Chase credit transfer offers a powerful tool for tackling high-interest debt. By transferring balances from other credit cards to a Chase card with a lower APR, you can save on interest payments and pay off your debt faster. This strategy can be particularly beneficial if you’re struggling with credit card debt and want to get a handle on your finances.

This guide will walk you through the process of using Chase credit card balance transfers, covering everything from eligibility requirements to potential risks. We’ll also compare Chase’s offerings to other balance transfer options, helping you make the best decision for your unique financial situation.

Chase Credit Card Balance Transfers

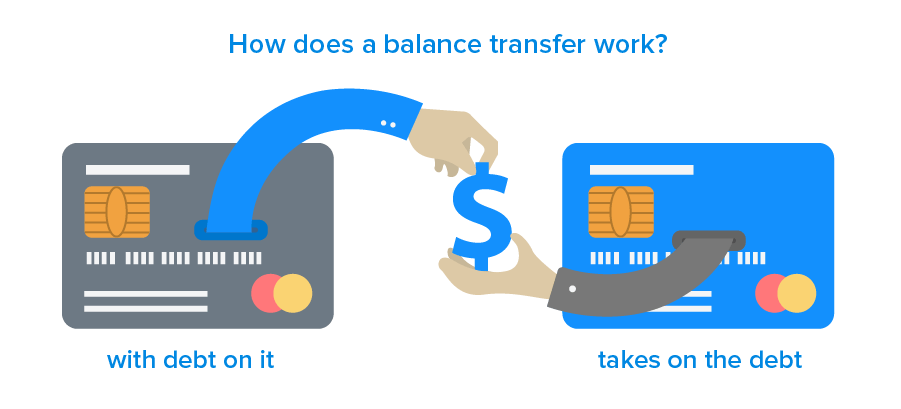

A Chase credit card balance transfer allows you to move outstanding balances from other credit cards to a Chase credit card. This can be a valuable tool for consolidating debt and potentially saving money on interest charges.

Benefits of Chase Credit Card Balance Transfers

Chase credit card balance transfers offer several benefits, including:

- Lower Interest Rates: Chase often offers introductory 0% APR periods on balance transfers, allowing you to pay down your debt without accruing interest. This can significantly reduce the total amount you pay over time.

- Debt Consolidation: Combining multiple credit card balances into one can simplify your debt management and make it easier to track your progress.

- Potential for Savings: By transferring balances to a card with a lower interest rate, you can save money on interest charges, freeing up cash flow for other financial goals.

Limitations of Chase Credit Card Balance Transfers

While Chase credit card balance transfers offer advantages, it’s important to consider potential drawbacks:

- Balance Transfer Fees: Chase may charge a fee for transferring balances, typically a percentage of the transferred amount. This fee can impact your savings, so it’s essential to factor it into your calculations.

- Introductory Period Expiration: The 0% APR period is usually temporary, and after it expires, the standard interest rate will apply. If you don’t pay off the balance before the introductory period ends, you’ll start accruing interest at the higher rate.

- Credit Limit Impact: Transferring a large balance can significantly reduce your available credit on the Chase card, potentially affecting your credit utilization ratio and credit score.

Eligibility Requirements and Application Process

To be eligible for a Chase credit card balance transfer, you must meet certain criteria, including having a good credit score and a history of responsible credit use. You’ll also need to have a Chase credit card account in good standing.

The application process for a Chase credit card balance transfer is relatively straightforward. You can apply online, over the phone, or through a Chase branch.

Balance Transfer Eligibility

Chase typically looks for applicants with a good credit history, which includes a strong credit score and responsible payment behavior.

- Credit Score: Chase generally prefers applicants with a credit score of at least 670. This score reflects your creditworthiness and ability to manage debt responsibly.

- Credit History: A history of on-time payments and responsible credit use is crucial. Chase evaluates your credit utilization ratio (the amount of credit you’re using compared to your total available credit) and the length of your credit history.

- Chase Credit Card Account: You’ll need to have an existing Chase credit card account in good standing to be eligible for a balance transfer. This means that your account should be active and in good payment status.

- Debt-to-Income Ratio: Your debt-to-income ratio, which is the percentage of your monthly income that goes towards debt payments, is also considered. A lower debt-to-income ratio is generally preferred.

- Income: Chase may review your income to assess your ability to repay the balance transfer.

Application Process

The application process for a Chase credit card balance transfer is straightforward:

- Apply Online: The easiest way to apply is through the Chase website. You’ll need to provide your personal information, including your Social Security number, and details about your existing credit card account.

- Apply Over the Phone: You can also apply by calling Chase customer service. Be prepared to provide the same information as you would when applying online.

- Apply in Person: You can visit a Chase branch to apply in person. This option allows you to speak with a representative directly and ask any questions you may have.

Required Documents

The documents required for a Chase credit card balance transfer may vary depending on the specific card and your situation. However, generally, you’ll need to provide the following information:

- Personal Information: Your full name, address, Social Security number, date of birth, and contact information.

- Financial Information: Details about your income, employment, and existing debt.

- Credit Card Information: The account number and balance of the credit card you want to transfer.

Transfer Fees and Interest Rates

Chase credit card balance transfers can be a valuable tool for consolidating debt and saving money on interest. However, it is important to understand the fees and interest rates associated with these transfers before making a decision.

Balance transfer fees are charged by Chase when you transfer a balance from another credit card to a Chase credit card. These fees are typically a percentage of the amount transferred.

