Credit cards that offer balance transfer with 0 apr – Credit cards that offer balance transfer with 0% APR can be a powerful tool for managing debt, allowing you to consolidate high-interest balances and potentially save on interest charges. This type of card provides a temporary grace period during which you can pay down your debt without accruing interest, giving you a chance to get ahead financially.

These cards are particularly beneficial for individuals with existing credit card debt carrying high interest rates. By transferring your balance to a card with a 0% APR, you can potentially save a significant amount of money in interest charges. However, it’s crucial to understand the terms and conditions of these cards, including the introductory period, balance transfer fees, and potential penalties for late payments.

Understanding Balance Transfers and 0% APR: Credit Cards That Offer Balance Transfer With 0 Apr

A balance transfer is a way to move debt from one credit card to another, often to take advantage of a lower interest rate or promotional offer. This can be a useful tool for managing debt, but it’s important to understand how it works and the potential benefits and drawbacks.

What is a Balance Transfer?

A balance transfer is the process of moving an outstanding balance from one credit card to another. This is typically done to take advantage of a lower interest rate or a promotional period with 0% APR on the new card. The process involves applying for a new credit card that offers balance transfer options, transferring the balance from your existing card to the new card, and then paying off the balance on the new card according to the terms of the balance transfer offer.

What is 0% APR?

0% APR stands for 0% Annual Percentage Rate. This means that you will not be charged any interest on your balance during the promotional period. This can be a significant advantage for consumers who are carrying a balance on their credit cards, as it can save them a substantial amount of money in interest charges.

Benefits of Balance Transfers with 0% APR

- Lower Interest Costs: The most significant benefit of balance transfers is the potential to save money on interest charges. By transferring your balance to a card with 0% APR, you can avoid paying interest for a set period, allowing you to focus on paying down the principal balance.

- Debt Consolidation: Balance transfers can be a convenient way to consolidate multiple credit card debts into one. This can simplify your debt management and make it easier to track your payments.

- Improved Credit Score: Making on-time payments on a balance transfer card can help improve your credit score, as it demonstrates responsible credit management. This can be beneficial when applying for other types of credit, such as a mortgage or auto loan.

Potential Drawbacks and Risks

- Balance Transfer Fees: Many credit card companies charge a balance transfer fee, typically a percentage of the transferred balance. This fee can eat into any potential savings from the lower interest rate.

- Limited Time Period: The 0% APR promotional period is typically for a limited time, such as 6, 12, or 18 months. After the promotional period ends, the standard APR on the card will apply, which can be significantly higher. It is crucial to have a plan to pay off the balance before the promotional period expires to avoid high interest charges.

- Hard Inquiry on Your Credit Report: Applying for a new credit card will result in a hard inquiry on your credit report, which can temporarily lower your credit score.

- Minimum Payment Trap: If you only make the minimum payment on your balance transfer card, it may take a long time to pay off the balance, especially if the promotional period is short. This can lead to accumulating interest charges after the promotional period ends.

Factors to Consider Before Transferring

Before you apply for a balance transfer credit card, it’s crucial to carefully consider several key factors that can impact your financial well-being. This includes understanding the terms of the promotional period, evaluating your credit score and eligibility, and assessing your ability to pay off the balance within the 0% APR timeframe.

Evaluating the Introductory 0% APR Period, Credit cards that offer balance transfer with 0 apr

The introductory 0% APR period is the most appealing feature of balance transfer cards. It’s essential to carefully review the length of this period and any associated fees. A longer introductory period gives you more time to pay off your balance without accruing interest charges. However, remember that this period is not indefinite, and interest charges will kick in once it expires.

Assessing Fees

Balance transfer cards often come with fees, such as a balance transfer fee, an annual fee, or a foreign transaction fee. These fees can significantly impact your savings, especially if you transfer a large balance. Compare fees across different cards and consider their impact on your overall cost.

Understanding Your Credit Score and Eligibility Requirements

Your credit score plays a significant role in determining your eligibility for a balance transfer card and the interest rate you qualify for. Lenders typically offer better terms to individuals with good credit scores. Before applying, check your credit score and ensure you meet the minimum credit score requirement for the card. You can also check the eligibility criteria on the card issuer’s website to determine if you qualify.

