Credit card with zero balance transfer – Zero balance transfer credit cards offer a compelling solution for those seeking to consolidate debt and potentially save on interest payments. These cards, as the name suggests, allow you to transfer existing balances from other credit cards to a new card with a 0% introductory APR, often for a limited period. This can be a game-changer for individuals looking to shed high-interest debt and gain some breathing room in their budget.

The allure of zero balance transfer credit cards lies in their potential to significantly reduce interest charges, especially when compared to high-APR credit cards. By transferring your balance to a card with a 0% introductory APR, you can avoid accruing interest for a set period, allowing you to focus on paying down the principal balance faster. However, it’s crucial to understand the intricacies of these cards, including their introductory periods, transfer fees, and the potential risks associated with carrying a balance after the promotional period expires.

Zero Balance Transfer Credit Cards

Zero balance transfer credit cards are a type of credit card that allows you to transfer your existing credit card balances to a new card with a zero percent introductory APR (annual percentage rate) for a specific period. This means you won’t have to pay any interest on the transferred balance during the introductory period, allowing you to save money on interest charges.

These cards can be a valuable tool for managing debt and saving money on interest. They offer a temporary reprieve from high interest rates, giving you time to pay down your debt without accruing additional interest charges.

Benefits of Zero Balance Transfer Credit Cards

Zero balance transfer credit cards offer several benefits that can make them a valuable financial tool.

- Lower Interest Rates: The most significant benefit of zero balance transfer cards is the opportunity to pay down debt at a lower interest rate. By transferring your balance to a card with a 0% introductory APR, you can avoid paying interest charges for a specified period, potentially saving hundreds or even thousands of dollars in interest payments.

- Debt Consolidation: Zero balance transfer cards can help you consolidate multiple credit card balances into one, making it easier to manage your debt and track your payments.

- Improved Credit Score: Paying down your debt on time can improve your credit score, as your credit utilization ratio (the amount of credit you’re using compared to your available credit) decreases.

Common Scenarios Where Zero Balance Transfer Cards Are Beneficial

Here are some common scenarios where a zero balance transfer card can be advantageous:

- High-Interest Debt: If you have a credit card with a high interest rate, transferring your balance to a zero balance transfer card can help you save money on interest charges and pay down your debt faster.

- Multiple Credit Card Balances: If you have multiple credit cards with outstanding balances, consolidating them into a single zero balance transfer card can simplify your debt management and make it easier to track your payments.

- Unexpected Expenses: If you’ve incurred unexpected expenses, such as medical bills or car repairs, a zero balance transfer card can help you manage the debt and avoid accruing high interest charges.

How Zero Balance Transfer Credit Cards Work

Zero balance transfer credit cards offer a temporary escape from high-interest debt by allowing you to move your existing balance to a new card with a lower introductory APR. This can save you money on interest charges, giving you time to pay down your debt.

