- Balance Transfer Credit Cards

- Key Features to Consider

- Top Balance Transfer Credit Cards in 2024

- How to Choose the Right Balance Transfer Credit Card

- Strategies for Using a Balance Transfer Credit Card Effectively

- Alternatives to Balance Transfer Credit Cards

- Concluding Remarks: Best Balance Transfer Credit Card 2024

- FAQs

Best balance transfer credit card 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Tired of high interest rates on your credit card debt? A balance transfer credit card can be your financial savior, allowing you to consolidate your existing balances and potentially save thousands in interest charges. These cards offer introductory 0% APR periods, giving you valuable time to pay down your debt without accruing hefty interest. However, it’s crucial to understand the potential drawbacks, such as balance transfer fees and the limited duration of the introductory APR.

This comprehensive guide will delve into the intricacies of balance transfer credit cards, equipping you with the knowledge and strategies to make informed decisions. We’ll examine the key features to consider, analyze the top contenders in the market, and provide expert tips on choosing the right card for your financial needs. We’ll also explore alternative debt management options and offer actionable strategies to maximize your chances of successfully using a balance transfer credit card to conquer your debt.

Balance Transfer Credit Cards

Balance transfer credit cards allow you to move high-interest debt from other credit cards to a new card with a lower interest rate. This can save you money on interest charges and help you pay off your debt faster.

Benefits of Balance Transfer Credit Cards

Balance transfer credit cards offer several advantages, including:

- Lower interest rates: These cards typically have lower introductory interest rates compared to regular credit cards. This can significantly reduce the amount of interest you pay on your debt. For example, if you have $10,000 in debt at 20% interest and transfer it to a card with a 0% introductory APR for 18 months, you could save hundreds of dollars in interest charges.

- Consolidation of debt: By transferring multiple balances to one card, you can simplify your debt management and make it easier to track your payments.

- Longer repayment terms: Some balance transfer cards offer longer repayment terms, giving you more time to pay off your debt and potentially lower your monthly payments.

Potential Drawbacks of Balance Transfer Credit Cards

While balance transfer cards can be beneficial, they also have some drawbacks:

- Balance transfer fees: Most cards charge a fee for transferring a balance, typically a percentage of the amount transferred. This fee can range from 3% to 5% of the balance, so it’s essential to factor it into your calculations to determine if the savings from a lower interest rate outweigh the fee.

- Introductory periods: The low introductory interest rate is usually temporary, lasting for a specific period, often 12 to 18 months. After this period, the interest rate will revert to the card’s standard APR, which can be significantly higher. This can lead to a substantial increase in your monthly payments if you haven’t paid off the balance by the time the introductory period ends.

- Credit score impact: Applying for a new credit card can impact your credit score, especially if you have multiple recent applications. This is because each application results in a hard inquiry on your credit report, which can temporarily lower your score.

Key Features to Consider

When choosing a balance transfer credit card, it’s crucial to consider key features that can help you save money and pay off your debt effectively. Understanding these features will enable you to make an informed decision and choose the card that best suits your financial needs.

Introductory APR and Duration

The introductory APR (Annual Percentage Rate) is a temporary, lower interest rate offered for a specific period, usually for balance transfers. It’s a crucial factor as it directly impacts the amount of interest you’ll pay during the introductory period. The longer the introductory APR period, the more time you have to pay down your balance before the standard APR kicks in. For example, a card with a 0% APR for 18 months will give you a significant advantage over a card with a 0% APR for only 12 months.

Balance Transfer Fee

Balance transfer fees are charges levied when you move your debt from another credit card to a new one. These fees can range from a fixed percentage of the transferred balance to a flat fee. It’s essential to consider the balance transfer fee as it can add to your overall debt. For instance, a 3% transfer fee on a $5,000 balance would amount to $150.

