- No Fee Balance Transfer Credit Cards with 0% APR: No Fee Balance Transfer Credit Cards With 0 Apr

- Key Features of No Fee Balance Transfer Credit Cards with 0% APR

- Eligibility Requirements for No Fee Balance Transfer Credit Cards with 0% APR

- The Importance of Responsible Use and Payment Strategies

- Final Wrap-Up

- Essential Questionnaire

No fee balance transfer credit cards with 0 apr – No fee balance transfer credit cards with 0% APR offer a powerful way to manage high-interest debt. These cards allow you to transfer existing balances from other credit cards to a new card with a temporary 0% interest rate, saving you money on interest charges and potentially helping you pay off your debt faster. This can be especially beneficial for individuals with high-interest debt or those looking to consolidate their debt into one manageable payment.

Imagine you have a credit card with a $5,000 balance and a 20% interest rate. You’re making minimum payments, but the interest charges are eating away at your progress. A balance transfer card with 0% APR could help you transfer that balance to a new card with a 0% interest rate for a set period, giving you a chance to make significant progress towards paying off your debt without accruing interest charges. This can be a game-changer for anyone struggling with high-interest debt.

No Fee Balance Transfer Credit Cards with 0% APR: No Fee Balance Transfer Credit Cards With 0 Apr

No fee balance transfer credit cards with 0% APR offer a compelling solution for individuals looking to manage their debt effectively. These cards allow you to transfer existing high-interest debt onto a new card with a temporary 0% interest rate, potentially saving you significant money on interest charges.

Benefits of No Fee Balance Transfer Credit Cards with 0% APR

These cards provide a range of benefits for consumers, primarily focused on reducing debt and managing finances effectively.

- Reduced Interest Charges: The most significant benefit is the potential to save on interest charges. By transferring high-interest debt to a 0% APR card, you can avoid paying interest for a specific promotional period, allowing you to focus on paying down the principal balance.

- Debt Consolidation: These cards can help you consolidate multiple debts into a single, manageable payment. This simplifies your debt management and can make it easier to track your progress towards paying off your debt.

- Improved Credit Utilization: By transferring balances to a new card, you can potentially reduce your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit. A lower credit utilization ratio can positively impact your credit score.

- Flexible Payment Options: Many balance transfer cards offer flexible payment options, allowing you to choose a payment plan that fits your budget. This can help you stay on track with your repayments and avoid falling behind.

Target Audience for No Fee Balance Transfer Credit Cards with 0% APR

These cards are particularly well-suited for individuals with the following financial situations:

- Individuals with High-Interest Debt: If you have credit card debt with high interest rates, a balance transfer card can help you save money on interest charges.

- Individuals Looking to Consolidate Debt: If you have multiple debts with different interest rates, a balance transfer card can help you consolidate them into a single, manageable payment.

- Individuals with Good Credit: Most balance transfer cards require good credit to qualify. If you have a good credit score, you’re more likely to be approved for a card with a 0% APR promotional period.

Real-World Scenarios Where No Fee Balance Transfer Credit Cards Can Be Beneficial

Here are some real-world scenarios where these cards can be valuable:

- Consolidating Store Credit Card Debt: Imagine you have multiple store credit cards with high interest rates. A balance transfer card can help you consolidate these balances into a single card with a lower interest rate, potentially saving you significant interest charges over time.

- Paying Off a High-Interest Personal Loan: If you have a personal loan with a high interest rate, transferring the balance to a 0% APR credit card can help you save money on interest charges.

- Taking Advantage of a Promotional Offer: Some balance transfer cards offer limited-time promotional periods with 0% APR. If you can transfer your debt during this promotional period, you can potentially save a significant amount of money on interest.

Key Features of No Fee Balance Transfer Credit Cards with 0% APR

No fee balance transfer credit cards with 0% APR offer a compelling way to consolidate high-interest debt and save on interest charges. These cards typically come with an introductory period during which you can transfer balances from other credit cards without incurring any interest charges. However, it’s crucial to understand the key features of these cards to determine if they’re right for your financial situation.

Introductory 0% APR Period

The introductory 0% APR period is the most attractive feature of these cards. This period allows you to transfer balances from high-interest credit cards and pay them down without accumulating interest charges. The length of this introductory period can vary depending on the card issuer, ranging from 6 to 18 months. It’s essential to make the most of this period by paying down as much of the balance as possible.

