- Introduction to Zero Interest Credit Cards

- Zero Transfer Fee Credit Cards

- Finding the Best Zero Interest and Zero Transfer Fee Credit Cards: Credit Cards With Zero Interest And Zero Transfer Fee

- Using Zero Interest and Zero Transfer Fee Credit Cards Effectively

- Alternatives to Zero Interest and Zero Transfer Fee Credit Cards

- Closure

- Frequently Asked Questions

Credit cards with zero interest and zero transfer fee are a tempting proposition, offering the allure of debt consolidation without the burden of upfront costs. These cards, often marketed as a solution for high-interest debt or large purchases, can seem like a financial panacea. However, as with any financial product, it’s essential to understand the nuances and potential pitfalls before diving in.

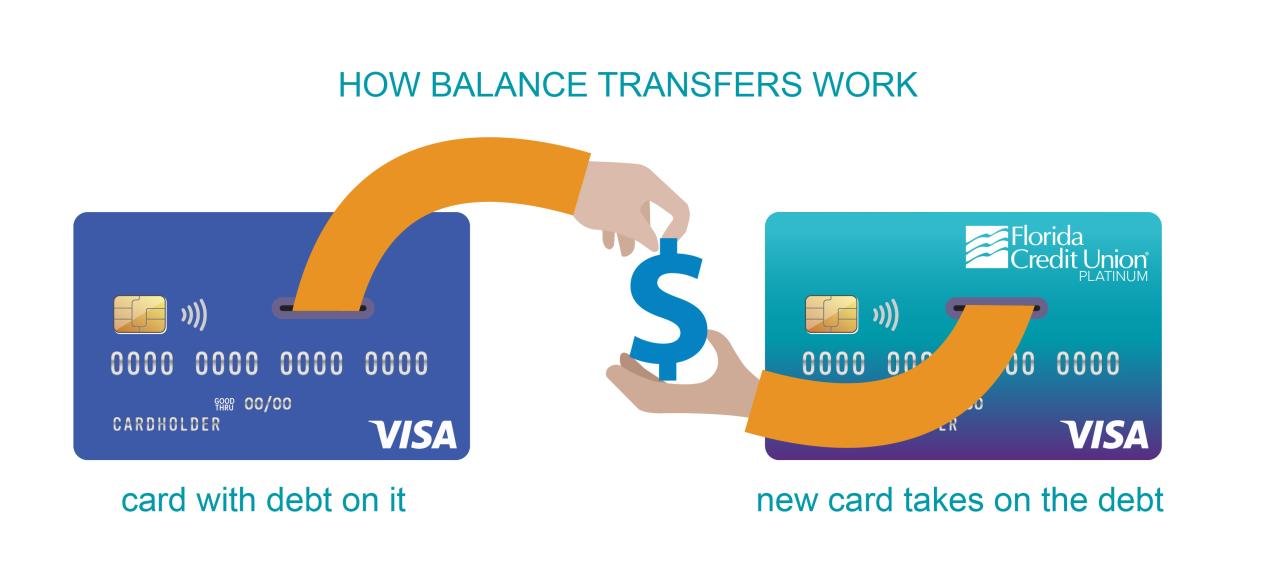

Zero interest credit cards typically come with an introductory period, during which you can enjoy the benefit of no interest charges. However, this period is usually limited, and once it ends, the interest rate can skyrocket. Zero transfer fee cards, on the other hand, allow you to transfer balances from other credit cards without incurring a transfer fee. While this can be advantageous for consolidating debt, it’s crucial to remember that you’re still responsible for the interest on the transferred balance.

Introduction to Zero Interest Credit Cards

Zero interest credit cards are a popular financial tool that allows consumers to make purchases or consolidate debt without accruing interest for a specified period. These cards offer an attractive proposition, particularly for individuals looking to manage their finances effectively.

Zero interest credit cards appeal to consumers because they provide a temporary respite from interest charges, allowing them to save money and potentially pay off their debt faster. This feature makes them ideal for consolidating high-interest debt, such as credit card balances or personal loans, as well as for making large purchases, such as home renovations or car repairs.