Minimizing the Risk of Incurring Interest Charges

To avoid accruing interest charges during the promotional period, it’s crucial to create a repayment plan and stick to it. Consider the following tips:

- Set a realistic budget: Determine how much you can afford to pay each month towards your balance transfer card.

- Automate payments: Set up automatic payments to ensure you don’t miss any deadlines.

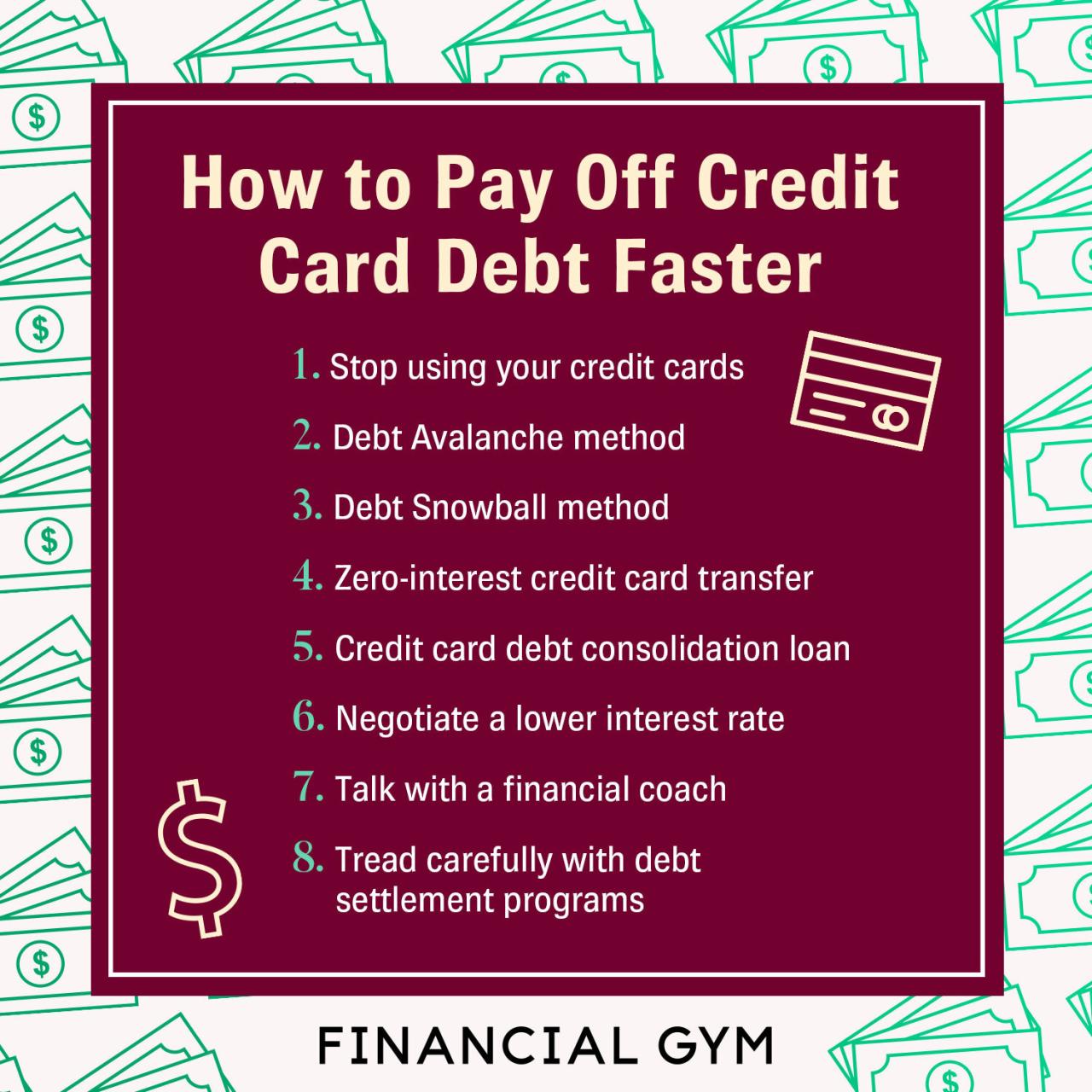

- Consider a debt consolidation loan: If you have multiple debts, a debt consolidation loan can help simplify your repayments and potentially secure a lower interest rate.

