Finding the best credit cards to transfer debt to can be a game-changer for your financial well-being. These cards, often referred to as balance transfer cards, offer a lifeline by allowing you to consolidate high-interest debt onto a new card with a lower interest rate. Imagine this: you have multiple credit cards with hefty balances and sky-high interest rates. The interest charges are eating away at your savings, and you’re struggling to make ends meet. A balance transfer card can provide a much-needed solution, offering a 0% APR introductory period, which allows you to focus on paying down your debt without the burden of exorbitant interest. The key is to choose the right card and understand its features, terms, and conditions to maximize its benefits.

Let’s delve into the world of balance transfer cards and explore how they work, what to look for, and how to make the most of this valuable financial tool.

Balance Transfer Credit Cards: Best Credit Cards To Transfer Debt To

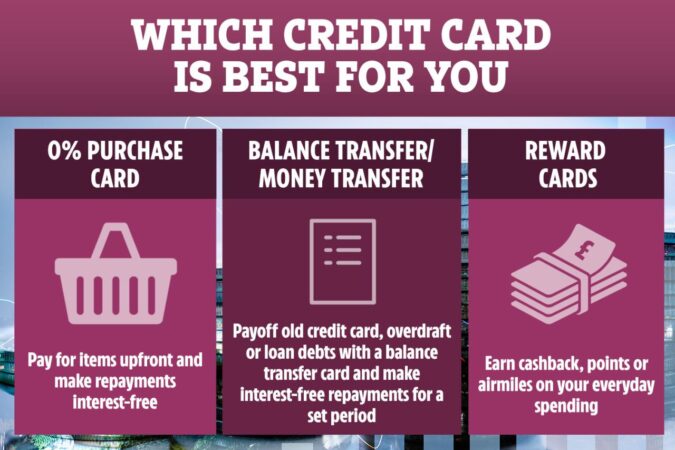

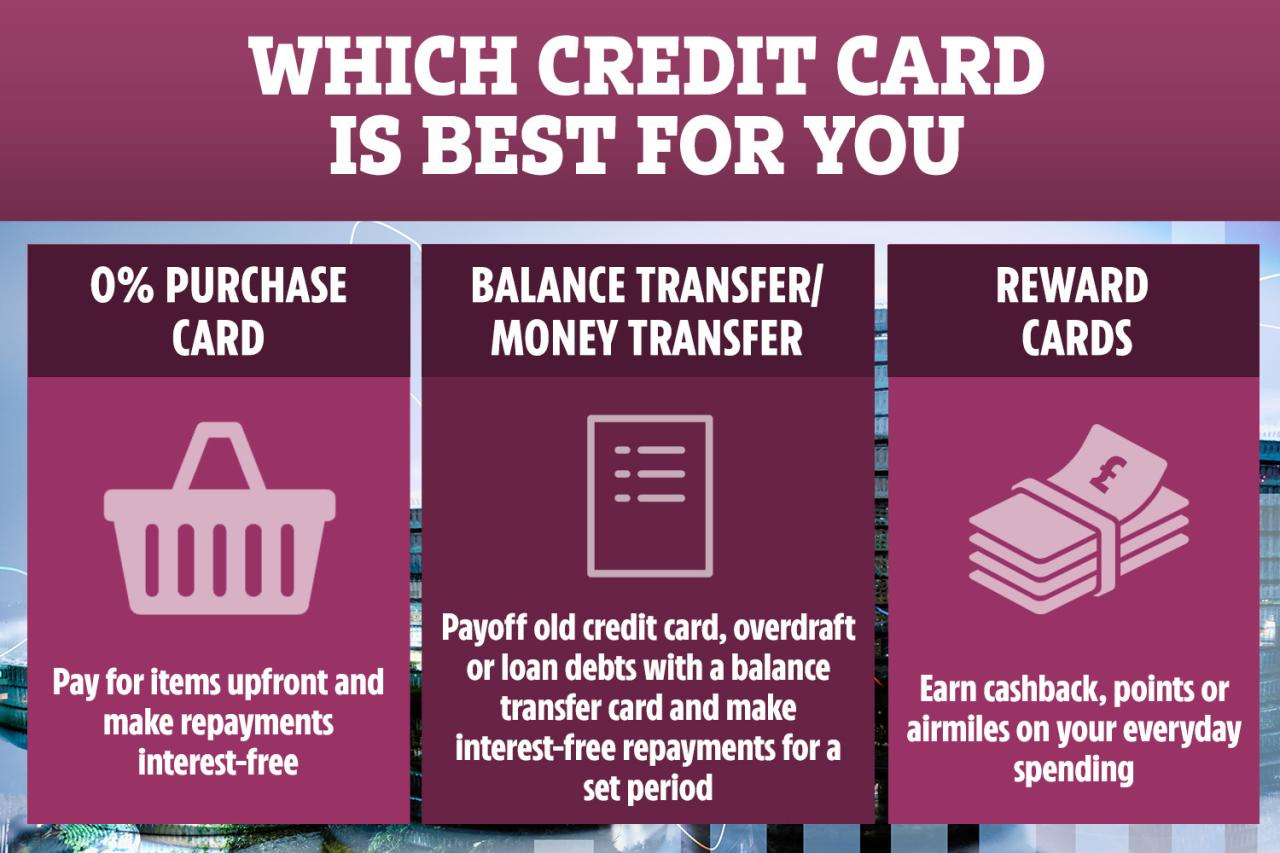

Balance transfer credit cards are a type of credit card that allows you to transfer high-interest debt from other credit cards to a new card with a lower interest rate. This can help you save money on interest charges and pay off your debt faster.

