Balance transfer credit card rates are a powerful tool for managing debt, but understanding them is crucial to maximizing their benefits. These cards allow you to transfer existing balances from high-interest credit cards to a new card with a lower APR, potentially saving you money on interest charges. This can be a game-changer if you’re struggling with high-interest debt and want to get your finances back on track.

By carefully considering factors like introductory periods, balance transfer fees, and ongoing APRs, you can find a balance transfer credit card that aligns with your financial goals. This guide will explore the ins and outs of balance transfer credit cards, empowering you to make informed decisions and navigate the process with confidence.

Balance Transfer Rates

Balance transfer rates are a crucial aspect of credit card management, particularly when seeking to consolidate high-interest debt. Understanding these rates and the factors that influence them is essential for making informed financial decisions.

Balance Transfer APR

Balance transfer APR, or Annual Percentage Rate, is the interest rate charged on the amount of debt transferred from another credit card to a new one. This rate can vary significantly depending on factors like the credit card issuer, your credit score, and the current market conditions.

Factors Influencing Balance Transfer Rates

Balance transfer rates are influenced by several key factors, including:

- Credit Score: Individuals with excellent credit scores typically qualify for lower balance transfer APRs, as lenders perceive them as lower risk borrowers.

- Credit Card Issuer: Different credit card issuers offer varying balance transfer APRs, reflecting their individual risk assessments and competitive strategies.

- Current Market Conditions: Interest rates fluctuate based on economic factors, impacting balance transfer rates offered by lenders.

- Promotional Periods: Some credit card issuers offer introductory balance transfer APRs, often with a 0% interest period for a limited time. This can be advantageous for debt consolidation, but it’s crucial to note that these rates often revert to a higher standard APR after the promotional period ends.

Fixed vs. Variable Balance Transfer Rates

Understanding the difference between fixed and variable balance transfer rates is vital for financial planning.

- Fixed Balance Transfer Rates: Fixed rates remain constant throughout the balance transfer period, offering predictable monthly payments. This predictability can be beneficial for budgeting and managing debt repayment.

- Variable Balance Transfer Rates: Variable rates fluctuate based on prevailing market interest rates. This can result in unpredictable monthly payments, potentially increasing the overall cost of debt repayment.

Finding the Best Balance Transfer Rates

Finding the best balance transfer rates requires careful consideration of various factors. You need to compare different offers from various credit card issuers and understand the terms and conditions associated with each offer.

Comparing Balance Transfer Credit Cards

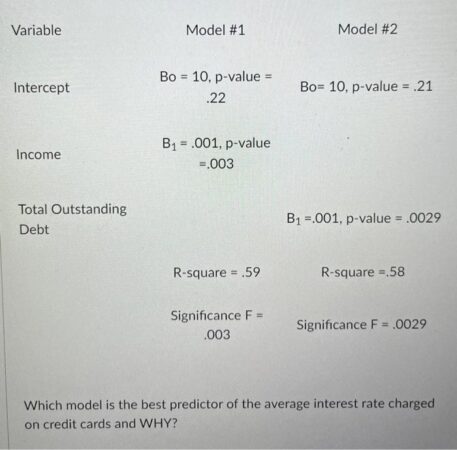

To find the best balance transfer credit card, you need to compare different offers and understand the terms and conditions associated with each offer. Here’s a table that Artikels the key features of different balance transfer credit cards:

| Card | Balance Transfer APR | Introductory Period | Annual Fee | Other Features |

|---|---|---|---|---|

| Card 1 | 0% for 18 months | 18 months | $0 | Rewards program, travel insurance |

| Card 2 | 0% for 12 months | 12 months | $95 | Cash back rewards, balance transfer bonus |

| Card 3 | 0% for 21 months | 21 months | $0 | Airline miles, travel benefits |

| Card 4 | 0% for 15 months | 15 months | $0 | Hotel points, travel insurance |

Note: This is a sample table and the specific features and rates may vary depending on the issuer and your creditworthiness.

The Balance Transfer Process

Transferring a balance to a new credit card can be a smart move if you’re looking to save money on interest charges. However, it’s important to understand the process and potential risks involved before making a decision.

Here’s a step-by-step guide on how to transfer a balance to a new credit card:

Steps Involved in Transferring a Balance

The process of transferring a balance from one credit card to another typically involves these steps:

- Find a new credit card with a 0% introductory APR offer. This is crucial for saving money on interest. Compare different cards to find the best deal, considering factors like the introductory period, the APR after the introductory period, and any balance transfer fees.

- Apply for the new credit card and get approved. The approval process may require a credit check and could take a few days.

- Request a balance transfer from your current credit card issuer. You’ll need to provide the new credit card’s account number and the amount you want to transfer.

- The balance is transferred to the new credit card. This may take a few days to complete.

- Start making payments on the new credit card. Remember to pay at least the minimum payment due each month to avoid late fees and damage to your credit score.

