- What is a Balance Transfer Credit Card?: Balance Transfer No Fee Credit Card

- Benefits of a Balance Transfer Credit Card with No Fees

- Finding the Right Balance Transfer Credit Card

- Understanding Balance Transfer Fees and Terms

- Using a Balance Transfer Credit Card Strategically

- Alternatives to Balance Transfer Credit Cards

- Risks and Considerations

- Closure

- FAQ Summary

Balance transfer no fee credit cards offer a potentially lucrative way to consolidate high-interest debt and save money. These cards allow you to transfer balances from existing credit cards to a new card with a lower interest rate, often with a promotional introductory period. This can significantly reduce your monthly payments and help you pay off your debt faster. However, it’s crucial to understand the terms and conditions of these cards, including the introductory APR period and the standard APR after the introductory period, to make informed decisions.

The primary advantage of a balance transfer credit card with no fees is the potential to save on interest charges. By transferring your debt to a card with a lower APR, you can reduce the amount of interest you pay over time. This can be particularly beneficial if you have a high-interest credit card balance that you’re struggling to pay off. Additionally, these cards can help improve your credit score if you use them responsibly and make timely payments.

What is a Balance Transfer Credit Card?: Balance Transfer No Fee Credit Card

A balance transfer credit card is a type of credit card designed to help you consolidate high-interest debt from other credit cards. It allows you to transfer your existing balances to a new card with a lower interest rate, potentially saving you money on interest charges.

Balance transfer credit cards offer a unique opportunity to manage your debt more effectively by lowering your monthly payments and accelerating your debt payoff.

How Balance Transfers Work

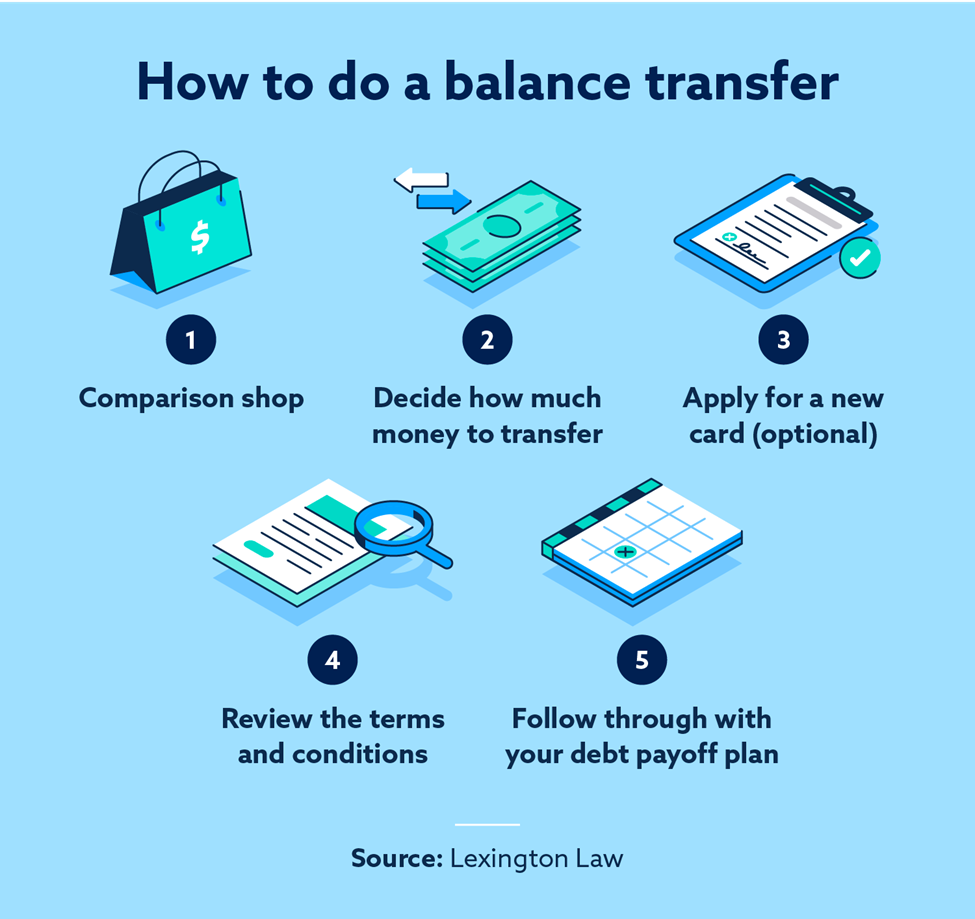

Balance transfers involve moving your existing credit card debt from one card to another. This process typically involves applying for a new balance transfer credit card, receiving approval, and then transferring the balance from your old card to the new one.

