- Introduction to Balance Transfers

- Factors to Consider When Choosing a Balance Transfer Card

- How to Apply for and Utilize a Balance Transfer Card

- Understanding the Risks and Considerations

- Alternative Options to Balance Transfers: Best Credit Card To Do A Balance Transfer

- Last Word

- Clarifying Questions

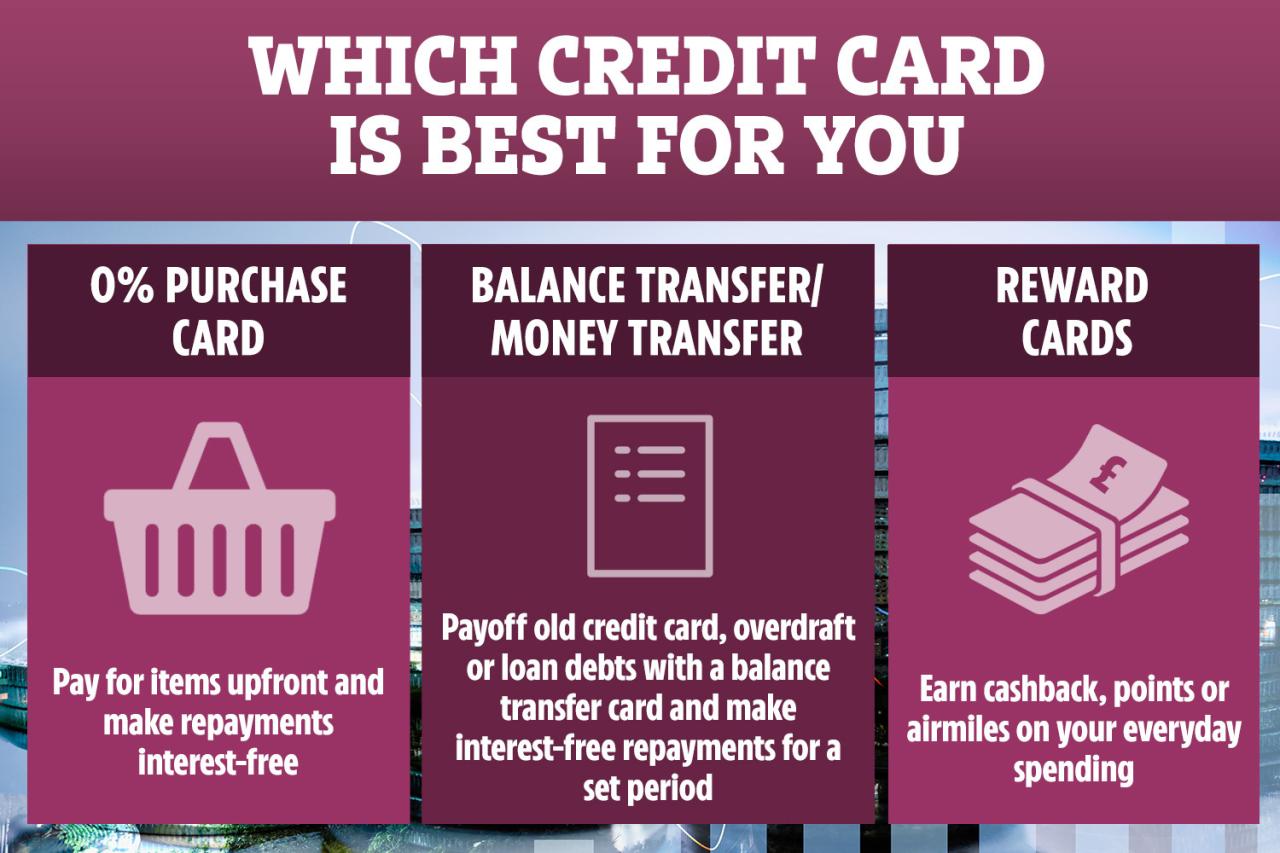

Are you burdened with high-interest credit card debt? The best credit card to do a balance transfer could be your financial savior. By transferring your existing balances to a card with a lower interest rate, you can save on interest charges and potentially pay off your debt faster. But before you dive in, it’s essential to understand the ins and outs of balance transfers, including the benefits, drawbacks, and key factors to consider.

Balance transfers can be a powerful tool for debt management, but they come with their own set of considerations. Understanding the factors like introductory APRs, balance transfer fees, and credit limit requirements can help you make an informed decision. This guide will equip you with the knowledge to navigate the world of balance transfer credit cards and find the best option for your financial needs.

Introduction to Balance Transfers

A balance transfer is a financial maneuver where you move outstanding debt from one credit card to another, typically one with a lower interest rate. This strategy aims to reduce the overall cost of your debt by lowering interest charges and potentially saving you money in the long run.

Balance transfers are a popular way to manage high-interest debt, such as credit card balances accumulated from purchases or cash advances. By transferring your balance to a card with a lower interest rate, you can significantly reduce the amount of interest you pay over time, making it easier to pay off your debt.