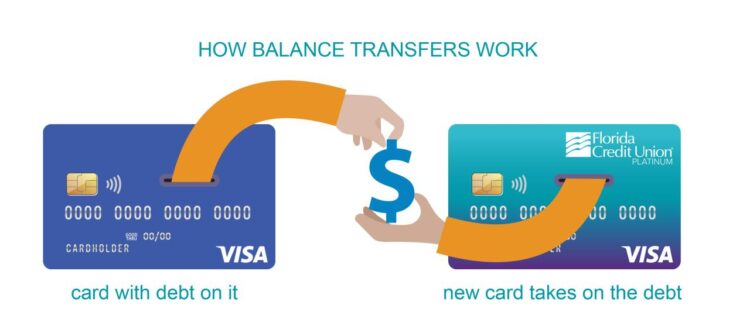

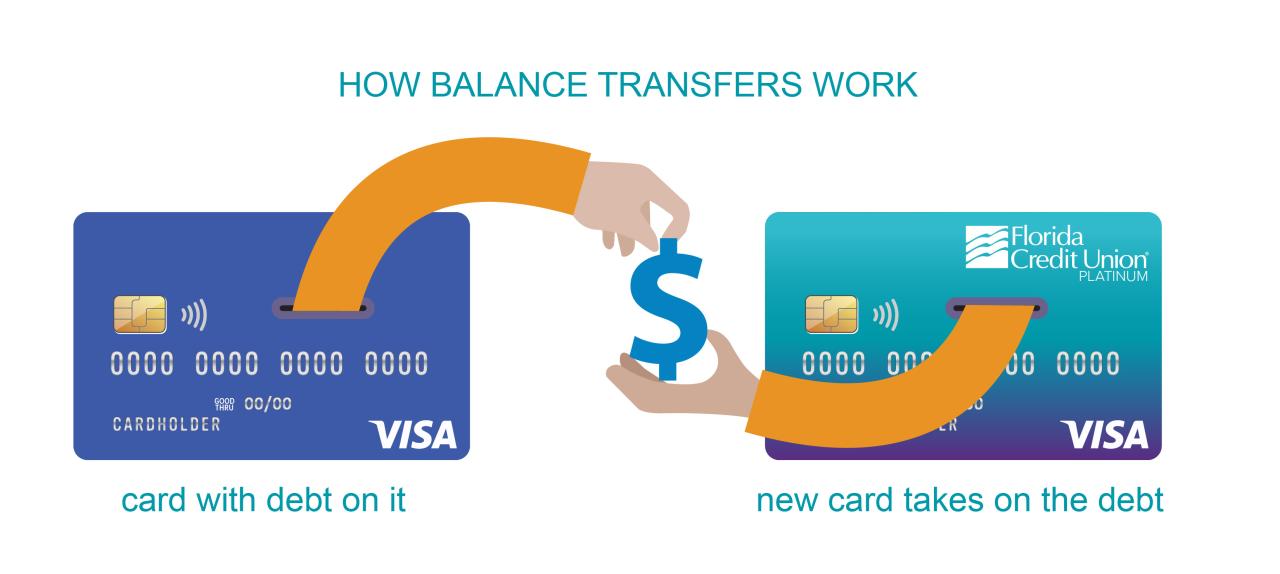

Balance Transfer Process

To transfer your balance, you’ll need to apply for a zero balance transfer credit card and be approved. Once approved, you’ll provide the card issuer with the account number and balance you wish to transfer. The issuer will then contact your existing card provider to initiate the transfer.

Introductory Period

Zero balance transfer cards typically offer an introductory period with a 0% APR, allowing you to avoid interest charges for a set amount of time. This period can range from 6 to 18 months, depending on the card issuer.

Interest Rates and Fees

While zero balance transfer cards offer a temporary reprieve from high interest, it’s important to understand the associated fees and interest rates:

- Balance Transfer Fee: Most zero balance transfer cards charge a fee, usually a percentage of the transferred balance, for transferring your debt. This fee can range from 3% to 5% of the balance.

- Regular APR: After the introductory period ends, the interest rate on your balance will revert to the card’s standard APR, which can be significantly higher than the introductory rate.

- Late Payment Fees: You’ll be charged a late payment fee if you miss your minimum payment due date.

- Cash Advance Fees: If you use the card for cash advances, you’ll likely face a higher interest rate and a cash advance fee.

Potential Risks and Considerations

Zero balance transfer credit cards can be a helpful tool for managing debt, but it’s essential to understand the potential risks and considerations before applying. While these cards offer an attractive introductory period with zero interest, there are crucial factors to keep in mind to avoid falling into a debt trap.

Carrying a Balance After the Introductory Period

After the introductory period ends, the interest rate on your transferred balance will revert to the card’s standard APR. This rate can be significantly higher than the introductory rate, making it challenging to pay down your debt if you’re still carrying a balance. For example, if your balance is $5,000 and the standard APR is 20%, you could end up paying hundreds of dollars in interest each year.

Being Denied a Balance Transfer, Credit card with zero balance transfer

Not everyone is approved for a balance transfer. Credit card issuers typically evaluate your creditworthiness before approving a balance transfer request. Factors like your credit score, credit history, and debt-to-income ratio can impact your chances of approval. If you have a low credit score or a history of missed payments, you might be denied a balance transfer.

Avoiding Late Payments and Fees

Late payments can significantly impact your credit score and lead to additional fees. To avoid late payments, set reminders for your due date, consider using autopay, and ensure you have enough funds available to cover your minimum payment. Additionally, be aware of other potential fees associated with balance transfers, such as balance transfer fees, annual fees, and over-limit fees.

Alternatives to Zero Balance Transfer Cards: Credit Card With Zero Balance Transfer

Zero balance transfer cards offer a tempting solution for debt consolidation, but they’re not the only option. If you’re looking to reduce your debt and save on interest, exploring other avenues could lead to better outcomes.

Balance Transfers with Lower Interest Rates

Balance transfer cards are a popular choice for debt consolidation. They allow you to transfer existing balances from high-interest credit cards to a new card with a lower APR. While zero balance transfer cards offer an initial interest-free period, many other balance transfer cards provide lower interest rates for a set period. This can be a more advantageous approach if you can pay off your debt within that timeframe.

Conclusive Thoughts

Zero balance transfer credit cards can be a powerful tool for debt management, but they require careful consideration. Before jumping into a balance transfer, thoroughly evaluate your credit score, the introductory period, transfer fees, and the APR that kicks in after the promotional period ends. By understanding the nuances of these cards and utilizing them strategically, you can potentially alleviate debt burden and take control of your finances. Remember, responsible use is key to maximizing the benefits of zero balance transfer cards and achieving your financial goals.

Key Questions Answered

What happens after the introductory period ends?

After the introductory period, the standard APR for the card applies to your remaining balance. This APR can be significantly higher than the 0% introductory APR, so it’s crucial to pay down the balance as quickly as possible before the promotional period expires.

Can I use a zero balance transfer card for new purchases?

Yes, you can typically use a zero balance transfer card for new purchases, but it’s important to note that interest will accrue on those purchases at the standard APR, which may be high. It’s generally advisable to use the card solely for balance transfers and pay off the transferred balance before making any new purchases.

How do I qualify for a zero balance transfer credit card?

To qualify for a zero balance transfer credit card, you generally need a good credit score and a history of responsible credit use. Credit card issuers assess your creditworthiness to determine your eligibility for these cards.

Are there any other fees associated with balance transfers?

Yes, some credit card issuers charge transfer fees, which are typically a percentage of the amount you transfer. It’s essential to compare the fees associated with different cards before making a decision.