Citi credit transfers offer a streamlined way to manage your finances by allowing you to move funds between different Citibank accounts. Whether you need to consolidate debt, pay off a large purchase, or simply access funds more conveniently, Citi’s credit transfer services provide a flexible and secure solution.

This comprehensive guide will delve into the intricacies of Citi credit transfers, exploring their various types, benefits, requirements, and the entire process from initiation to completion. We’ll also discuss the security measures in place to protect your financial information and provide valuable tips for a smooth and hassle-free experience.

Citi Credit Transfer Basics

A Citi credit transfer allows you to move money from one Citibank account to another, making it a convenient way to manage your finances. This process can be helpful for various reasons, including consolidating debt, transferring funds for a specific purpose, or simply simplifying your banking experience.

Types of Citi Credit Transfers

Citi offers various credit transfer options, each designed to cater to specific needs. Here are some common types:

- Balance Transfer: This allows you to transfer the outstanding balance from one Citi credit card to another. This can be advantageous if you’re seeking a card with a lower interest rate or want to consolidate your debt.

- Account-to-Account Transfer: This option enables you to transfer funds between your Citi checking, savings, or money market accounts. This is useful for moving money between different accounts within Citibank.

- External Transfer: This allows you to transfer funds from your Citi account to an account at another financial institution. This option is convenient for paying bills or sending money to someone who banks with a different institution.

Initiating a Credit Transfer

The process of initiating a Citi credit transfer is straightforward and can be done through various channels. Here’s a step-by-step guide:

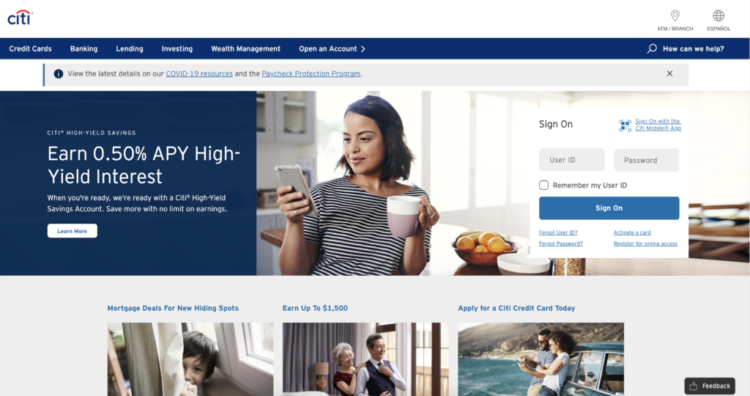

- Log in to your Citibank Online Banking account. This is the most common method for initiating a credit transfer.

- Navigate to the “Transfers” or “Move Money” section. The exact location may vary depending on your account type and the specific Citibank platform you’re using.

- Select the “Credit Transfer” option. This will display a form where you can specify the details of your transfer.

- Choose the source account and destination account. Enter the account numbers and amounts for both the sending and receiving accounts.

- Review and confirm the transfer details. Ensure all the information is accurate before proceeding.

- Submit the transfer request. Once you’ve confirmed the details, your transfer will be processed. The time it takes for the funds to be transferred will depend on the type of transfer and the destination institution.

Citibank may impose fees for certain types of credit transfers, so it’s essential to review the applicable fees before initiating the transfer.

Benefits of Citi Credit Transfers

Citi credit transfers offer a range of benefits, making them a valuable tool for managing debt and potentially saving money. By transferring balances from high-interest credit cards to a Citi card with a lower interest rate, you can reduce your overall debt burden and save on interest charges.

Potential Cost Savings, Citi credit transfer

Credit transfers can significantly reduce your overall interest costs. When you transfer a balance from a card with a high APR to a card with a lower APR, you’ll pay less interest over the life of the debt.

For example, if you have a $10,000 balance on a credit card with a 20% APR and transfer it to a Citi card with a 10% APR, you could save hundreds or even thousands of dollars in interest charges over the course of the repayment period.

Security and Safety

Citi Credit Transfer prioritizes the security and safety of your financial transactions. We implement robust measures to protect your data and ensure the integrity of your credit transfers.

Security Measures Implemented for Credit Transfers

Citi Credit Transfer employs a comprehensive suite of security measures to safeguard your financial transactions. These measures include:

- Data Encryption: All data transmitted during credit transfers is encrypted using industry-standard encryption protocols, such as Transport Layer Security (TLS), to prevent unauthorized access and interception.

- Two-Factor Authentication (2FA): We utilize 2FA to add an extra layer of security to your account. This requires you to provide both your password and a unique code generated by a mobile app or email, ensuring that only authorized users can access your account.

- Fraud Detection Systems: Advanced fraud detection systems continuously monitor credit transfer activities for suspicious patterns and anomalies. These systems leverage machine learning algorithms to identify and prevent fraudulent transactions.

- Secure Payment Gateways: We utilize secure payment gateways that comply with industry standards, such as Payment Card Industry Data Security Standard (PCI DSS), to protect your sensitive payment information during transactions.

Measures Taken to Protect Customer Data During Transfers

Citi Credit Transfer adheres to strict data privacy regulations and practices to protect your personal and financial information. We implement the following measures:

- Data Minimization: We collect only the essential data necessary for processing credit transfers, minimizing the amount of sensitive information stored.

- Access Control: Access to customer data is restricted to authorized personnel on a need-to-know basis. This ensures that only individuals with legitimate reasons can access your information.

- Regular Security Audits: We conduct regular security audits to assess the effectiveness of our security measures and identify any potential vulnerabilities. These audits help us maintain a robust security posture.

- Data Backup and Recovery: We maintain secure backups of customer data to ensure its availability in case of any unforeseen events, such as system failures or cyberattacks.

Preventing Fraudulent Credit Transfers

While we employ comprehensive security measures, it is essential to be proactive in protecting yourself from fraudulent credit transfers. Here are some tips to help prevent fraudulent activity:

- Be Vigilant: Be cautious of suspicious emails, phone calls, or text messages that request your personal or financial information. Do not click on links or open attachments from unknown sources.

- Monitor Your Account: Regularly review your account statements and transactions for any unauthorized activity. Report any suspicious activity to Citi Credit Transfer immediately.

- Use Strong Passwords: Create strong passwords that are difficult to guess and avoid using the same password for multiple accounts. Consider using a password manager to securely store your passwords.

- Enable Security Features: Utilize security features offered by Citi Credit Transfer, such as two-factor authentication and fraud alerts, to enhance your account protection.

Outcome Summary

Citi credit transfers empower you to manage your finances effectively, providing a convenient and secure way to move funds between your accounts. By understanding the different types of transfers, their benefits, and the requirements involved, you can make informed decisions that align with your financial goals. Remember to always prioritize security and utilize the resources available to ensure a smooth and successful transfer process.

FAQ Compilation: Citi Credit Transfer

What are the fees associated with Citi credit transfers?

Fees may vary depending on the type of transfer and the amount involved. It’s best to check with Citibank for the most up-to-date information on fees.

How long does a Citi credit transfer take to process?

Processing times can vary based on the transfer type. Typically, transfers between Citibank accounts are processed within a few business days.

What happens if I need to cancel a Citi credit transfer?

You may be able to cancel a pending credit transfer by contacting Citibank customer support. However, cancellation policies may vary depending on the transfer type.