Benefits of Balance Transfers

A balance transfer can offer several advantages:

* Lower Interest Rates: The most significant benefit is the potential to lower your interest rate. This can save you substantial amounts of money in interest charges, especially if you have a large balance and a high interest rate on your existing card.

* Reduced Monthly Payments: Lower interest rates can translate to lower monthly payments, making it easier to manage your debt and potentially free up cash flow for other financial goals.

* Debt Consolidation: Balance transfers can help consolidate multiple debts into one manageable balance, simplifying your debt management process.

* Promotional Periods: Many balance transfer cards offer introductory periods with 0% interest rates. This can give you time to pay down your balance without accruing any interest charges, making it easier to pay off your debt faster.

Drawbacks of Balance Transfers

While balance transfers offer benefits, they also come with some potential drawbacks:

* Balance Transfer Fees: Most balance transfer cards charge a fee, typically a percentage of the transferred balance. This fee can add to the overall cost of the transfer, so it’s important to factor it into your calculations.

* Limited Time Periods: Promotional 0% interest rates are often limited to a specific period, after which the standard interest rate kicks in. This means you need to pay off your balance before the promotional period ends to avoid accruing high interest charges.

* Credit Score Impact: Applying for a new credit card can impact your credit score, especially if you have several recent inquiries. This is because each application represents a hard inquiry on your credit report.

* Balance Transfer Limits: Credit card companies often set limits on the amount you can transfer, so you may not be able to transfer your entire balance.

* Potential for Overspending: Having a new credit card with a lower interest rate can tempt some people to overspend, which can lead to further debt accumulation.

Factors to Consider When Choosing a Balance Transfer Card

Choosing the right balance transfer card can significantly reduce your debt and save you money. It’s important to carefully consider several factors before making a decision.

Comparing APRs and Fees

The Annual Percentage Rate (APR) and fees associated with balance transfers are crucial factors to compare. A lower APR will save you money on interest charges, and a low balance transfer fee will minimize the upfront cost of transferring your debt.

Comparing Key Features of Balance Transfer Cards

A balance transfer card’s features can vary greatly, impacting your overall savings. It’s essential to compare key aspects of different cards to find the best fit for your needs.

| Feature | Card 1 | Card 2 | Card 3 |

|---|---|---|---|

| Introductory APR | 0% for 18 months | 0% for 12 months | 0% for 21 months |

| Standard APR | 18.99% | 16.99% | 19.99% |

| Balance Transfer Fee | 3% | 5% | 2% |

| Annual Fee | $0 | $95 | $0 |

| Credit Limit | $10,000 | $5,000 | $15,000 |

| Rewards Program | Cash back | Travel miles | Points redeemable for merchandise |

| Other Benefits | Purchase protection | Extended warranty | Travel insurance |

Determining the Best Credit Limit

Your credit limit is the maximum amount you can borrow on your card. It’s essential to choose a credit limit that aligns with your needs and financial situation.

A good rule of thumb is to choose a credit limit that allows you to transfer your entire balance and still have some room for future purchases.

Rewards Programs and Offset Fees

Some balance transfer cards offer rewards programs that can help offset transfer fees. For example, if you earn cash back on your purchases, you can use these rewards to pay down your balance transfer fee.

How to Apply for and Utilize a Balance Transfer Card

Applying for and utilizing a balance transfer credit card involves a few straightforward steps. You’ll need to find a card that offers a balance transfer promotion and meet the eligibility requirements. Once approved, you can transfer your existing balance and begin paying it down.

Applying for a Balance Transfer Card, Best credit card to do a balance transfer

The application process for a balance transfer card is similar to applying for any other credit card. You’ll need to provide personal information, such as your name, address, Social Security number, and income. You’ll also need to provide your credit card history. The issuer will then review your application and determine whether to approve you.

- Compare offers from different card issuers: To find the best deal, it’s essential to compare offers from different card issuers. Look for cards with low introductory APRs, balance transfer fees, and annual fees.

- Check your credit score: Before applying, it’s a good idea to check your credit score. A higher credit score will increase your chances of approval and may qualify you for lower interest rates.

- Complete the application online or by phone: Most credit card issuers allow you to apply online or by phone. Be sure to provide accurate information on your application.

- Wait for a decision: Once you submit your application, the issuer will review it and make a decision. You’ll typically receive a notification within a few days.

Transferring a Balance

Once your application is approved, you can transfer your existing balance to the new card. The process is usually straightforward. You’ll need to provide the new card issuer with the account number and balance of the card you want to transfer. The issuer will then transfer the balance to your new card.

- Request a balance transfer: Contact the new card issuer and request a balance transfer. You’ll need to provide the account number and balance of the card you want to transfer.

- Complete the transfer process: The issuer will typically send you a balance transfer form. You’ll need to complete and return this form to initiate the transfer.

- Confirm the transfer: Once the transfer is complete, the issuer will notify you. You should also check your statements to ensure that the balance has been transferred correctly.

