Best credit cards to do a balance transfer can be a game-changer for those burdened with high-interest debt. These cards offer the opportunity to consolidate existing balances onto a new card with a lower interest rate, potentially saving you hundreds or even thousands of dollars in interest charges. The key is finding the right card that aligns with your financial goals and credit profile.

This guide explores the ins and outs of balance transfers, from understanding the concept and its benefits to choosing the right card and maximizing your savings. We’ll delve into factors like APR, transfer fees, introductory periods, and eligibility requirements, empowering you to make informed decisions about your debt management strategy.

Understanding Balance Transfers

A balance transfer is a way to move your existing credit card debt to a new credit card with a lower interest rate. This can be a great way to save money on interest charges and pay off your debt faster.

Balance transfers work by transferring the balance from your existing credit card to a new credit card. The new credit card issuer will then pay off your existing balance, and you will be responsible for paying back the new credit card issuer.

Benefits of Balance Transfers

Balance transfers can offer several benefits, including:

- Lower interest rates: Balance transfer offers often come with lower interest rates than your existing credit card. This can save you money on interest charges over time.

- Potential savings: By transferring your balance to a card with a lower interest rate, you can potentially save money on interest charges and pay off your debt faster.

Types of Balance Transfer Offers

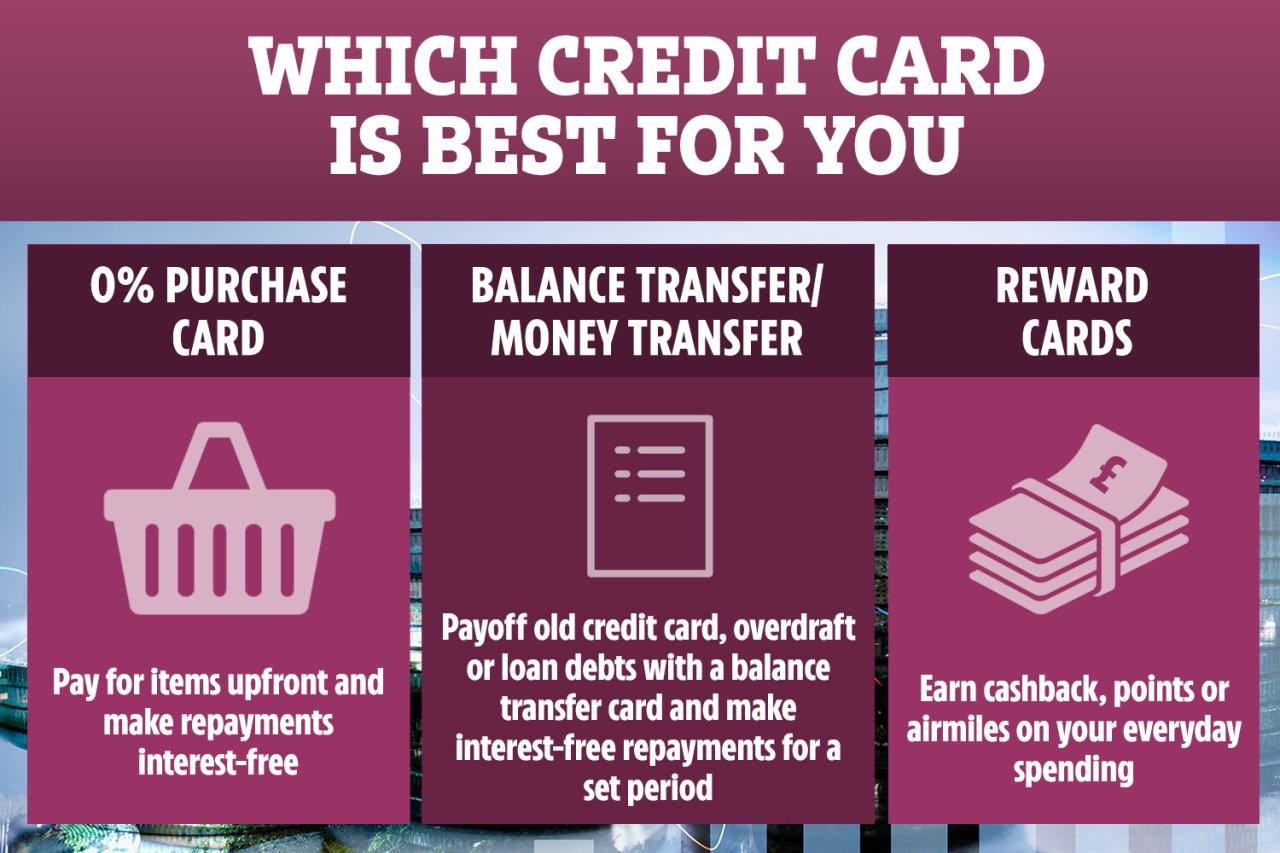

There are different types of balance transfer offers available, including:

- 0% APR periods: Some credit cards offer a 0% APR period for a certain amount of time, usually 12 to 18 months. During this time, you will not be charged any interest on your balance. However, after the introductory period ends, the interest rate will revert to the standard rate, which can be quite high.

- Introductory rates: Other credit cards offer introductory rates that are lower than the standard rate for a set period of time. This can be a good option if you are looking for a lower interest rate but don’t need a 0% APR period.

Factors to Consider When Choosing a Balance Transfer Card

Choosing the right balance transfer card can save you significant money on interest charges. However, it’s crucial to consider several factors to ensure you’re getting the best deal.

This section will delve into key factors to consider when choosing a balance transfer card, including APR, transfer fees, eligibility requirements, and rewards programs. We’ll also explore how to compare different options based on these factors and offer tips for finding the best card for your specific needs.

Interest Rates

