- Introduction to Balance Transfers

- Chase Credit Cards Offering Balance Transfers

- Eligibility Requirements for Balance Transfers

- Understanding Balance Transfer APRs

- Balance Transfer Fees and Other Considerations

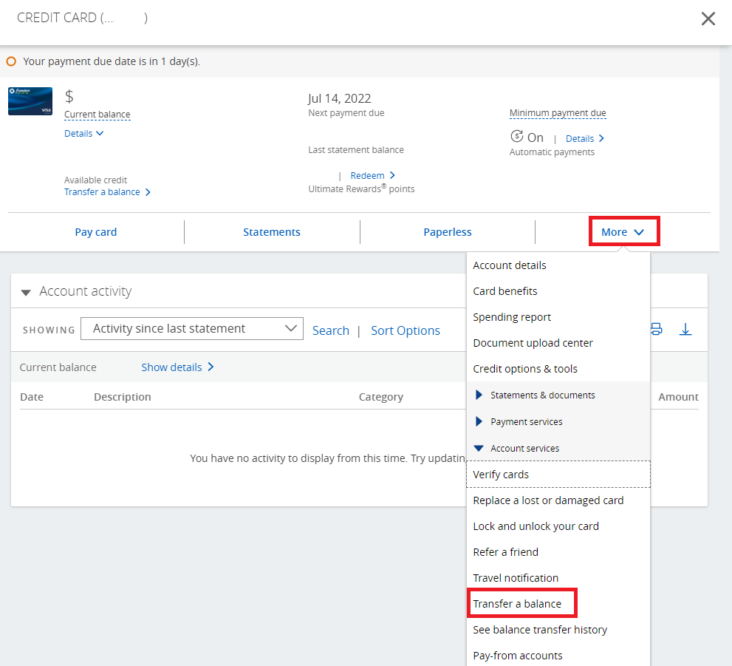

- Managing Balance Transfers Effectively

- Alternatives to Balance Transfers: Chase Credit Card Transfer Balance

- Closing Summary

- FAQ Explained

Chase credit card transfer balance – Chase credit card balance transfers can be a powerful tool for managing debt, offering the potential to lower interest rates and consolidate multiple balances into a single account. But before diving into the benefits, it’s crucial to understand the mechanics, fees, and eligibility requirements to ensure you’re making the most informed decision for your financial situation.

This guide will delve into the ins and outs of Chase credit card balance transfers, providing a comprehensive overview of everything from introductory APRs and transfer fees to managing your balance effectively and exploring alternative debt management strategies.

Introduction to Balance Transfers

A balance transfer is a way to move your existing credit card debt from one card to another, often to take advantage of a lower interest rate. This can be a helpful strategy to save money on interest charges and potentially pay off your debt faster.

Balance transfers are particularly beneficial when you have high-interest debt from another credit card. By transferring your balance to a card with a lower APR (Annual Percentage Rate), you can significantly reduce the amount of interest you pay over time. This can free up more of your monthly budget to pay down the principal balance and help you get out of debt sooner.

Benefits of Balance Transfers

Balance transfers can offer several advantages:

- Lower Interest Rates: A primary benefit of balance transfers is the opportunity to secure a lower interest rate on your existing debt. This can lead to significant savings on interest charges, especially if you have a high-interest credit card.

- Debt Consolidation: Balance transfers can simplify your debt management by consolidating multiple credit card balances into a single account. This can make it easier to track your payments and potentially reduce the risk of missing deadlines.

- Introductory Offers: Some credit cards offer introductory periods with 0% APR for balance transfers. During this period, you won’t accrue any interest charges, allowing you to focus on paying down the principal balance.

Drawbacks of Balance Transfers, Chase credit card transfer balance

While balance transfers offer potential benefits, there are also drawbacks to consider:

- Transfer Fees: Most credit cards charge a fee for balance transfers, typically a percentage of the transferred amount. This fee can eat into the savings you gain from a lower interest rate.

- Limited Timeframes: Introductory 0% APR periods for balance transfers are often limited in time. After the promotional period ends, the standard APR for the card will apply, potentially increasing your interest charges.

