- Understanding “No Balance Transfer Fee Credit Cards and 0% Interest”

- Eligibility and Application Process

- Types of Balance Transfer Cards

- Key Features and Considerations

- Benefits of Balance Transfer Cards

- Potential Drawbacks and Risks

- Responsible Use and Management: No Balance Transfer Fee Credit Cards And 0 Interest

- Final Thoughts

- Common Queries

No balance transfer fee credit cards and 0 interest – No balance transfer fee credit cards and 0% interest offer a compelling solution for individuals looking to manage their debt effectively and save money on interest charges. These cards allow you to transfer outstanding balances from high-interest credit cards to a new card with a promotional period of 0% interest, often accompanied by a waiver of balance transfer fees. This strategic approach can significantly reduce your overall debt burden and provide you with valuable breathing room to get your finances back on track.

By understanding the mechanics of balance transfer cards, their eligibility requirements, and the key features to consider, you can make informed decisions and choose the right card to meet your specific financial needs. This guide will explore the ins and outs of these cards, outlining their benefits, potential drawbacks, and responsible usage strategies. Whether you’re grappling with existing debt or seeking to consolidate multiple credit card balances, this comprehensive overview will equip you with the knowledge to navigate the world of balance transfer cards confidently.

Understanding “No Balance Transfer Fee Credit Cards and 0% Interest”

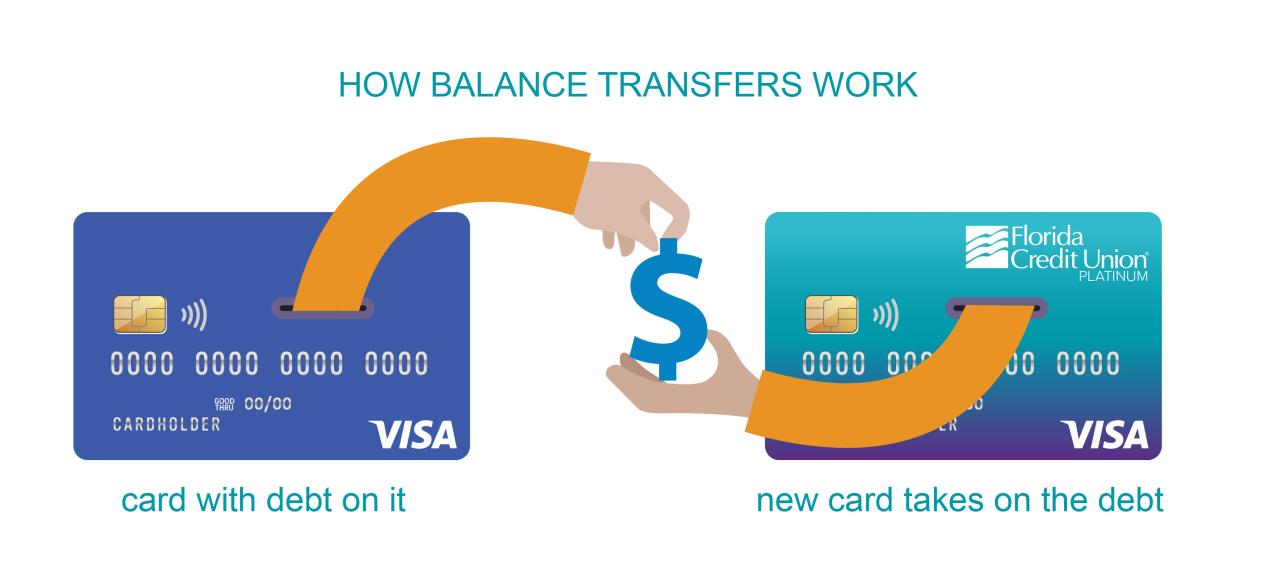

Balance transfer credit cards are a type of credit card that allows you to transfer existing balances from other credit cards to the new card. This can be a useful tool for consolidating debt and saving money on interest charges.

No Balance Transfer Fees

No balance transfer fees are a common feature of balance transfer credit cards. This means that you won’t have to pay a fee to transfer your existing balance to the new card. This can save you a significant amount of money, especially if you have a large balance to transfer.

0% Interest Periods

Another common feature of balance transfer credit cards is a 0% interest period. This means that you won’t have to pay any interest on your transferred balance for a certain period of time, typically 12 to 18 months. This can be a great way to save money on interest charges and pay off your debt faster.

Eligibility and Application Process

Securing a balance transfer credit card with 0% interest often requires meeting specific eligibility criteria and completing an application process. Understanding these aspects can help you determine your chances of approval and prepare for the application.