Potential Risks Associated with Balance Transfers

While balance transfers can be beneficial, there are also some potential risks to consider:

- Balance transfer fees. Many credit card issuers charge a fee for transferring a balance, typically a percentage of the amount transferred. Be sure to factor this fee into your calculations when comparing offers.

- Introductory APR period ends. Once the introductory 0% APR period ends, you’ll be charged the standard APR, which can be significantly higher. Make sure you have a plan to pay off the balance before the introductory period expires.

- Hard inquiry on your credit report. Applying for a new credit card can result in a hard inquiry on your credit report, which can temporarily lower your credit score. If you have several hard inquiries in a short period, it can negatively impact your creditworthiness.

- Credit utilization ratio increases. Transferring a balance can increase your credit utilization ratio, which is the percentage of your available credit you’re using. A high credit utilization ratio can also negatively impact your credit score.

Managing Debt Effectively After a Balance Transfer, Balance transfer credit card rates

After successfully transferring your balance, it’s important to manage your debt effectively to avoid accumulating more interest and potentially harming your credit score:

- Make more than the minimum payment. Pay as much as you can afford each month to pay off the balance faster and save on interest charges. Aim to pay more than the minimum payment, especially during the introductory 0% APR period.

- Set a budget and stick to it. Create a budget that helps you track your income and expenses and allocate funds for debt repayment. This will help you stay on track and avoid overspending.

- Avoid making new purchases on the balance transfer card. Using the card for new purchases will negate the benefits of the 0% introductory APR and potentially increase your debt.

- Monitor your credit card statement. Regularly review your credit card statement to ensure there are no errors or unauthorized charges. This will help you stay on top of your spending and prevent any surprises.

Balance Transfer vs. Other Debt Consolidation Options

Debt consolidation is a popular strategy for managing multiple debts. This approach combines several loans or credit card balances into a single payment, potentially reducing interest rates and monthly payments. Balance transfers are one method for debt consolidation, but other options exist.

Comparing Balance Transfers and Debt Consolidation Loans

Debt consolidation loans and balance transfers are common strategies for managing debt. Understanding the pros and cons of each option helps determine the best approach for your situation.

- Balance Transfers: This involves transferring existing credit card balances to a new credit card with a lower interest rate. This strategy can save money on interest charges and reduce monthly payments.

- Debt Consolidation Loans: These loans combine multiple debts into a single loan with a fixed interest rate and a set repayment period. The loan can be secured (using collateral) or unsecured (no collateral).

Pros and Cons of Each Option

- Balance Transfers:

- Pros:

- Lower interest rates compared to existing credit cards.

- Potential for lower monthly payments.

- Convenience of managing one account instead of multiple.

- Cons:

- Balance transfer fees can be significant.

- Introductory low interest rates are often temporary, reverting to a higher rate after a promotional period.

- New credit card debt can be tempting to use, potentially increasing overall debt.

- Pros:

- Debt Consolidation Loans:

- Pros:

- Fixed interest rates and repayment periods provide predictability.

- Can potentially reduce monthly payments.

- Can improve credit score by reducing credit utilization.

- Cons:

- Interest rates may be higher than balance transfer offers.

- Loan application process can be lengthy.

- Secured loans require collateral, which can be lost if unable to repay.

- Pros:

Factors to Consider When Choosing a Debt Consolidation Method

Choosing the right debt consolidation method depends on your financial situation and goals.

- Credit Score: Balance transfers generally require good credit, while debt consolidation loans may be more accessible to those with lower credit scores.

- Debt Amount: Balance transfers may be more beneficial for smaller debt amounts, while debt consolidation loans may be more suitable for larger debts.

- Interest Rates: Compare interest rates for both options to determine which offers the lowest cost.

- Fees: Consider balance transfer fees, loan origination fees, and other associated costs.

- Repayment Term: Choose a repayment term that fits your budget and allows for timely repayment.

- Financial Discipline: Balance transfers can be tempting to use, so consider your financial discipline before opting for this approach.

Outcome Summary: Balance Transfer Credit Card Rates

In conclusion, balance transfer credit cards can be a valuable tool for debt consolidation, but it’s essential to approach them strategically. Carefully evaluate the terms and conditions, compare rates, and consider the long-term implications before making a decision. By doing your research and understanding the potential risks, you can leverage balance transfer credit cards to your advantage and embark on a path toward financial freedom.

Query Resolution

What is a balance transfer fee?

A balance transfer fee is a percentage charged by the credit card issuer when you transfer a balance from another card. It’s usually calculated as a percentage of the transferred balance.

How long do introductory balance transfer APRs typically last?

Introductory balance transfer APRs typically last for a limited time, usually between 6 and 18 months. After the introductory period, the APR will revert to the standard APR for the card.

What are the risks of using a balance transfer credit card?

Some risks include accruing new debt on the card, missing the minimum payment due date, and the introductory APR expiring, leading to a higher interest rate.