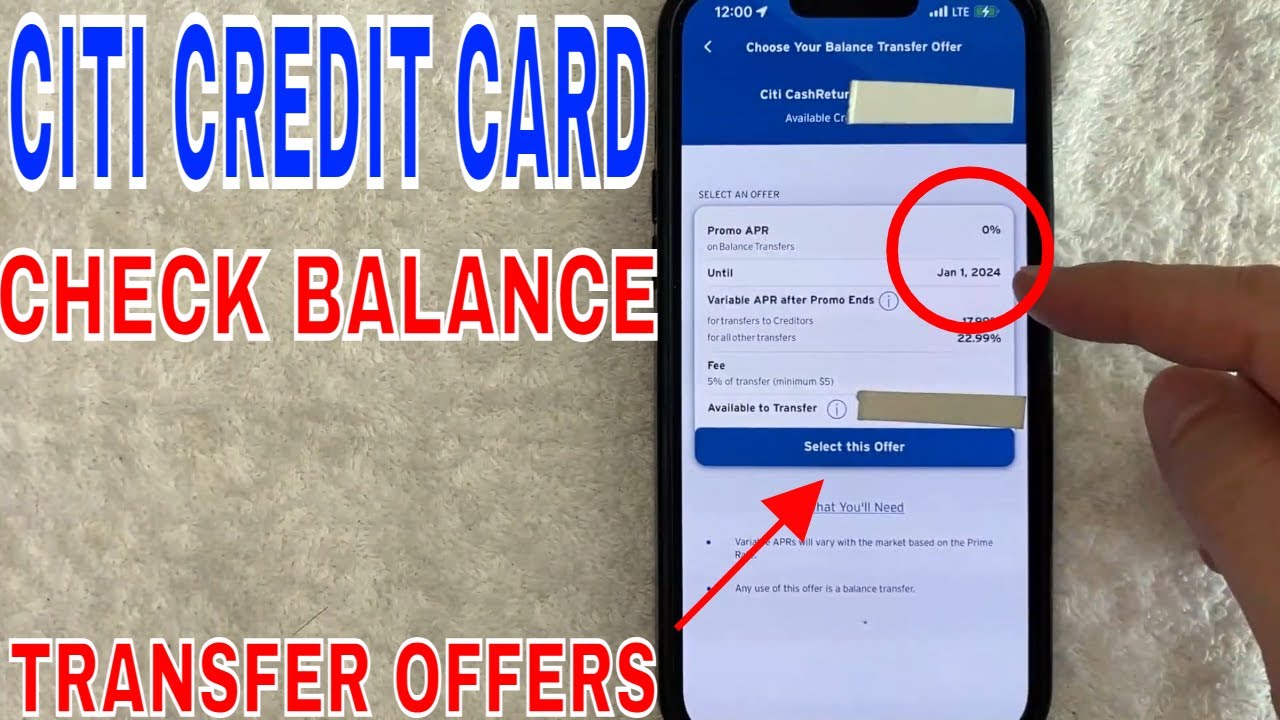

Citibank offers a range of balance transfer credit cards that can help you consolidate high-interest debt and save money on interest charges. These cards typically feature introductory periods with 0% APR on balance transfers, allowing you to pay down your debt without accruing interest during that time. However, it’s crucial to understand the terms and conditions associated with these offers to make informed decisions.

Balance Transfer Offer Terms and Conditions

Balance transfer offers typically include specific terms and conditions, including interest rates, fees, and introductory periods. Understanding these terms is essential to determine if a balance transfer offer is right for you.

Interest Rates

Balance transfer offers often come with an introductory 0% APR period, which means you won’t pay interest on transferred balances for a specific duration. After this introductory period, a standard APR will apply.

The standard APR on balance transfer cards can vary significantly, so it’s essential to compare offers from different lenders.

Fees

Balance transfer offers may involve various fees, including:

- Balance Transfer Fee: This fee is charged as a percentage of the transferred balance, typically ranging from 3% to 5%. It’s important to factor this fee into your overall cost savings when considering a balance transfer.

- Annual Fee: Some balance transfer cards charge an annual fee, which can add to the overall cost. This fee may be waived for the first year but will apply in subsequent years.

- Late Payment Fee: If you miss a payment, you may incur a late payment fee. These fees can vary depending on the lender.

- Over-Limit Fee: If you exceed your credit limit, you may be charged an over-limit fee.

Introductory Periods

Balance transfer offers typically include an introductory period with 0% APR on transferred balances. This period can range from 6 to 18 months or even longer.

It’s crucial to pay down as much of your balance as possible during the introductory period to minimize interest charges once the standard APR kicks in.

Examples of Citibank Balance Transfer Credit Cards

Citibank offers several balance transfer credit cards, each with its unique features and benefits. Here are some examples:

- Citi Simplicity® Card: This card offers a 0% APR on balance transfers for 18 months, followed by a variable APR of 19.24% to 26.24%. It also features no annual fee and no foreign transaction fees.

- Citi® Double Cash Card: This card offers 2% cash back on all purchases and 1% cash back on all purchases. It also features a 0% APR on balance transfers for 18 months, followed by a variable APR of 19.24% to 26.24%.

- Citi® Rewards+℠ Card: This card offers 2x ThankYou® Points on dining and entertainment purchases, 1x ThankYou® Point on all other purchases, and a 0% APR on balance transfers for 15 months, followed by a variable APR of 19.24% to 26.24%.

Benefits of Transferring a Balance to Citibank: Transfer Credit Card Balance To Citibank

Transferring a credit card balance to Citibank can be a smart financial move, offering various advantages that can help you manage your debt more effectively and potentially save money.

