- Credit Cards with No Balance Transfer Fee and 0% Interest

- Understanding Balance Transfer Fees and Interest Rates

- Eligibility and Application Process

- Responsible Use and Management

- Alternatives to Balance Transfer Cards

- Ultimate Conclusion: Credit Cards With No Balance Transfer Fee And 0 Interest

- Quick FAQs

Credit cards with no balance transfer fee and 0 interest – Credit cards with no balance transfer fee and 0% interest offer a lifeline for those burdened by high-interest debt. These cards allow you to transfer existing balances from other cards without incurring transfer fees and enjoy a period of 0% interest, giving you breathing room to pay down your debt without accruing additional interest charges. Imagine consolidating your debt onto one card, eliminating monthly interest payments, and using the saved money to pay down your principal faster – that’s the power of these cards.

This type of credit card can be a valuable tool for managing debt, but understanding how they work and their potential drawbacks is crucial. In this guide, we’ll delve into the world of balance transfer cards, exploring their benefits, features, and considerations before you make a decision.

Credit Cards with No Balance Transfer Fee and 0% Interest

Credit cards with no balance transfer fee and 0% interest offer a compelling opportunity to save money on existing debt. These cards allow you to transfer balances from high-interest credit cards to a card with a promotional period of 0% interest, often lasting several months or even years. This can significantly reduce your overall interest payments and accelerate your debt repayment journey.

How These Cards Work

These cards typically work by providing a promotional period during which you can transfer balances from other credit cards without incurring a balance transfer fee. The 0% interest rate applies to the transferred balance for a specified period, allowing you to focus on paying down the principal without accruing interest. After the promotional period, the interest rate reverts to the card’s standard APR, which can be significantly higher.

Advantages of Using These Cards

- Reduced Interest Payments: By transferring balances to a card with 0% interest, you can save a substantial amount of money on interest charges. This can be especially beneficial if you have a high-interest balance on an existing card.

- Faster Debt Repayment: With 0% interest, your monthly payments go directly towards paying down the principal balance, enabling you to pay off your debt faster. This can help you become debt-free sooner and improve your credit score.

- Flexibility and Convenience: These cards offer the flexibility to consolidate multiple debts into one account, simplifying your repayment process. They can also provide additional benefits such as rewards programs, travel perks, or purchase protection.

Real-World Scenario

Imagine you have a $5,000 balance on a credit card with a 20% APR. By transferring this balance to a card with a 0% introductory APR for 18 months, you could potentially save thousands of dollars in interest charges. During the promotional period, you would only pay the minimum monthly payment, allowing you to focus on paying down the principal balance. Once the promotional period ends, you would need to ensure you have a plan to pay off the remaining balance before the higher interest rate kicks in.

Understanding Balance Transfer Fees and Interest Rates

Transferring a balance from one credit card to another can be a useful strategy for managing debt, especially when you find a card offering a 0% introductory APR. However, it’s crucial to understand the associated fees and how interest rates work after the introductory period.

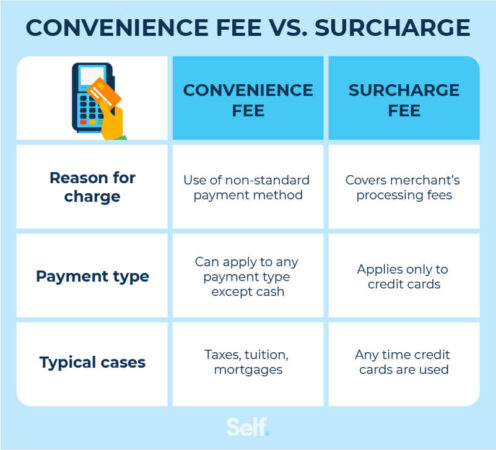

Balance Transfer Fees

Balance transfer fees are charged by credit card issuers when you move a balance from another card to theirs. These fees are typically a percentage of the balance transferred, ranging from 2% to 5% of the total amount. For instance, if you transfer a $10,000 balance and the fee is 3%, you’ll be charged $300.

Introductory 0% Interest Periods

Many credit cards offer introductory periods with 0% APR on balance transfers. This means you won’t accrue interest on the transferred balance for a specific duration, usually ranging from 6 to 18 months. This can be advantageous if you need time to pay down your debt without accruing interest.

Interest Rates After the Introductory Period, Credit cards with no balance transfer fee and 0 interest

Once the introductory period ends, the interest rate on your balance transfer will revert to the card’s standard APR. These rates can vary significantly, ranging from around 15% to 30% or higher. It’s crucial to carefully review the terms and conditions of any balance transfer offer to understand the interest rate that will apply after the introductory period.

