Best credit card offers balance transfer – Best credit card offers for balance transfers can be a powerful tool for tackling high-interest debt. By transferring your existing balances to a card with a lower introductory APR, you can potentially save a significant amount of money on interest charges. However, it’s crucial to understand the nuances of these offers to ensure you’re making the most of them.

This guide will delve into the world of balance transfer credit cards, exploring the benefits and drawbacks, essential factors to consider, and strategies for managing your balance transfers effectively. We’ll also examine alternative debt consolidation options and provide insights into choosing the best approach for your unique financial situation.

Understanding Balance Transfers

A balance transfer is a financial tool that allows you to move outstanding debt from one credit card to another, often with the goal of securing a lower interest rate. This can be a valuable strategy for saving money on interest charges and paying off your debt faster.

Benefits of Balance Transfers

Balance transfers can offer several advantages, particularly for individuals looking to manage their debt more effectively.

- Lower Interest Rates: One of the primary benefits of balance transfers is the potential to secure a lower interest rate on your existing debt. This can significantly reduce your monthly interest payments and accelerate your debt repayment journey. For example, if you have a credit card with a 20% APR and transfer your balance to a card with a 0% introductory APR, you could save hundreds of dollars in interest charges over the introductory period.

- Consolidation of Debt: Balance transfers can help you simplify your debt management by consolidating multiple credit card balances into a single account. This can make it easier to track your payments and potentially streamline your budgeting process.

- Potential for Faster Debt Repayment: With lower interest rates, you can allocate more of your monthly payments towards the principal balance, leading to faster debt repayment. This can help you become debt-free sooner and save on overall interest costs.

Potential Drawbacks of Balance Transfers

While balance transfers can be advantageous, it’s essential to be aware of potential drawbacks to make informed decisions.

- Transfer Fees: Many credit card issuers charge a fee for balance transfers, typically a percentage of the transferred balance. This fee can offset some of the savings from a lower interest rate.

- Introductory Periods: Balance transfers often come with an introductory period during which you enjoy a lower interest rate. However, this introductory period is usually limited (often 12-18 months). After the introductory period, the interest rate may revert to a higher standard rate, potentially increasing your monthly payments.

- Increased Debt: If you continue to make new purchases on your credit card after transferring a balance, you could potentially increase your overall debt. It’s crucial to manage your spending responsibly and avoid accumulating additional debt during the balance transfer period.

Best Credit Card Offers for Balance Transfers

Transferring high-interest debt to a credit card with a lower introductory APR can help you save money on interest charges. Several credit cards offer balance transfer promotions with 0% APR periods that can last for 12 to 21 months. However, it is important to understand the terms and conditions of these offers before transferring your balance.

Factors to Consider When Comparing Balance Transfer Offers

To find the best balance transfer offer for your needs, you should consider several factors, including:

- Introductory APR: The introductory APR is the interest rate you’ll pay for a specified period, usually 12 to 21 months. Look for a card with the lowest introductory APR, as this will save you the most on interest charges.

- Balance Transfer Fee: Most credit cards charge a fee for transferring a balance, typically a percentage of the amount transferred. This fee can range from 3% to 5% of the balance transferred, so it is important to factor this cost into your decision.

- Regular APR: After the introductory period expires, the regular APR will apply. Make sure the regular APR is competitive, as you don’t want to be stuck with a high interest rate after the introductory period ends.

- Rewards Program: Some balance transfer cards offer rewards programs, such as cash back, points, or travel miles. If you’re looking for rewards, make sure the card’s rewards program aligns with your spending habits.

- Eligibility Requirements: Before applying for a balance transfer card, make sure you meet the eligibility requirements. These requirements may include minimum credit score, income level, and credit history.