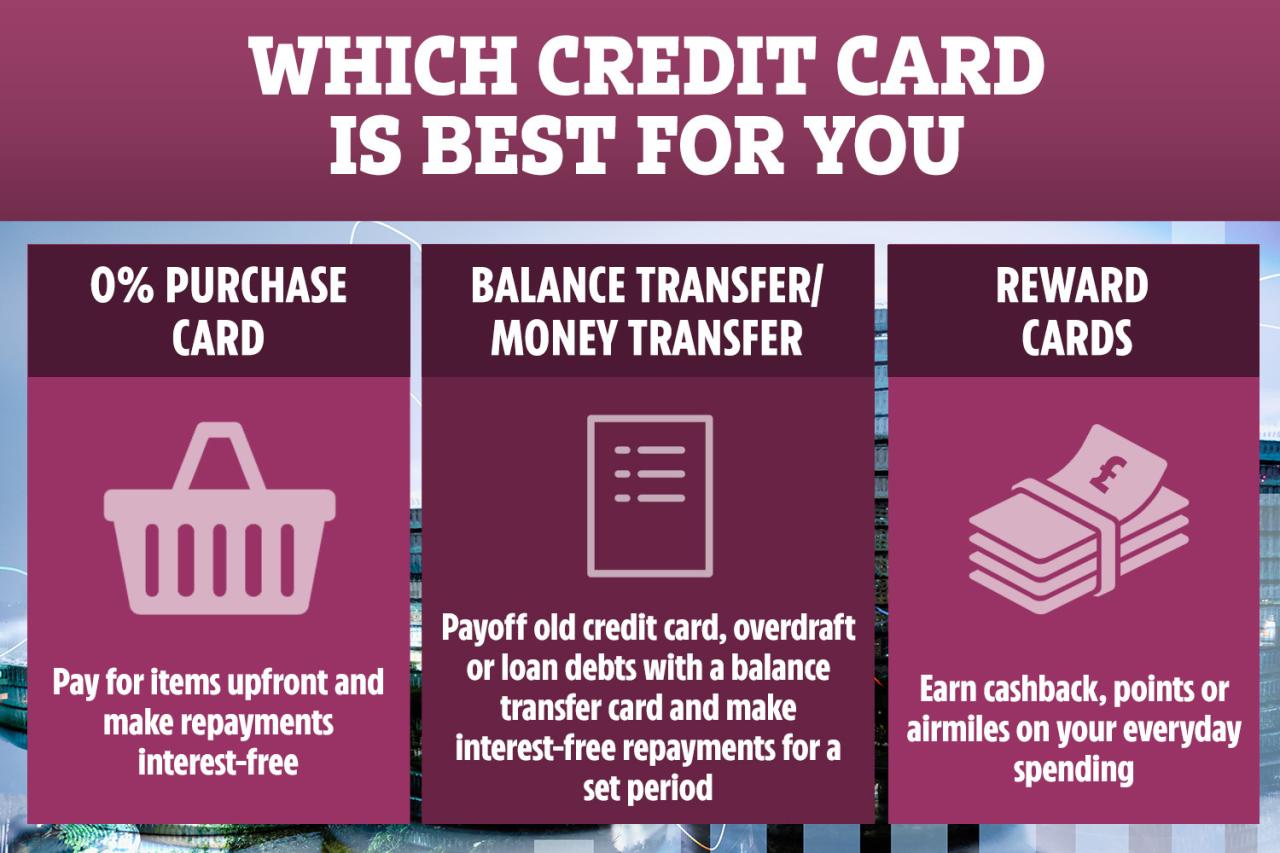

Types of Balance Transfer Credit Cards

Balance transfer credit cards can come with various benefits, including rewards programs and travel perks. It’s important to weigh these benefits against the card’s APR and fees to determine if they align with your spending habits.

- Rewards Cards: Some balance transfer cards offer rewards programs, allowing you to earn points or cash back on your purchases. These rewards can offset the cost of the transfer fee or even help you pay down your debt faster.

- Travel Cards: Travel cards offer perks like travel insurance, airport lounge access, or bonus points for travel-related expenses. If you’re a frequent traveler, a travel card can be a valuable option, but ensure the card’s APR and fees are competitive.

Top Balance Transfer Credit Cards in 2024

Now that you understand the key features to consider when choosing a balance transfer credit card, let’s look at some of the top options available in 2024. This list includes cards with competitive introductory APRs, balance transfer fees, and other valuable features that can help you save money and get your debt under control.

Top Balance Transfer Credit Cards

Here are some of the top balance transfer credit cards available in 2024, based on their introductory APRs, balance transfer fees, and other notable features:

| Card Name | Introductory APR | Balance Transfer Fee | Annual Fee | Other Notable Features |

|---|---|---|---|---|

| Citi® Double Cash Card – 18 month BT offer | 0% for 18 months | 5% of the amount transferred (minimum $5) | $0 | Unlimited 2% cash back on all purchases (1% when you buy, 1% when you pay) |

| Chase Freedom Unlimited® | 0% for 15 months | 3% of the amount transferred (minimum $5) | $0 | Unlimited 1.5% cash back on all purchases |

| Discover it® Cash Back | 0% for 18 months | 3% of the amount transferred (minimum $5) | $0 | Unlimited 5% cash back rotating categories each quarter (earn 1% cash back on all other purchases) |

| Capital One QuicksilverOne® Cash Rewards Credit Card | 0% for 15 months | 5% of the amount transferred (minimum $5) | $0 | Unlimited 1.5% cash back on all purchases |

These cards offer a combination of low introductory APRs, reasonable balance transfer fees, and other benefits that can make them attractive to consumers looking to save money on their debt.

