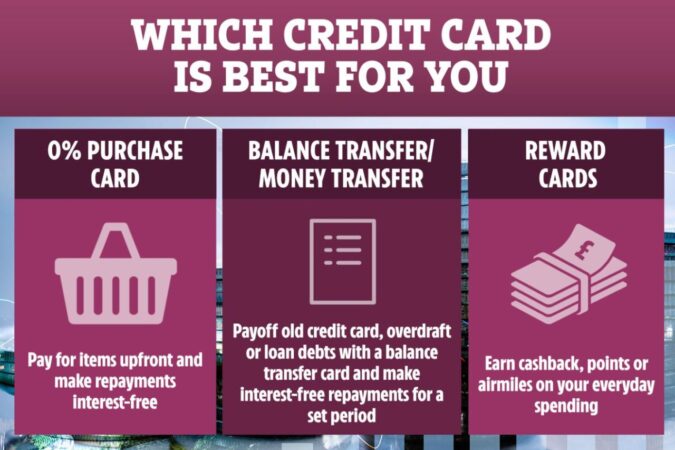

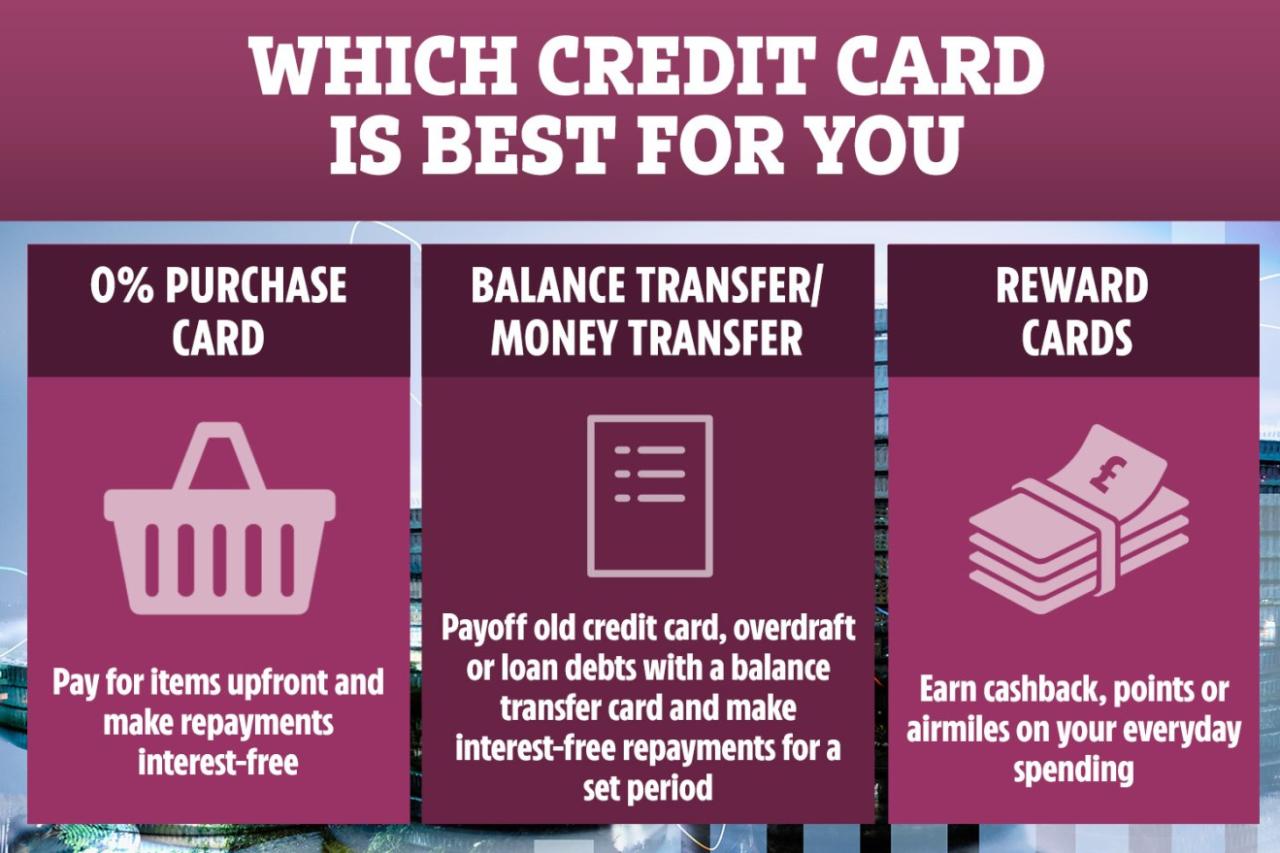

Finding the best credit cards for a balance transfer can be a game-changer for those looking to consolidate debt and save on interest. A balance transfer card offers a temporary lower interest rate on your existing debt, allowing you to pay it down faster and potentially save hundreds, even thousands, in interest charges. But navigating the world of balance transfers requires careful consideration, as hidden fees and terms can quickly turn a seemingly good deal into a financial burden.