The annual percentage rate (APR) is the most important factor to consider when choosing a balance transfer card. A lower APR means you’ll pay less interest on your transferred balance, saving you money in the long run. Look for cards offering a 0% introductory APR for a specific period, typically 12 to 18 months. After the introductory period, the APR will revert to the card’s standard rate, which can be significantly higher. Therefore, it’s crucial to ensure you can pay off the transferred balance before the introductory period ends.

Transfer Fees

Most balance transfer cards charge a transfer fee, typically a percentage of the transferred balance. This fee can range from 3% to 5% and can significantly impact your overall savings. Compare transfer fees across different cards and choose one with a low or waived transfer fee, especially if you’re transferring a large balance.

Eligibility Requirements

Not everyone qualifies for a balance transfer card. Lenders have specific eligibility requirements, including credit score, income, and debt-to-income ratio. Before applying, check your credit score and ensure you meet the card’s eligibility criteria. It’s also a good idea to compare eligibility requirements across different cards to find one that suits your profile.

Rewards Programs

Some balance transfer cards offer rewards programs, such as cash back, travel miles, or points. While these rewards can be beneficial, it’s essential to consider the overall value proposition. A card with a low APR and transfer fee might be more beneficial than one with a generous rewards program but higher fees and interest rates. Prioritize your financial goals and choose a card that aligns with your needs.

Other Considerations, Best credit cards to do a balance transfer

Besides the above factors, you should also consider the following:

- Card issuer: Choose a reputable and reliable card issuer with a history of customer satisfaction.

- Customer service: Look for a card issuer with excellent customer service, especially if you anticipate needing assistance with your account.

- Security features: Ensure the card issuer offers robust security features, such as fraud protection and zero liability for unauthorized transactions.

Potential Risks and Considerations

While balance transfers can be a valuable tool for saving money on debt, it’s essential to be aware of the potential risks involved. Understanding these risks and taking precautions can help you maximize the benefits of a balance transfer and avoid costly mistakes.

Late Fees

Late fees are a common risk associated with credit cards, and they can significantly impact your savings from a balance transfer. If you miss a payment, even by a day, you could be charged a late fee, which can range from $25 to $39, depending on the issuer. These fees can quickly add up, erasing any savings you’ve gained from a lower interest rate.

