Credit card no fee balance transfer offers a potentially powerful tool for tackling debt. By transferring your existing balances to a new card with a 0% introductory APR, you can avoid accruing interest for a set period, allowing you to pay down your debt faster and potentially save a significant amount of money. However, it’s essential to understand the nuances of balance transfers before diving in. While they can be a valuable strategy, there are also potential drawbacks to consider.

This guide will delve into the ins and outs of no fee balance transfers, covering everything from the benefits and drawbacks to choosing the right card and effectively managing your debt after the transfer. We’ll also explore the factors to consider when selecting a card, such as credit score requirements, interest rates, rewards programs, and customer service. By the end, you’ll be equipped with the knowledge to make an informed decision about whether a no fee balance transfer is the right solution for your financial situation.

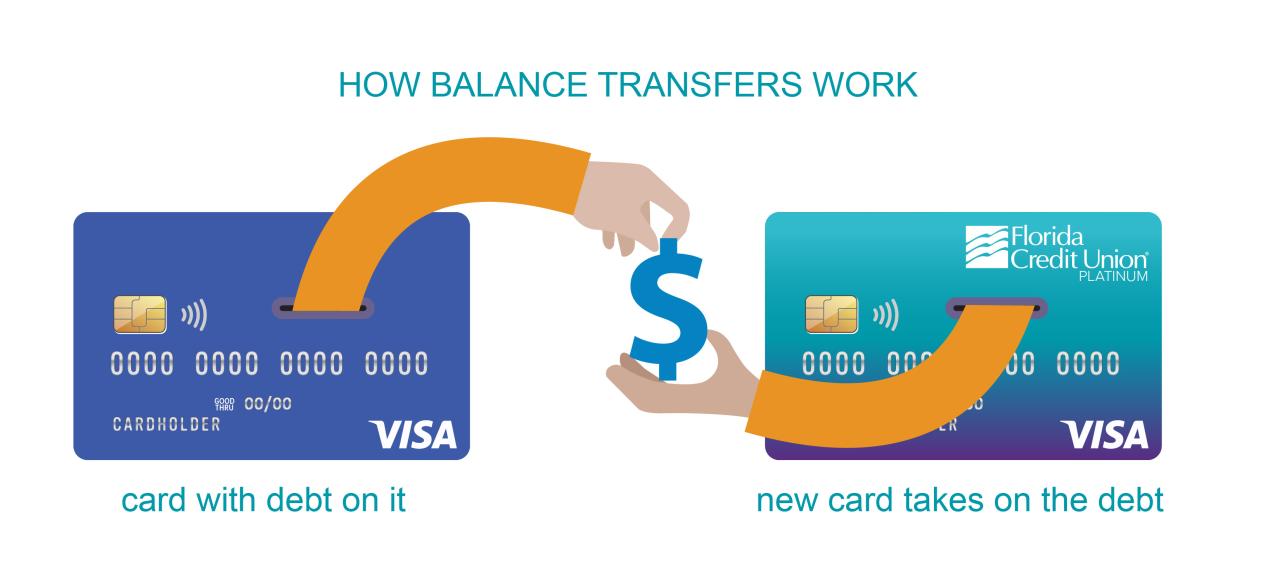

Understanding Balance Transfers

Balance transfers are a way to move debt from one credit card to another. This can be a useful tool for managing debt, especially if you can find a card with a lower interest rate.

When you transfer a balance, you’re essentially borrowing money from the new credit card to pay off the old one. The new card may offer a promotional period with a 0% interest rate for a certain time, allowing you to pay down your debt without accumulating interest charges.

Benefits of Balance Transfers

Balance transfers can offer several benefits, making them an attractive option for managing credit card debt:

- Lower Interest Rates: By transferring your balance to a card with a lower interest rate, you can save money on interest charges over time. This can significantly reduce the overall cost of your debt.

- Promotional 0% APR Periods: Many balance transfer cards offer introductory periods with 0% interest rates. This allows you to pay down your debt without accumulating interest charges for a specific time, giving you more flexibility and financial breathing room.

- Consolidation of Debt: Balance transfers can help you consolidate multiple credit card debts into a single account, simplifying your debt management and potentially reducing your monthly payments.

Potential Drawbacks of Balance Transfers

While balance transfers can be beneficial, it’s crucial to be aware of their potential drawbacks:

- Balance Transfer Fees: Many cards charge a fee for transferring a balance, typically a percentage of the amount transferred. These fees can add up and offset the savings from a lower interest rate, so it’s important to consider the overall cost.

- Limited Timeframes: Promotional 0% APR periods usually have a limited duration, typically 12 to 18 months. After the promotional period ends, the standard interest rate applies, potentially increasing your monthly payments significantly.

- Credit Score Impact: Applying for a new credit card for a balance transfer can impact your credit score. Hard inquiries from credit applications can temporarily lower your score, especially if you have multiple inquiries within a short period.

- Potential for Overspending: Having a new credit card with available credit can tempt you to overspend, potentially increasing your debt burden. It’s crucial to stick to a budget and avoid accumulating more debt while using a balance transfer card.