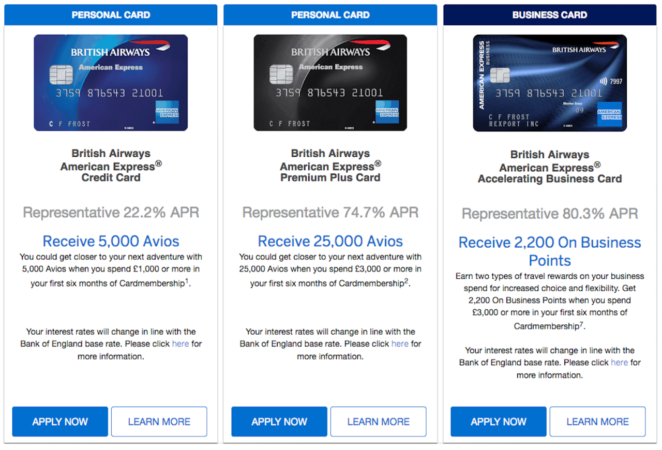

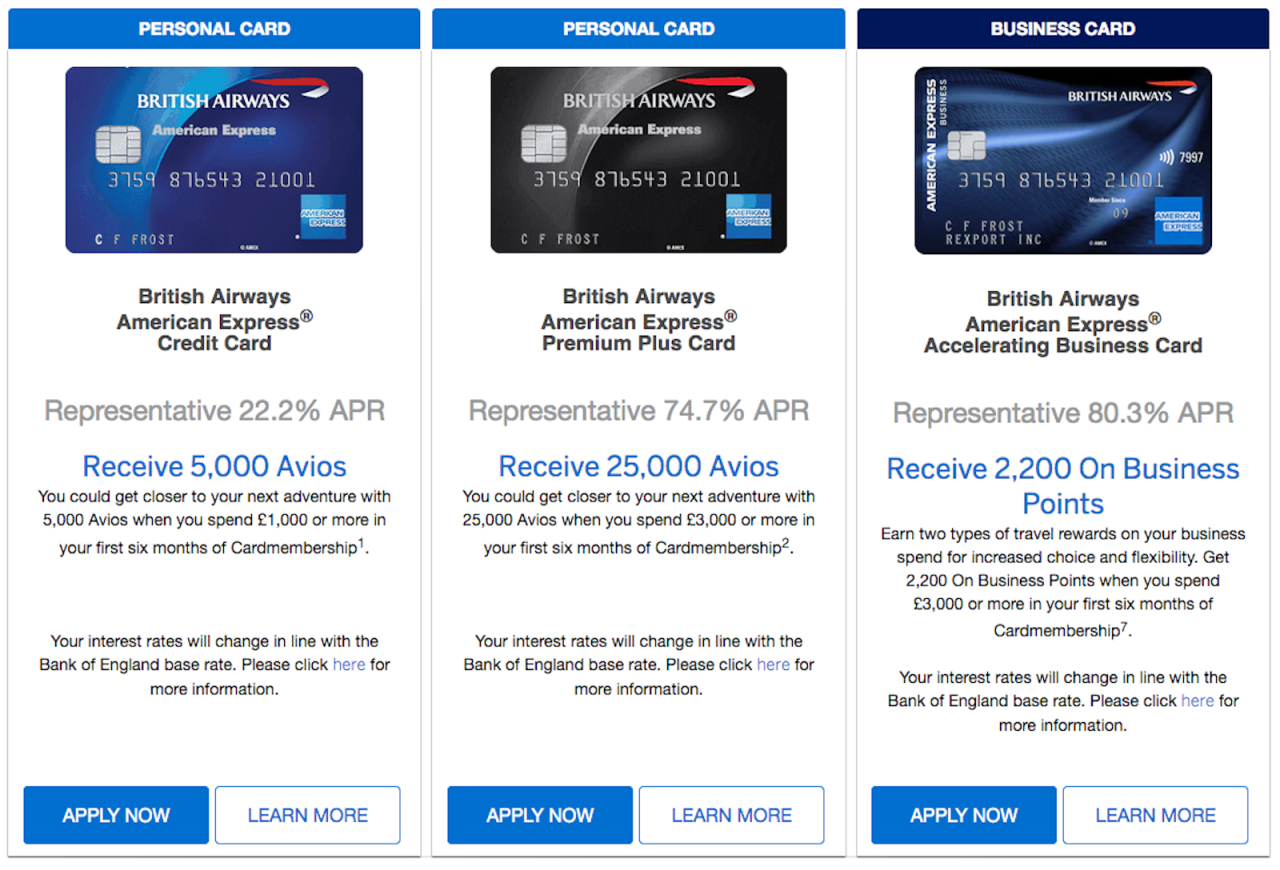

Examples of Best Balance Transfer Credit Card Offers

Here are some examples of credit cards that offer competitive balance transfer promotions:

- Chase Slate: This card offers a 0% introductory APR for 15 months on balance transfers, with no annual fee. The balance transfer fee is 3% of the amount transferred, with a minimum of $5. After the introductory period, the regular APR is a variable rate of 19.24% – 29.24%.