Transfer Fees

The transfer fee for Chase credit card balance transfers is typically a percentage of the amount transferred, usually ranging from 3% to 5%. This fee is charged upfront and is deducted from the amount of the balance transfer.

Interest Rates

The interest rate on a Chase credit card balance transfer can vary depending on your creditworthiness and the specific card you choose. Generally, balance transfer interest rates are lower than standard purchase interest rates. However, they are typically higher than the interest rates offered by some other balance transfer cards.

Impact of Fees and Interest Rates

Transfer fees and interest rates can significantly impact the overall cost of a balance transfer. It is essential to consider these costs when deciding whether a balance transfer is right for you. For example, a balance transfer fee of 3% on a $10,000 balance would cost you $300. If you are considering a balance transfer, you should compare the interest rates and fees offered by different credit card companies to find the best deal.

Transfer Limits and Timeframes

Chase credit card balance transfers are subject to specific limits and processing times, which can vary based on factors like your creditworthiness, account history, and the specific terms of your credit card.

Transfer Limits

The maximum transfer amount you can request depends on your credit limit and the specific terms of your Chase credit card. Chase typically sets a maximum balance transfer amount, but this can vary depending on the card you hold.

Processing Time, Chase credit transfer

Chase typically processes balance transfers within 7 to 10 business days. However, the actual processing time may vary depending on several factors, including:

Tips for Successful Balance Transfer

A Chase credit card balance transfer can be a valuable tool for managing debt, but to make the most of it, you need to be strategic. Here are some tips for maximizing the benefits of a balance transfer and ensuring a smooth transition.

Choosing the Right Chase Credit Card

The first step is to choose the right Chase credit card for your balance transfer needs. Not all Chase cards offer balance transfer promotions, and those that do may have varying terms and conditions. Consider these factors:

- Balance Transfer Fee: Look for a card with a low or no balance transfer fee, as this can save you significant money in the long run.

- Introductory APR: Aim for a card with a long introductory 0% APR period, ideally 12 to 18 months, to give you ample time to pay down your balance without accruing interest.

- Regular APR: Ensure the regular APR is reasonable, as it will kick in after the introductory period expires.

- Credit Limit: Choose a card with a credit limit that’s high enough to accommodate your balance transfer and allow for future purchases.

Managing Debt Effectively

Once you’ve successfully transferred your balance, it’s crucial to manage your debt effectively to avoid accruing interest after the introductory period ends. Here’s how:

- Set a Budget: Create a detailed budget that Artikels your income and expenses, allowing you to allocate a specific amount to your debt repayment each month.

- Make Minimum Payments: Always make at least the minimum payment on all your credit cards, even if you’re focusing on paying down the balance transfer card.

- Prioritize Payments: Prioritize payments on the card with the highest interest rate, as this will minimize the overall interest charges you pay.

- Consider Debt Consolidation: If you have multiple credit cards with high balances, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially save you money.

Potential Risks and Considerations: Chase Credit Transfer

While balance transfers can be a valuable tool for saving money on interest, they come with potential risks and considerations. It’s essential to weigh these factors carefully before deciding if a balance transfer is right for you.

Impact on Credit Score

Credit card balance transfers can have both positive and negative impacts on your credit score.

- A balance transfer can improve your credit utilization ratio, which is the percentage of available credit you’re using. This can lead to a higher credit score if your utilization ratio was previously high.

- However, applying for a new credit card to perform a balance transfer can lead to a hard inquiry on your credit report. Hard inquiries can temporarily lower your credit score, but their impact is usually minimal.

- If you don’t manage your new credit card responsibly and fall behind on payments, it can negatively affect your credit score.

Other Factors to Consider

- Transfer Fees: Chase credit card balance transfers typically involve a transfer fee, which can range from 3% to 5% of the transferred balance. This fee can significantly reduce the potential savings from a lower interest rate.

- Introductory Interest Rate: While Chase offers introductory 0% APR periods for balance transfers, these periods are usually limited. After the introductory period expires, the interest rate can increase significantly, potentially offsetting any initial savings.

- Minimum Payments: Make sure you understand the minimum payment requirements for your new credit card. Failing to make the minimum payment on time can result in late fees and damage your credit score.

- Credit Limit: Ensure that the credit limit on your new credit card is sufficient to cover your existing balance and any future purchases. If you exceed your credit limit, you may face over-limit fees and further damage your credit score.

Final Review

Ultimately, the decision to utilize a Chase credit card balance transfer hinges on your individual financial circumstances. By carefully weighing the potential benefits and risks, you can determine if this strategy aligns with your goals and helps you achieve financial freedom. Remember, a well-planned approach to debt management, including responsible credit card use and budgeting, can significantly improve your financial well-being in the long run.

Clarifying Questions

How long does it take for a Chase credit card balance transfer to be processed?

Processing times for Chase credit card balance transfers typically range from 7 to 14 business days. However, it’s essential to allow ample time for the transfer to complete, as the exact timeframe can vary depending on factors such as the amount being transferred and the lender’s processing speed.

Can I transfer a balance from a Chase credit card to another Chase credit card?

Yes, you can transfer a balance from one Chase credit card to another. However, keep in mind that the new card must be eligible for balance transfers and meet the minimum balance transfer amount. It’s advisable to contact Chase customer service to confirm the transfer process and eligibility requirements.