Benefits of Zero Interest Credit Cards, Credit cards with zero interest and zero transfer fee

Zero interest credit cards offer several benefits, making them a valuable financial tool for consumers:

- Debt Consolidation: Zero interest credit cards can be used to consolidate multiple high-interest debts into a single, lower-interest loan. This can simplify debt management and potentially reduce overall interest payments.

- Large Purchases: Zero interest credit cards provide the flexibility to make large purchases without incurring interest charges during the introductory period. This can be beneficial for individuals who need to finance significant expenses, such as home improvements or medical bills.

- Improved Credit Score: Using a zero interest credit card responsibly and paying off the balance within the introductory period can help improve your credit score. This can lead to better interest rates on future loans and credit cards.

Potential Drawbacks of Zero Interest Credit Cards

While zero interest credit cards offer significant advantages, it’s crucial to be aware of their potential drawbacks:

- High Interest Rates After Introductory Period: Once the introductory period ends, the interest rate on a zero interest credit card can revert to a much higher rate, potentially exceeding the rates on other credit cards. This can result in substantial interest charges if the balance isn’t paid off before the promotional period ends.

- Balance Transfer Fees: Some zero interest credit cards charge a balance transfer fee when you transfer debt from another card. This fee can significantly impact the overall cost of using the card.

- Annual Fees: Some zero interest credit cards have annual fees, which can add to the overall cost of using the card. It’s essential to consider the annual fee when comparing different cards.

Strategies for Maximizing Zero Interest Credit Card Benefits

To maximize the benefits of a zero interest credit card, it’s essential to implement effective strategies:

- Set a Budget and Payment Plan: Create a realistic budget and payment plan that ensures you can pay off the balance in full before the introductory period ends.

- Avoid Overspending: Resist the temptation to overspend simply because you have a zero interest credit card. Stick to your budget and only make purchases you can afford to pay off within the promotional period.

- Monitor Your Account: Regularly monitor your account balance and due dates to ensure you stay on track with your payments.

- Consider a Balance Transfer: If you have high-interest debt, consider transferring the balance to a zero interest credit card to potentially save on interest charges. However, remember to factor in any balance transfer fees.

Zero Transfer Fee Credit Cards

Zero transfer fee credit cards are a valuable tool for consumers looking to consolidate debt and save money on interest charges. These cards allow you to transfer balances from other high-interest credit cards to a new card with a lower interest rate, often with no transfer fee. This can significantly reduce your monthly payments and help you pay off your debt faster.

Comparison with Traditional Balance Transfer Options

Traditional balance transfer options, such as those offered by banks or credit card companies, often come with transfer fees. These fees can range from a flat fee to a percentage of the balance transferred. While some banks offer introductory periods with 0% interest, these often come with a transfer fee.

- Zero transfer fee credit cards eliminate the upfront cost of transferring your balance, making them a more attractive option for consumers seeking to save money.

- However, it is important to note that while zero transfer fee credit cards may not charge a fee upfront, they may have higher interest rates after the introductory period expires.

- Traditional balance transfer options, on the other hand, may have lower interest rates after the introductory period but may come with a transfer fee.

Potential Risks Associated with Balance Transfers

While balance transfers can be a useful tool for debt consolidation, it is essential to be aware of the potential risks associated with them.

- High interest rates: After the introductory period, the interest rate on your balance transfer credit card may increase significantly. This can negate the savings you initially realized by transferring your balance.

- Transfer fees after the introductory period: Some credit cards may charge a transfer fee after the introductory period expires. This can add to your overall debt and make it more difficult to pay off.

- Increased credit utilization: Transferring a large balance to a new credit card can increase your credit utilization ratio, which can negatively impact your credit score.

It is crucial to carefully compare the terms and conditions of different balance transfer credit cards before making a decision. Consider factors such as the introductory interest rate, the length of the introductory period, and any associated fees.

Finding the Best Zero Interest and Zero Transfer Fee Credit Cards: Credit Cards With Zero Interest And Zero Transfer Fee

Finding the best zero interest and zero transfer fee credit card requires careful consideration of your individual needs and financial situation. There are several key factors to consider when comparing different credit card offers, including the introductory interest rate, the length of the introductory period, transfer fees, and annual fees.