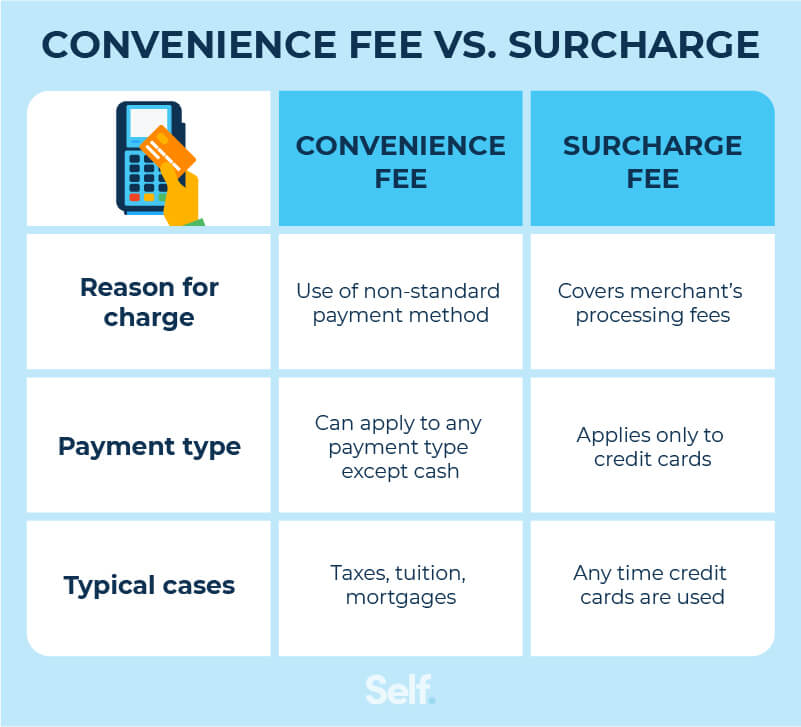

Balance Transfer Fees

While these cards are marketed as “no fee,” they often have a balance transfer fee. This fee is a percentage of the transferred balance, typically ranging from 3% to 5%. It’s crucial to factor this fee into your calculations to determine the overall cost savings of a balance transfer.

Minimum Monthly Payments

These cards have minimum monthly payments that you’re required to make. While the minimum payment may seem manageable, it’s important to remember that it only covers a small portion of the balance. If you only make the minimum payment, it will take much longer to pay off the balance, and you could end up paying more in interest charges after the introductory period ends.

Impact on Debt Consolidation

No fee balance transfer credit cards with 0% APR can be a valuable tool for debt consolidation. By transferring balances from high-interest credit cards to a card with 0% APR, you can significantly reduce your monthly interest payments and accelerate debt repayment. However, it’s essential to have a plan in place to pay off the balance before the introductory period ends. Failure to do so could result in significant interest charges.

Comparison of Key Features

Here’s a table comparing the key features of some popular no fee balance transfer credit cards with 0% APR:

| Card | Introductory 0% APR Period | Balance Transfer Fee | Minimum Monthly Payment |

|————————————|—————————|———————-|————————|

| Chase Slate | 15 months | 3% | $25 or 1% of balance |

| Citi Simplicity | 18 months | 5% | $25 or 1% of balance |

| Discover it Balance Transfer | 18 months | 3% | $25 or 1% of balance |

| Wells Fargo Reflect | 18 months | 3% | $25 or 1% of balance |

Eligibility Requirements for No Fee Balance Transfer Credit Cards with 0% APR

To qualify for a no-fee balance transfer credit card with a 0% APR, you’ll need to meet certain creditworthiness criteria. Issuers assess your credit history, income, and debt levels to determine your eligibility.

Credit Score Requirements

Your credit score is a key factor in determining your eligibility for a balance transfer card. Generally, you’ll need a good credit score, typically in the 670s or higher, to qualify for the best offers. A good credit score indicates a responsible borrowing history and a lower risk for lenders.

Income Requirements, No fee balance transfer credit cards with 0 apr

While credit score is crucial, income is also a consideration for eligibility. Lenders want to ensure you have the financial capacity to manage your debt responsibly. They may assess your income level and debt-to-income ratio (DTI) to determine your ability to make monthly payments.

