Credit card balance transfer low interest offers a tempting solution for those burdened by high-interest debt. By transferring your balance to a card with a lower APR, you can potentially save money on interest charges and pay off your debt faster. However, it’s crucial to understand the nuances of balance transfers before diving in, as there are potential pitfalls to avoid.

This guide will delve into the ins and outs of credit card balance transfers, covering everything from finding the right offer to managing your balance effectively. We’ll also explore alternative debt consolidation strategies and highlight the importance of responsible financial management.

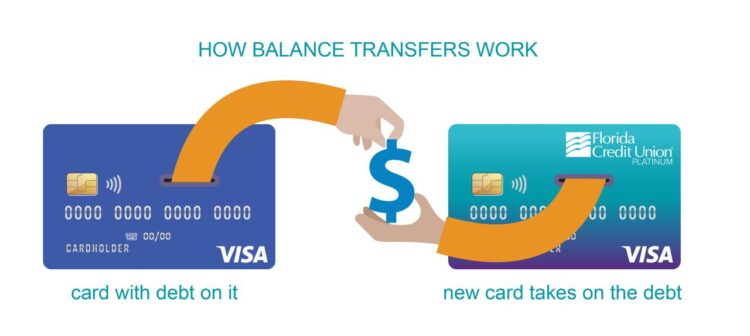

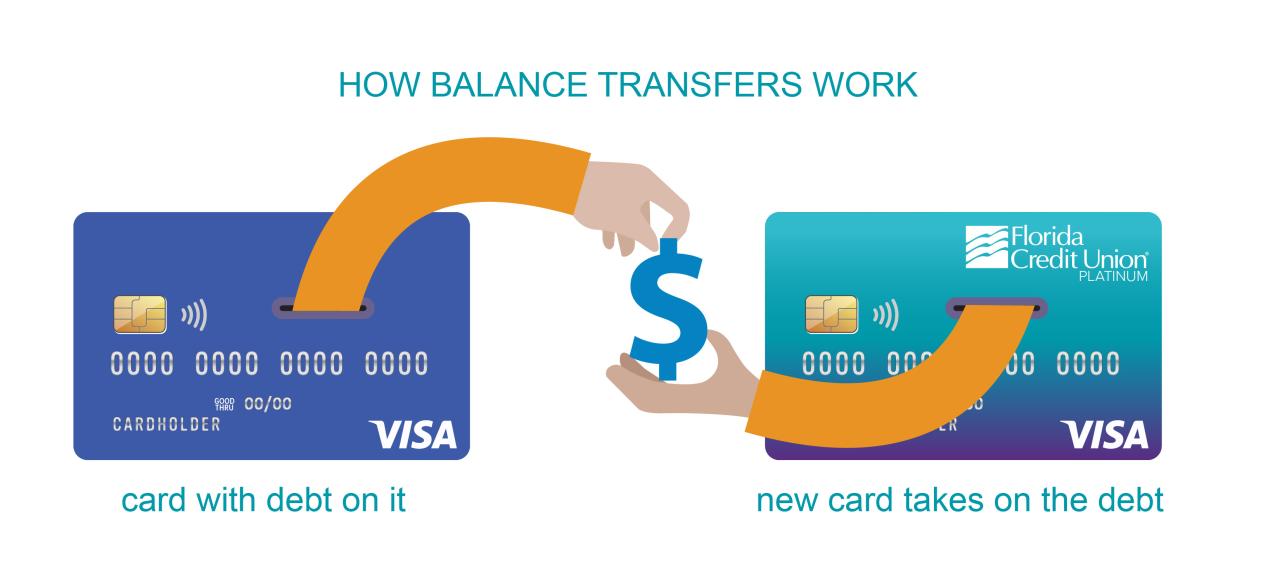

Understanding Credit Card Balance Transfers

A credit card balance transfer is a financial strategy that involves moving an outstanding balance from one credit card to another. This process typically entails transferring the existing debt to a new credit card with a lower interest rate, potentially saving you money on interest charges.