Balance transfer cards can be particularly beneficial in situations where you have accumulated significant debt on credit cards with high interest rates. For example, if you have a credit card with a 20% APR and a balance of $5,000, you could potentially save hundreds of dollars in interest charges by transferring the balance to a card with a 0% APR introductory period.

Key Factors to Consider When Choosing a Balance Transfer Card

Choosing the right balance transfer card is crucial to maximize your savings. Here are some key factors to consider:

- Introductory APR: The introductory APR is the interest rate you’ll pay for a certain period of time, usually 12-18 months. Look for cards with the lowest introductory APR, ideally 0%.

- Balance Transfer Fee: Most balance transfer cards charge a fee for transferring your balance. This fee is typically a percentage of the amount you transfer, usually 3-5%.

- Regular APR: After the introductory period ends, the regular APR will apply. It’s important to compare the regular APRs of different cards to ensure you’re getting a good deal in the long run.

- Credit Limit: The credit limit is the maximum amount you can borrow on the card. Make sure the credit limit is sufficient to cover your entire balance transfer.

- Rewards Program: Some balance transfer cards offer rewards programs, such as cash back or travel points. However, it’s important to note that rewards programs may not be as valuable as a lower APR.

Key Features to Look For

Balance transfer credit cards can be a valuable tool for consolidating debt and saving money on interest charges. To maximize your savings, it’s crucial to understand the key features of these cards and choose one that best suits your needs.

Introductory APR Periods, Best credit cards to transfer debt to

The most significant benefit of balance transfer cards is the 0% introductory APR period. This period typically lasts for a set amount of time, such as 12, 18, or even 21 months. During this period, you’ll only pay the minimum payment, and no interest will accrue on your transferred balance. This can save you hundreds or even thousands of dollars in interest charges, especially if you have a high-interest credit card balance.

Balance Transfer Fees

While balance transfer cards offer 0% APR periods, they often come with a balance transfer fee. This fee is typically a percentage of the transferred balance, ranging from 3% to 5%. It’s essential to factor this fee into your calculations to determine if a balance transfer card is truly beneficial.

Minimum Payment Requirements

Balance transfer cards usually have minimum payment requirements. These requirements can vary depending on the card issuer, but they are typically a small percentage of the outstanding balance. While these minimum payments may seem manageable, it’s crucial to make more than the minimum payment to pay down your balance faster and avoid accumulating interest after the introductory period expires.

Rewards Programs

Some balance transfer cards offer rewards programs, such as cash back, travel miles, or points. These programs can provide additional benefits, but it’s essential to weigh the value of the rewards against the balance transfer fee and APR.

Cash Back Offers

Certain balance transfer cards offer cash back rewards on purchases made with the card. This can be a valuable perk, but it’s important to understand the cash back rate and any limitations or restrictions.

Travel Perks

Some balance transfer cards offer travel perks, such as airport lounge access, travel insurance, or bonus miles for airline or hotel partners. These perks can be valuable for frequent travelers, but they may not be as relevant for those who rarely travel.

Credit Score and Eligibility

Your credit score and credit history significantly impact your eligibility for balance transfer cards. Credit card issuers typically prefer applicants with good to excellent credit scores. If you have a lower credit score, you may be offered a card with a higher APR or a shorter introductory period.

Finding the Best Balance Transfer Cards

Once you’ve determined the key features you need in a balance transfer card, it’s time to start comparing options. You’ll want to consider the 0% APR period, balance transfer fee, annual percentage rate (APR) after the introductory period, and other perks like rewards programs and travel benefits.

Balance Transfer Credit Card Comparison

Here’s a table comparing some of the top balance transfer credit cards available. This information is current as of October 26, 2023, but it’s essential to verify details with the card issuer before applying.

| Card Name | 0% APR Period | Balance Transfer Fee | Other Key Features | Issuer Website |

|---|---|---|---|---|

| Citi Simplicity® Card | 21 months | 5% of the amount transferred (minimum $5) | No annual fee, no foreign transaction fees, rewards program | https://www.citi.com/credit-cards/simplicity-card |

| Chase Slate Edge® | 21 months | 5% of the amount transferred (minimum $5) | No annual fee, no foreign transaction fees | https://creditcards.chase.com/slate-edge |

| Discover it® Balance Transfer | 18 months | 3% of the amount transferred (minimum $5) | No annual fee, cash back rewards program, 0% APR on purchases for the first 14 months | https://www.discover.com/credit-cards/balance-transfer/ |

| U.S. Bank Visa® Platinum Card | 18 months | 3% of the amount transferred (minimum $5) | No annual fee, rewards program | https://www.usbank.com/credit-cards/visa-platinum-card.html |

Tips for Successful Balance Transfers

Balance transfers can be a powerful tool for saving money on debt, but they require careful planning and execution to maximize their benefits. By understanding the key strategies and avoiding common pitfalls, you can make the most of balance transfer cards and effectively manage your debt.