Lower Interest Rates

Citibank offers balance transfer credit cards with introductory 0% APR periods, allowing you to save on interest charges for a set period. This can be particularly beneficial if you have a high-interest credit card balance that you’re struggling to pay off. By transferring your balance to a Citibank card with a lower APR, you can significantly reduce your monthly interest payments, allowing you to pay down your debt faster.

Consolidating Debt

Transferring balances to a single Citibank card can simplify your debt management. This consolidation can help you track your payments more efficiently, making it easier to stay on top of your debt obligations.

Improving Credit Utilization

Credit utilization ratio is a significant factor in your credit score. It measures the amount of credit you’re using compared to your total available credit. A high credit utilization ratio can negatively impact your credit score. Transferring your balance to a Citibank card with a higher credit limit can help reduce your credit utilization ratio, potentially boosting your credit score over time.

Eligibility and Requirements for Balance Transfers

To transfer a balance to Citibank, you must meet certain eligibility requirements. These requirements are designed to ensure that Citibank is comfortable extending credit to you and that you can manage the transferred balance responsibly.

Eligibility for a balance transfer can vary depending on the specific Citibank credit card you’re applying for. However, there are some general requirements that are common across most Citibank balance transfer offers.

Credit Score and Credit History

Citibank generally requires a good credit score to approve a balance transfer. This means you’ll need a credit score that falls within a certain range, typically above 670. Your credit history is also considered, and a history of responsible credit management will increase your chances of approval.

Income and Debt-to-Income Ratio, Transfer credit card balance to citibank

Citibank will also assess your income and debt-to-income ratio (DTI). Your DTI is the percentage of your monthly income that goes towards debt payments. A lower DTI generally indicates that you have more financial flexibility and can manage additional debt responsibly.

Existing Credit Lines

Citibank may consider the number and types of existing credit lines you have. Having too many open credit lines or high credit utilization ratios can negatively impact your eligibility for a balance transfer.

Application Process

To apply for a balance transfer to Citibank, you’ll need to follow these general steps:

- Choose a Citibank credit card that offers a balance transfer option.

- Check the eligibility requirements for the chosen card.

- Complete the application form, providing your personal and financial information.

- Submit the application and wait for a decision from Citibank.

Considerations Before Transferring a Balance

While transferring a balance to a Citibank credit card can be a good way to save money on interest, it’s essential to consider the potential drawbacks and carefully weigh your options before making a decision.

Potential Drawbacks of Balance Transfers

Before transferring a balance, it’s crucial to consider the potential drawbacks, such as transfer fees and the risk of losing a low interest rate on an existing card.

- Transfer Fees: Most credit cards charge a balance transfer fee, typically a percentage of the transferred amount. This fee can eat into any potential savings from a lower interest rate. For example, a 3% transfer fee on a $5,000 balance would cost you $150.

- Introductory Interest Rate Expiration: Balance transfer offers usually have a promotional period with a low introductory interest rate. After this period, the interest rate typically reverts to a higher standard rate. If you don’t pay off the balance before the promotional period ends, you’ll start paying a higher interest rate, potentially negating any initial savings.

- Loss of Low Interest Rate: If you have a credit card with a low interest rate, transferring your balance to a new card with a higher interest rate could actually cost you more in the long run.

Comparing Offers from Different Lenders

It’s essential to compare offers from different lenders before deciding on a balance transfer. Look at the interest rate, transfer fees, and promotional period for each card. Also, consider the credit card’s other features, such as rewards programs, cash-back offers, and travel benefits.

- Interest Rate: The interest rate is the most crucial factor to consider when comparing balance transfer offers. Look for a card with the lowest possible interest rate, especially during the promotional period.

- Transfer Fees: Compare the transfer fees charged by different lenders. Some cards may offer a lower interest rate but have a higher transfer fee.

- Promotional Period: Consider the length of the promotional period for the low introductory interest rate. A longer promotional period gives you more time to pay off the balance and avoid a higher interest rate.

Understanding the Long-Term Implications of a Balance Transfer

It’s important to understand the long-term implications of a balance transfer.

- Impact on Credit Score: Opening a new credit card can slightly lower your credit score, as it increases your credit utilization ratio. However, this impact is usually minimal and temporary, especially if you maintain a good payment history.

- Financial Discipline: A balance transfer can be a good way to save money on interest, but it’s essential to have a plan to pay off the balance within the promotional period. If you don’t, you could end up paying more interest than you would have on your original card.

- Debt Management: A balance transfer can be a useful tool for debt management, but it’s not a solution for overspending. You need to address the underlying causes of your debt and develop a budget to avoid accumulating more debt in the future.

Closure

Transferring a credit card balance to Citibank can be a strategic way to manage your debt and potentially save money on interest. However, it’s essential to carefully consider the terms and conditions of each offer, including transfer fees, introductory periods, and long-term interest rates. By understanding the process and making an informed decision, you can leverage a balance transfer to your advantage and take control of your finances.

FAQ Compilation

How long does it take to transfer a credit card balance to Citibank?

The transfer process typically takes 7-10 business days. However, it can vary depending on the specific card and the lender you’re transferring from.

Can I transfer my entire balance to Citibank?

You can usually transfer your entire balance, but Citibank may have a maximum transfer limit. This limit will be specified in the terms and conditions of the balance transfer offer.

What happens if I miss a payment after transferring my balance to Citibank?

Missing a payment after a balance transfer can result in a late payment fee and a higher interest rate. It can also negatively impact your credit score.

What are the benefits of using a balance transfer credit card from Citibank?

Citibank balance transfer cards offer potential benefits such as lower interest rates, 0% introductory APRs, and the opportunity to consolidate debt. These benefits can help you save money on interest and pay down your debt faster.