Benefits of Balance Transfers

Transferring your balance to a low-interest credit card can offer several advantages, primarily by helping you save money on interest charges.

- Reduced Interest Payments: By transferring your balance to a card with a lower APR, you can significantly reduce the amount of interest you pay over time, allowing you to pay down your debt faster.

- Lower Monthly Payments: A lower interest rate can result in lower monthly payments, making it easier to manage your debt and potentially free up more cash flow for other financial goals.

- Potential for Debt Consolidation: Balance transfers can be a helpful tool for consolidating multiple credit card debts into a single account, simplifying your debt management and potentially lowering your overall interest rate.

Potential Drawbacks and Risks of Balance Transfers

While balance transfers can be beneficial, it’s crucial to understand the potential drawbacks and risks associated with this strategy.

- Balance Transfer Fees: Most credit card issuers charge a balance transfer fee, typically a percentage of the transferred amount, which can add to your overall debt. It’s essential to factor this fee into your calculations to determine if a balance transfer is truly cost-effective.

- Introductory APR Periods: Many balance transfer offers feature introductory APR periods, during which you enjoy a low interest rate. However, this low rate is usually temporary, and after the introductory period, the interest rate can revert to a much higher standard APR. It’s crucial to understand the duration of the introductory period and the subsequent APR to avoid a sudden increase in your interest charges.

- Potential for Overspending: While balance transfers can help manage existing debt, they can also create an opportunity for overspending. If you’re not careful, you could end up adding new debt to your transferred balance, negating the benefits of the lower interest rate.

Finding the Right Balance Transfer Offer: Credit Card Balance Transfer Low Interest

Finding the right balance transfer offer can save you significant money on interest charges, but it’s essential to compare different options carefully. This involves understanding the interest rates, transfer fees, and other associated costs.

Comparing Interest Rates, Credit card balance transfer low interest

It’s crucial to compare the interest rates offered by different credit card providers. Look for cards with a low introductory APR (Annual Percentage Rate) for balance transfers. This introductory rate is usually valid for a specific period, such as 6, 12, or 18 months. After the introductory period, the interest rate typically reverts to a standard APR.

Analyzing Transfer Fees and Other Costs

Balance transfer offers often come with a transfer fee, which is a percentage of the amount transferred. The transfer fee can vary depending on the credit card provider. Some credit card providers may also charge other fees, such as an annual fee or a penalty fee for late payments.

- Transfer Fee: This is a percentage of the amount you transfer, typically ranging from 1% to 5% of the balance. It’s crucial to factor this fee into your calculations, as it can add a significant amount to your overall cost.

- Annual Fee: Some balance transfer credit cards may charge an annual fee. This fee is usually charged once a year, and it can vary depending on the card issuer.

- Late Payment Fee: A late payment fee is charged if you miss a payment on your balance transfer credit card. These fees can be substantial, so it’s important to make payments on time.

Finding the Best Balance Transfer Offer

Here are some tips to help you find the best balance transfer offer:

- Compare Interest Rates and Fees: Use a credit card comparison website or call different credit card providers to compare interest rates, transfer fees, and other costs.

- Look for a Long Introductory Period: A longer introductory period will give you more time to pay off your balance before the interest rate increases.

- Consider the Terms and Conditions: Carefully read the terms and conditions of any balance transfer offer before you accept it. Pay attention to the introductory period, the APR after the introductory period, and any other fees or penalties.

- Check Your Credit Score: Your credit score will affect the interest rate you qualify for. A higher credit score will generally get you a lower interest rate.

- Avoid Using the Card for New Purchases: Once you transfer your balance, try to avoid using the card for new purchases. This will help you focus on paying off your existing debt.

