Credit card with 0 interest and no transfer fee – Credit card with 0% interest and no transfer fee sounds like a dream, right? It’s a financial tool that can help you save money on interest charges and avoid transfer fees when consolidating high-interest debt. Imagine transferring your existing balances to a new card with a 0% introductory APR and enjoying a period of time to pay down your debt without accumulating interest. But, like any financial product, it comes with its own set of advantages and disadvantages. This article will guide you through the ins and outs of these cards, helping you understand how they work, whether they’re right for you, and how to use them effectively.

This article will delve into the intricacies of 0% interest credit cards with no transfer fees, exploring their benefits, drawbacks, and how to make the most of them. We’ll also cover the importance of understanding promotional periods, transfer fee policies, and the factors to consider when choosing the right card for your needs.

Introduction to 0% Interest Credit Cards

A 0% interest credit card offers a period of time where you can use the card without accruing any interest charges on your balance. This can be a valuable tool for managing debt or making large purchases, but it’s crucial to understand the terms and conditions before applying.

The concept of a promotional period is central to 0% interest credit cards. This period, typically lasting several months, is the timeframe during which you’ll enjoy the 0% interest rate. After the promotional period ends, the standard interest rate, often much higher, applies.

Advantages of 0% Interest Credit Cards

A 0% interest credit card can be advantageous in several ways:

- Debt Consolidation: Transferring high-interest debt to a 0% interest credit card can save you significant interest charges, allowing you to pay off the debt faster.

- Large Purchases: Spreading out the cost of a large purchase, such as a new appliance or a vacation, with a 0% interest card can make it more manageable financially.

- Build Credit: Responsible use of a 0% interest credit card, such as making timely payments, can help improve your credit score.

Disadvantages of 0% Interest Credit Cards

While 0% interest credit cards offer benefits, they also have some drawbacks:

- Limited Time: The promotional period is finite, and once it ends, you’ll be subject to the standard interest rate, which can be significantly higher.

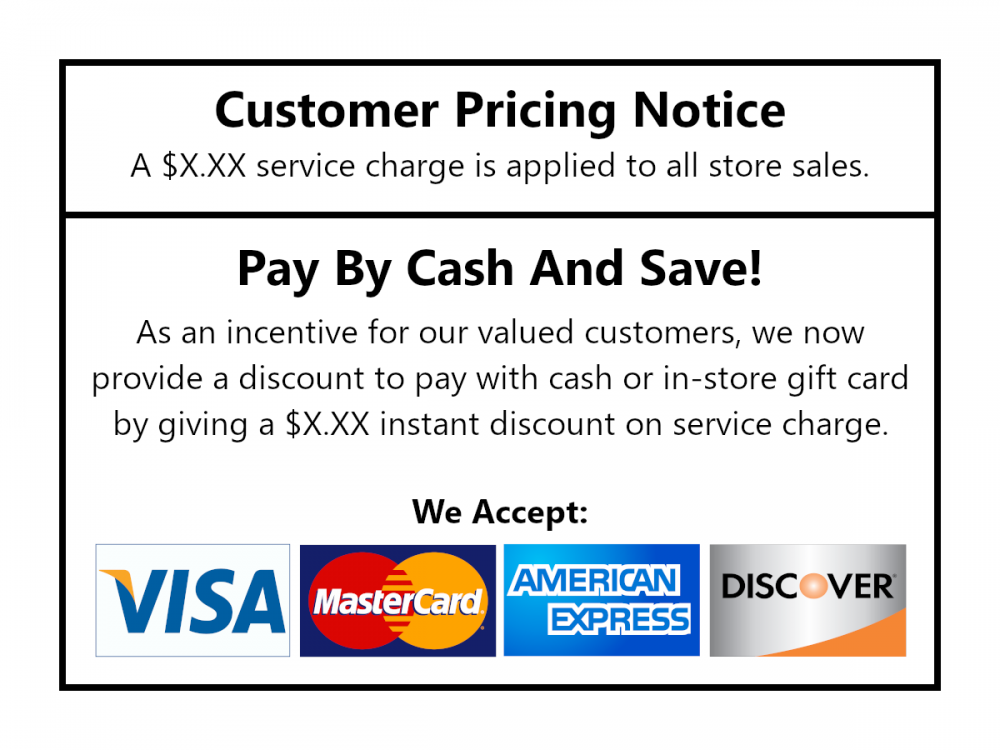

- Balance Transfer Fees: Some cards charge a fee for transferring balances from other credit cards, which can eat into the potential savings.