- Credit Score Impact: Applying for a new credit card for a balance transfer can temporarily lower your credit score. This is because the inquiry on your credit report can affect your credit utilization ratio.

- Minimum Payment Requirements: Even with a lower interest rate, you still need to make minimum payments on your balance transfer. Failure to meet these payments can result in penalties and potentially damage your credit score.

Chase Credit Cards Offering Balance Transfers

Chase offers several credit cards that allow you to transfer balances from other credit cards. These balance transfer offers can help you save money on interest charges and consolidate your debt.

Balance Transfer Terms and Conditions

The terms and conditions of balance transfers can vary depending on the Chase credit card you choose. Here are some of the key factors to consider:

* Transfer Fee: A balance transfer fee is a percentage of the amount you transfer, typically ranging from 3% to 5%.

* Introductory APR: This is the interest rate you’ll pay on your balance transfer for a specified period. Introductory APRs can be as low as 0% for a certain amount of time, but they typically revert to a higher standard APR after the introductory period expires.

* Standard APR: This is the interest rate you’ll pay on your balance transfer after the introductory period ends. Standard APRs can vary depending on your creditworthiness.

Chase Credit Cards Offering Balance Transfers

Here’s a table comparing the key features of some of the Chase credit cards that offer balance transfer options:

| Card Name | Transfer Fee | Introductory APR | Introductory Period | Standard APR |

|---|---|---|---|---|

| Chase Freedom Unlimited | 3% | 0% | 15 months | Variable, based on creditworthiness |

| Chase Slate | 0% | 0% | 15 months | Variable, based on creditworthiness |

| Chase Sapphire Preferred | 3% | 0% | 18 months | Variable, based on creditworthiness |

| Chase Ink Business Preferred | 3% | 0% | 18 months | Variable, based on creditworthiness |

Note: The specific terms and conditions of each Chase credit card are subject to change. It’s always a good idea to review the latest information on the Chase website or by contacting Chase customer service.

Eligibility Requirements for Balance Transfers

To be eligible for a balance transfer with Chase, you need to meet certain criteria, including your credit score, credit history, and income. These requirements help Chase assess your ability to manage the transferred balance responsibly.

Credit Score Requirements

Chase typically prefers applicants with good to excellent credit scores. While specific requirements may vary depending on the credit card you’re applying for, a score of at least 670 is generally considered favorable. This score indicates a good credit history and responsible financial management.

Credit History

In addition to your credit score, Chase also reviews your credit history. They look for factors such as the number of open accounts, credit utilization ratio, and payment history. A positive credit history demonstrates your ability to repay debts on time, which is crucial for qualifying for a balance transfer.

Income Considerations

Chase may also consider your income to determine your ability to manage the transferred balance. They want to ensure you have sufficient income to cover the minimum monthly payments and any other financial obligations.

Applying for a Balance Transfer

To apply for a balance transfer, you’ll typically need to complete an online application or contact Chase directly. You’ll need to provide personal information, such as your name, address, Social Security number, and employment details. You’ll also need to provide details about the balance you wish to transfer and the credit card you’re transferring from.

Documentation Needed

Depending on the situation, Chase may request additional documentation to verify your identity and financial information. This could include:

- Proof of income, such as pay stubs or tax returns

- A copy of your driver’s license or other government-issued identification

- Statements from your existing credit cards

Understanding Balance Transfer APRs

Balance transfer APRs, or annual percentage rates, are crucial to understanding the cost of transferring your credit card debt. These rates determine how much interest you’ll pay on your transferred balance over time. It’s essential to understand the different types of APRs associated with balance transfers and how they impact your overall cost.

Introductory APRs and Standard APRs

Introductory APRs are temporary rates offered for a limited time when you transfer a balance. They are typically much lower than standard APRs, making balance transfers an attractive option for saving money on interest. However, it’s important to remember that these introductory rates are only valid for a specific period, after which the standard APR kicks in.

