The largest balance transfer credit card can be a game-changer for those seeking to consolidate high-interest debt and save money on interest charges. These cards offer enticing features like extended 0% introductory periods and substantial credit limits, allowing you to transfer balances from other credit cards and potentially pay them off faster. However, it’s crucial to understand the associated fees, terms, and potential risks before diving in.

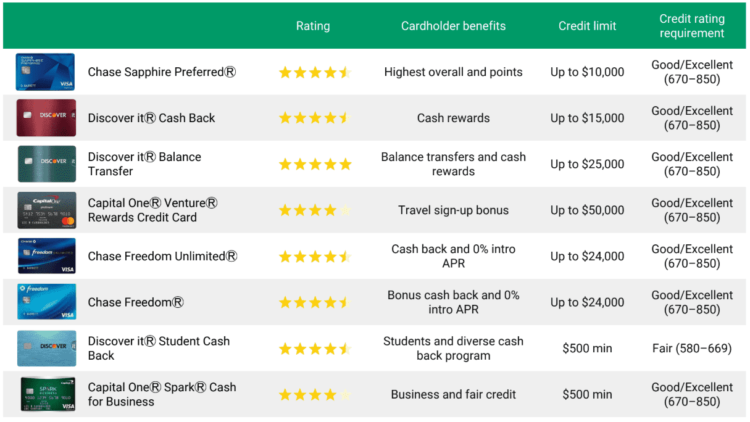

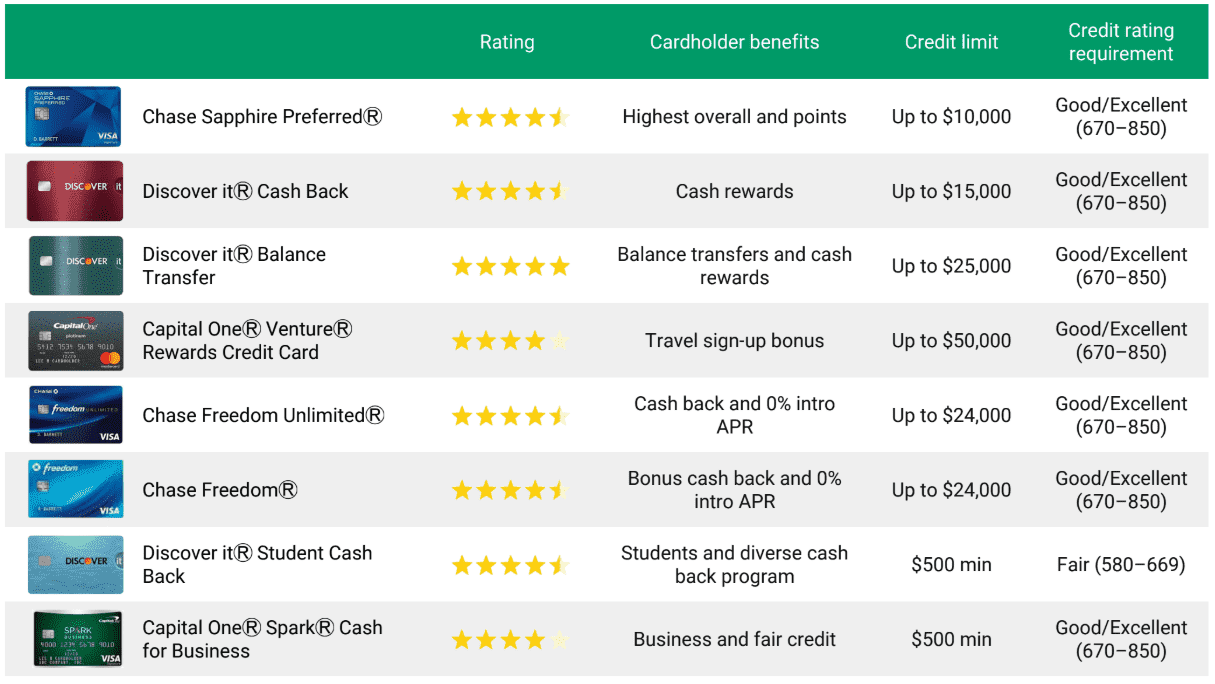

The process of choosing the right balance transfer credit card involves careful consideration of various factors, including interest rates, balance transfer fees, credit score requirements, credit limits, and introductory offer periods. It’s essential to compare offers from different issuers and evaluate which card aligns best with your financial situation and goals.

