Low cost balance transfer credit cards offer a lifeline for consumers burdened by high-interest debt. These cards allow you to transfer existing balances from other credit cards to a new card with a lower interest rate, potentially saving you hundreds or even thousands of dollars in interest charges. The key to success lies in finding the right card with attractive introductory periods and minimal fees, while also understanding the mechanics of balance transfers and the potential risks involved.

This guide will delve into the world of low cost balance transfer credit cards, explaining their benefits and how to choose the best option for your financial situation. We’ll also explore the process of transferring a balance, strategies for managing your new card effectively, and alternative debt management solutions.

Understanding Low-Cost Balance Transfer Credit Cards

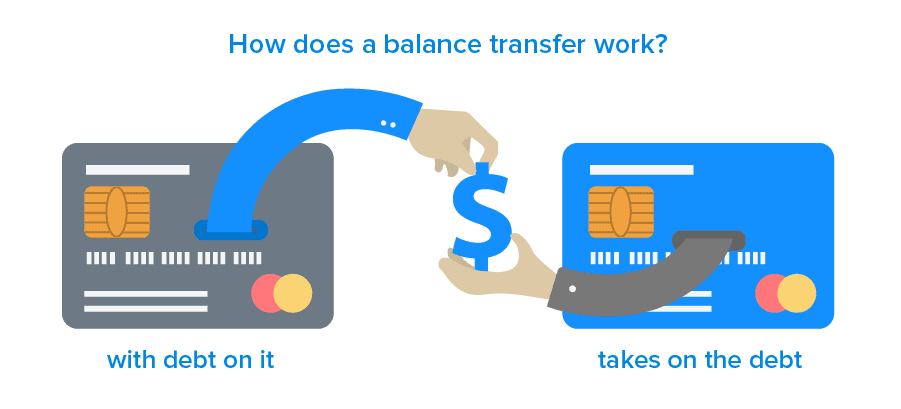

Balance transfer credit cards are designed to help you consolidate high-interest debt from other credit cards or loans into a single, lower-interest account. This strategy can save you money on interest charges and help you pay off your debt faster.

These cards offer a tempting solution to high-interest debt by allowing you to transfer balances from other credit cards at a lower interest rate. This can significantly reduce the amount of interest you pay over time and accelerate your debt repayment journey.

Interest Rates and Fees

Low-cost balance transfer credit cards typically have a promotional period, usually lasting for 0 to 21 months, during which you’ll enjoy a low or even 0% interest rate on your transferred balance. However, it’s crucial to understand that after this introductory period, the interest rate will revert to the card’s standard APR, which can be significantly higher.

It’s important to note that balance transfer credit cards often come with a balance transfer fee, usually a percentage of the amount transferred. This fee can range from 2% to 5% of the balance transferred.

In addition to the balance transfer fee, you may also encounter other fees, such as an annual fee or a late payment fee. It’s essential to carefully review the terms and conditions of the card to understand all applicable fees.

It’s crucial to factor in all fees and interest rates to determine whether a balance transfer credit card is the right solution for your debt consolidation needs.

Finding the Right Low-Cost Balance Transfer Credit Card

Finding the right low-cost balance transfer credit card involves considering several factors to ensure you get the best deal. This includes comparing interest rates, transfer fees, introductory periods, and rewards programs.

Understanding Key Factors

- Interest Rates: The interest rate determines the cost of borrowing. Look for cards with low introductory APRs (Annual Percentage Rate) for balance transfers, followed by a reasonable ongoing APR.

- Transfer Fees: Most cards charge a fee for transferring balances. This fee can range from 3% to 5% of the transferred amount. Choose a card with a low or no transfer fee, especially if you’re transferring a large balance.

- Introductory Periods: This is the time during which the introductory APR applies. The longer the introductory period, the more time you have to pay down your balance before the higher standard APR kicks in.

- Rewards Programs: Some balance transfer cards offer rewards programs, such as cash back or travel miles. While these programs may not be the primary focus when looking for a balance transfer card, they can be a nice perk.

Comparing Offers

- Use Comparison Websites: Websites like NerdWallet, Bankrate, and Credit Karma allow you to compare offers from different credit card issuers. You can filter your search by APR, transfer fees, introductory periods, and other criteria.

- Check Credit Card Issuer Websites: Visit the websites of major credit card issuers to see their current balance transfer offers.

- Read the Fine Print: Before applying for a card, carefully review the terms and conditions, including the APR, transfer fee, introductory period, and any other fees or restrictions.

Comparing Popular Low-Cost Balance Transfer Credit Cards

| Card | Introductory APR | Transfer Fee | Introductory Period | Rewards Program |

|---|---|---|---|---|

| Chase Slate | 0% APR for 15 months | None | 15 months | None |

| Citi Simplicity® Card | 0% APR for 21 months | 5% of the balance transferred | 21 months | None |

| Discover it® Balance Transfer | 0% APR for 18 months | None | 18 months | Cashback rewards |

| US Bank Visa Platinum Card | 0% APR for 18 months | None | 18 months | Cashback rewards |

The Process of Transferring a Balance

Transferring a balance from an existing credit card to a new balance transfer card can be a good way to save money on interest charges. However, it’s important to understand the process and the potential risks involved.