Interest Rate Increases

Another potential risk is an increase in the interest rate on your balance transfer card after the introductory period ends. Many balance transfer cards offer a low introductory interest rate for a limited time, typically 6 to 18 months. After this period, the interest rate may revert to a higher, standard rate, which can significantly increase your monthly payments and the total cost of your debt.

Missing the Introductory Period

Missing the introductory period can also be costly. If you don’t transfer your balance before the promotional period ends, you’ll be subject to the card’s regular interest rate, which can be much higher than the introductory rate.

How to Avoid These Risks

To mitigate these risks and maximize the benefits of a balance transfer, it’s crucial to follow these guidelines:

- Read the terms and conditions carefully before transferring your balance. Pay close attention to the introductory interest rate, the length of the promotional period, and any fees associated with the balance transfer. Also, understand the card’s standard interest rate and the terms for potential interest rate increases.

- Make on-time payments. Set reminders and automate payments to ensure you don’t miss any deadlines. Late payments can result in fees and negatively impact your credit score.

- Use balance transfers responsibly. Avoid using the balance transfer card for new purchases, as this will add to your debt and negate the benefits of the lower interest rate.

- Consider transferring your balance in smaller increments. This allows you to take advantage of multiple promotional periods and minimize the impact of potential interest rate increases.

- Create a budget and stick to it. This will help you track your spending, ensure you can make your payments on time, and avoid accumulating additional debt.

Alternatives to Balance Transfers

While balance transfers can be a helpful tool for managing high-interest debt, they’re not the only solution. Several other options can help you tackle debt effectively. Understanding these alternatives allows you to make informed decisions about the best approach for your financial situation.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially save you money on interest.

- Advantages:

- Lower monthly payments, making debt management more manageable.

- Reduced interest rates compared to credit cards, saving you money over time.

- Simplified debt management with one monthly payment instead of multiple.

- Disadvantages:

- If you don’t lower your spending habits, you may accumulate more debt.

- Longer repayment terms may result in higher overall interest paid.

- May require a credit score to qualify for a favorable interest rate.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes, including debt consolidation. They often have lower interest rates than credit cards, making them a viable option for debt repayment.

- Advantages:

- Lower interest rates than credit cards, potentially saving you money on interest.

- Flexible repayment terms, allowing you to choose a loan term that suits your budget.

- Can be used for various purposes, not just debt consolidation.

- Disadvantages:

- May require a credit score to qualify for a favorable interest rate.

- Interest rates can vary significantly depending on your creditworthiness.

- May come with origination fees or other charges.

Debt Management Programs

Debt management programs (DMPs) are offered by non-profit credit counseling agencies. They work with creditors to negotiate lower interest rates and monthly payments, often consolidating your debts into one monthly payment.

- Advantages:

- Reduced interest rates and monthly payments, making debt management more affordable.

- Professional guidance and support from credit counselors.

- May help you avoid bankruptcy or foreclosure.

- Disadvantages:

- May require a monthly fee for the program.

- May affect your credit score, as the program reports your payments to credit bureaus.

- You may lose access to your credit cards while enrolled in the program.

Epilogue

By carefully considering your options, understanding the potential risks, and employing smart strategies, you can leverage the power of balance transfers to effectively manage your debt and achieve financial freedom. Remember, the key is to choose the right card, understand the terms and conditions, and utilize balance transfers responsibly to ensure a successful and rewarding experience.

User Queries: Best Credit Cards To Do A Balance Transfer

How do I know if a balance transfer is right for me?

Balance transfers are most beneficial if you have high-interest debt and can pay down the transferred balance within the introductory period. Consider your credit score, debt amount, and financial goals to determine if a balance transfer is the right strategy for you.

What are the common pitfalls of balance transfers?

Common pitfalls include missing the introductory period, incurring late fees, and accumulating new charges on the transferred balance. Always read the terms and conditions carefully and make timely payments to avoid these issues.

What are some alternatives to balance transfers?

Alternatives include debt consolidation loans, personal loans, and debt management programs. Each option has its own advantages and disadvantages, so it’s important to compare them carefully before making a decision.