Duration of Introductory APRs

The duration of introductory APRs varies depending on the credit card issuer and the specific balance transfer offer. Common durations range from 6 to 18 months, with some offers extending up to 21 months. It’s crucial to carefully review the terms and conditions of the balance transfer offer to determine the introductory APR period.

Factors Affecting Standard APRs

After the introductory APR period expires, the standard APR applies to your transferred balance. This standard APR is typically higher than the introductory rate and can vary based on factors such as:

- Your credit score: A higher credit score generally results in a lower standard APR.

- The credit card issuer’s current interest rates: The issuer’s overall interest rates can influence the standard APR offered for balance transfers.

- The credit card’s specific terms: Some credit cards have different standard APRs for balance transfers compared to purchases.

Paying Down the Transferred Balance

Paying down the transferred balance before the introductory APR expires is crucial to minimizing interest charges. If you don’t pay off the balance within the introductory period, you’ll start accruing interest at the higher standard APR.

For example, if you transfer a $5,000 balance with a 0% introductory APR for 12 months and only pay the minimum payment each month, you’ll likely have a significant balance remaining after the introductory period. This balance will then accrue interest at the standard APR, potentially increasing your debt significantly.

It’s best to develop a plan to pay down the transferred balance as quickly as possible, ideally within the introductory period. This will help you avoid accruing interest at the higher standard APR and save money on interest charges.

Balance Transfer Fees and Other Considerations

Balance transfers can be a great way to save money on interest, but it’s important to understand the fees associated with them. These fees can significantly impact the overall cost of a balance transfer, so it’s crucial to factor them into your decision.

Balance Transfer Fees

Balance transfer fees are charged by credit card issuers when you transfer a balance from another credit card to your new card. These fees are typically a percentage of the balance transferred, ranging from 1% to 5%.

For example, if you transfer a balance of $5,000 and the transfer fee is 3%, you would pay a fee of $150. This fee is usually added to the balance transferred, so your new balance would be $5,150.

It’s important to note that some credit card issuers offer balance transfers with no fees for a limited time, usually for the first few months after opening the account.

Annual Fees

Some credit cards charge an annual fee, which is a fixed amount you pay each year to keep the card open. This fee can vary depending on the card, ranging from $0 to hundreds of dollars.

If you’re considering a balance transfer, it’s essential to factor in the annual fee when calculating the overall cost. This fee will be charged every year, so it’s important to consider whether the benefits of the card outweigh the cost of the annual fee.

Impact of Fees on Overall Cost

The fees associated with balance transfers can significantly impact the overall cost of the transfer. If you’re not careful, you could end up paying more in fees than you save on interest.

For example, if you transfer a balance of $5,000 with a 3% transfer fee and a 1% annual fee, you would pay $150 in transfer fees and $50 in annual fees, for a total of $200 in fees. This means that you would need to save at least $200 in interest to make the balance transfer worthwhile.

Tips for Minimizing Fees and Maximizing Benefits

- Look for cards with low or no balance transfer fees. Many credit card issuers offer introductory periods with no balance transfer fees.

- Consider cards with low or no annual fees. If you’re only planning on using the card for a short period, a card with no annual fee may be a better option.

- Compare offers from multiple credit card issuers. There are many different credit cards available, so it’s important to shop around and compare offers to find the best deal.

- Make sure you can pay off the balance within the introductory period. If you don’t pay off the balance before the introductory period ends, you’ll start paying interest at the regular APR, which can be much higher.

Managing Balance Transfers Effectively

A balance transfer can be a helpful tool for saving money on interest charges, but it’s important to manage the transfer effectively to avoid accruing additional interest and maximize the benefits. This involves understanding the terms of the transfer, making timely payments, and tracking your progress.

Setting Up Automatic Payments

Setting up automatic payments for your balance transfer credit card is crucial for managing the debt effectively. Automating your payments ensures that you never miss a due date, which can help you avoid late fees and damage your credit score. This also helps you stay on track with your repayment plan. You can typically set up automatic payments online or through the credit card company’s mobile app.