The Application Process

Applying for a balance transfer is generally straightforward, but understanding the steps and requirements is essential. This process involves filling out an application, providing necessary documentation, and waiting for approval.

Application Process

The application process for a balance transfer typically involves the following steps:

- Locate a balance transfer offer: Begin by researching different credit card companies and comparing their balance transfer offers. Consider factors like the interest rate, transfer fee, and any introductory periods.

- Pre-qualify for the offer: Most credit card issuers allow you to pre-qualify online without impacting your credit score. This step helps you understand your eligibility for the offer and gives you an idea of the interest rate and terms you might qualify for.

- Complete the application: If you decide to proceed, complete the balance transfer application form. This typically involves providing personal information, such as your name, address, Social Security number, and income details. You’ll also need to provide information about the credit card you wish to transfer the balance from, including the account number and balance amount.

- Provide required documentation: The lender may request additional documentation to verify your identity and financial information. This could include:

- Proof of income (pay stubs, tax returns, or bank statements)

- Copy of your driver’s license or passport

- Recent credit card statements

- Await approval: Once you submit the application, the lender will review your credit history and financial information. The approval process can take a few days to a week, depending on the lender.

- Complete the transfer: If approved, the lender will initiate the balance transfer from your old credit card to your new credit card. This process can take a few business days to complete.

Required Documents

The specific documents required for a balance transfer application can vary depending on the lender. However, common documents include:

- Proof of income: This could be in the form of pay stubs, tax returns, or bank statements.

- Government-issued identification: A driver’s license, passport, or other official identification is usually required.

- Credit card statements: You may need to provide recent statements from the credit card you’re transferring the balance from.

- Social Security number: This is required for verifying your identity and credit history.

Credit Score Requirements

Credit score requirements for balance transfer approvals can vary depending on the lender and the specific offer. However, generally, a good credit score (at least 670) is required for approval. A higher credit score often results in more favorable terms, such as a lower interest rate and a lower transfer fee.

“A credit score of 670 or higher is generally considered good and can increase your chances of approval for a balance transfer with favorable terms.”

Managing Your Balance Transfer

Once you’ve successfully transferred your balance, it’s crucial to manage it effectively to reap the benefits of the lower interest rate. This involves a combination of responsible budgeting, strategic repayment, and disciplined spending habits.

Creating a Budget for Balance Transfer Payments

A budget helps you track your income and expenses, ensuring you have enough money to make your balance transfer payments on time. This avoids late fees and potential damage to your credit score.

- Track your income: Record all sources of income, including your salary, bonuses, and any other regular payments.

- List your expenses: Categorize your expenses into essential (housing, food, utilities) and non-essential (entertainment, dining out). Identify areas where you can cut back to free up funds for your balance transfer payments.

- Allocate funds for your balance transfer: Dedicate a specific amount from your budget to your balance transfer payments. This ensures you prioritize paying down the debt.

- Review your budget regularly: Review your budget at least monthly to ensure it’s still accurate and adjust it as needed. Life changes can affect your income and expenses, so regular adjustments are essential.

Strategies for Paying Off the Transferred Balance Quickly

The faster you pay off the transferred balance, the less interest you’ll accrue and the quicker you’ll become debt-free. Here are some effective strategies:

- Make more than the minimum payment: Aim to pay more than the minimum amount due each month. Even a small increase can significantly shorten your repayment period.

- Consider making a lump-sum payment: If you have extra funds available, consider making a large payment towards your balance transfer. This can drastically reduce the principal amount and lower your overall interest costs.

- Set up automatic payments: Automate your balance transfer payments to ensure you never miss a deadline. This also frees up mental energy and reduces the risk of late fees.

- Negotiate a lower interest rate: Contact your credit card issuer and see if you can negotiate a lower interest rate on your balance transfer. This can save you money in the long run.

Avoiding New Charges on the Transferred Card

While you’re focusing on paying off the transferred balance, it’s crucial to avoid adding new charges to the same card. This can hinder your progress and prolong your debt repayment journey.