Managing Your Balance After a Transfer

After transferring your balance, it’s important to manage your credit card balance effectively. This will help you pay off the debt quickly and avoid accumulating more interest charges.

- Make more than the minimum payment: The minimum payment on a credit card is usually only a small percentage of the balance. To pay off your debt quickly, make more than the minimum payment each month.

- Avoid using the card for new purchases: While you have a balance transfer, it’s best to avoid using the card for new purchases. This will prevent you from accumulating more debt.

- Set a budget: Create a budget to track your income and expenses. This will help you determine how much you can afford to pay towards your credit card debt each month.

- Consider debt consolidation: If you have multiple credit card balances, debt consolidation may be an option. This involves taking out a loan to pay off your credit card debt. You’ll then make a single monthly payment to the loan lender.

Understanding the Risks and Considerations

While balance transfers can be a valuable tool for saving money on interest, it’s crucial to understand the potential risks and considerations involved. Failing to do so could lead to unexpected costs and setbacks in your debt repayment journey.

High Interest Rates After the Introductory Period

Balance transfer cards typically offer a 0% introductory APR for a specific period, often ranging from 6 to 18 months. This promotional period allows you to transfer your existing debt and make interest-free payments for a set duration. However, it’s crucial to remember that this introductory period is temporary. Once it ends, the interest rate on your balance transfer will revert to the card’s standard APR, which can be significantly higher.

For instance, if you transfer a $5,000 balance to a card with a 0% APR for 12 months, and the standard APR is 18%, you’ll start accruing interest at 18% on your balance after the introductory period ends. This can quickly add up to significant costs if you haven’t paid off the balance by then.

Fees for Transferring Balances

Most balance transfer cards charge a fee for transferring your debt, typically a percentage of the transferred balance. This fee can range from 3% to 5% of the amount you transfer, depending on the card issuer and the terms of the offer.

For example, if you transfer a $10,000 balance with a 3% transfer fee, you’ll be charged $300 upfront, reducing your available credit and adding to your overall debt.

Credit Score Impact

Applying for a new credit card, including a balance transfer card, can have a temporary impact on your credit score. This is because a hard inquiry is made on your credit report when you apply for a new account. While this inquiry typically only lowers your score by a few points, multiple hard inquiries in a short period can negatively impact your score.

It’s essential to be aware of this potential impact and ensure that you’re confident in your ability to manage the new credit line responsibly.

Alternative Options to Balance Transfers: Best Credit Card To Do A Balance Transfer

While balance transfers offer a way to consolidate debt and potentially save on interest, they aren’t the only solution for managing debt. Other options exist, each with its own set of pros and cons.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts into a single loan with a new interest rate. This can simplify your payments and potentially lower your monthly obligations.

- Pros:

- Lower monthly payments due to a potentially lower interest rate.

- Simplified debt management with one loan instead of multiple.

- Potentially improve your credit score by consolidating high-interest debt.

- Cons:

- If you don’t qualify for a lower interest rate, consolidation may not be beneficial.

- You may end up paying more in interest over the loan’s lifetime if you extend the repayment term.

- A new loan can negatively impact your credit score if you have a low credit score or apply for several loans.

Debt Management Programs

Debt management programs (DMPs) are offered by non-profit credit counseling agencies. These programs negotiate with creditors to lower interest rates, reduce monthly payments, and create a structured repayment plan.

- Pros:

- Reduced monthly payments and interest rates.

- Professional guidance and support in managing debt.

- Potential for faster debt repayment.

- Cons:

- Monthly fees associated with the program.

- Potential impact on credit score due to late payments while enrolled.

- Limited availability and not suitable for all debt situations.

Balance Transfer Checks

Some credit card companies offer balance transfer checks, which allow you to transfer balances from other credit cards or loans to your new card.

- Pros:

- Convenience of transferring balances directly without having to pay them off first.

- Potentially lower interest rates than your existing credit cards or loans.

- Cons:

- Often have higher fees compared to traditional balance transfers.

- May not be available for all credit card holders.

- May not be suitable for all debt situations.

Last Word

Choosing the right balance transfer credit card can significantly impact your debt repayment journey. By carefully comparing APRs, fees, and other features, you can find a card that aligns with your financial goals. Remember, a successful balance transfer requires a disciplined approach to repayment. Prioritize paying down your balance before the introductory period ends to maximize the benefits and avoid incurring higher interest rates. With careful planning and a proactive approach, balance transfers can help you achieve financial freedom and reach your debt-free goals.

Clarifying Questions

What is the minimum credit score required for a balance transfer card?

The minimum credit score needed for a balance transfer card varies by issuer and card. Generally, a good credit score (at least 670) is recommended to qualify for the best offers.

How long do introductory APRs typically last?

Introductory APRs for balance transfers usually last for a set period, ranging from 6 to 18 months. After the introductory period, the standard APR applies, which is usually higher.

What are the risks of using a balance transfer card?

The main risks include: high interest rates after the introductory period, balance transfer fees, potential credit score impact, and the temptation to make new purchases on the card.