- Citi Simplicity®: This card offers a 0% introductory APR for 21 months on balance transfers and purchases, with no annual fee. The balance transfer fee is 5% of the amount transferred, with a minimum of $5. After the introductory period, the regular APR is a variable rate of 19.24% – 29.24%.

- Discover it® Balance Transfer: This card offers a 0% introductory APR for 14 months on balance transfers, with no annual fee. The balance transfer fee is 3% of the amount transferred, with a minimum of $5. After the introductory period, the regular APR is a variable rate of 16.99% – 25.99%.

Tips for Finding the Best Balance Transfer Offer

Here are some tips for finding the best balance transfer offer for your needs:

- Compare offers from multiple lenders: Don’t settle for the first offer you see. Shop around and compare offers from different lenders to find the best terms.

- Consider your credit score: Your credit score will affect your eligibility for different offers and the interest rate you’ll be offered. If you have a good credit score, you’ll likely qualify for lower interest rates and better terms.

- Read the fine print: Before you transfer your balance, carefully read the terms and conditions of the offer. Pay attention to the introductory APR, the balance transfer fee, the regular APR, and any other fees or charges.

- Pay down your balance as quickly as possible: Even with a 0% introductory APR, you’ll still need to pay down your balance before the introductory period ends. Otherwise, you’ll start paying interest at the regular APR, which could be much higher.

Factors to Consider When Choosing a Balance Transfer Offer: Best Credit Card Offers Balance Transfer

Before you jump at a balance transfer offer, it’s crucial to evaluate your financial situation and the specifics of the offer to determine if it’s truly beneficial.

Understanding Your Current Debt Situation and Credit Score

Knowing your current debt situation and credit score is essential when considering a balance transfer offer. Your credit score plays a crucial role in determining your eligibility for balance transfer offers and the interest rates you qualify for.

Introductory APR Periods

Balance transfer offers often come with an introductory APR period, which can be a significant advantage for debt repayment. However, it’s vital to understand the duration of this introductory period and the APR that applies after it expires.

Transfer Fees, Best credit card offers balance transfer

While balance transfer offers can seem appealing, they often come with transfer fees. These fees can significantly impact your overall savings, so it’s crucial to compare them across different offers.

Strategies for Managing Balance Transfers Effectively

A balance transfer can be a powerful tool for saving money on interest charges, but it’s crucial to use it strategically to maximize its benefits. By understanding the nuances of balance transfers and implementing effective management strategies, you can successfully consolidate your debt and achieve your financial goals.

Transferring Your Balance Without Fees or Penalties

It’s essential to avoid incurring additional fees or penalties when transferring your balance. Here are some strategies to ensure a smooth transfer process:

- Compare Transfer Fees: Carefully compare the balance transfer fees charged by different credit card issuers. Some cards offer zero transfer fees, while others charge a percentage of the transferred amount. Opting for a card with no transfer fee can save you significant money in the long run.

- Meet the Eligibility Criteria: Make sure you meet the eligibility requirements for the balance transfer offer, such as having a good credit score and sufficient available credit on your existing card. Failing to meet these criteria may result in your transfer being denied or subject to higher fees.

- Transfer Before the Introductory Period Ends: Ensure you complete the balance transfer before the introductory period ends. Most balance transfer offers have a limited time frame, typically 6 to 18 months, during which you’ll enjoy the 0% interest rate. After the introductory period expires, the standard interest rate will apply, potentially negating the benefits of the transfer.

Designing a Debt Repayment Plan

A well-structured debt repayment plan is essential for maximizing the benefits of a balance transfer and ensuring you pay off your debt as quickly as possible.

- Calculate Your Minimum Payment: Determine the minimum monthly payment required on your new balance transfer card. Make sure you understand the terms of the introductory period and the interest rate that will apply after it ends.

- Set a Higher Payment: Aim to pay more than the minimum payment each month to accelerate your debt repayment. This will help you reduce the total interest charges and pay off the balance sooner. Consider using a debt repayment calculator to determine the optimal payment amount to reach your desired payoff timeline.

- Prioritize High-Interest Debt: If you have multiple debts, prioritize paying down those with the highest interest rates first. This strategy, known as the “debt snowball” or “debt avalanche” method, can help you save significantly on interest charges over time.