Here’s a breakdown of the process:

- Apply for a balance transfer credit card: You’ll need to meet the eligibility criteria and submit an application.

- Receive approval and a balance transfer offer: Once approved, the card issuer will provide you with a balance transfer offer, outlining the terms and conditions, including the interest rate, transfer fee, and any promotional periods.

- Transfer your balance: You’ll need to provide the card issuer with the details of your existing credit card, including the account number and the amount you wish to transfer.

- Payment: The balance transfer credit card issuer will pay off your existing card balance, and you’ll be responsible for repaying the transferred balance to the new card issuer.

Benefits of a Balance Transfer Credit Card

Balance transfer credit cards offer several potential benefits, including:

- Lower interest rates: One of the primary advantages of balance transfer cards is the opportunity to secure a lower interest rate on your existing debt. This can significantly reduce your monthly interest charges and help you pay off your debt faster.

- Promotional periods with 0% APR: Many balance transfer cards offer introductory periods with 0% APR (Annual Percentage Rate). This means you won’t accrue any interest during this period, allowing you to focus on paying down the principal balance without interest charges.

- Consolidation of debt: By transferring multiple balances to a single card, you can simplify your debt management. This can make it easier to track your payments and avoid missing deadlines.

- Potential for rewards and benefits: Some balance transfer cards offer rewards programs or other perks, such as cash back, travel points, or purchase protection.

Purpose of a Balance Transfer Credit Card

Balance transfer credit cards are primarily designed to help individuals with high-interest debt consolidate their balances and save money on interest charges. This can be particularly beneficial for people with:

- High credit card balances: Individuals with significant balances on their existing credit cards can benefit from transferring them to a card with a lower interest rate.

- Multiple credit card accounts: Consolidating multiple balances onto a single card can streamline debt management and simplify payments.

- Limited financial resources: By reducing interest charges, balance transfer cards can free up more cash flow for other financial obligations or savings goals.

Benefits of a Balance Transfer Credit Card with No Fees

A balance transfer credit card with no fees can be a valuable tool for individuals looking to save money on interest and reduce their debt burden. By transferring high-interest debt to a card with a lower APR, you can potentially save thousands of dollars in interest charges over time.

Interest Savings

Transferring a balance to a card with a lower APR can significantly reduce your interest charges. For example, if you have a $10,000 balance on a credit card with an 18% APR and transfer it to a card with a 0% APR for 12 months, you would save $1,800 in interest charges over the introductory period.

Reduced Debt Burden

A balance transfer credit card can help you reduce your overall debt burden. By consolidating multiple high-interest debts into a single lower-interest balance, you can simplify your debt management and potentially pay off your debt faster.

Potential Impact on Credit Score

While a balance transfer can help you save money and manage your debt, it’s essential to consider its potential impact on your credit score.

A balance transfer can lower your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit. A lower credit utilization ratio can positively impact your credit score.

However, opening a new credit card can temporarily lower your credit score as it increases your overall credit utilization and reduces your average credit age. Additionally, if you miss payments on your balance transfer card, it can negatively affect your credit score.

Finding the Right Balance Transfer Credit Card

With so many balance transfer credit cards available, finding the best one for your needs can seem overwhelming. To help you navigate this process, we’ll explore key factors to consider and provide a comprehensive comparison of popular balance transfer cards.

Factors to Consider When Choosing a Balance Transfer Credit Card

When selecting a balance transfer credit card, consider these crucial factors:

- Introductory APR: The introductory APR (Annual Percentage Rate) is the interest rate you’ll pay on transferred balances for a specific period. Aim for a card with a low introductory APR and a long introductory period to minimize interest charges.

- Balance Transfer Fees: These fees are charged for transferring your balance from another card. Look for cards with low or no balance transfer fees, as these can significantly impact your savings.

- Regular APR: After the introductory period ends, the regular APR applies. Ensure the regular APR is competitive to avoid high interest charges in the long run.

- Other Fees: Some balance transfer cards may have additional fees, such as annual fees, late payment fees, or over-limit fees. Carefully review the terms and conditions to understand all applicable fees.

- Credit Limit: The credit limit determines the maximum amount you can transfer. Choose a card with a credit limit sufficient to cover your outstanding balances.

- Rewards and Perks: While not the primary focus, some balance transfer cards offer rewards programs or other perks, such as cash back, travel miles, or purchase protection. Consider these benefits if they align with your spending habits.

