- Introduction to Balance Transfer Credit Cards

- Citibank Balance Transfer Credit Cards

- How to Apply for a Citibank Balance Transfer Credit Card

- Utilizing a Citibank Balance Transfer Credit Card Effectively

- Alternatives to Citibank Balance Transfer Credit Cards

- Ultimate Conclusion: Balance Transfer Credit Card Citibank

- FAQ Resource

Balance transfer credit card citibank – Citibank balance transfer credit cards can be a valuable tool for those looking to consolidate debt and save money on interest charges. By transferring high-interest balances from other credit cards to a Citibank card with a lower APR and a promotional introductory period, you can potentially save thousands of dollars in interest payments. However, it’s crucial to understand the terms and conditions of these cards before you apply, as there may be transfer fees, eligibility requirements, and other factors to consider.

This guide will delve into the world of Citibank balance transfer credit cards, exploring their benefits, drawbacks, and how to use them effectively. We’ll also discuss the application process, eligibility criteria, and alternative options available in the market.

Introduction to Balance Transfer Credit Cards

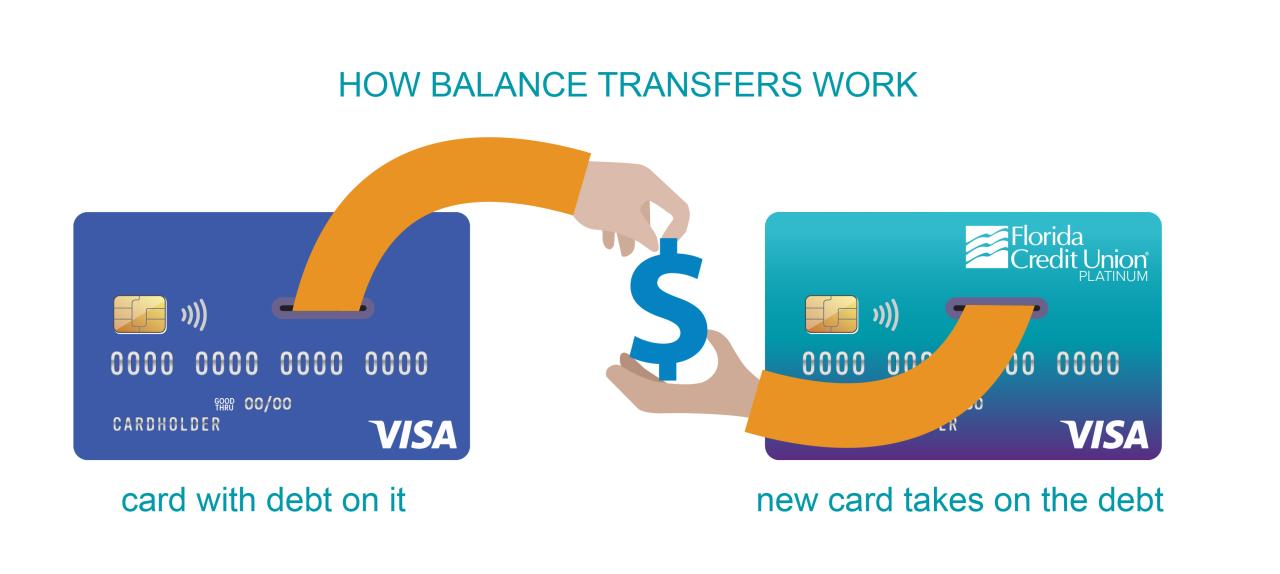

A balance transfer credit card is a type of credit card that allows you to transfer the outstanding balance from another credit card to it. This can be a helpful tool for managing debt, especially if you have high-interest credit card debt.

Balance transfer credit cards typically offer a promotional period during which you can transfer your balance and pay only a low introductory interest rate. This can save you money on interest charges, allowing you to pay down your debt more quickly.

Benefits of Balance Transfer Credit Cards

A balance transfer credit card can offer several benefits, including:

- Lower interest rates: Balance transfer credit cards often have introductory interest rates that are significantly lower than the rates on your existing credit cards. This can save you a significant amount of money on interest charges over time.

- Consolidation of debt: By transferring multiple credit card balances to a single card, you can simplify your debt management and make it easier to track your payments.