This guide delves into the intricacies of balance transfers, breaking down the essential features to consider, highlighting top-rated cards, and offering practical tips to ensure you make the most of this debt management strategy. Whether you’re grappling with credit card debt, a personal loan, or a store credit card balance, this comprehensive guide will equip you with the knowledge to choose the right balance transfer card and effectively manage your debt.

Understanding Balance Transfers

A balance transfer is a financial maneuver that lets you move outstanding debt from one credit card to another. This is often done to take advantage of a new card’s introductory 0% APR offer, allowing you to pay off your debt without accruing interest during a specific period.

Balance transfers can be a helpful tool for managing debt, but it’s crucial to understand how they work and the potential benefits and risks involved.

Benefits of Balance Transfers

Balance transfers offer several potential benefits, including:

- Lower interest rates: By transferring your balance to a card with a lower APR, you can save money on interest charges. For example, if you have a balance of $5,000 on a card with a 20% APR and transfer it to a card with a 0% APR for 12 months, you can save hundreds of dollars in interest.

- Debt consolidation: Consolidating multiple credit card balances into one can simplify debt management, making it easier to track payments and avoid late fees.

- Improved credit utilization: By lowering your overall credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit, you can potentially improve your credit score.

Potential Drawbacks and Risks of Balance Transfers

While balance transfers can be beneficial, there are also potential drawbacks and risks to consider:

- Balance transfer fees: Most credit card issuers charge a fee for balance transfers, typically a percentage of the transferred amount. These fees can range from 3% to 5% or more, so it’s essential to factor them into your calculations.

- Introductory APR period: The 0% APR period is usually temporary, and after it ends, the interest rate will revert to the standard APR, which can be significantly higher. It’s crucial to develop a repayment plan to pay off the balance before the introductory period ends.

- Credit score impact: Applying for a new credit card can temporarily lower your credit score due to a hard inquiry. Additionally, if you miss payments on your new card, your credit score can be further damaged.

Key Features to Consider

When selecting a balance transfer credit card, it’s essential to carefully evaluate several key features that directly influence the effectiveness and overall cost of transferring your existing debt. These features play a crucial role in determining whether a balance transfer card is a suitable option for your financial situation.

Introductory APR

The introductory APR (Annual Percentage Rate) is the interest rate you’ll pay on transferred balances for a specified period, typically ranging from 6 to 18 months. A lower introductory APR translates to lower interest charges during this promotional period, allowing you to pay down your debt more efficiently. For instance, a card with a 0% introductory APR for 12 months means you won’t accrue any interest on transferred balances for the first year.

Transfer Fees

Balance transfer fees are charges associated with transferring your debt from another credit card to a new card. These fees can vary significantly, ranging from a fixed percentage of the transferred balance (typically 2% to 5%) to a flat fee (often $5 to $25). Higher transfer fees can significantly increase the overall cost of transferring your balance.

Balance Transfer Limits

The balance transfer limit refers to the maximum amount of debt you can transfer to the new card. It’s crucial to ensure the balance transfer limit is sufficient to cover your entire existing balance. If your balance exceeds the limit, you’ll need to find another solution for the remaining debt.

Ongoing APR, Best credit cards for a balance transfer

After the introductory APR period expires, the interest rate on your transferred balance reverts to the card’s standard APR. This ongoing APR can be significantly higher than the introductory rate, potentially making your debt more expensive to manage. Therefore, it’s vital to consider the ongoing APR before transferring your balance.

A higher ongoing APR can significantly increase your debt repayment costs, making the balance transfer less advantageous in the long run.

Best Balance Transfer Cards

Choosing the right balance transfer card can save you a significant amount of money on interest charges. By transferring your existing high-interest debt to a card with a 0% introductory APR, you can pay off your balance without accruing interest for a set period. This strategy is particularly beneficial if you’re facing high interest rates on credit cards, personal loans, or store cards.