- Use a different card for everyday purchases: Switch to a different credit card for everyday purchases, allowing you to concentrate on paying down the balance transfer debt.

- Practice mindful spending: Be conscious of your spending habits and avoid impulsive purchases. Stick to your budget and prioritize essential expenses.

- Set spending limits: Set spending limits for yourself and track your progress. This helps you stay within your budget and avoid unnecessary debt accumulation.

Alternatives to Balance Transfers

While balance transfers can be a helpful tool for managing high-interest credit card debt, they’re not the only option. Exploring other debt consolidation strategies can be beneficial, especially if your credit score isn’t strong enough for a balance transfer offer or if you prefer a more structured approach to debt repayment.

Comparing Balance Transfers to Other Debt Consolidation Options

Balance transfers and other debt consolidation options offer different approaches to managing high-interest debt. It’s crucial to compare their features, benefits, and drawbacks to make an informed decision.

- Balance Transfers: These involve moving your existing credit card balances to a new card with a lower interest rate, often for a limited introductory period. They are a good option for those with good credit who can qualify for a low-interest transfer offer.

- Debt Consolidation Loans: These are personal loans designed to pay off multiple debts, including credit cards. They consolidate your debt into a single loan with a fixed interest rate and repayment term. These loans are beneficial for those seeking a fixed interest rate and a predictable repayment schedule.

- Debt Management Programs: These are offered by non-profit credit counseling agencies and involve working with a counselor to negotiate lower interest rates and monthly payments with your creditors. They can help you manage your debt and develop a repayment plan.

Debt Consolidation Loans

Debt consolidation loans offer a structured approach to managing multiple debts, often with a fixed interest rate and a set repayment term. This can provide a predictable repayment plan and potentially lower your overall interest costs, especially if your current credit card interest rates are high.

- Pros:

- Lower interest rates: You may qualify for a lower interest rate on a consolidation loan compared to your existing credit cards, potentially saving you money on interest charges.

- Fixed monthly payments: A fixed monthly payment makes budgeting easier and helps you track your progress towards debt repayment.

- Simplified repayment: Consolidating multiple debts into one loan simplifies your repayment process, reducing the number of payments you need to make.

- Cons:

- Harder to qualify: You may need a good credit score and a stable income to qualify for a debt consolidation loan.

- Origination fees: Some lenders charge origination fees, which can add to the overall cost of the loan.

- Potential for higher overall interest: If you take out a consolidation loan for a longer term, you might end up paying more interest over time.

Final Review

Navigating the world of credit card balance transfers requires careful consideration and a proactive approach. By understanding the benefits, risks, and best practices, you can make informed decisions that align with your financial goals. Remember, while balance transfers can be a valuable tool for debt management, they are not a quick fix. It’s essential to develop a comprehensive plan and commit to responsible spending habits to achieve long-term financial stability.

Answers to Common Questions

What is the typical interest rate for a balance transfer offer?

Interest rates for balance transfers vary widely, but they are generally lower than standard credit card rates. You can expect to find rates ranging from 0% to 18% or more, depending on your credit score and the issuer.

How long do balance transfer promotional periods last?

Promotional periods for balance transfers can last anywhere from 6 months to 18 months or even longer. It’s important to note that after the promotional period expires, the interest rate will revert to the card’s standard APR, which can be significantly higher.

Are there any fees associated with balance transfers?

Yes, most credit card issuers charge a fee for balance transfers, typically a percentage of the transferred amount. The fee can range from 1% to 5% or more. It’s crucial to factor in these fees when comparing offers.

What happens if I don’t pay off my balance transfer before the promotional period ends?

If you don’t pay off your balance transfer before the promotional period ends, you’ll start accruing interest at the card’s standard APR. This can quickly lead to a significant increase in your debt. Make sure you have a plan in place to pay off the balance before the promotional period expires.