Eligibility and Application Process

Securing a credit card with no balance transfer fee and 0% interest often involves meeting specific eligibility requirements. These cards are typically designed for individuals with good to excellent credit history. Understanding the application process and taking steps to improve your creditworthiness can increase your chances of approval.

Eligibility Requirements

Issuers consider several factors when evaluating applications for balance transfer cards.

- Credit Score: A good credit score, generally 670 or higher, is usually required. A higher score may improve your chances of getting approved and securing a lower interest rate.

- Credit History: A positive credit history, including timely payments on existing accounts and limited credit utilization, is essential.

- Income: Credit card issuers often assess your income to determine your ability to manage debt responsibly.

- Debt-to-Income Ratio: This ratio compares your monthly debt payments to your gross monthly income. A lower ratio indicates a better ability to handle debt.

Applying for a Balance Transfer Card

The application process for a balance transfer card typically involves these steps:

- Choose a card: Research different cards and compare their features, such as interest rates, balance transfer fees, and introductory periods.

- Complete the application: Provide your personal and financial information, including your Social Security number, income, and credit history.

- Submit the application: Once you complete the application, submit it electronically or by mail.

- Wait for approval: The issuer will review your application and notify you of their decision.

- Transfer your balance: If approved, you can transfer your balance from your existing card to the new one.

Tips for Increasing Approval Chances

- Check your credit report: Review your credit report for any errors and dispute them with the credit bureaus.

- Pay down existing debt: Reducing your debt-to-income ratio can improve your creditworthiness.

- Avoid applying for too much credit: Multiple credit inquiries can negatively impact your credit score.

- Consider a secured credit card: If you have limited credit history, a secured credit card can help build your credit score.

Responsible Use and Management

Utilizing credit cards with no balance transfer fees and 0% interest offers a valuable opportunity to manage debt effectively and potentially save money on interest charges. However, it’s crucial to approach these cards with a responsible mindset to maximize their benefits and avoid potential pitfalls.

Here’s a guide to help you make the most of these cards while maintaining a healthy financial standing.

Best Practices for Effective Utilization

Utilizing credit cards with no balance transfer fees and 0% interest requires a strategic approach to ensure you reap the benefits without falling into debt traps. Here are some best practices to consider:

- Transfer only high-interest debt: Focus on transferring balances from cards with the highest interest rates to maximize savings. This prioritizes debt reduction and allows you to allocate your payments more effectively.

- Avoid new purchases: Resist the temptation to make new purchases on the card during the introductory period. This ensures you dedicate all your payments to reducing the transferred balance and avoids accruing new interest charges.

- Set a payment schedule: Develop a realistic payment plan that Artikels how much you’ll pay each month to ensure you pay off the balance before the introductory period ends. Consider using a debt snowball or debt avalanche method to prioritize repayment.

- Track your spending: Monitor your spending habits closely to avoid overspending and accumulating new debt. Tools like budgeting apps or spreadsheets can help you track your expenses and stay on track with your repayment goals.

Managing Balance Transfers

Effectively managing balance transfers involves a systematic approach to ensure a smooth transition and efficient debt reduction. Here’s a step-by-step guide to navigate the process:

- Compare card offers: Research different credit cards with no balance transfer fees and 0% interest to find the best terms and conditions, including the introductory period, interest rate after the promotional period, and any annual fees.

- Apply for the card: Once you’ve chosen a suitable card, apply and ensure you meet the eligibility criteria.

- Initiate the balance transfer: After your application is approved, contact the new card issuer to initiate the balance transfer process. You’ll typically need to provide details of the account you’re transferring from, including the account number and balance.

- Confirm the transfer: Verify the transferred balance and ensure it’s reflected correctly on your new card statement.

- Make payments: Start making payments on the new card according to your payment schedule.