Comparing Popular Balance Transfer Credit Cards

Here’s a comparison of popular balance transfer credit cards with no fees, highlighting key features and benefits:

| Card | Introductory APR | Introductory Period | Balance Transfer Fee | Annual Fee | Other Perks |

|---|---|---|---|---|---|

| Card A | 0% | 18 months | $0 | $0 | Cash back rewards |

| Card B | 0% | 15 months | $0 | $0 | Travel miles |

| Card C | 0% | 12 months | $0 | $0 | Purchase protection |

Understanding Balance Transfer Fees and Terms

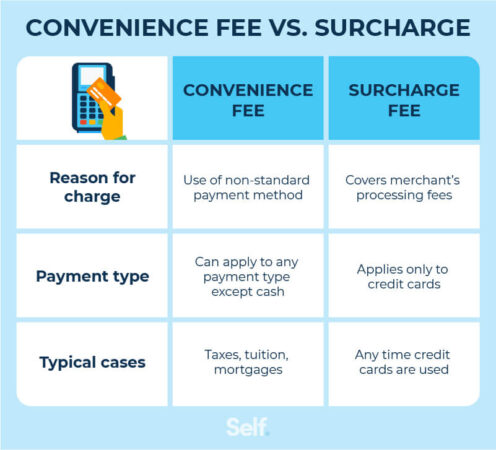

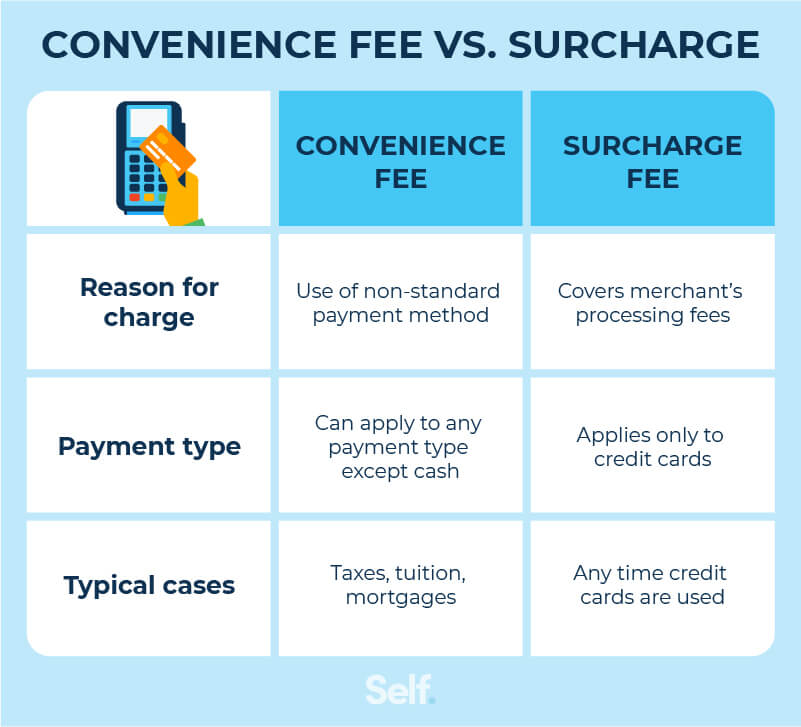

While balance transfer credit cards can offer substantial savings on interest, it’s crucial to understand the associated fees and terms to make informed decisions. These fees and terms can significantly impact your overall savings and potentially negate the benefits of transferring your balance.

Balance Transfer Fees

Balance transfer fees are charged when you move a balance from another credit card to a new one. These fees are usually a percentage of the transferred amount, ranging from 1% to 5%. For example, a 3% balance transfer fee on a $10,000 balance would cost you $300.

It’s essential to compare balance transfer fees across different cards to find the most favorable option.

Annual Fees

Many balance transfer credit cards charge an annual fee, which can range from $0 to $100 or more. This fee is charged annually for the privilege of using the card.

It’s important to factor in the annual fee when comparing cards, as it can significantly impact the overall cost of using the card.

Interest Rates

Balance transfer credit cards often offer an introductory APR (Annual Percentage Rate) for a specific period, typically 6 to 18 months. After this introductory period, the standard APR applies, which can be much higher. The standard APR can range from 15% to 25% or more.

It’s essential to understand the introductory APR period and the standard APR that follows to ensure you have enough time to pay off your balance before the higher rate kicks in.