Comparing Key Features of Popular Zero Interest and Zero Transfer Fee Credit Cards

| Credit Card | APR | Introductory Period | Transfer Fee | Annual Fee |

|---|---|---|---|---|

| Chase Slate | 15.24% – 24.24% Variable | 0% APR for 15 months on purchases and balance transfers | $0 | $0 |

| Citi Simplicity® Card | 13.49% – 24.49% Variable | 0% APR for 18 months on purchases and balance transfers | $0 | $0 |

| Discover it® Balance Transfer | 13.99% – 25.99% Variable | 0% APR for 18 months on balance transfers | $0 | $0 |

| Capital One QuicksilverOne Cash Rewards Credit Card | 16.99% – 26.99% Variable | 0% APR for 15 months on purchases and balance transfers | $0 | $0 |

Researching and Comparing Credit Card Offers

It is crucial to research and compare different credit card offers before making a decision. Here’s a step-by-step guide:

- Determine your needs: Identify the specific features you require, such as a long introductory period, a low APR, or a balance transfer option.

- Compare offers: Use online comparison tools or websites that specialize in credit card reviews to compare different offers.

- Read the fine print: Pay close attention to the terms and conditions, including the APR, the introductory period, transfer fees, and annual fees.

- Consider your credit history: Your credit history will affect your eligibility for certain credit cards. If you have a low credit score, you may be limited to cards with higher APRs.

- Contact customer service: If you have any questions, don’t hesitate to contact the credit card issuer’s customer service department for clarification.

Considering Individual Financial Needs and Credit History

It is essential to choose a credit card that aligns with your individual financial needs and credit history.

For example, if you have a large balance on a high-interest credit card, a zero interest balance transfer card can help you save money on interest charges. However, if you have a low credit score, you may be limited to cards with higher APRs and fewer benefits.

Using Zero Interest and Zero Transfer Fee Credit Cards Effectively

Zero interest and zero transfer fee credit cards can be powerful tools for managing debt and making large purchases, but they require careful planning and responsible use to maximize their benefits. Understanding how to leverage these features effectively and avoid potential pitfalls is crucial for achieving financial success.

Planning for Effective Use

To maximize the benefits of zero interest and zero transfer fee credit cards, it’s essential to develop a clear plan for using them. This plan should encompass both the initial utilization phase and the transition period after the introductory offer expires.

- Determine the Purpose: Clearly define whether you intend to use the card to consolidate existing debt, finance a major purchase, or both. This will help you set realistic goals and track progress.

- Calculate the Minimum Payment: Understand the minimum monthly payment required to avoid late fees and penalties. Aim to pay more than the minimum to accelerate debt reduction and minimize interest charges after the introductory period.

- Set a Budget: Create a detailed budget that includes all income and expenses. This will help you allocate sufficient funds for the minimum payment and any additional amounts you plan to contribute towards debt reduction.

- Establish a Payment Schedule: Create a schedule that Artikels how much you will pay each month and when. This will help you stay organized and on track with your debt repayment goals.

Avoiding High Interest Charges After the Introductory Period

The introductory period on zero interest credit cards is a valuable opportunity to make significant progress on debt repayment or finance a large purchase without accruing interest. However, it’s crucial to have a strategy in place to minimize interest charges once the introductory period ends.

- Pay Off the Balance Before the Introductory Period Ends: This is the most effective way to avoid interest charges altogether. If you can’t pay off the entire balance, try to pay as much as possible to reduce the remaining amount.

- Consider a Balance Transfer: If you have a significant balance, consider transferring it to another zero interest credit card with a longer introductory period. This can give you more time to pay off the debt without accruing interest.

- Negotiate a Lower Interest Rate: Contact your credit card issuer and inquire about lowering your interest rate once the introductory period ends. They may be willing to negotiate a lower rate if you have a good payment history.

- Look for a New Card: If your current credit card issuer is unwilling to lower your interest rate, consider applying for a new card with a lower interest rate. However, ensure you meet the eligibility criteria and understand the terms and conditions before applying.

