Balance credit card transfers are a powerful tool for managing debt, offering the potential to save money on interest and consolidate multiple balances into a single, manageable account. But understanding how they work and choosing the right card are crucial for maximizing their benefits.

This comprehensive guide will explore the ins and outs of balance transfers, from the fundamentals to advanced strategies. We’ll cover everything you need to know, from choosing the right card to avoiding common pitfalls and ensuring a positive impact on your credit score.

Understanding Balance Transfer Credit Cards

A balance transfer credit card is a credit card that allows you to transfer outstanding balances from other credit cards to it. This can be a valuable tool for managing debt, especially if you have high-interest credit card debt.

Benefits of Balance Transfers

Balance transfers can be beneficial for several reasons.

- Lower Interest Rates: One of the primary benefits of balance transfers is the potential to secure a lower interest rate on your debt. Many balance transfer credit cards offer introductory 0% APR periods, which can save you significant interest charges over time.

- Debt Consolidation: Consolidating multiple credit card balances onto a single card can simplify your debt management. You’ll have just one minimum payment to track and one interest rate to worry about, which can help you stay organized and on top of your debt.

- Improved Credit Utilization: By transferring balances, you can potentially reduce your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A lower credit utilization ratio can improve your credit score, making it easier to obtain loans and credit in the future.

Examples of Situations Where Balance Transfers Are Beneficial

Balance transfers can be particularly helpful in the following situations:

- High-Interest Debt: If you have credit card debt with a high interest rate, transferring it to a balance transfer card with a lower interest rate can save you a substantial amount of money in interest charges. For example, if you have $10,000 in debt at 20% APR, you’ll pay over $2,000 in interest over five years. However, if you transfer that balance to a card with a 0% APR for 12 months, you’ll save that entire amount in interest, assuming you pay off the balance within the promotional period.

- Multiple Credit Cards: If you have several credit cards with outstanding balances, transferring them to a single balance transfer card can simplify your debt management. You’ll only have one minimum payment to track and one interest rate to worry about, which can make it easier to stay on top of your debt. This can also improve your credit utilization ratio, as you’ll have a single credit card with a higher available credit limit.

- Consolidation of Debt: Balance transfers can be used to consolidate other types of debt, such as personal loans or medical bills. This can be a good option if you’re looking to simplify your debt payments and lower your overall interest rate.

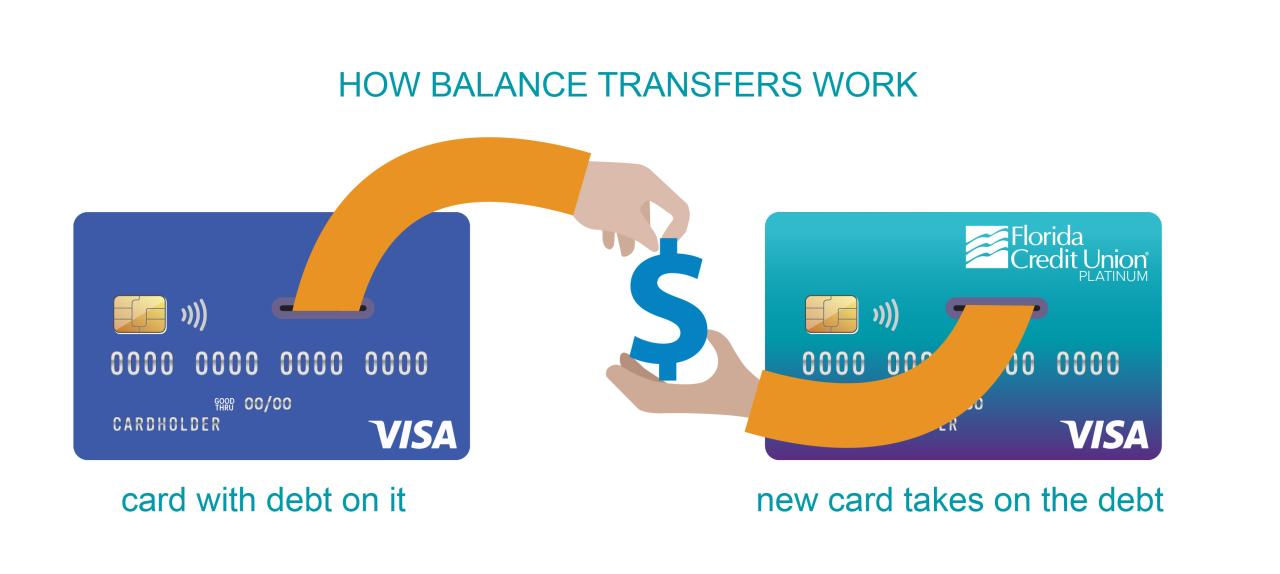

How Balance Transfers Work: Balance Credit Card Transfer

A balance transfer is a way to move debt from one credit card to another. This can be a good option if you’re looking to save money on interest or get a lower APR. To make a balance transfer, you’ll need to apply for a new credit card that offers balance transfer benefits.

The Process of Transferring a Balance

The process of transferring a balance is relatively simple. You’ll need to contact your new credit card issuer and provide them with the following information:

* The account number of the credit card you’re transferring the balance from.