- 0% APR promotional period: Many balance transfer credit cards offer a 0% APR promotional period, which means you won’t have to pay any interest on your transferred balance for a certain amount of time. This can give you the opportunity to pay down your debt more quickly without incurring additional interest charges.

Drawbacks of Balance Transfer Credit Cards

While balance transfer credit cards can be a valuable tool for managing debt, it’s important to be aware of their potential drawbacks:

- Balance transfer fees: Most balance transfer credit cards charge a fee for transferring your balance, typically a percentage of the amount transferred. This fee can add up, so it’s important to factor it into your calculations before transferring your balance.

- Limited time frame: The promotional period for balance transfer credit cards is usually limited to a specific time frame, such as 12 to 18 months. After the promotional period expires, the interest rate on your transferred balance will revert to the card’s standard interest rate, which can be much higher.

- Potential for overspending: Having a balance transfer credit card can make it tempting to overspend, especially if you’re not careful about managing your credit card spending. This can lead to further debt accumulation, which is the opposite of what you’re trying to achieve.

Citibank Balance Transfer Credit Cards

Citibank offers a variety of balance transfer credit cards that can help you consolidate debt and save money on interest. These cards typically have a 0% introductory APR for a certain period, allowing you to pay down your balance without accruing interest.

Citibank Balance Transfer Credit Card Options

Citibank offers several balance transfer credit cards, each with its own set of features and benefits. Here’s a comparison table to help you choose the right card for your needs:

| Card | APR | Transfer Fee | Introductory Period | Rewards | Eligibility Criteria |

|---|---|---|---|---|---|

| Citi Simplicity® Card | 13.99% – 26.99% Variable APR | 3% of the amount transferred | 18 months | None | Good credit history |

| Citi Double Cash® Card | 13.99% – 26.99% Variable APR | 3% of the amount transferred | 18 months | 2% cash back on all purchases | Good credit history |

| Citi ThankYou® Preferred Card | 15.99% – 26.99% Variable APR | 3% of the amount transferred | 18 months | 2 points per $1 spent on eligible purchases | Good credit history |

Eligibility Requirements for Citibank Balance Transfer Credit Cards

To be eligible for a Citibank balance transfer credit card, you typically need to have good credit history. This means having a credit score of at least 670. You may also need to meet certain income requirements.

Citibank will review your credit history, income, and other factors to determine your eligibility for a balance transfer credit card. You can check your credit score for free through websites like Credit Karma or AnnualCreditReport.com.

How to Apply for a Citibank Balance Transfer Credit Card

Applying for a Citibank balance transfer credit card is a straightforward process that can help you consolidate your debt and potentially save money on interest charges. To apply, you’ll need to gather some basic information and submit an application online or by phone.

Factors Affecting Approval for a Balance Transfer Credit Card, Balance transfer credit card citibank

Your chances of getting approved for a Citibank balance transfer credit card depend on several factors. These include your credit score, credit history, income, and debt-to-income ratio.

- Credit Score: A higher credit score generally increases your chances of approval. A good credit score typically falls within the range of 670 to 739.

- Credit History: Lenders look at your payment history on existing credit accounts. A consistent record of on-time payments is essential for approval.

- Income: Citibank assesses your income to determine your ability to repay the balance transfer. A stable income history strengthens your application.

- Debt-to-Income Ratio: This ratio represents the percentage of your monthly income that goes towards debt payments. A lower debt-to-income ratio is more favorable.

Utilizing a Citibank Balance Transfer Credit Card Effectively

A Citibank balance transfer credit card can be a valuable tool for consolidating debt and saving money on interest charges. However, to maximize the benefits of this type of card, it’s crucial to understand how to use it effectively. By following a few key strategies, you can make the most of your balance transfer and achieve your financial goals.

Strategies for Paying Down the Transferred Balance Quickly

To reap the most benefits from a balance transfer credit card, it’s essential to pay down the transferred balance as quickly as possible. Here are some strategies to help you achieve this:

- Make More Than the Minimum Payment: While the minimum payment will keep your account in good standing, it will take a long time to pay off the balance. Aim to make payments that are significantly higher than the minimum to reduce your debt faster.