Other Terms and Conditions

Balance transfer credit cards may have other terms and conditions that impact your ability to transfer your balance. These terms may include:

- A minimum transfer amount

- A limit on the total amount you can transfer

- Restrictions on the types of balances you can transfer

It’s crucial to review these terms carefully before making a balance transfer.

Using a Balance Transfer Credit Card Strategically

A balance transfer credit card can be a powerful tool for reducing debt and saving money, but only if you use it strategically. By understanding how these cards work and following a few key strategies, you can maximize their benefits and avoid common pitfalls.

Paying Down the Transferred Balance Within the Introductory Period

The key to using a balance transfer card effectively is to pay down the transferred balance within the introductory period. This means making more than the minimum payment each month. To create a plan, consider these steps:

- Determine the total amount of debt you want to transfer. This will give you a clear target for your repayment efforts.

- Calculate the minimum monthly payment required for the new card. This will help you understand your baseline payment obligation.

- Set a realistic repayment goal. This could involve making extra payments each month or allocating a portion of your income to debt repayment.

- Create a budget. This will help you track your income and expenses and identify areas where you can cut back to free up money for debt repayment.

- Set a deadline for paying off the balance. This will provide a sense of urgency and help you stay on track.

For example, if you have a $5,000 balance on your existing card and you transfer it to a balance transfer card with a 0% introductory APR for 18 months, you could aim to pay off the balance in 12 months by making additional payments of $416.67 each month.

Avoiding Additional Debt

Once you’ve transferred your balance, it’s important to avoid incurring additional debt on the new card. This can negate the benefits of the introductory APR and make it harder to pay down your debt. Here are some tips to avoid accumulating more debt:

- Resist the temptation to use the card for everyday purchases. Stick to using the card only for paying down your existing debt.

- Set spending limits. This will help you stay within your budget and avoid overspending.

- Consider using a different card for everyday purchases. This will help you avoid temptation and keep your balance transfer card dedicated to debt repayment.

Maximizing the Benefits of the Introductory APR

The introductory APR on a balance transfer card is a valuable benefit, but it’s only temporary. To maximize its benefits, you need to use it strategically. Here are some tips:

- Time your transfer strategically. Aim to transfer your balance just before the introductory period begins. This will give you the maximum amount of time to pay down your debt at the lower rate.

- Avoid using the card for new purchases. This will ensure that you don’t incur interest charges at the higher standard APR.

- Make as much progress as possible towards paying off the balance before the introductory period ends. This will minimize the amount of interest you’ll have to pay once the introductory period expires.

Alternatives to Balance Transfer Credit Cards

While balance transfer credit cards offer a tempting solution for debt consolidation, they aren’t the only option available. Understanding alternative approaches can help you choose the best strategy for your financial situation.

Debt Consolidation Loans

Debt consolidation loans provide a single loan to pay off multiple debts, simplifying your repayment process. This can be beneficial if you have several high-interest debts, as you’ll have a single lower interest rate to manage.

- Lower Interest Rates: Debt consolidation loans often have lower interest rates compared to credit cards, especially if you have good credit. This can significantly reduce your overall interest charges and help you pay off your debt faster.

- Simplified Repayment: Instead of juggling multiple payments, you’ll have one monthly payment to manage, making it easier to stay on track with your debt repayment.

- Fixed Interest Rates: Debt consolidation loans typically come with fixed interest rates, providing predictable monthly payments and protecting you from interest rate fluctuations.

Personal Loans

Similar to debt consolidation loans, personal loans offer a lump sum of money to pay off existing debts. They are typically unsecured loans, meaning they don’t require collateral.

- Flexibility: Personal loans can be used for various purposes, including debt consolidation, home improvements, or medical expenses. This flexibility makes them a versatile financial tool.

- Competitive Interest Rates: Personal loans often have competitive interest rates, especially if you have good credit. This can help you save money on interest charges compared to high-interest credit cards.

- Fixed or Variable Interest Rates: Personal loans can come with fixed or variable interest rates. Fixed interest rates provide stability, while variable rates can fluctuate based on market conditions.