* The amount of the balance you want to transfer.

* Your billing address and contact information.

Once you’ve provided this information, the credit card issuer will initiate the balance transfer. The process can take a few days to complete, depending on the credit card issuer.

Fees Associated with Balance Transfers

Most credit card issuers charge a fee for balance transfers. This fee is typically a percentage of the balance transferred. For example, a credit card issuer might charge a 3% fee for a balance transfer of $1,000. This would mean that you would be charged $30 in fees.

Balance transfer fees are a common cost associated with transferring your balance.

Introductory APR Period, Balance credit card transfer

Many credit card issuers offer an introductory APR period for balance transfers. This means that you’ll be charged a lower interest rate on your balance transfer for a set period of time. The introductory APR period can vary depending on the credit card issuer.

An introductory APR period is a promotional period where you’ll pay a lower interest rate on your balance transfer.

For example, a credit card issuer might offer an introductory APR of 0% for 12 months. This means that you would not have to pay any interest on your balance transfer for the first 12 months. After the introductory APR period expires, the interest rate will revert to the standard APR.

It’s important to note that the introductory APR period may not apply to all purchases made on the new credit card. The introductory APR period is typically only applicable to balance transfers.

Choosing the Right Balance Transfer Card

Choosing the right balance transfer card can be a smart move to save money on interest charges and pay off your debt faster. But with so many options available, it can be overwhelming to know where to start. Here’s a guide to help you navigate the process and find the best card for your needs.

Factors to Consider When Choosing a Balance Transfer Card

The best balance transfer card for you depends on your individual circumstances and financial goals. Here are some key factors to consider:

- Balance Transfer Fee: Balance transfer fees are charged when you transfer your debt from another credit card. These fees can range from 1% to 5% of the transferred balance, so it’s important to compare offers and find a card with a low or no balance transfer fee.

- Introductory APR: The introductory APR is the interest rate you’ll pay on your transferred balance for a specified period, usually 12 to 18 months. Look for cards with a 0% introductory APR, as this will give you time to pay down your debt without accruing interest.

- Regular APR: After the introductory period ends, your balance will be subject to the regular APR. Make sure you understand the regular APR before transferring your balance, as it can be significantly higher than the introductory rate.

- Credit Limit: The credit limit is the maximum amount you can charge to your card. Choose a card with a credit limit that’s high enough to accommodate your balance transfer, but not so high that it tempts you to overspend.

- Rewards Program: Some balance transfer cards offer rewards programs, such as cash back or travel points. While these rewards can be nice, it’s important to remember that they’re not the primary reason for getting a balance transfer card.

- Annual Fee: Many balance transfer cards have an annual fee, which can range from $0 to $100 or more. Consider the value of the card’s benefits and features in relation to the annual fee.

- Credit Score: Your credit score will play a role in the balance transfer card offers you qualify for. If you have a good credit score, you’ll likely be eligible for the best offers with low interest rates and no fees. If your credit score is lower, you may have to settle for a card with a higher APR or a balance transfer fee.

Comparing Balance Transfer Card Offers

Once you’ve considered the key factors above, you can start comparing balance transfer card offers from different issuers. Here are some tips for comparing offers:

- Use a Balance Transfer Calculator: A balance transfer calculator can help you estimate how much you’ll save on interest charges and how long it will take you to pay off your debt with different card offers.

- Read the Fine Print: Carefully review the terms and conditions of each card offer before you apply. Pay attention to the introductory APR period, the regular APR, the balance transfer fee, and any other fees or restrictions.

- Compare Multiple Offers: Don’t settle for the first offer you see. Compare offers from several different issuers to find the best deal for you.

Identifying the Best Card for Your Needs

To identify the best balance transfer card for your needs, consider your financial goals and prioritize the factors that are most important to you.

- If you’re focused on paying off your debt quickly and saving money on interest, look for a card with a 0% introductory APR and a low balance transfer fee.

- If you’re looking for a card with rewards, choose a card that offers a rewards program that aligns with your spending habits.

- If you have a low credit score, you may have to accept a higher APR or a balance transfer fee.

Final Thoughts

By carefully considering your options and implementing a strategic approach, balance transfers can be a valuable tool for managing debt and improving your financial well-being. Remember to compare offers, factor in fees, and prioritize responsible repayment to reap the full benefits of this powerful financial tool.

Key Questions Answered

What is the typical introductory APR period for balance transfers?

Introductory APR periods for balance transfers usually last between 6 to 18 months, but this can vary depending on the card issuer.

What happens after the introductory APR period ends?

Once the introductory period expires, the APR will revert to the card’s standard rate, which is often significantly higher. It’s crucial to pay down your balance before this happens to avoid accruing significant interest charges.

Can I transfer my balance multiple times?

While some card issuers allow multiple balance transfers, others restrict this practice. It’s essential to check the terms and conditions of your chosen card to avoid penalties or restrictions.

How do balance transfers affect my credit score?

Balance transfers can have a mixed impact on your credit score. While transferring a balance to a card with a lower APR can help you manage debt and improve your credit utilization ratio, opening a new credit card can temporarily lower your score. It’s crucial to use balance transfers responsibly to minimize any negative impact.