No Fee Balance Transfers

No fee balance transfers can be a great way to save money on interest charges and pay off your debt faster. However, it’s important to understand how they work and what to look for in a no-fee balance transfer card.

What are No Fee Balance Transfers?

A no-fee balance transfer is a transfer of your outstanding balance from one credit card to another, usually with a lower interest rate. No fee balance transfers are a popular way to save money on interest charges, as they typically come with a promotional period during which you can pay down your balance without accruing interest.

Credit Cards That Offer No Fee Balance Transfers

Many credit card companies offer no-fee balance transfer cards. Here are a few examples:

- Chase Slate: Offers a 0% intro APR for 15 months on balance transfers.

- Citi Simplicity®: Card: Offers a 0% intro APR for 21 months on balance transfers.

- Discover it® Balance Transfer: Offers a 0% intro APR for 18 months on balance transfers.

Comparing No Fee Balance Transfer Cards

When comparing no-fee balance transfer cards, it’s important to consider the following factors:

- Intro APR: The introductory APR is the interest rate you’ll be charged for a certain period.

- Promotional Period: The promotional period is the amount of time you have to pay off your balance before the intro APR expires.

- Balance Transfer Fee: While some cards offer no-fee balance transfers, others may charge a small fee, usually a percentage of the balance transferred.

- Regular APR: The regular APR is the interest rate you’ll be charged after the promotional period ends.

- Annual Fee: Some cards may have an annual fee.

Finding the Right Card

Now that you understand the basics of balance transfers and no-fee balance transfer cards, it’s time to find the right card for your needs. This process involves carefully considering your financial situation, comparing different card options, and making an informed decision.

Choosing a No-Fee Balance Transfer Card

To choose the best no-fee balance transfer card, follow these steps:

1. Determine your balance transfer needs: Consider the amount of debt you want to transfer, your desired introductory period, and any potential fees associated with the transfer.

2. Compare card offers: Research different no-fee balance transfer cards from various banks and credit card companies. Look for cards that offer competitive interest rates, introductory periods, and rewards programs.

3. Check your credit score: Balance transfer cards often have minimum credit score requirements. Ensure you meet the eligibility criteria before applying.

4. Review the terms and conditions: Carefully read the fine print, including the interest rate after the introductory period, annual fees, and any other charges.

5. Consider your spending habits: If you frequently use your credit card for everyday purchases, look for a card with rewards programs that align with your spending patterns.

Comparing Key Features of No-Fee Balance Transfer Cards

Here’s a table comparing the key features of some popular no-fee balance transfer cards:

| Card Name | APR | Balance Transfer Fee | Introductory Period |

|—|—|—|—|

| Card A | 14.99% | 0% | 18 months |

| Card B | 16.99% | 0% | 12 months |

| Card C | 13.99% | 0% | 21 months |

Factors to Consider When Selecting a Card

- Credit score requirements: Different cards have varying credit score requirements. Ensure you meet the minimum score to be eligible for the card.

- Interest rate after the introductory period: After the introductory period ends, the interest rate will revert to the standard APR. Make sure you can comfortably manage the higher interest payments.

- Rewards program: Some balance transfer cards offer rewards programs, such as cash back or points, for purchases made using the card.

- Customer service: Choose a card issuer with a reputation for excellent customer service. This can be helpful if you encounter any issues with your account.

Transferring Your Balance

Transferring your balance to a new credit card is a process that involves moving the outstanding balance from your existing card to a new one. This can be a beneficial strategy for saving money on interest charges, especially if you’re currently carrying a high balance on a card with a high APR.

Balance Transfer Process

The balance transfer process typically involves the following steps:

- Apply for a balance transfer credit card: Start by researching and applying for a balance transfer credit card that offers a 0% introductory APR for a specific period. Carefully review the terms and conditions of the card, including the transfer fee and the duration of the introductory period.

- Get approved: Once you’re approved for the card, you’ll receive a credit limit. This limit determines the maximum amount you can transfer.

- Provide your old credit card information: The issuer of your new card will require the account number, balance, and other details of the credit card you’re transferring from. This information will be used to initiate the balance transfer.

- Initiate the transfer: You can usually initiate the transfer online, over the phone, or by mail. Some issuers may allow you to transfer your balance directly from your existing card’s website.

- Monitor the transfer: Keep an eye on your accounts to ensure the balance transfer has been completed successfully. You should receive confirmation from both the new and old card issuers.

Balance Transfer Requirements and Documentation

To transfer your balance, you’ll typically need to meet certain requirements and provide specific documentation.

- Good credit score: Most balance transfer cards require a good credit score, typically above 670. This is because issuers want to ensure you’re a responsible borrower and will repay the transferred balance.

- Available credit limit: Your new card issuer will need to have enough available credit to accommodate the balance you’re transferring. If you’re transferring a large balance, you may need to apply for a card with a high credit limit.

- Documentation: You’ll likely need to provide your old credit card account number, the amount you want to transfer, and any other relevant information. Some issuers may require you to sign a balance transfer agreement.