- Temptation to Overspend: The convenience of 0% interest can lead to overspending, which can create a debt burden once the promotional period ends.

Managing Your 0% Interest Credit Card: Credit Card With 0 Interest And No Transfer Fee

A 0% interest credit card can be a powerful tool for managing debt or making large purchases, but it’s crucial to use it responsibly. Without careful planning, you could easily end up paying interest or late fees, negating the benefits of the introductory period.

Budgeting and Tracking Spending, Credit card with 0 interest and no transfer fee

Budgeting and tracking your spending are essential for managing your 0% interest credit card effectively. A well-defined budget helps you allocate funds for necessary expenses and avoid overspending. Tracking your spending allows you to identify areas where you can cut back and stay within your budget.

“Creating a budget is like making a plan for your money. It helps you decide how much you’ll spend and save each month.”

By sticking to your budget, you can ensure you’re not using more credit than you can comfortably repay during the promotional period. Additionally, tracking your spending helps you stay informed about your financial situation and avoid unexpected surprises.

Key Considerations for Managing a 0% Interest Credit Card

The following table Artikels key considerations for managing a 0% interest credit card:

| Factor | Description |

|---|---|

| Promotional Period | The length of time you’ll enjoy 0% interest. Make sure you have a plan to pay off the balance before the promotional period ends. |

| APR (Annual Percentage Rate) | The interest rate you’ll be charged after the promotional period expires. Ensure you understand the APR and compare it to other credit cards. |

| Minimum Payment | The minimum amount you need to pay each month. While making only the minimum payment may seem convenient, it can prolong the repayment period and increase interest charges. |

| Fees | Be aware of any fees associated with the card, such as annual fees, balance transfer fees, or late payment fees. |

| Credit Limit | The maximum amount you can borrow on the card. Use your credit limit wisely and avoid maxing out the card. |

Avoiding Late Fees and Interest Charges

To avoid late fees and interest charges during the promotional period, consider the following tips:

- Set Reminders: Set reminders for your payment due date and ensure you make payments on time. Many credit card companies offer online account management tools or mobile apps that allow you to set up alerts.

- Automate Payments: Consider setting up automatic payments to ensure your bills are paid on time. This eliminates the risk of forgetting or missing a payment.

- Pay More Than the Minimum: Making more than the minimum payment each month can help you pay off the balance faster and reduce the total interest charges.

- Monitor Your Balance: Regularly check your credit card balance and track your spending to ensure you’re staying within your budget.

Final Wrap-Up

In conclusion, credit cards with 0% interest and no transfer fees can be a valuable tool for debt consolidation and financial management. By understanding their features, carefully considering your options, and managing your spending responsibly, you can leverage these cards to achieve your financial goals. Remember, the key is to use them strategically and avoid falling into the trap of accruing interest after the promotional period ends. So, if you’re looking for a way to simplify your finances and reduce your debt burden, exploring 0% interest credit cards with no transfer fees might be the right move for you.

General Inquiries

What happens after the promotional period ends on a 0% interest credit card?

Once the promotional period ends, the standard APR for the card kicks in. You’ll start accruing interest on your remaining balance at the regular rate, which can be significantly higher than the introductory 0% APR. It’s crucial to pay down your balance as much as possible during the promotional period to minimize the impact of the higher interest rate.

Are there any income requirements for getting a 0% interest credit card?

Credit card issuers typically have income requirements, but they vary widely. Some may require a minimum income level, while others may focus more on your credit score and debt-to-income ratio. It’s best to check the specific requirements of the card you’re interested in.

Can I transfer all my debt to a 0% interest credit card?

While you can often transfer a significant amount of debt, there may be limits on the total amount you can transfer to a 0% interest credit card. It’s essential to review the card’s terms and conditions to understand any transfer limits.