ACH Credit Transfer Stripe sets the stage for a streamlined and secure payment experience, empowering businesses to seamlessly process transactions within the United States. This method, relying on the Automated Clearing House (ACH) network, allows for electronic funds transfers directly from a customer’s bank account to a business’s designated account, bypassing traditional credit card processing.

Stripe’s integration with ACH credit transfers simplifies the process for both businesses and customers. It offers a user-friendly platform that facilitates the initiation and receipt of ACH payments, eliminating the need for complex manual procedures. By leveraging Stripe’s infrastructure, businesses can enjoy the benefits of faster processing times, reduced transaction fees, and enhanced security measures, all while providing a convenient and familiar payment option for their customers.

ACH Credit Transfer Basics

ACH credit transfers are a widely used electronic payment method that enables funds to be transferred between bank accounts within the United States. They are commonly used for various purposes, including payroll, bill payments, and business transactions.

Understanding the Fundamentals of ACH Credit Transfers, Ach credit transfer stripe

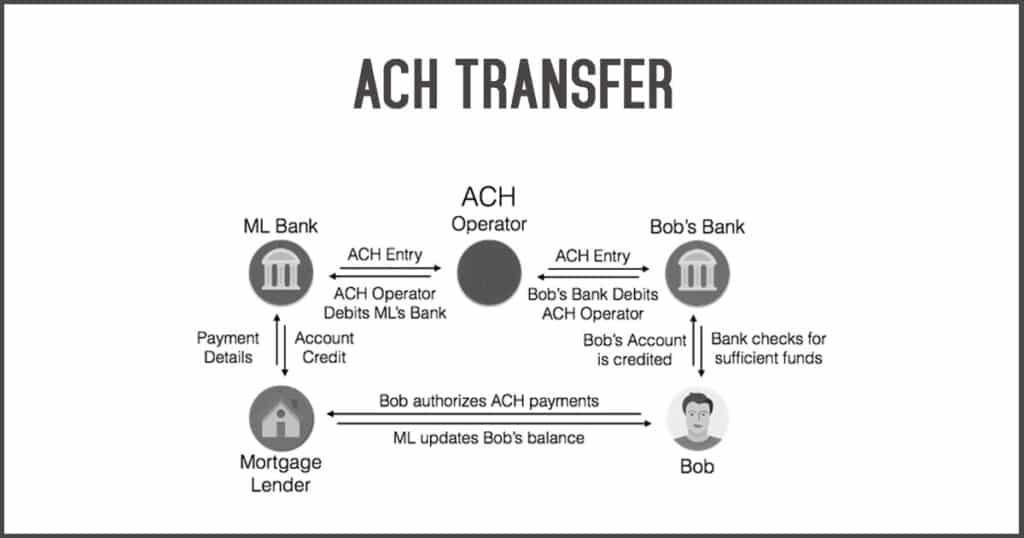

ACH credit transfers operate within a network managed by the National Automated Clearing House Association (NACHA). This network facilitates the exchange of electronic payment instructions between financial institutions. The process involves several key participants, including:

- Originating Depository Financial Institution (ODFI): The bank or credit union that initiates the transfer request.

- Receiving Depository Financial Institution (RDFI): The bank or credit union that receives the funds.

- Originator: The individual or business initiating the transfer.

- Receiver: The individual or business receiving the funds.

The transfer process begins when the originator instructs their ODFI to initiate the transfer. The ODFI then sends the payment instructions to the ACH network. The ACH network processes the instructions and delivers them to the RDFI. The RDFI then credits the funds to the receiver’s account.

Initiating ACH Credit Transfers

To initiate an ACH credit transfer, the originator must provide their ODFI with specific information, including:

- The receiver’s bank account number and routing number.

- The amount of the transfer.

- The date of the transfer.

- The purpose of the transfer.

The ODFI then prepares an ACH file containing the transfer details and transmits it to the ACH network.

Receiving ACH Credit Transfers

When the RDFI receives the payment instructions, it credits the funds to the receiver’s account. The receiver will typically receive a notification from their RDFI informing them of the deposit.

Comparing ACH Credit Transfers with Other Payment Methods

ACH credit transfers offer several advantages over other payment methods, such as wire transfers:

- Lower transaction fees: ACH credit transfers typically have lower transaction fees compared to wire transfers.

- Faster processing times: While wire transfers can be processed within a few hours, ACH credit transfers can take one to three business days to complete.

- Increased security: ACH credit transfers are generally considered more secure than wire transfers, as they are processed through a secure network.

However, ACH credit transfers are not suitable for all situations, such as when immediate funds transfer is required. In such cases, wire transfers may be a more appropriate option.

Last Recap

ACH credit transfers, powered by Stripe, offer a compelling alternative to traditional payment methods, enabling businesses to optimize their financial operations and enhance the customer experience. Whether it’s recurring subscriptions, online purchases, or B2B transactions, Stripe’s ACH integration streamlines the payment process, fostering efficiency, security, and cost-effectiveness. By embracing this modern approach to payments, businesses can unlock new opportunities for growth and success in today’s competitive landscape.

Frequently Asked Questions: Ach Credit Transfer Stripe

What are the fees associated with ACH credit transfers through Stripe?

Stripe charges a small fee per successful ACH transaction. The exact fee varies depending on your Stripe pricing plan and transaction volume. You can find detailed information on Stripe’s website.

How long does it take for an ACH credit transfer to be processed?

ACH credit transfers typically take 1-3 business days to process, depending on the banks involved. Stripe’s platform provides real-time updates on the status of each transaction.

What are the security measures in place for ACH credit transfers with Stripe?

Stripe utilizes industry-standard security protocols, including encryption and tokenization, to safeguard sensitive data during ACH transactions. They adhere to strict compliance regulations, ensuring the highest level of security for both businesses and customers.