Eligibility Requirements

Issuers assess your creditworthiness before approving a balance transfer card. The following factors are typically considered:

* Credit Score: A strong credit score is crucial. Most issuers prefer applicants with a credit score of at least 670 or higher, as this indicates a lower risk of default.

* Credit History: A history of responsible credit use, such as paying bills on time and maintaining low credit utilization, is essential.

* Income: Lenders want to ensure you have the financial capacity to manage the transferred balance. They often consider your income level and debt-to-income ratio (DTI).

* Existing Debt: The amount of outstanding debt you currently have can impact your eligibility. A high debt load may make lenders hesitant to approve you.

* Employment History: A stable employment history is generally considered a positive factor, as it shows you have a reliable source of income.

Application Process

Applying for a balance transfer card typically involves these steps:

- Choose a Card: Research different balance transfer cards, comparing their introductory interest rates, fees, and eligibility requirements to find the best fit for your needs.

- Pre-qualify: Many issuers offer a pre-qualification process where you can check your eligibility without affecting your credit score. This allows you to get an idea of your chances of approval before applying.

- Complete the Application: Once you’ve chosen a card, complete the online or paper application form, providing accurate personal and financial information. This usually includes:

- Personal Information: Name, address, Social Security number, date of birth, etc.

- Financial Information: Income, employment history, existing debt, credit card information (if transferring a balance), etc.

- Contact Information: Phone number, email address, etc.

- Submit Supporting Documentation: You may be required to submit additional documentation, such as proof of income (pay stubs, tax returns), bank statements, or a copy of your driver’s license.

- Credit Check: The issuer will conduct a hard credit inquiry, which may temporarily lower your credit score.

- Decision: The issuer will review your application and supporting documents and make a decision. You will receive a notification via email or phone.

- Balance Transfer: If approved, you’ll need to provide the account details of the debt you want to transfer. The issuer will then process the balance transfer, typically within a few business days.

It’s important to note that balance transfer offers and eligibility criteria can vary depending on the issuer. Be sure to carefully review the terms and conditions of any card you are considering.

Types of Balance Transfer Cards

Balance transfer cards offer a way to consolidate debt and potentially save money on interest charges. However, not all balance transfer cards are created equal. Understanding the different types of balance transfer cards can help you choose the best option for your needs.

Types of Balance Transfer Cards

There are several different types of balance transfer cards available, each with its own unique features and benefits. Here are some of the most common types:

- Standard Balance Transfer Cards: These cards typically offer a 0% introductory APR for a specific period, such as 12, 18, or 24 months. After the introductory period, the APR reverts to the card’s standard APR, which can be quite high.

- Balance Transfer Credit Cards with Rewards: These cards offer rewards, such as cash back, travel miles, or points, in addition to a 0% introductory APR. However, they may have higher annual fees or other restrictions compared to standard balance transfer cards.

- Balance Transfer Cards with Low APRs: These cards offer a lower standard APR compared to other balance transfer cards. While they may not have a 0% introductory period, they can be a good option if you plan to keep the balance on the card for a longer period.

- Balance Transfer Cards with Special Features: Some balance transfer cards offer special features, such as a balance transfer bonus or a grace period for payments. These features can make the card more appealing to certain borrowers.

Comparison of Balance Transfer Card Features

Here is a table comparing the key features of different types of balance transfer cards:

| Feature | Standard Balance Transfer Card | Balance Transfer Credit Card with Rewards | Balance Transfer Card with Low APR | Balance Transfer Card with Special Features |

|---|---|---|---|---|

| Introductory APR | 0% for a set period | 0% for a set period | Not applicable | May offer a 0% introductory period |

| Standard APR | Variable | Variable | Lower than average | Variable |

| Rewards | None | Cash back, travel miles, points | None | May offer a bonus or a grace period |

| Annual Fee | May or may not have an annual fee | May have a higher annual fee | May or may not have an annual fee | May have an annual fee |

Pros and Cons of Different Balance Transfer Cards

Standard Balance Transfer Cards

Pros

- Lower Interest Charges: You can save money on interest charges during the introductory period.

- Simplified Debt Management: You can consolidate multiple debts into one card.

Cons

- High Standard APR: The APR after the introductory period can be very high.

- Limited Timeframe: The 0% introductory period is typically limited to a few months.

Balance Transfer Credit Cards with Rewards

Pros

- Earn Rewards: You can earn rewards while you pay down your balance.

- Lower Interest Charges: You can save money on interest charges during the introductory period.

Cons

- Higher Annual Fees: These cards may have higher annual fees than standard balance transfer cards.

- Limited Rewards: The rewards may be limited or subject to restrictions.