Minimizing Balance Transfer Fees and Interest Charges

Balance transfer fees are a common cost associated with transferring debt. These fees are typically a percentage of the balance transferred, and they can range from 2% to 5% or more. To minimize these fees, consider the following:

- Choose a card with a low or waived balance transfer fee: Many balance transfer cards offer introductory periods with no balance transfer fees. This can save you a significant amount of money, especially if you’re transferring a large balance.

- Transfer your balance before the introductory period ends: If you don’t transfer your balance before the introductory period expires, you’ll be charged the standard interest rate, which can be significantly higher than the introductory rate.

- Time your transfer strategically: If you know you’ll be receiving a large sum of money, such as a tax refund or bonus, you can use that money to pay off the balance transfer fee and avoid accruing interest charges.

It’s also crucial to understand that balance transfer cards often come with an introductory period of 0% APR, after which the standard APR kicks in. To minimize interest charges, you must:

- Pay down the transferred balance within the introductory period: This is the most important factor in making a balance transfer successful. The goal is to pay off the balance before the introductory period ends to avoid high interest charges.

- Create a realistic repayment plan: Divide the total balance by the number of months in the introductory period to determine the minimum monthly payment needed to pay off the debt within the timeframe.

Potential Drawbacks and Considerations

While balance transfer cards offer a tempting solution to high-interest debt, it’s crucial to consider the potential downsides and make informed decisions. Understanding the drawbacks can help you determine if a balance transfer card is the right fit for your financial situation.

Balance transfer cards, despite their benefits, come with certain risks and considerations. Failing to pay down the transferred balance within the introductory period can lead to high interest rates, ultimately negating the initial savings. It’s crucial to understand these potential drawbacks and make informed decisions about using balance transfer cards.

High Annual Fees

Balance transfer cards often come with annual fees, which can range from $0 to over $100. These fees can significantly impact the cost of transferring your balance, particularly if you have a large amount of debt. It’s essential to factor in the annual fee when comparing different balance transfer cards.

Limited Transfer Amounts

Most balance transfer cards have a maximum transfer amount, which can be a significant limitation if you have a substantial amount of debt. Additionally, some cards may charge a transfer fee, which is typically a percentage of the transferred amount.

Interest Rate Increases After Introductory Period

The most significant drawback of balance transfer cards is the interest rate increase after the introductory period. If you fail to pay down the transferred balance within the introductory period, you’ll be subject to the card’s standard APR, which can be significantly higher.

Consequences of Failing to Pay Down the Balance

If you fail to pay down the transferred balance within the introductory period, you’ll be subject to the card’s standard APR, which can be significantly higher. This can quickly negate the initial savings from the balance transfer and potentially lead to further debt accumulation.

Responsible Credit Card Use

Using balance transfer cards responsibly is crucial to avoid potential pitfalls. This includes:

- Carefully researching and comparing different balance transfer cards to find the best deal.

- Making sure you can pay down the transferred balance within the introductory period.

- Developing a realistic budget and sticking to it.

- Monitoring your credit card statement regularly to ensure accuracy.

- Using your credit card responsibly and avoiding overspending.

Debt Management Strategies

Using a balance transfer card is only one part of a comprehensive debt management strategy. It’s essential to consider other options, such as debt consolidation loans or working with a credit counselor, to address your debt effectively.

Closing Notes

Transferring debt to a balance transfer card can be a smart move if you’re looking to save money on interest charges and get your finances back on track. However, remember to carefully consider the terms and conditions of the card, and make sure you can pay down the transferred balance within the introductory period. With careful planning and responsible use, you can harness the power of balance transfer cards to achieve your financial goals and escape the clutches of high-interest debt.

Clarifying Questions

What is the typical balance transfer fee?

Balance transfer fees typically range from 3% to 5% of the transferred balance. Some cards may offer a lower fee or even a fee-free transfer for a limited time.

How long do 0% APR introductory periods last?

Introductory 0% APR periods for balance transfer cards can range from 6 months to 21 months. It’s important to note that the interest rate will revert to the standard APR after the introductory period expires.

What happens if I don’t pay off the balance within the introductory period?

If you don’t pay off the transferred balance within the introductory period, you’ll start accruing interest at the standard APR, which can be significantly higher than the introductory rate. It’s crucial to develop a repayment plan and stick to it to avoid accumulating interest charges.

Can I transfer my entire debt balance?

The maximum amount you can transfer to a balance transfer card varies depending on the card’s terms and conditions. It’s important to check the card’s limitations before transferring your debt.