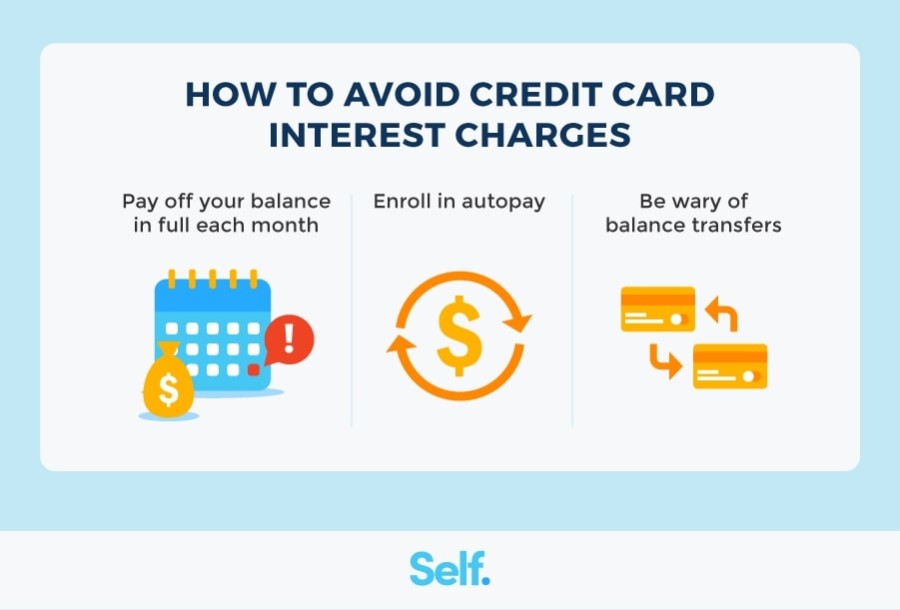

Importance of Paying Off the Balance Before the Introductory Period Expires

The introductory period for 0% interest offers a valuable window to pay down your debt without accruing interest charges. However, it’s crucial to pay off the balance before this period ends. Failing to do so will result in a significant interest rate increase, potentially negating the benefits of the balance transfer.

- High interest rates: After the introductory period, the interest rate on these cards typically reverts to a standard rate, which can be significantly higher than the initial 0% rate. This can quickly add up to a substantial amount of interest charges.

- Debt accumulation: Failing to pay off the balance within the promotional period can lead to a cycle of debt accumulation, as you’ll be paying more in interest than you can afford to pay down the principal balance.

- Credit score impact: Carrying a balance on your card after the introductory period can negatively impact your credit score, making it more difficult to secure loans or credit in the future.

Alternatives to Balance Transfer Cards

While balance transfer cards can be a valuable tool for managing debt, they are not the only solution. Several other options can help you consolidate your debt and potentially save money.

This section will explore some alternatives to balance transfer cards, comparing their pros and cons and outlining potential risks.

Personal Loans

Personal loans are a popular alternative to balance transfer cards, offering a fixed interest rate and a set repayment period.

Here are some key aspects of personal loans:

* Pros:

* Fixed Interest Rate: Unlike credit cards, personal loans usually have a fixed interest rate, protecting you from rate increases.

* Set Repayment Period: A fixed repayment period allows you to budget effectively and track your progress.

* Potential for Lower Interest Rates: Personal loans often offer lower interest rates than credit cards, especially if you have good credit.

* Cons:

* Loan Application Process: Applying for a personal loan can involve a credit check and income verification, which may affect your credit score.

* Origination Fees: Some lenders charge origination fees, which can add to the overall cost of the loan.

* Risks:

* Potential for Higher Interest Rates: If you have a low credit score, you may be offered a higher interest rate on a personal loan.

* Debt Consolidation: While a personal loan can consolidate debt, it doesn’t necessarily address the underlying spending habits that led to debt accumulation.

Debt Management Programs

Debt management programs (DMPs) are offered by non-profit credit counseling agencies and can help you manage and reduce your debt.

Here’s a breakdown of DMPs:

* Pros:

* Lower Interest Rates: DMPs can negotiate lower interest rates with your creditors.

* Reduced Monthly Payments: By consolidating your debt into a single monthly payment, DMPs can make your debt more manageable.

* Financial Counseling: Credit counseling agencies provide guidance on managing your finances and avoiding future debt.

* Cons:

* Fees: DMPs typically charge a monthly fee.

* Credit Score Impact: Enrolling in a DMP can negatively impact your credit score.

* Risks:

* Limited Eligibility: Not everyone qualifies for a DMP.

* Potential for Credit Score Damage: Enrolling in a DMP can negatively impact your credit score.

Ultimate Conclusion: Credit Cards With No Balance Transfer Fee And 0 Interest

While balance transfer cards can be a powerful tool for debt management, they are not a magic bullet. It’s essential to use them responsibly and strategize your repayment plan to avoid accruing interest once the introductory period ends. Remember, these cards are designed to help you get out of debt, not to accumulate more. By carefully evaluating your options and using these cards strategically, you can take control of your finances and pave the way for a brighter financial future.

Quick FAQs

What is the typical introductory 0% interest period offered by balance transfer cards?

Introductory 0% interest periods on balance transfer cards typically range from 12 to 21 months, although some cards may offer longer periods.

What happens to the interest rate after the introductory period ends?

Once the introductory period ends, the interest rate on your balance transfer card will revert to the standard APR, which can be significantly higher. It’s crucial to have a plan in place to pay off your balance before the introductory period expires.

Are there any other fees associated with balance transfer cards?

Besides the balance transfer fee, some cards may charge annual fees or other miscellaneous fees. Make sure to read the terms and conditions carefully before applying.