Balance Transfer Cards with Low APRs

Pros

- Lower Interest Charges: You can save money on interest charges over the long term.

- No Introductory Period: You don’t have to worry about the APR reverting to a higher rate after a certain period.

Cons

- No Introductory Period: You won’t benefit from a 0% introductory period.

- May Not Be the Best Option for Everyone: This type of card is best suited for borrowers who plan to keep the balance on the card for a longer period.

Balance Transfer Cards with Special Features

Pros

- Balance Transfer Bonus: You may receive a bonus for transferring a certain amount of debt.

- Grace Period: You may have a grace period to make payments before interest starts accruing.

Cons

- Limited Availability: These cards are not as widely available as other types of balance transfer cards.

- May Have Higher Fees: These cards may have higher annual fees or other fees associated with special features.

Key Features and Considerations

Balance transfer cards with 0% introductory APR periods offer a tempting way to save money on interest charges, but understanding the key features and considerations is crucial before applying.

Introductory 0% APR Period

The introductory 0% APR period is the primary attraction of balance transfer cards. This period allows you to transfer your existing debt from other credit cards to the new card without accruing interest for a specified time. The length of this period varies significantly among issuers, ranging from a few months to as long as 21 months.

Interest Rate and Fees After the Introductory Period, No balance transfer fee credit cards and 0 interest

Once the introductory period ends, the 0% APR period ends, and the card reverts to its standard APR, which can be significantly higher than the introductory rate. It’s essential to understand the standard APR and any applicable fees to make informed financial decisions. For example, if the standard APR is 20%, you’ll be charged 20% interest on your remaining balance after the introductory period.

Minimum Monthly Payment Requirements

The minimum monthly payment required for balance transfer cards is typically calculated as a percentage of the outstanding balance or a fixed amount, whichever is greater. These minimum payments are often lower than the minimum payments required on other credit cards, making it seem like a more manageable option. However, it’s crucial to remember that making only the minimum payment will prolong the repayment period and increase the total interest paid over time.

Other Potential Fees

Balance transfer cards often come with various fees, in addition to the standard APR, that can impact the overall cost of using the card. These fees include:

- Balance Transfer Fee: While many cards advertise “no balance transfer fee,” some may charge a percentage of the transferred balance as a fee. This fee can range from 1% to 5% of the transferred amount.

- Annual Fee: Some balance transfer cards have an annual fee, which can add to the overall cost of the card.

- Late Payment Fee: If you fail to make your minimum payment by the due date, you may be charged a late payment fee.

- Over-Limit Fee: If you exceed your credit limit, you may be charged an over-limit fee.

- Foreign Transaction Fee: If you use the card for transactions outside the United States, you may be charged a foreign transaction fee.

Benefits of Balance Transfer Cards

Balance transfer cards can be a valuable tool for managing debt and saving money. These cards offer a temporary period of 0% interest on transferred balances, giving you time to pay down your debt without accruing interest charges. This can be particularly beneficial if you have high-interest debt from other credit cards or loans.

Debt Management

Balance transfer cards can help you manage debt by consolidating multiple balances into one. This simplifies your payments and makes it easier to track your progress. By transferring your debt to a card with a 0% interest rate, you can avoid accruing interest charges and focus on paying down the principal balance.

Saving Money on Interest Charges

The most significant benefit of balance transfer cards is the potential to save money on interest charges. By transferring your debt to a card with a 0% interest rate, you can avoid paying interest for a set period, typically 12 to 18 months. This can save you hundreds or even thousands of dollars in interest charges, depending on the amount of debt you transfer.

Improving Credit Scores

While not a direct benefit of balance transfer cards, using them strategically can help improve your credit score. By transferring high-interest debt and paying it down consistently, you can lower your credit utilization ratio, which is a significant factor in your credit score. Additionally, making on-time payments on your balance transfer card demonstrates responsible credit management, further boosting your credit score.

Potential Drawbacks and Risks

While balance transfer cards offer a compelling way to save money on interest, they come with potential drawbacks and risks that you should carefully consider. It’s crucial to understand these potential downsides before making a decision to use a balance transfer card.

High Interest Rates After the Introductory Period

One of the most significant drawbacks of balance transfer cards is the high interest rate that typically kicks in after the introductory period ends. While the initial 0% interest rate can be tempting, it’s important to remember that this period is usually limited, often lasting for 12 to 18 months. After this period, the interest rate can jump to a much higher level, potentially exceeding 20%.

For example, if you transfer a $5,000 balance to a card with a 0% introductory APR for 12 months, and then the APR jumps to 20%, you’ll start accruing interest at a rate of $83.33 per month. This can quickly add up, making the card more expensive than your original credit card if you don’t pay off the balance quickly.