Pros and Cons of Each Card

It’s important to consider the pros and cons of each card before making a decision. Here’s a breakdown of the key advantages and disadvantages of each card:

Citi® Double Cash Card – 18 month BT offer

- Pros:

- Long introductory APR period (18 months)

- Excellent cash back rewards (2% on all purchases)

- No annual fee

- Cons:

- High balance transfer fee (5%)

Chase Freedom Unlimited®

- Pros:

- Good introductory APR period (15 months)

- No annual fee

- Cons:

- Lower cash back rewards than Citi Double Cash (1.5%)

- Balance transfer fee (3%)

Discover it® Cash Back

- Pros:

- Long introductory APR period (18 months)

- No annual fee

- High cash back rewards (5% on rotating categories)

- Cons:

- Balance transfer fee (3%)

Capital One QuicksilverOne® Cash Rewards Credit Card

- Pros:

- Good introductory APR period (15 months)

- No annual fee

- Cons:

- Lower cash back rewards than Citi Double Cash (1.5%)

- Balance transfer fee (5%)

How to Choose the Right Balance Transfer Credit Card

Finding the best balance transfer credit card for your needs involves a careful consideration of various factors. The right card can help you save money on interest charges and pay off your debt faster, but choosing the wrong one could lead to higher costs and a longer repayment period.

Factors to Consider When Choosing a Balance Transfer Credit Card, Best balance transfer credit card 2024

To find the ideal balance transfer credit card, you should consider your current debt, credit score, and spending habits. These factors play a crucial role in determining the most suitable card for your financial situation.

- Current Debt: Your current debt level directly impacts your choice. If you have a large balance, a card with a long introductory 0% APR period and a low balance transfer fee is beneficial. However, if your debt is smaller, a card with a shorter introductory period and a higher fee might be more cost-effective.

- Credit Score: Your credit score influences your eligibility for different cards and the interest rates you qualify for. A higher credit score typically opens doors to cards with better terms and lower interest rates. If you have a lower credit score, you might need to explore cards with less stringent eligibility requirements.

- Spending Habits: Consider your spending habits and how they align with the card’s features. For example, if you frequently make purchases, a card with rewards or cash back might be advantageous. However, if you primarily use the card for balance transfers, a card focused on low interest rates and fees might be more suitable.

Understanding the Terms and Conditions

It is crucial to carefully read and understand the terms and conditions of any balance transfer credit card before you apply. This ensures you are aware of all the associated fees, interest rates, and limitations.

- Balance Transfer Fee: This fee is charged when you transfer your balance from another credit card. It is usually a percentage of the transferred amount. Ensure the balance transfer fee is within your budget and does not significantly negate the potential savings from the introductory 0% APR period.

- Introductory 0% APR Period: This period offers a temporary interest-free period for your transferred balance. After this period, the standard APR applies, which can be significantly higher. Make sure the introductory period aligns with your repayment plan and allows you to pay off a substantial portion of your debt before the higher interest rate kicks in.

- Standard APR: The standard APR is the interest rate you will pay after the introductory period ends. Compare the standard APRs of different cards and choose one with a reasonable rate to minimize your interest charges in the long run.

- Other Fees: Be aware of other fees associated with the card, such as annual fees, late payment fees, and over-limit fees. Choose a card with minimal fees to avoid unnecessary expenses.

Tips for Choosing the Right Balance Transfer Credit Card

By following these tips, you can make an informed decision and choose a balance transfer credit card that aligns with your financial goals.

- Compare Offers: Use online comparison tools or websites to compare offers from different credit card issuers. Look at the introductory 0% APR period, balance transfer fees, standard APRs, and other fees.

- Check Your Credit Score: Before applying for a balance transfer card, check your credit score. A higher credit score will increase your chances of getting approved for a card with better terms and lower interest rates.

- Read the Fine Print: Carefully read the terms and conditions of any balance transfer card before you apply. Pay attention to the introductory 0% APR period, balance transfer fees, standard APRs, and other fees. Make sure you understand the terms and conditions before you commit.

- Consider Your Repayment Plan: Determine how much you can realistically afford to pay each month. Choose a card with an introductory 0% APR period that allows you to make significant progress on your debt repayment before the standard APR kicks in.

Strategies for Using a Balance Transfer Credit Card Effectively

A balance transfer credit card can be a valuable tool for saving money on interest charges, but it’s essential to use it strategically to maximize its benefits. By carefully planning your approach, you can effectively manage your debt and achieve your financial goals.

