Credit card transfer comparison is a crucial step in managing your debt effectively. By understanding the different offers available, you can potentially save money on interest charges and streamline your repayment process. From transfer fees to interest rates, a comprehensive comparison helps you make informed decisions and choose the option that aligns best with your financial goals.

This guide will delve into the key factors to consider when comparing credit card transfer offers, providing insights into transfer fees, interest rates, transfer periods, and minimum payments. We’ll also explore strategies for minimizing costs and maximizing the benefits of credit card transfers.

Introduction to Credit Card Transfers

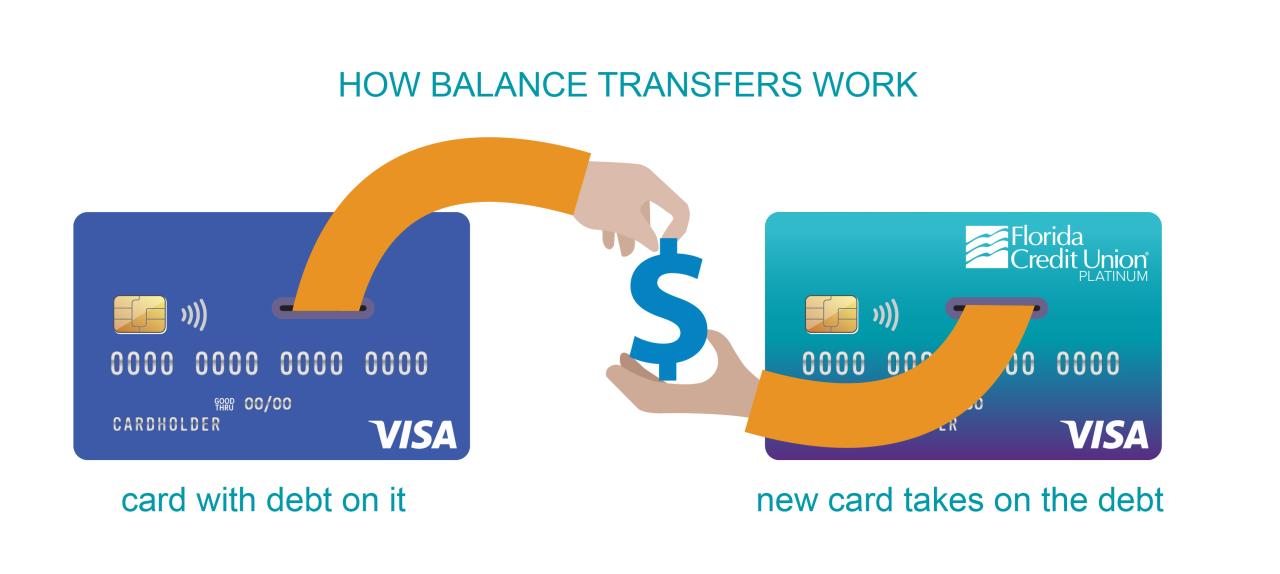

Credit card transfers allow you to move balances from one credit card to another. This can be a useful tool for managing debt, but it’s important to understand the nuances of this financial maneuver before making a decision.

Credit card transfers can be categorized into two main types:

Balance Transfers

Balance transfers involve moving the outstanding balance from one credit card to another, often with the aim of taking advantage of a lower interest rate offered by the new card. This can be a strategic move to save money on interest charges, especially if you have a high-interest credit card. For example, if you have a balance of $5,000 on a credit card with a 20% APR and transfer it to a card with a 0% introductory APR for 12 months, you can potentially save a significant amount of interest during that period.

Cash Advance Transfers

Cash advance transfers allow you to withdraw cash from your credit card account and transfer it to another account. This is often used for situations where you need immediate access to cash, but it usually comes with higher interest rates and fees compared to regular purchases.

Benefits of Credit Card Transfers

There are several benefits to credit card transfers:

- Lower Interest Rates: Transferring your balance to a card with a lower APR can save you money on interest charges.

- Consolidation of Debt: You can simplify your debt management by combining multiple credit card balances into one.

- 0% Introductory APR Offers: Many credit cards offer introductory periods with 0% APR, allowing you to pay down your balance without accruing interest.

Potential Drawbacks of Credit Card Transfers

While credit card transfers can be beneficial, they also have potential drawbacks:

- Transfer Fees: Some credit cards charge fees for balance transfers, which can eat into any potential savings.

- Introductory APR Expiration: The 0% APR period on most credit cards is temporary. Once it expires, the standard APR will apply, which could be significantly higher.

- Impact on Credit Score: Applying for a new credit card can temporarily lower your credit score, especially if you already have multiple recent credit inquiries.

Factors to Consider When Comparing Credit Card Transfers

When considering a credit card balance transfer, it’s crucial to compare offers from different lenders to find the most beneficial option. Several key factors play a significant role in determining the best choice for your specific needs.

Transfer Fees

Transfer fees are charges levied by credit card issuers when you move a balance from another card to their card. These fees are typically a percentage of the balance transferred, ranging from 1% to 5%. It’s essential to consider these fees when comparing offers as they can significantly impact the overall cost of the transfer.

For instance, if you transfer a $10,000 balance with a 3% transfer fee, you’ll pay a $300 fee.

Interest Rates

The interest rate charged on the transferred balance is a critical factor. A lower interest rate can save you significant interest charges over time.

It’s vital to compare the interest rates offered by different lenders and choose the one with the lowest rate.

Transfer Periods

The transfer period refers to the duration for which the introductory interest rate is applicable. This period can vary from a few months to several years.

It’s crucial to understand the transfer period and ensure it aligns with your financial goals.

Minimum Payments, Credit card transfer comparison

The minimum payment amount required each month is another crucial factor. A higher minimum payment can make it challenging to pay off the balance quickly.

It’s recommended to choose a card with a manageable minimum payment to avoid falling behind on your payments.

Last Recap

Navigating the world of credit card transfers can be daunting, but by carefully comparing offers and understanding the intricacies involved, you can unlock substantial savings and optimize your debt management strategy. Remember, the key is to find an offer that aligns with your individual needs and financial situation, ensuring a smooth and cost-effective transfer experience.

FAQ Guide: Credit Card Transfer Comparison

What is the best time to transfer a credit card balance?

The best time to transfer a credit card balance is when you can secure a low introductory interest rate, typically during promotional periods. However, remember to factor in transfer fees and the duration of the introductory offer.

How do credit card transfers affect my credit score?

Credit card transfers can impact your credit score, both positively and negatively. While transferring a balance can help you manage debt and potentially lower your overall interest payments, it can also increase your credit utilization ratio, which could temporarily lower your score.

Can I transfer a credit card balance to a different type of card?

You can typically transfer a credit card balance to another credit card, but transferring to a different type of card, such as a debit card or a personal loan, might not be possible. Always check the terms and conditions of both the original and the new card before initiating a transfer.