Calculating Potential Savings

Balance transfers can help you save money on interest charges, but it’s essential to calculate the potential savings before you make a decision.

Potential Savings = (Old Card APR – New Card APR) * Outstanding Balance

For example, if you have an outstanding balance of $5,000 on a card with a 20% APR and you transfer it to a card with a 0% APR for 12 months, your potential savings would be:

(20% – 0%) * $5,000 = $1,000

This calculation assumes you pay the minimum amount due each month and don’t make any additional purchases on the new card during the introductory period. However, it’s crucial to remember that once the introductory period ends, the APR will revert to the standard rate, and you’ll start accruing interest again.

Managing Your Debt

A balance transfer can be a great way to save money on interest and pay off your debt faster, but it’s important to manage your debt effectively after the transfer. Here are some strategies to help you stay on track and avoid accumulating more debt.

Strategies for Managing Debt After a Balance Transfer

After transferring your balance, it’s crucial to establish a plan for managing your debt effectively. This involves understanding your spending habits, setting realistic goals, and employing strategies to minimize future debt accumulation.

- Create a Budget: Tracking your income and expenses allows you to identify areas where you can cut back and allocate more funds toward debt repayment. A detailed budget helps you understand your financial situation and prioritize debt repayment.

- Set Realistic Goals: Establish achievable targets for debt repayment, considering your income and expenses. This could involve setting a monthly payment amount or aiming to pay off the balance within a specific timeframe.

- Avoid New Debt: Refrain from acquiring new credit card debt or taking on additional loans. Focus on paying off your existing debt before taking on new financial obligations.

- Consider Debt Consolidation: If you have multiple high-interest debts, debt consolidation might be an option. This involves combining your debts into a single loan with a lower interest rate, potentially simplifying repayment and reducing interest charges.

Steps to Avoid Accumulating New Debt

Preventing the accumulation of new debt is crucial for achieving financial stability. Here’s a checklist to help you avoid falling back into debt:

- Track Your Spending: Monitor your spending habits closely using a budgeting app, spreadsheet, or notebook. This allows you to identify areas where you can cut back and allocate more funds toward debt repayment.

- Resist Impulse Purchases: Before making a purchase, consider whether it’s a necessity or a want. Avoid impulsive purchases that can add to your debt burden. If you have a strong desire for something, wait a few days before buying it to ensure it’s a well-considered decision.

- Use Cash for Small Purchases: Paying for small purchases with cash can help you stay within your budget and avoid accumulating credit card debt. Cash transactions provide a tangible reminder of your spending and can encourage more mindful purchasing habits.

- Set Spending Limits: Establish spending limits for different categories, such as groceries, entertainment, or dining out. This helps you stay within your budget and avoid overspending. You can use a budgeting app or spreadsheet to track your spending and ensure you’re adhering to your limits.

- Pay Bills on Time: Late payments can result in penalties and higher interest rates. Set reminders or use online bill pay services to ensure your bills are paid promptly. Timely payments can help you maintain a good credit score and avoid accumulating unnecessary debt.

Tips for Paying Off Your Balance as Quickly as Possible, Credit card no fee balance transfer

Accelerating your debt repayment can save you significant interest charges and help you achieve financial freedom sooner. Here are some tips for paying off your balance as quickly as possible:

- Make More Than the Minimum Payment: Paying more than the minimum payment each month will significantly reduce your balance and interest charges. Even a small increase in your payment amount can make a big difference over time.

- Prioritize High-Interest Debt: Focus on paying off your highest-interest debt first, as this will save you the most money on interest charges. This approach can be more effective than focusing on the smallest balance first.

- Use the Debt Snowball Method: This method involves paying off your smallest debts first, regardless of interest rates. This can provide a sense of accomplishment and motivate you to continue paying down your debt.

- Consider a Debt Consolidation Loan: If you have multiple high-interest debts, a debt consolidation loan could help you lower your interest rate and simplify repayment. This can be a viable option if you have a good credit score and can qualify for a lower interest rate.

Wrap-Up

Navigating the world of credit card balance transfers requires careful consideration and a strategic approach. By understanding the benefits, drawbacks, and key factors involved, you can make an informed decision about whether a no fee balance transfer is right for you. Remember to choose a card that aligns with your financial goals and manage your debt responsibly to maximize the potential savings and avoid future debt accumulation.

Query Resolution: Credit Card No Fee Balance Transfer

What is the typical introductory period for a no fee balance transfer card?

Introductory periods for no fee balance transfer cards can vary, but they typically range from 12 to 18 months.

Can I transfer my entire balance from one card to another?

Yes, you can typically transfer your entire balance from one card to another, up to the credit limit of the new card.

What happens after the introductory period ends?

After the introductory period, the standard APR of the card will apply to your remaining balance. Make sure to understand the APR before transferring your balance.

Are there any other fees associated with balance transfers?

While some cards offer no fee balance transfers, others may charge a small percentage fee for the transfer. Check the terms and conditions of the card before transferring your balance.