- Set a Budget and Stick to It: Create a realistic budget that allocates extra funds towards your balance transfer card. This will help you stay on track and make consistent payments.

- Consider a Debt Consolidation Loan: If you have multiple high-interest debts, a debt consolidation loan can help you simplify your payments and potentially secure a lower interest rate.

- Utilize the Grace Period: Take advantage of the grace period offered by your balance transfer card to avoid interest charges. Ensure that you pay off the balance in full before the grace period ends.

Monitoring Your Credit Utilization Ratio

Maintaining a healthy credit utilization ratio is crucial for your overall credit score. A high utilization ratio can negatively impact your creditworthiness, making it more challenging to obtain loans or credit cards in the future.

Your credit utilization ratio is the percentage of your available credit that you’re currently using.

When using a balance transfer credit card, it’s essential to monitor your credit utilization ratio closely. Aim to keep your ratio below 30% to maintain a good credit score.

- Pay Down Your Balance Regularly: Make consistent payments to reduce your outstanding balance and lower your utilization ratio.

- Avoid Overspending: Resist the temptation to use your balance transfer card for new purchases. Focus on paying down the transferred balance.

- Monitor Your Credit Reports: Regularly check your credit reports for any errors that could impact your utilization ratio.

Alternatives to Citibank Balance Transfer Credit Cards

While Citibank offers a range of balance transfer credit cards with competitive features, exploring other options can be beneficial to find the best fit for your needs. Alternative balance transfer credit cards from different lenders may offer unique benefits, interest rates, and transfer periods that could be more advantageous for your situation.

Comparison of Features and Benefits

It’s essential to compare the features and benefits of alternative balance transfer credit cards with those offered by Citibank. Key factors to consider include:

- Balance Transfer Fee: This is the percentage charged for transferring your existing debt. Compare the fees across different credit cards to determine the most cost-effective option.

- Introductory APR: This is the interest rate applied to your transferred balance for a specified period. Look for credit cards with a longer introductory period and a lower APR.

- Regular APR: This is the interest rate applied to your balance after the introductory period expires. Choose a card with a reasonable regular APR to avoid high interest charges.

- Credit Limit: Ensure the credit limit is sufficient to accommodate your transferred balance and any future purchases.

- Rewards Program: Some balance transfer credit cards offer rewards programs, such as cash back, travel points, or miles, which can add value to your card.

- Other Benefits: Consider other benefits, such as purchase protection, extended warranty, or travel insurance, which can provide additional value.

Pros and Cons of Choosing an Alternative Balance Transfer Credit Card

Selecting an alternative balance transfer credit card can offer advantages and disadvantages compared to Citibank offerings.

- Pros:

- Lower Interest Rates: Some alternative credit cards may offer lower introductory or regular APRs compared to Citibank.

- Longer Introductory Periods: Alternative cards might provide longer introductory periods for lower interest rates, giving you more time to pay off your balance.

- Unique Benefits: Alternative credit cards may offer specialized benefits, such as travel rewards or cash back programs, that align better with your needs.

- Cons:

- Higher Fees: Some alternative credit cards might have higher balance transfer fees than Citibank.

- Less Established Credit Card: Alternative credit cards may not have the same reputation or established history as Citibank, which could be a concern for some consumers.

- Limited Availability: Certain alternative credit cards might not be available in all geographic regions or to all credit score ranges.

Ultimate Conclusion: Balance Transfer Credit Card Citibank

Ultimately, deciding whether a Citibank balance transfer credit card is right for you depends on your individual financial situation and goals. Carefully weigh the pros and cons, compare different options, and make an informed decision based on your needs. By understanding the intricacies of these cards and using them strategically, you can potentially save money on interest payments and get your debt under control.

FAQ Resource

What is the minimum credit score required for a Citibank balance transfer credit card?

Citibank’s credit score requirements vary depending on the specific card. Generally, you’ll need a good credit score, typically 670 or higher, to be approved.

How long does it take to transfer a balance to a Citibank credit card?

The transfer process usually takes 7-10 business days, but it can vary depending on the issuing bank and the volume of transfers being processed.

What are the fees associated with balance transfer credit cards?

Citibank balance transfer credit cards often have a transfer fee, typically a percentage of the transferred balance. It’s important to factor this fee into your overall cost savings calculation.