Balance Transfer Credit Cards

A balance transfer credit card is a type of credit card that allows you to transfer outstanding balances from other credit cards to it. This can be a useful tool for managing debt, especially if you have high-interest credit card debt.

The primary purpose of a balance transfer credit card is to help you consolidate your debt and potentially save money on interest charges. By transferring your balances to a card with a lower interest rate, you can reduce the amount of interest you pay over time, making it easier to pay off your debt.

Benefits of Balance Transfer Credit Cards

The benefits of using a balance transfer credit card can be significant, especially for individuals with high-interest credit card debt. Here are some of the key advantages:

- Lower Interest Rates: Balance transfer credit cards often offer introductory interest rates that are significantly lower than the rates on your existing credit cards. This can save you a substantial amount of money in interest charges over time.

- Debt Consolidation: By transferring multiple balances to a single card, you can simplify your debt management. This can make it easier to track your payments and keep your finances organized.

- Potential for Faster Debt Repayment: With a lower interest rate, you may be able to pay off your debt faster, as more of your monthly payments go towards principal rather than interest.

Potential Drawbacks and Risks

While balance transfer credit cards can be beneficial, it’s important to be aware of their potential drawbacks and risks.

- Balance Transfer Fees: Most balance transfer credit cards charge a fee for transferring balances, typically a percentage of the amount transferred. It’s essential to factor this fee into your calculations to ensure you’re actually saving money.

- Introductory Period Expiration: The low introductory interest rate on a balance transfer credit card is usually temporary. Once the introductory period expires, the interest rate will revert to the card’s standard APR, which can be significantly higher. If you haven’t paid off your balance by the time the introductory period ends, you could end up paying more in interest than you would have on your original credit card.

- Potential for Overspending: Having a new credit card with a high credit limit can make it tempting to overspend. If you’re not careful, you could end up accumulating more debt than you can handle.

- Impact on Credit Score: Opening a new credit card can temporarily lower your credit score, as it increases your credit utilization ratio. This is a factor that lenders consider when evaluating your creditworthiness.

Factors to Consider When Choosing a Largest Balance Transfer Credit Card

Choosing the right balance transfer credit card can significantly reduce your debt burden and save you money on interest charges. However, with numerous options available, it’s crucial to consider several factors to ensure you select the best card for your needs.

Interest Rates

Interest rates are the primary factor to consider when choosing a balance transfer credit card. A lower interest rate translates to lower interest charges over time, resulting in faster debt repayment. Compare the interest rates offered by different credit card issuers to find the lowest available rate. It’s essential to consider both the introductory APR and the standard APR, as the introductory rate usually lasts for a limited period.

Balance Transfer Fees

Balance transfer fees are charged when you transfer a balance from another credit card to a new one. These fees can vary significantly depending on the issuer. Analyze the balance transfer fee structure and its impact on your overall savings. Consider the following:

- Percentage-based fees: These fees are calculated as a percentage of the transferred balance.

- Fixed fees: These fees are a flat amount, regardless of the balance transferred.

While a low introductory APR might seem attractive, a high balance transfer fee can negate the savings. It’s essential to calculate the total cost of transferring your balance, including the fees, to determine the best option.

Minimum Credit Score Requirements, Largest balance transfer credit card

Credit card issuers typically have minimum credit score requirements for eligibility. Research the minimum credit score requirements for each card you are considering to ensure you meet the criteria. If your credit score is lower than the required minimum, you may be eligible for a secured credit card or a card with a higher interest rate.