Responsible Credit Card Use

Using credit cards responsibly is essential for maintaining a good credit score and avoiding financial problems. Here are some key tips for responsible credit card use:

- Track Your Spending: Keep a detailed record of all your credit card transactions. This will help you stay aware of your spending habits and identify areas where you can cut back.

- Pay Your Bills on Time: Always make your minimum payment on time to avoid late fees and penalties. Aim to pay more than the minimum to reduce your balance and avoid accruing interest.

- Monitor Your Credit Score: Regularly check your credit score to ensure it remains healthy. A good credit score can qualify you for better interest rates on loans and credit cards.

- Use Your Credit Card Wisely: Only use your credit card for purchases you can afford to pay back in full. Avoid using it for impulse buys or unnecessary expenses.

Alternatives to Zero Interest and Zero Transfer Fee Credit Cards

While zero interest and zero transfer fee credit cards offer enticing benefits, they might not be the most suitable solution for everyone. Understanding alternative options can help you make informed decisions about managing debt or financing large purchases.

Personal Loans

Personal loans provide a lump sum of money that you can use for various purposes, including debt consolidation or financing a large purchase. They often come with fixed interest rates and repayment terms, offering predictability and financial stability.

Advantages of Personal Loans

- Fixed Interest Rates: Personal loans typically have fixed interest rates, which means your monthly payments will remain consistent throughout the loan term, offering predictability and financial stability.

- Flexible Repayment Terms: You can choose a repayment term that aligns with your budget and financial goals, offering flexibility and control over your finances.

- Faster Funding: Personal loans are often funded faster than credit cards, allowing you to access the funds you need quickly.

- Potential for Lower Interest Rates: Depending on your creditworthiness, you may qualify for a lower interest rate on a personal loan compared to a credit card, saving you money on interest charges.

Disadvantages of Personal Loans

- Credit Check Required: Obtaining a personal loan requires a credit check, which can impact your credit score if you have multiple inquiries within a short period.

- Potential for Higher Interest Rates: If you have a lower credit score, you may be offered a higher interest rate, increasing the cost of borrowing.

- Loan Fees: Some personal loans may have origination fees or other associated costs, adding to the overall borrowing expense.

Balance Transfer Checks

Balance transfer checks allow you to transfer balances from high-interest credit cards to a new credit card with a lower interest rate. This strategy can help you save money on interest charges and pay off your debt faster.

Advantages of Balance Transfer Checks

- Lower Interest Rates: Balance transfer checks often come with introductory zero or low-interest periods, providing a significant opportunity to reduce interest charges and pay off debt faster.

- Debt Consolidation: Balance transfer checks can help you consolidate multiple credit card balances into a single account, simplifying debt management and making repayments more manageable.

Disadvantages of Balance Transfer Checks

- Limited Timeframe: Introductory interest rates on balance transfer checks are typically temporary, and after the promotional period, the interest rate may revert to a higher standard rate.

- Balance Transfer Fees: Many balance transfer checks involve a transfer fee, which can add to the cost of transferring your debt.

- Credit Score Impact: Applying for a new credit card can temporarily lower your credit score due to the hard inquiry on your credit report.

Closure

Ultimately, the decision of whether or not to use a zero interest and zero transfer fee credit card boils down to your individual financial situation and goals. If you can strategically utilize the introductory period to pay down debt or make a large purchase, these cards can be a valuable tool. However, if you’re not confident in your ability to pay off the balance before the introductory period ends, it’s best to explore alternative options. Remember, responsible credit card use involves careful planning, tracking, and a commitment to maintaining a healthy credit score.

Frequently Asked Questions

What happens after the introductory period ends?

After the introductory period, the interest rate on your credit card will revert to the standard APR, which can be significantly higher. Make sure to understand the standard APR before applying for a card.

Are there any other fees associated with these cards?

While there may not be a transfer fee, other fees, such as annual fees, late payment fees, or over-limit fees, may apply. Be sure to read the terms and conditions carefully.

How do I find the best zero interest and zero transfer fee credit card for me?

Consider your credit history, spending habits, and financial goals. Compare offers from different lenders, taking into account APR, introductory period, fees, and rewards programs.