Comparing Alternatives

| Feature | Balance Transfer Credit Card | Debt Consolidation Loan | Personal Loan |

|---|---|---|---|

| Interest Rates | 0% introductory APR for a limited period, then a standard APR | Fixed or variable APR, typically lower than credit cards | Fixed or variable APR, often competitive with debt consolidation loans |

| Fees | Balance transfer fee (usually a percentage of the transferred balance), annual fee | Origination fee, closing costs | Origination fee, closing costs |

| Terms | Variable terms, often with a limited introductory period | Fixed or variable terms, depending on the loan type | Fixed or variable terms, depending on the loan type |

| Eligibility | Good to excellent credit score | Good to excellent credit score | Good to excellent credit score |

Choosing the Right Option, Balance transfer no fee credit card

The best option for you depends on your individual circumstances and financial goals. Consider these factors:

- Credit Score: Your credit score will influence the interest rates and fees you qualify for. If you have excellent credit, you may be eligible for lower interest rates and fewer fees.

- Debt Amount: The amount of debt you need to consolidate will determine the loan amount you need. Debt consolidation loans are often suitable for larger debt amounts.

- Financial Goals: Consider your long-term financial goals. If you’re aiming to improve your credit score, paying off debt quickly with a balance transfer credit card might be beneficial.

Risks and Considerations

While balance transfer credit cards can be a valuable tool for managing debt, it’s essential to be aware of the potential risks and considerations before applying. These cards can offer significant savings, but they also come with certain downsides that could impact your finances if not managed carefully.

High Interest Rates After Introductory Period

After the promotional period, balance transfer credit cards often revert to a standard interest rate, which can be significantly higher than the introductory rate. This can quickly negate any savings you’ve achieved through the balance transfer.

- For example, if you transfer a $5,000 balance to a card with a 0% introductory APR for 12 months, but the standard APR is 20%, you’ll start accruing interest at a much higher rate after the promotional period ends.

- It’s crucial to ensure you can pay off the balance within the introductory period to avoid accruing high interest charges.

Impact on Credit Score

Applying for a new credit card can temporarily lower your credit score, even if you’re approved. This is because the credit inquiry associated with the application can impact your credit history.

- If you’re not able to pay off the transferred balance within the promotional period, the high interest charges can also negatively impact your credit score.

- It’s essential to manage your credit card debt responsibly and make timely payments to maintain a healthy credit score.

Balance Transfer Fees

While many balance transfer cards offer introductory 0% APRs, they often charge a balance transfer fee. This fee is typically a percentage of the balance transferred, which can add up quickly.

- For example, a 3% balance transfer fee on a $5,000 balance would cost you $150.

- It’s important to factor in these fees when comparing different balance transfer cards and to ensure the savings from the lower APR outweigh the fees.

Other Fees

Some balance transfer cards may charge additional fees, such as annual fees or late payment fees.

- It’s essential to read the terms and conditions carefully to understand all the fees associated with the card.

- Comparing different cards and understanding the fee structure can help you choose the most cost-effective option.

Checklist for Applying for a Balance Transfer Credit Card

Before applying for a balance transfer credit card, it’s crucial to consider the following factors:

- Your current debt situation: Evaluate your current debt levels and your ability to pay off the balance within the promotional period.

- Your credit score: Check your credit score and ensure you meet the eligibility criteria for the card.

- Interest rates and fees: Compare different cards and their interest rates, balance transfer fees, and other fees.

- Promotional period: Understand the length of the introductory period and how long you have to pay off the balance before interest charges start accruing.

- Terms and conditions: Read the terms and conditions carefully to understand all the requirements and fees associated with the card.

Closure

In conclusion, balance transfer credit cards can be a valuable tool for managing debt and saving money. By understanding the terms and conditions and using these cards strategically, you can potentially reduce your debt burden and improve your financial well-being. However, it’s important to remember that these cards are not a magic bullet and require responsible usage to be truly effective. Always compare different cards, consider the potential risks and benefits, and make sure you have a plan to pay off the transferred balance within the introductory period.

FAQ Summary

What is the typical introductory APR offered by balance transfer credit cards?

Introductory APRs for balance transfer cards can vary widely, but they typically range from 0% to 18% for a period of 12 to 18 months.

What happens after the introductory APR period ends?

After the introductory period ends, the interest rate on your balance transfer card will revert to the standard APR, which is usually higher than the introductory rate. This can significantly increase your monthly payments, so it’s essential to have a plan to pay off the balance before the introductory period expires.

How do balance transfers affect my credit score?

A balance transfer can have a positive or negative impact on your credit score, depending on how you manage the card. If you use the card responsibly and make timely payments, it can help improve your credit score. However, if you miss payments or exceed your credit limit, it can negatively affect your credit score.

Are there any other fees associated with balance transfer credit cards?

Besides the transfer fee, some cards may charge annual fees or balance transfer fees. It’s important to read the terms and conditions carefully to understand all the fees associated with the card.