Risks of Not Paying the Balance on Time

Failing to make your minimum monthly payments on time can have serious consequences, even during the introductory period.

- Late Payment Fees: You will likely be charged a late payment fee, which can range from $25 to $35 or more, depending on the card issuer.

- Interest Accrual: Even during the introductory period, some balance transfer cards accrue interest on the transferred balance if you miss a payment. This can negate the benefits of the 0% APR.

- Damage to Credit Score: Late payments can negatively impact your credit score, making it harder to get approved for loans or credit cards in the future.

Other Potential Risks

Besides the risks associated with interest rates and late payments, other potential drawbacks of balance transfer cards include:

- Balance Transfer Fees: While some cards offer no balance transfer fees, many charge a percentage of the transferred balance. This fee can add up, especially for large balances.

- Annual Fees: Some balance transfer cards come with an annual fee, which can further increase the cost of using the card.

- Limited Spending: Some balance transfer cards have a limited spending limit, which may not be sufficient for all your needs.

- Potential for Overspending: The convenience of a balance transfer card can sometimes lead to overspending, especially if you’re not careful with your budget.

Responsible Use and Management: No Balance Transfer Fee Credit Cards And 0 Interest

Balance transfer cards can be a valuable tool for managing debt, but they should be used responsibly to avoid potential pitfalls and maximize their benefits.

Strategies for Effective Debt Management

Effective debt management involves a comprehensive approach that considers the overall financial situation and prioritizes responsible spending habits. Here are some strategies:

- Create a Budget: A detailed budget helps track income and expenses, allowing for the identification of areas where spending can be reduced. This provides a clear picture of available funds for debt repayment.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first, as this minimizes overall interest charges. This approach saves money in the long run, even if the principal amount is smaller.

- Establish a Payment Schedule: Create a schedule that Artikels specific amounts and deadlines for each debt, ensuring consistent and timely payments. This helps track progress and maintain motivation.

- Automate Payments: Set up automatic payments to avoid late fees and ensure consistent debt repayment. This eliminates the risk of forgetting payments and promotes financial discipline.

- Seek Professional Advice: If overwhelmed by debt, consider consulting a financial advisor or credit counselor. These professionals can provide personalized guidance and develop a tailored debt management plan.

Tips for Avoiding the Pitfalls of Balance Transfer Cards

Balance transfer cards offer a temporary solution to high-interest debt, but it’s crucial to use them strategically to avoid potential drawbacks:

- Understand the Terms: Carefully review the balance transfer card’s terms and conditions, including the introductory interest rate period, the APR after the introductory period, and any associated fees. Understanding these aspects is crucial for making informed decisions.

- Avoid Overspending: Resist the temptation to use the balance transfer card for new purchases. The focus should be on transferring existing debt, not accumulating more.

- Pay More Than the Minimum: Aim to pay more than the minimum payment to accelerate debt repayment and avoid accruing interest. This reduces the overall interest paid and shortens the repayment period.

- Plan for the End of the Introductory Period: Recognize that the introductory interest rate is temporary. Develop a plan to either pay off the balance before the introductory period ends or secure a new balance transfer offer if necessary.

- Monitor Your Credit Utilization: Balance transfers can increase your credit utilization ratio, potentially impacting your credit score. Keep track of your credit utilization and ensure it remains within a healthy range.

Final Thoughts

Balance transfer cards can be a powerful tool for debt management, offering a chance to reduce interest costs and gain control over your finances. However, it’s crucial to approach them strategically, considering the terms, potential risks, and responsible usage practices. By carefully evaluating your options, comparing features, and adhering to a responsible repayment plan, you can leverage these cards to your advantage and pave the way for a brighter financial future. Remember, the key lies in making informed decisions, utilizing the introductory 0% periods effectively, and staying vigilant about your debt management strategies.

Common Queries

What are the typical eligibility requirements for balance transfer cards?

Eligibility criteria can vary depending on the issuer, but generally include good credit history, a minimum credit score, and sufficient income to make regular payments.

How long does it typically take for a balance transfer to be processed?

Processing times can range from a few days to several weeks, depending on the card issuer and the complexity of the transfer.

What happens if I don’t pay off the balance before the introductory period ends?

Once the introductory period expires, the standard interest rate on the card will apply, potentially resulting in higher monthly payments and increased interest charges.

Are there any other fees associated with balance transfer cards besides the balance transfer fee?

Yes, other potential fees may include annual fees, late payment fees, over-limit fees, and cash advance fees. It’s essential to review the card’s terms and conditions carefully to understand all applicable fees.