Tracking Your Balance

Tracking your balance transfer credit card balance regularly is essential for staying on top of your debt. You can track your balance online through your credit card account, using a budgeting app, or through a spreadsheet. By tracking your balance, you can monitor your progress and ensure you’re making timely payments to avoid interest charges.

Using a Balance Transfer Calculator

A balance transfer calculator is a helpful tool for estimating the time it will take to pay off your balance transfer debt. This calculator takes into account factors such as your balance, interest rate, and monthly payments. It can help you determine how long it will take to pay off the debt and how much you’ll pay in interest. For example, a balance transfer calculator can help you determine if it’s better to pay off a balance transfer with a lower interest rate over a longer period or a higher interest rate over a shorter period.

Alternatives to Balance Transfers: Chase Credit Card Transfer Balance

While balance transfers offer a compelling way to manage credit card debt, they aren’t the only option. Exploring alternative approaches can help you find the best solution for your specific financial circumstances.

Debt Consolidation Loans

Debt consolidation loans combine multiple debts, such as credit card balances, into a single loan with a fixed interest rate and monthly payment. This approach can simplify debt management, potentially lower interest rates, and provide a clear path to repayment.

Benefits of Debt Consolidation Loans

- Lower Interest Rates: Debt consolidation loans often have lower interest rates than credit cards, allowing you to save money on interest charges and accelerate debt repayment.

- Simplified Repayment: Combining multiple debts into one loan simplifies your finances by reducing the number of monthly payments you need to track.

- Predictable Payments: Fixed interest rates and monthly payments provide predictability, making budgeting easier and helping you stay on track with repayment.

Considerations for Debt Consolidation Loans

- Credit Score Requirements: Obtaining a debt consolidation loan often requires a good credit score, which may not be feasible for everyone.

- Loan Fees: Debt consolidation loans can involve origination fees, which can impact the overall cost of the loan.

- Length of Repayment: While a longer repayment term can lower monthly payments, it can also lead to higher overall interest charges.

Balance Transfer Credit Cards from Other Institutions

Balance transfer credit cards offered by other financial institutions can provide a competitive alternative to Chase’s offerings. These cards often have introductory 0% APR periods and lower balance transfer fees, making them attractive for debt consolidation.

Comparing Balance Transfer Credit Cards

- Introductory 0% APR Period: Compare the length of the introductory 0% APR period offered by different institutions, as this can significantly impact your savings on interest charges.

- Balance Transfer Fees: Assess the balance transfer fees charged by each card, as these fees can vary significantly.

- Ongoing APR: Consider the ongoing APR after the introductory period expires, as this will determine your interest charges if you haven’t fully paid off the balance by then.

Choosing the Best Debt Management Solution

Selecting the most effective debt management solution depends on your individual financial situation. Consider the following factors:

- Credit Score: Your credit score will influence your eligibility for different loan products and the interest rates you qualify for.

- Debt Amount: The amount of debt you need to manage will impact the type of loan or credit card that is most suitable.

- Financial Goals: Your financial goals, such as paying off debt quickly or maintaining a good credit score, should guide your decision-making.

Closing Summary

By understanding the nuances of Chase credit card balance transfers, you can make informed decisions about whether this strategy aligns with your financial goals. Remember to weigh the potential benefits against the associated fees and eligibility requirements, and always prioritize responsible debt management practices.

FAQ Explained

What is the minimum credit score required for a Chase balance transfer?

Chase doesn’t publicly disclose a specific minimum credit score for balance transfers. However, generally, a good credit score (at least 670) is recommended to increase your chances of approval.

Can I transfer balances from other Chase credit cards?

Yes, you can usually transfer balances from other Chase credit cards to a different Chase card that offers a balance transfer promotion. However, there may be limitations or restrictions.

What happens if I don’t pay off the transferred balance before the introductory APR expires?

Once the introductory APR period ends, the standard APR will apply, which is typically higher. This can significantly increase your interest charges if you haven’t paid down a substantial portion of the balance.

Are there any hidden fees associated with Chase balance transfers?

Besides the transfer fee, there might be other fees associated with your Chase credit card, such as annual fees or late payment fees. It’s essential to review the terms and conditions of your specific card.