The process of transferring a balance typically involves several steps.

Initiating a Balance Transfer

To initiate a balance transfer, you’ll need to contact the new credit card issuer and provide them with the following information:

* The account number of the credit card you’re transferring the balance from.

* The amount of the balance you want to transfer.

* The name of the issuer of the existing credit card.

The new credit card issuer will then typically send you a balance transfer request form. You’ll need to sign this form and return it to the issuer along with any required documentation.

Documentation Required for Balance Transfers, Low cost balance transfer credit card

The documentation required for balance transfers may vary depending on the credit card issuer. However, you may need to provide the following:

* A copy of your driver’s license or other government-issued ID.

* A recent credit card statement from the existing card.

* A copy of your Social Security card.

Potential Risks and Considerations

There are a few potential risks and considerations associated with balance transfers.

* Balance Transfer Fees: Most credit card issuers charge a balance transfer fee, which is typically a percentage of the amount you transfer.

* Interest Rates: While balance transfer cards often offer a 0% introductory APR, this rate is typically only for a limited time. Once the introductory period expires, the interest rate on the balance will revert to the card’s standard APR, which can be significantly higher.

* Credit Score Impact: Applying for a new credit card can have a slight negative impact on your credit score. This is because the inquiry on your credit report will show that you’ve recently applied for credit.

It’s important to carefully consider the terms and conditions of a balance transfer offer before you transfer a balance. Make sure you understand the balance transfer fee, the introductory APR, and the standard APR.

Alternatives to Balance Transfer Cards

While balance transfer cards can be a valuable tool for managing high-interest debt, they are not the only option. Several alternative methods can help you tackle your debt effectively.

Here are some alternative strategies to consider, along with their potential advantages and disadvantages:

Debt Consolidation Loans

Debt consolidation loans involve taking out a single loan to pay off multiple debts, typically at a lower interest rate. This can simplify your debt management and potentially reduce your monthly payments.

- Advantages:

- Lower interest rates: Consolidating your debt into a lower-interest loan can save you money on interest charges over time.

- Simplified payments: Instead of juggling multiple payments, you only have one monthly payment to make.

- Improved credit score: Making consistent payments on a consolidation loan can help improve your credit score.

- Disadvantages:

- Potential for higher overall interest: If you don’t qualify for a significantly lower interest rate, the overall interest you pay could be higher than your existing debts.

- Extended repayment period: Consolidating your debt can lengthen your repayment term, potentially increasing the total interest you pay.

- Risk of taking on more debt: If you’re not careful, you could end up taking on more debt than you can afford.

Balance Transfer Checks

Balance transfer checks allow you to transfer balances from other credit cards to a new account, often with a promotional 0% APR period. This can be a good option if you have a high-interest balance and need time to pay it off.

- Advantages:

- 0% APR period: This can help you save money on interest charges during the promotional period.

- Lower minimum payments: With a 0% APR, you can make smaller minimum payments and pay down your balance faster.

- Disadvantages:

- Balance transfer fees: These fees can be substantial, so be sure to factor them into your calculations.

- Limited time: The 0% APR period is typically limited, and you’ll need to pay off the balance before it expires.

- High interest rate after the promotional period: Once the promotional period ends, you’ll be charged a high interest rate on any remaining balance.

Conclusion: Low Cost Balance Transfer Credit Card

By carefully selecting a low cost balance transfer credit card, understanding the transfer process, and utilizing effective management strategies, you can significantly reduce your debt burden and take control of your finances. Remember to compare offers, read the fine print, and prioritize paying down the transferred balance as quickly as possible. With a strategic approach, balance transfer cards can be a powerful tool for achieving financial freedom.

Detailed FAQs

What is the difference between a balance transfer credit card and a regular credit card?

A balance transfer credit card is specifically designed to help you move high-interest debt from other credit cards to a new card with a lower interest rate. Regular credit cards typically have higher interest rates and are primarily used for everyday purchases.

How long does it take to transfer a balance?

The time it takes to transfer a balance can vary depending on the issuer, but it usually takes a few business days. You may need to wait longer if you’re transferring a large balance or if the issuer requires additional documentation.

Can I use a balance transfer card for new purchases?

Yes, you can use a balance transfer card for new purchases, but it’s generally recommended to avoid this as it can increase your debt burden. The focus should be on paying down the transferred balance as quickly as possible.

What happens when the introductory period ends?

Once the introductory period ends, the interest rate on your balance transfer card will revert to the standard rate, which can be significantly higher. It’s crucial to have a plan in place to pay off the transferred balance before the introductory period expires.