Avoiding Common Pitfalls

Balance transfers can be a valuable tool for debt management, but it’s important to be aware of potential pitfalls that can undermine their effectiveness.

- Overspending: After transferring your balance, it’s crucial to avoid overspending on the new card. This can negate the benefits of the balance transfer by adding more debt to your account. Resist the temptation to use the new card for everyday purchases and focus on paying down the transferred balance.

- Neglecting Other Debt Obligations: Don’t neglect other debt obligations while focusing on the balance transfer. Ensure you continue to make minimum payments on other loans and credit cards to avoid late fees and damage to your credit score.

- Missing the Deadline: Keep track of the introductory period end date for your balance transfer. If you miss the deadline, you’ll be subject to the standard interest rate, potentially increasing your debt burden. Set reminders or mark the date on your calendar to avoid this situation.

Alternatives to Balance Transfers

While balance transfers are a popular debt consolidation strategy, they are not the only option available. Other methods, such as personal loans and debt consolidation programs, offer different advantages and disadvantages. Understanding these alternatives can help you make the most informed decision for your financial situation.

Personal Loans

Personal loans are a type of unsecured loan that can be used for various purposes, including debt consolidation. They typically offer fixed interest rates and repayment terms, making them predictable and manageable.

Advantages of Personal Loans

- Fixed Interest Rates: Unlike credit cards, which often have variable interest rates, personal loans usually have fixed interest rates. This means your monthly payments will remain the same throughout the loan term, making budgeting easier.

- Longer Repayment Terms: Personal loans typically have longer repayment terms than credit cards, which can result in lower monthly payments. This can be beneficial if you need to reduce your immediate monthly expenses.

- Potential for Lower Interest Rates: If you have good credit, you may qualify for a personal loan with a lower interest rate than your credit cards. This can save you money on interest charges over time.

Disadvantages of Personal Loans

- Origination Fees: Some lenders charge origination fees when you take out a personal loan. These fees can add to the overall cost of the loan.

- Credit Score Impact: Applying for a personal loan can result in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Potential for Higher Interest Rates: If you have poor credit, you may be offered a personal loan with a higher interest rate than your credit cards. This can make the loan more expensive.

Debt Consolidation Programs

Debt consolidation programs are designed to help individuals manage multiple debts by combining them into a single loan with a lower interest rate. These programs often work with creditors to negotiate lower interest rates and monthly payments.

Advantages of Debt Consolidation Programs

- Lower Monthly Payments: By combining multiple debts into one, you can potentially reduce your overall monthly payment, making it easier to manage your finances.

- Simplified Debt Management: Dealing with a single loan instead of multiple debts can simplify your debt management process.

- Potential for Lower Interest Rates: Debt consolidation programs can sometimes negotiate lower interest rates with your creditors, saving you money on interest charges over time.

Disadvantages of Debt Consolidation Programs

- Fees: Debt consolidation programs typically charge fees for their services, which can add to the overall cost of debt consolidation.

- Credit Score Impact: Applying for a debt consolidation program can result in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Potential for Higher Interest Rates: If you have poor credit, you may not qualify for a debt consolidation program with a lower interest rate than your existing debts. This can make the program less effective.

Last Point

Ultimately, the decision of whether a balance transfer is right for you depends on your individual circumstances and debt management goals. By carefully evaluating your options, understanding the associated fees and terms, and implementing a strategic repayment plan, you can potentially leverage balance transfer credit cards to achieve your financial objectives and take control of your debt.

Questions and Answers

What is the average introductory APR for balance transfer credit cards?

Introductory APRs for balance transfers typically range from 0% to 18%, but they can vary widely depending on the card issuer and your creditworthiness.

How long do introductory APR periods typically last?

Introductory APR periods usually last for 12 to 18 months, but some cards may offer longer periods. It’s important to note that the APR will revert to the standard rate after the introductory period ends.

Are there any fees associated with balance transfers?

Most balance transfer credit cards charge a transfer fee, which is typically a percentage of the amount transferred. Some cards may waive the transfer fee for a limited time or for specific types of transfers.

What is the difference between a balance transfer and a cash advance?

A balance transfer involves moving an existing balance from one credit card to another, while a cash advance is a withdrawal of cash from your credit card account. Cash advances typically have higher interest rates and fees than balance transfers.