Transfer balance credit card no interest – Transfer balance credit cards with “no interest” offers can seem like a financial savior, promising a chance to escape the clutches of high-interest debt. But before you dive into this seemingly enticing pool, it’s crucial to understand the ins and outs of these offers. While the promise of interest-free periods is tempting, these cards often come with hidden fees and terms that could end up costing you more in the long run.

This guide will delve into the world of balance transfer credit cards, shedding light on the advantages, disadvantages, and hidden pitfalls associated with these offers. We’ll explore the concept of introductory “no interest” periods, explain how interest rates work after the introductory period, and provide insights into choosing the right card for your needs. We’ll also discuss strategies for managing your balance transfer credit card effectively and explore alternative methods for debt consolidation.

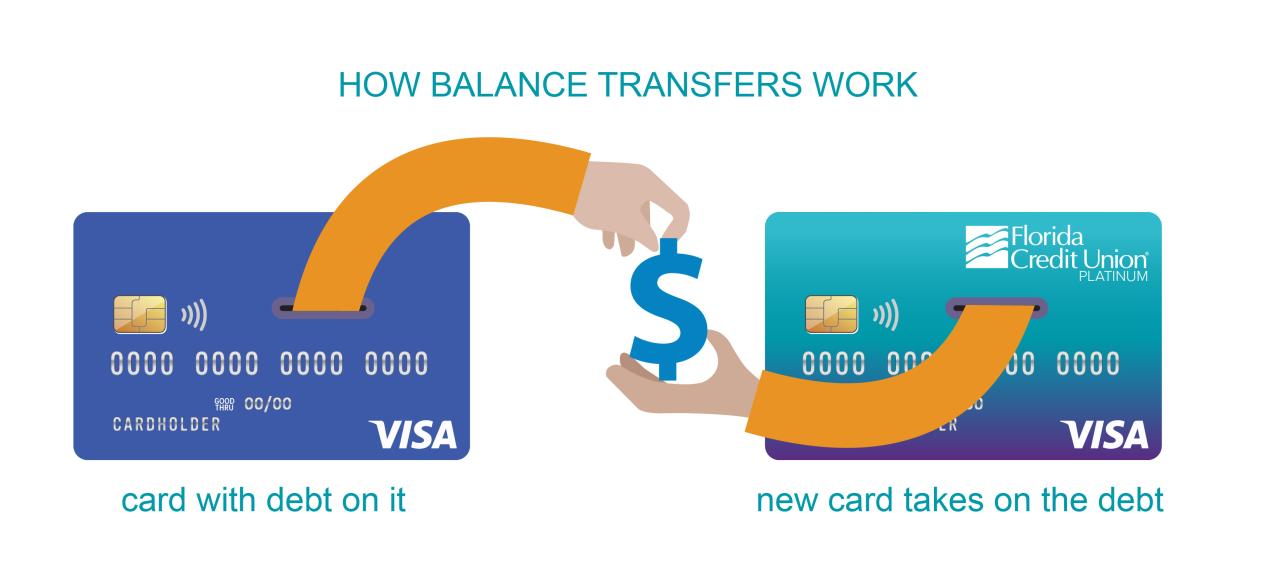

Introduction to Balance Transfer Credit Cards

Balance transfer credit cards are a type of credit card that allows you to transfer the balance from another credit card to a new card. This can be beneficial if you have a high-interest credit card balance and are looking for a way to save money on interest charges.

Balance transfer credit cards often offer a promotional period with a 0% APR (Annual Percentage Rate) for a set period of time, usually between 6 and 18 months. During this time, you won’t have to pay any interest on your transferred balance, allowing you to focus on paying down the principal amount.

Benefits of Balance Transfer Credit Cards

A balance transfer credit card can offer several benefits, including:

- Lower interest rates: Balance transfer credit cards often have lower interest rates than other types of credit cards. This can save you money on interest charges, especially if you have a large balance.

- Promotional 0% APR periods: These cards often come with a promotional period during which you won’t have to pay any interest on your transferred balance. This can give you time to pay down your balance without incurring interest charges.