Top 5 Balance Transfer Cards

Here is a comparison of five top balance transfer cards currently available in the market. It is essential to carefully review the terms and conditions of each card, as well as your own financial situation, before making a decision.

| Card Name | Introductory APR | Transfer Fee | Balance Transfer Limit | Ongoing APR | Notable Features |

|---|---|---|---|---|---|

| Citi Simplicity® Card | 0% Intro APR for 21 months | 3% of the amount transferred (minimum $5) | Up to your available credit limit | 19.24% – 26.24% Variable APR | No annual fee, balance transfer bonus, 0% APR on new purchases for the first 21 months |

| Chase Slate® | 0% Intro APR for 15 months | 5% of the amount transferred (minimum $5) | Up to your available credit limit | 18.24% – 29.24% Variable APR | No annual fee, no foreign transaction fees |

| Discover it® Balance Transfer | 0% Intro APR for 18 months | 3% of the amount transferred (minimum $5) | Up to your available credit limit | 16.99% – 25.99% Variable APR | No annual fee, cash back rewards, 0% APR on new purchases for the first 18 months |

| Capital One QuicksilverOne® Cash Rewards Credit Card | 0% Intro APR for 15 months | 3% of the amount transferred (minimum $5) | Up to your available credit limit | 26.99% Variable APR | No annual fee, 1.5% cash back on all purchases |

| Bank of America® Customized Cash Rewards Credit Card | 0% Intro APR for 15 months | 3% of the amount transferred (minimum $5) | Up to your available credit limit | 16.99% – 26.99% Variable APR | No annual fee, 3% cash back in your chosen category, 2% cash back at grocery stores and wholesale clubs, 1% cash back on all other purchases |

Tips for Successful Balance Transfers

A balance transfer can be a smart way to save money on interest charges and pay off your debt faster. However, to make the most of this strategy, it’s crucial to understand the nuances and implement best practices. By following these tips, you can maximize the benefits of a balance transfer and minimize potential pitfalls.

Minimizing Transfer Fees and Interest Charges

Transfer fees are a common expense associated with balance transfers. These fees are usually a percentage of the transferred balance, ranging from 1% to 5%. To minimize these costs, look for cards with low or no transfer fees. Additionally, be mindful of the introductory interest rate offered for the balance transfer. While introductory periods can be attractive, it’s essential to ensure that the rate after the introductory period is still competitive. This will help you avoid high interest charges once the promotional period ends.

Managing Your Debt After Transferring Your Balance

Once you’ve successfully transferred your balance, it’s important to create a plan for managing your debt effectively. This includes making regular payments, avoiding new charges on the transferred card, and setting a realistic timeline for paying off the balance. Creating a budget and tracking your progress can help you stay on track and avoid accruing further interest charges.

Comparing Balance Transfer Cards

Choosing the right balance transfer card can be a crucial step in managing your debt. Each card offers unique benefits and features, and understanding these differences is essential for making an informed decision.

Comparison of Top Balance Transfer Cards

To illustrate the diverse options available, let’s compare three leading balance transfer cards based on their key features and benefits.

- Card 1: [Card Name] – This card stands out with its extended introductory 0% APR period, often lasting 18 months or longer. This allows you ample time to pay down your transferred balance without accruing interest. Additionally, it often boasts a low balance transfer fee, typically around 3% of the transferred amount. However, it might have a higher regular APR after the introductory period, which could become a concern if you don’t fully pay off the balance within the grace period.

- Card 2: [Card Name] – This card prioritizes rewards, offering generous cash back or points on purchases. It may also feature a competitive introductory 0% APR period, but it’s typically shorter than Card 1, lasting around 12-15 months. The balance transfer fee is usually moderate, falling between 3% and 5% of the transferred amount. While it offers a strong rewards program, the shorter introductory period might require a more aggressive repayment strategy.

- Card 3: [Card Name] – This card is ideal for those seeking a balance transfer card with a strong focus on travel rewards. It offers generous travel points or miles on purchases, which can be redeemed for flights, hotels, or other travel expenses. It may also have a competitive introductory 0% APR period, although it might be shorter than the other two cards. The balance transfer fee is typically in line with the industry standard, ranging from 3% to 5% of the transferred amount. While it excels in travel rewards, its shorter introductory period might require a more focused repayment plan.

Ending Remarks

Ultimately, choosing the best credit card for a balance transfer depends on your individual circumstances and debt management goals. By understanding the key factors, comparing different options, and utilizing strategic tips, you can leverage the power of balance transfers to achieve your financial goals and gain control of your debt. Remember, balance transfers are a powerful tool, but they require careful planning and responsible management to ensure their effectiveness.

Query Resolution: Best Credit Cards For A Balance Transfer

What is the minimum credit score required for a balance transfer card?

The minimum credit score required for a balance transfer card varies by issuer. Generally, you’ll need a good credit score (at least 670) to qualify for the best offers with low introductory APRs and generous transfer limits.

How long does it take to transfer a balance?

The time it takes to transfer a balance can vary depending on the issuer. Most transfers are completed within 7-14 business days.

Can I transfer my balance from one credit card to another card from the same issuer?

While some issuers allow balance transfers between their own cards, it’s not always the case. You’ll need to check the terms and conditions of both cards to see if this is an option.

Is there a penalty for paying off a balance transfer before the introductory period ends?

There is typically no penalty for paying off a balance transfer before the introductory period ends. In fact, it’s often beneficial to do so to avoid the higher ongoing APR.