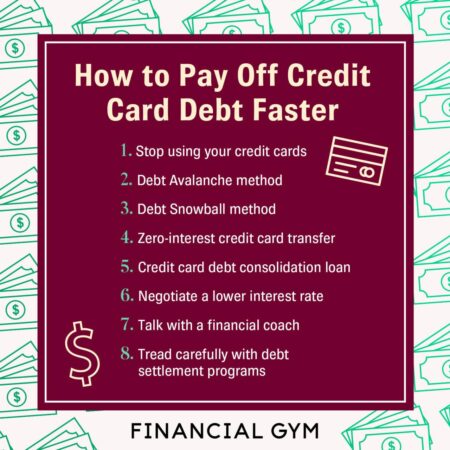

Strategies for Effective Utilization

A balance transfer credit card with 0% APR can be a powerful tool for saving money on interest charges and paying off debt faster. However, maximizing its benefits requires careful planning and execution.

Creating a Repayment Plan

Developing a repayment plan is crucial to ensure you pay off the transferred balance within the promotional period. This strategy involves determining a monthly payment amount that is manageable and ensures complete debt repayment before the 0% APR offer expires.

- Calculate the Total Balance: Begin by determining the total amount of debt you want to transfer. Include any interest charges or fees associated with the transfer.

- Determine the Promotional Period: Identify the length of the 0% APR offer. This information is typically found in the card’s terms and conditions.

- Calculate Monthly Payments: Use an online debt calculator or a spreadsheet to determine the monthly payment amount needed to pay off the balance within the promotional period.

- Adjust for Other Expenses: Consider your overall budget and adjust your monthly payment amount as needed. You may need to make some temporary lifestyle changes to free up more funds for debt repayment.

- Set Up Automatic Payments: To avoid late payments and ensure consistent progress, set up automatic payments from your bank account to your credit card.

Monitoring Credit Card Activity

Maintaining vigilance over your credit card activity during the promotional period is vital to prevent accruing interest charges. This involves tracking all transactions and ensuring you only use the card for the balance transfer.

- Avoid New Purchases: Resist the temptation to use the card for new purchases during the promotional period. This can lead to interest charges and hinder your debt repayment progress.

- Regularly Review Statements: Carefully review your monthly statements for any unexpected charges or fees.

- Set Spending Limits: Consider setting a spending limit on the card to prevent accidental overspending.

Managing Credit Utilization

Maintaining a healthy credit utilization ratio is crucial for a strong credit score. This ratio is calculated by dividing your total credit card balances by your total credit limits.

- Keep Utilization Low: Aim to keep your credit utilization ratio below 30%. A lower ratio demonstrates responsible credit management and can positively impact your credit score.

- Avoid Maxing Out Cards: Avoid using your credit card to its full limit. This can negatively impact your credit score and make it harder to secure future loans or credit.

- Pay Down Balances Regularly: Make regular payments on your credit card balances to keep your utilization ratio low.

Conclusive Thoughts

Choosing a credit card that offers balance transfer with 0% APR can be a smart financial decision, but it’s essential to carefully consider all the factors involved. By understanding the terms, fees, and potential risks, you can make an informed choice that aligns with your financial goals. Remember, utilizing these cards strategically and paying off the transferred balance within the promotional period is key to maximizing their benefits and achieving financial freedom.

Questions and Answers

What happens after the 0% APR period ends?

Once the introductory period ends, the standard APR for the card will apply to your remaining balance. It’s crucial to pay off the transferred balance before this happens to avoid accruing high interest charges.

How do I know if I qualify for a balance transfer credit card?

Credit card issuers have specific eligibility requirements. Typically, you’ll need a good credit score and a history of responsible credit use. It’s recommended to check your credit report and score before applying.

Can I transfer my entire balance from another card?

Most balance transfer credit cards have a limit on the amount you can transfer. Check the terms and conditions of the card to determine the maximum transfer amount.