- Debt consolidation: You can use a balance transfer credit card to consolidate multiple credit card balances into one. This can make it easier to manage your debt and track your payments.

Potential Drawbacks of Balance Transfer Credit Cards

While balance transfer credit cards can be beneficial, it’s important to be aware of their potential drawbacks.

- Balance transfer fees: Most balance transfer credit cards charge a fee for transferring your balance. This fee is typically a percentage of the transferred amount, so it’s important to factor it into your calculations.

- Limited time offer: The promotional 0% APR period is usually for a limited time. After the promotional period ends, you’ll start paying interest on your balance at the standard APR, which can be significantly higher.

- Credit score impact: Applying for a balance transfer credit card can affect your credit score. This is because a hard inquiry is made on your credit report when you apply for a new credit card.

- Minimum payments: While you may not have to pay interest during the promotional period, you will still be required to make minimum payments on your balance. If you don’t make these payments, you could incur late fees and damage your credit score.

Transferring Your Balance

Transferring your balance to a new credit card can be a great way to save money on interest charges. However, it’s important to understand the process and the potential challenges involved.

Steps Involved in a Balance Transfer

To transfer your balance, you’ll need to follow these steps:

- Choose a balance transfer credit card. This means selecting a card that offers a 0% APR introductory period and low transfer fees.

- Apply for the card. Be sure to read the terms and conditions carefully before you apply.

- Complete the balance transfer request. Once you’re approved for the card, you’ll need to provide the credit card company with the information about the account you want to transfer. This information will usually include the account number, the balance you want to transfer, and the name of the issuing bank.

- Wait for the transfer to be processed. The transfer process can take a few days or weeks, depending on the credit card company.

Documents and Information Needed for a Balance Transfer

Before you start the transfer process, make sure you have the following information:

- Your current credit card account number.

- The balance you want to transfer.

- The name of the issuing bank for your current credit card.

- Your Social Security number.

- Your contact information.

Potential Challenges During the Transfer Process

While balance transfers can be a great way to save money, there are a few potential challenges you should be aware of:

- Transfer fees. Most balance transfer credit cards charge a fee, typically a percentage of the balance transferred. For example, a 3% fee on a $10,000 balance transfer would cost you $300.

- Transfer limits. Some credit cards have a limit on the amount of debt you can transfer. This limit may be a percentage of your available credit or a fixed dollar amount.

- Credit score impact. Applying for a new credit card can lower your credit score temporarily. This is because the application is a hard inquiry on your credit report.

- Interest rate changes. The 0% APR introductory period on a balance transfer credit card is usually temporary. Once the introductory period ends, the interest rate will revert to the standard APR, which can be much higher.

Solutions to Potential Challenges, Transfer balance credit card no interest

To avoid some of the potential challenges of balance transfers, consider the following solutions:

- Shop around for the best balance transfer offers. Compare the transfer fees, APRs, and introductory periods offered by different credit card companies.

- Consider transferring a smaller amount of debt first. If you have a large balance, you may want to transfer a smaller amount first to see how the process works.

- Pay down your balance as quickly as possible. Once you’ve transferred your balance, make sure you pay down the balance as quickly as possible to avoid accruing interest.

Closing Summary

Ultimately, the decision to use a balance transfer credit card is a personal one. Weigh the potential benefits against the risks and make an informed choice that aligns with your financial goals. By understanding the intricacies of these offers, you can navigate the world of balance transfer credit cards with confidence and make informed decisions that benefit your financial well-being.

FAQ Compilation: Transfer Balance Credit Card No Interest

What is a balance transfer fee?

A balance transfer fee is a percentage of the amount you transfer from your old credit card to your new balance transfer credit card. It’s typically charged when you initiate the balance transfer.

How long do introductory “no interest” periods typically last?

Introductory “no interest” periods on balance transfer credit cards usually range from 6 to 18 months. However, the specific duration varies depending on the card issuer and the terms of the offer.

What happens after the introductory “no interest” period ends?

Once the introductory “no interest” period expires, the standard interest rate for the credit card applies to your remaining balance. This interest rate can be significantly higher than the introductory rate.