Paying Down the Balance as Quickly as Possible

Paying down your balance as quickly as possible is crucial for minimizing interest charges and avoiding the potential for accruing more debt. The longer you carry a balance, the more interest you’ll pay over time.

- Make more than the minimum payment. Aim to pay as much as you can afford each month, even if it’s just a little extra. Every additional payment will help you reduce your balance faster and save money on interest.

- Set up automatic payments. Automating your payments ensures that you never miss a deadline and can consistently make progress toward paying off your balance.

- Consider a debt consolidation loan. If you have multiple high-interest debts, a debt consolidation loan can help you combine them into one lower-interest loan, making it easier to manage and pay off your debt faster.

Avoiding Late Fees and Other Penalties

Late fees and penalties can quickly add up and derail your efforts to pay off your balance. To avoid these charges, it’s essential to be mindful of your payment due date and make sure you pay on time.

- Set reminders. Use your phone’s calendar or a reminder app to alert you about your payment due date.

- Pay online or through your bank’s mobile app. This allows you to make payments quickly and easily, reducing the risk of forgetting.

- Sign up for text or email alerts. Many credit card issuers offer text or email alerts to remind you when your payment is due.

Designing a Strategy for Using a Balance Transfer Credit Card

Before applying for a balance transfer credit card, it’s essential to develop a clear strategy for using it effectively. This will help you avoid falling into debt and ensure that you achieve your financial goals.

- Calculate your total debt and interest charges. This will give you a clear picture of how much you owe and how much interest you’re paying.

- Compare different balance transfer credit cards. Look for cards with low introductory APRs, no balance transfer fees, and long introductory periods.

- Set a realistic payment plan. Determine how much you can afford to pay each month and stick to it.

- Avoid using the card for new purchases. The purpose of a balance transfer card is to consolidate existing debt, not to accumulate more.

- Stay organized. Keep track of your payments, due dates, and interest rates to ensure you’re on track.

Alternatives to Balance Transfer Credit Cards

While balance transfer credit cards can be a valuable tool for managing debt, they are not the only option. Several alternatives offer advantages and disadvantages, making them suitable for different financial situations.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts into a single loan with a new interest rate. This can simplify debt management and potentially lower monthly payments.

- Benefits:

- Lower monthly payments due to a lower interest rate

- Simplified debt management with a single monthly payment

- Potentially improved credit score if you make payments on time

- Drawbacks:

- Higher interest rates than some balance transfer cards

- Potential for longer repayment terms, leading to higher overall interest paid

- May not be available to borrowers with poor credit

Example: A person with multiple credit cards with high interest rates can consolidate their debt with a debt consolidation loan. This could result in lower monthly payments, making it easier to manage their debt. However, if the loan’s interest rate is not significantly lower than the credit cards’ interest rates, they could end up paying more interest over the long term.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including debt consolidation. They offer fixed interest rates and repayment terms, making budgeting easier.

- Benefits:

- Fixed interest rates, providing predictable monthly payments

- Flexible repayment terms, allowing you to choose a term that fits your budget

- Potential for lower interest rates than credit cards

- Drawbacks:

- Interest rates can be higher than some balance transfer cards

- May not be available to borrowers with poor credit

- Origination fees can add to the overall cost of the loan

Example: A person with a high-interest balance on their credit card can use a personal loan to pay off the balance. The fixed interest rate and predictable monthly payments can make managing debt easier and potentially save money on interest charges compared to the credit card.

Concluding Remarks: Best Balance Transfer Credit Card 2024

By understanding the nuances of balance transfer credit cards and implementing strategic debt management techniques, you can unlock the potential to significantly reduce your debt burden. Don’t let high interest rates hold you back from achieving your financial goals. Empower yourself with the knowledge to make informed decisions and embark on a journey towards financial freedom.

FAQs

What is the best balance transfer credit card for someone with a low credit score?

Credit cards with lower credit score requirements may have higher APRs or fees. Consider cards that offer a balance transfer bonus, such as a cash back reward or a travel credit, to offset these costs.

How long does it typically take to pay off a balance transfer?

The ideal timeframe for paying off a balance transfer is within the introductory 0% APR period. This will minimize interest charges and allow you to maximize your savings. However, it’s important to create a realistic repayment plan based on your budget and debt amount.

Are there any other fees associated with balance transfer credit cards besides the transfer fee?

Yes, some cards may have additional fees such as annual fees or late payment fees. It’s crucial to carefully review the terms and conditions to avoid unexpected charges.