Impact of Credit History and Debt-to-Income Ratio

Your credit history plays a significant role in determining your eligibility. Lenders review your credit history to assess your past borrowing behavior and repayment patterns. A strong credit history, characterized by timely payments and responsible credit utilization, improves your chances of approval.

Your debt-to-income ratio (DTI) is another critical factor. DTI is calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI generally indicates a better ability to manage debt and increases your eligibility for a balance transfer card.

Documents Required for Application

To apply for a no-fee balance transfer credit card, you’ll typically need to provide the following documents:

- Personal Information: Name, address, Social Security number, date of birth, and contact information.

- Income Verification: Pay stubs, W-2 forms, or tax returns.

- Employment Information: Current employer, job title, and length of employment.

- Credit Card Information: Account numbers and balances of existing credit cards.

The Importance of Responsible Use and Payment Strategies

While balance transfer cards offer a tempting way to save on interest, it’s crucial to use them responsibly to avoid falling into a debt trap. Understanding the potential risks and implementing effective payment strategies is key to maximizing the benefits of these cards.

Understanding Potential Risks

Failing to make timely payments or exceeding the credit limit can lead to significant financial consequences. One of the most common risks is accruing high interest charges after the introductory period expires. The interest rate on balance transfer cards often reverts to a much higher rate after the introductory period, which can quickly negate any initial savings.

For example, if you transfer a $5,000 balance with a 0% APR for 18 months, and then fail to pay off the balance before the introductory period ends, you could be charged a high interest rate, such as 25%, on the remaining balance. This could result in hundreds of dollars in interest charges each month.

Another risk is damaging your credit score. Late payments or exceeding your credit limit can negatively impact your creditworthiness, making it harder to secure loans or credit cards in the future.

Managing Debt Responsibly

To avoid these pitfalls, it’s essential to adopt a responsible approach to managing your balance transfer card.

- Create a Budget: Develop a detailed budget that tracks your income and expenses. This will help you identify areas where you can cut back and allocate funds towards paying down your debt.

- Make Timely Payments: Set reminders or automate payments to ensure you make your minimum payments on time, every month. This will help you avoid late fees and protect your credit score.

- Pay More Than the Minimum: If possible, make payments that are larger than the minimum amount due. This will help you pay down the balance faster and reduce the total amount of interest you pay.

- Consider a Debt Consolidation Loan: If you have multiple high-interest debts, a debt consolidation loan may help you lower your interest rates and simplify your payments.

Tracking Expenses

Tracking your spending habits is essential for managing debt effectively.

- Use a Budgeting App: Many budgeting apps are available that can help you track your spending, categorize your expenses, and set financial goals.

- Review Your Statements: Regularly review your credit card statements to ensure all charges are accurate and identify areas where you can reduce spending.

- Set Spending Limits: Establish spending limits for different categories of expenses, such as groceries, entertainment, and dining out. This will help you stay within your budget and avoid overspending.

Final Wrap-Up

Balance transfer cards with 0% APR can be a valuable tool for managing debt, but it’s important to use them responsibly. Understanding the terms, such as the introductory 0% APR period and balance transfer fees, is crucial. By carefully comparing offers and using a balance transfer card strategically, you can potentially save money on interest charges and get your debt under control. Remember to make timely payments and avoid accumulating interest charges after the introductory period. With careful planning and responsible use, these cards can be a powerful ally in your journey towards financial freedom.

Essential Questionnaire

What happens after the 0% APR period ends?

Once the introductory 0% APR period ends, the standard APR for the card will apply. This could be significantly higher than the 0% APR, so it’s essential to pay off the balance before the promotional period expires or be prepared for higher interest charges.

Are there any balance transfer fees?

Some balance transfer cards have a balance transfer fee, typically a percentage of the transferred balance. Make sure to check for this fee before you transfer your balance.

How do I know if I qualify for a balance transfer card?

To qualify for a balance transfer card, you’ll generally need a good credit score and a decent credit history. The specific requirements will vary depending on the lender.

What if I can’t pay off the balance before the 0% APR period ends?

If you can’t pay off the balance before the promotional period ends, you can consider contacting the issuer to see if they offer options for extending the 0% APR period or transferring the balance to another card with a promotional period.