Credit Limit

The credit limit offered by a balance transfer credit card should be sufficient to cover the balance you intend to transfer. A higher credit limit provides greater flexibility and can help improve your credit utilization ratio, which is a factor in your credit score. However, it’s crucial to avoid overextending yourself and using more than 30% of your available credit.

Introductory Offer Periods

Many balance transfer credit cards offer introductory periods with a low or 0% APR. These introductory periods typically last for a limited time, such as 6, 12, or 18 months. Evaluate the available introductory offer periods and their impact on the overall cost of transferring your balance. A longer introductory period gives you more time to pay down your debt without incurring significant interest charges. However, remember that the standard APR will apply once the introductory period expires.

How to Effectively Utilize a Balance Transfer Credit Card

A balance transfer credit card can be a valuable tool for saving money on interest charges, but it’s important to use it strategically to maximize its benefits. This section will provide a step-by-step guide on transferring a balance, emphasize the importance of timely payments, and offer strategies for managing debt and minimizing interest charges.

Transferring a Balance

Transferring a balance from another credit card is a straightforward process. Here’s a step-by-step guide:

- Choose a balance transfer credit card with a 0% introductory APR: Compare offers from different issuers to find the best terms, including the introductory period and any balance transfer fees.

- Apply for the card and get approved: Once you’ve selected a card, submit an application and ensure you meet the eligibility criteria.

- Initiate the balance transfer: Contact the new card issuer and provide the details of the credit card you want to transfer the balance from. You may need to provide the account number and balance amount.

- Monitor the transfer process: Keep track of the transfer timeline and ensure the balance is successfully moved to the new card.

Making Timely Payments

Making timely payments is crucial to avoid accruing interest on your balance transfer credit card.

- Set up automatic payments: Schedule automatic payments to ensure you never miss a due date.

- Set reminders: Use calendar reminders or mobile app notifications to stay on top of payment deadlines.

- Pay more than the minimum: Paying more than the minimum payment each month will help you pay down the balance faster and reduce the overall interest charges.

Managing Debt and Minimizing Interest Charges

- Create a budget: Track your income and expenses to identify areas where you can cut back and allocate more funds toward debt repayment.

- Prioritize high-interest debt: Focus on paying down debt with the highest interest rates first to minimize overall interest charges.

- Consider a debt consolidation loan: If you have multiple high-interest debts, a debt consolidation loan could help you combine them into a single loan with a lower interest rate.

Financial Planning and Debt Management Resources

- Credit counseling agencies: These agencies offer free or low-cost financial counseling services, including debt management plans.

- Consumer financial protection bureaus: Government agencies like the Consumer Financial Protection Bureau (CFPB) provide resources and guidance on managing debt and credit.

- Financial advisors: Consult a financial advisor for personalized advice on managing debt and creating a financial plan.

Conclusive Thoughts

Navigating the world of balance transfer credit cards can be a smart move for those looking to reduce their debt burden. By understanding the intricacies of these cards, including their benefits, drawbacks, and best practices for utilization, you can make informed decisions and potentially achieve significant financial savings. Remember to weigh your options carefully, prioritize responsible debt management, and consider consulting with a financial advisor for personalized guidance.

Frequently Asked Questions: Largest Balance Transfer Credit Card

How long do balance transfer introductory periods typically last?

Introductory periods for balance transfers usually range from 6 to 18 months, but can vary depending on the card issuer.

What happens after the introductory period ends?

Once the introductory period ends, the standard interest rate for the card applies to the remaining balance. This rate can be significantly higher than the introductory rate, so it’s important to have a plan to pay off the balance before the end of the introductory period.

Can I transfer my balance to a different balance transfer credit card after the introductory period?

Yes, you can often transfer your balance to another balance transfer credit card with a new introductory period, but be aware of potential balance transfer fees and the possibility of a credit score impact.

Are there any penalties for paying off a balance transfer credit card early?

No, there are usually no penalties for paying off a balance transfer credit card early. In fact, it’s often beneficial to pay it off as quickly as possible to minimize interest charges.